A chartist who wrote for an investment magazine I used to edit swore by the concept of momentum investing. If the stock is rising, buy it. When it falls, sell.

This form of technical analysis confounded me. I rely on company fundamentals, so I study a firm’s business model, management, earnings outlook, valuation and so on.

I like to buy quality companies when they are out of favour and trade well below their true value. I’m prepared to wait for the market to recognise that value.

In contrast, the chartist didn’t care about company fundamentals. In some cases, he didn’t know what the company did but was prepared to buy.

For him, the only thing that mattered was the share-price chart and what that data said about the stock. When the stock broke through price resistance on the chart, he bought. If it fell through price support, he sold.

Each to their own. Over the years, I’ve met few chartists who had sustained investment success for long periods (though I’m sure they exist). I have met some who combine fundamental and technical analysis with reasonable success.

Momentum investing has its place in rising equity markets. When interest rates were near zero a few years back, asset prices generally were increasing.

Funds that latched on to overpriced tech stocks through momentum-based strategies starred for a while. Now they look like fools or are going out of business.

This is no market for momentum-based strategies. The free kick for equity markets from ultra-low interest rates is gone. This is a market for genuine stock pickers.

As an aside, this is also a far tougher market for Exchange Traded Funds (ETF). By their design, index funds appeal when markets are rising. When the music stops, some ETF investors end up owning indices full of overpriced companies.

In my experience, the best form of investing has no label. It’s grounded in buying quality companies when they trade below their true value. At times, it’s akin to value investing. Other times, it’s growth investing (growth stocks can also be undervalued).

I think about momentum differently to my chartist colleague. I look for quality companies trading below their fair value – in sectors with strong momentum.

I’m a firm believer that a bad industry can beat a good company, at least in terms of relative investment returns. And that some bad companies can still thrive if they are in an industry with strong growth prospects.

Consider retail. Some retail stocks currently look undervalued, but it’s too soon to get interested given the consumer outlook, as interest rates remain high. The time will come for retail stocks, but momentum is working against the sector.

The same is true in technology. Tech stocks, such as Data3 (which I included in my top small-cap ideas for my 2023 column) look interesting. But again, it is mostly too soon to get interested in tech as high interest rates sap the momentum of growth stocks.

So, where is the momentum? In small-cap land, it’s energy, resource services and other companies linked to the commodity cycle.

Many small-cap managers avoid small-cap resource stocks, partly because of their earnings profile and also because of the fund’s investing style. That makes investing in small-cap resource stocks even less efficient – and creates opportunity.

Some mining and energy-services small-caps appeal in this market. I included two in my ideas list for 2023: MMA Offshore and Perenti. Here is an update on them.

- MMA Offshore (ASX: MRM)

To recap, the marine services company has 18 offshore vessels operating in 10 countries. MMA specialises in the energy sector, providing marine and subsea services.

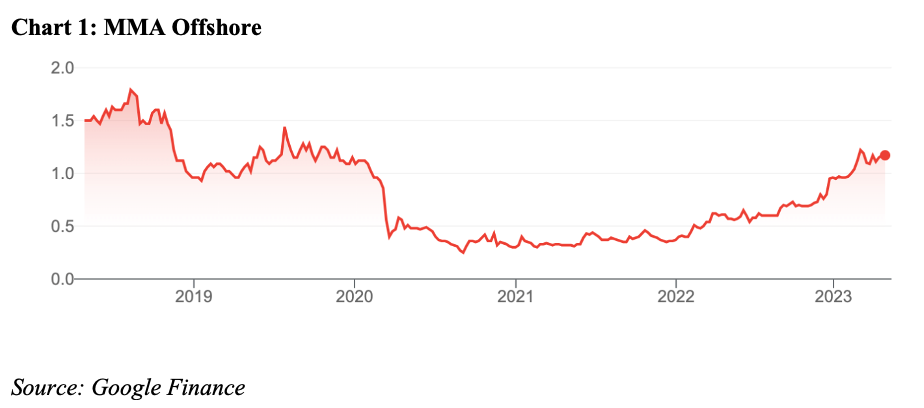

MMA had a long period of underperformance and the market forgot about it. At one point last year, it traded at 34 cents. I included MMA in my small-cap ideas list for 2023 at 79 cents because I like the outlook for activity in the oil and gas sector.

MMA now trades at $1.16 (it briefly traded at $1.27 in March 2023). I note more fund managers are starting to talk about MMA in the media – a good sign.

Wilson Asset Management, a savvy judge of small-cap stocks, lifted its stake in MMA in mid-April. It can be a good sign when funds that invested early in a small-caps recovery – and did all that due diligence – lift their ownership as its price rallies.

In addition to energy projects, MMA is building a strong position in renewable projects, such as offshore wind farms. It’s also extending its service offering.

MMA’s potential in renewable energy is getting more attention. For mine, it’s the forecast US$147 billion of oil and gas activity in MMA’s core regions that stands out.

MMA had an excellent first half of FY23 and says early activity in the second half has been “sound”. It sees a continuing strengthening market in FY24 and FY25.

At the current price, MMA still ticks the boxes I look for: quality company, undervalued and momentum in its underlying markets. Its share-price rally is due for a consolidation or a pause, but I can see MMA’s rally extending over time.

- Perenti (ASX: PRN)

The global mining services group provides a range of services in surface mining, underground mining and mining support. Perenti operates in 11 countries.

Like MMA Offshore, Perenti featured in my small-cap ideas list for 2023. At the time, Perenti was $1.06 (December 2022). It’s now $1.14.

Also, like MMA, Perenti disappointed investors for a long time. Worker fatalities at a project and earnings downgrades crunched the share price. The market lost confidence in Perenti, even though it was among the cheapest mining services stocks on ASX.

Perenti’s revenue and earnings have has been improving since early FY21. For the first time in a long time, Perenti looks to have strengthening tailwinds in its operations and is gradually becoming more diversified. Its revenue from the fast-growing battery minerals is rising.

Perenti’s tech division – idoba – is worth watching. Yet it seems to be getting limited attention in the market. Like other mining services companies, Perenti is trying to create value from its technology and data capabilities through a standalone brand.

One only need look at the success (and valuation) of Imdex (another stock featured in my top small-cap ideas list for 2023) to understand why mining tech is in demand.

Perenti has a lot of hard work ahead and its recovery will take time. The stock suits experienced investors who understand the features, benefits and risks of speculating in small-cap recovery ideas in commodity-based sectors.

Addendum: Lindsay Australia (ASX: LAU)

In December, I included the North Queensland trucking business in my small-cap ideas list for 2023 at 68 cents. It has since soared to $1.28.

I’ll have more to say on Lindsay and other small-cap transport stocks in coming weeks. If I owned Lindsay, I would consider taking some profits after the speed and extent of its rally, with a view to buying back in at lower prices later this year.

Tony Featherstone is a former managing editor of BRW, Shares and Personal Investor magazines. The information in this article should not be considered personal advice. It has been prepared without considering your objectives, financial situation or needs. Before acting on information in this article consider its appropriateness and accuracy, regarding your objectives, financial situation and needs. Do further research of your own and/or seek personal financial advice from a licensed adviser before making any financial or investment decisions based on this article. All prices and analysis at 29 March 2023.