Contrarian investors are often told to be greedy when others are fearful. To invest when there’s ‘blood on the streets’ and capitalise on market noise.

When the market is gripped by fear and panic – and good companies are being indiscriminately dumped – the smart money pounces on bargains.

When irrational exuberance is rife – and investors believe stocks will only ever rise – the smart money sells early in anticipation of better value later.

This is an obvious strategy, yet in my time researching and writing about shares (32 years), I’ve met few investors who are genuine contrarians.

Our emotions get in the way. It takes great discipline and skill to ignore market noise and focus on what matters most: company fundamentals and valuation.

Market noise is the great wealth destroyer. Too many investors listen to macro-economic forecasts or other top-down trends that are mostly wrong. We seek investment shortcuts and avoid the hard work of company valuation.

Consider housing. Right now, it’s hard to read a newspaper without learning about another property developer going bust. The industry is in crisis.

Building-material costs have soared, wages are rising, staff shortages are worsening, and red tape is crippling.

Home buyers are being crushed by high interest rates and sky-high property prices. How many stories have you read this year about people struggling to build or buy a house – or having problems with a house under construction?

Politicians have turned the housing crisis into a sport. Day after day, we hear them debate problems in new homes. Nothing changes. Nothing gets fixed.

In property development, there’s not just blood on the streets. It’s a massacre.

Investors could be forgiven for avoiding building stocks at all costs. But here’s the thing: amid all the doom and gloom, Australia has strong expected population growth over coming decades, as the recent Intergenerational Report showed.

We don’t have anywhere near as many houses as we need. As our population ages and skills shortages worsen, the government will surely let many more skilled migrants move to Australia. That means higher housing demand.

Valuation is another consideration. Yes, there are many challenges in new housing. But the market capitalisation of many property developers tumbled last year. I find it interesting that two key developers, Stockland Corporation and Mirvac Group, are up this year. The smart money sees value.

Prospective investors in property developers will need patience, risk tolerance and an ability to ignore market noise. Others might tell them they are crazy buying property-related stocks when so many developers are going bust.

I’ve identified a few property developers in this report in the past 12 months, notably Stockland, and residential community developers and build-to-rent firms Lifestyle Communities, Ingenia Communities Group and Aspen Group.

Here are another two property-related stocks to watch:

- GWA Group (GWA)

GWA supplies building materials for new homes, in its case, bathrooms and kitchens. It owns Caroma, Methven, Clark, Dorff and other brands.

GWA is highly leveraged to the building cycle in Australia and to a much lesser extent in New Zealand and the United Kingdom. Weaker building and renovation activity means softer demand for bathrooms and kitchens, and vice versa.

In its recent FY23 results, GWA described the year as one of two halves. Conditions were strong in the first half with higher interest rates yet to fully bite. Then, weakness in the second half as housing activity slowed.

Despite all the housing gloom, GWA reported only a 1.6% decline in full-year revenue growth. Normalised after-tax net profit fell 6.6% to $44.1 million.

GWA expects a solid level of housing completions to continue into the first half of FY24. Activity in the repair and renovations market will be subdued with consumers under more financial pressure. Parts of the commercial property sector, notably health and aged-care developments, will have increasing demand. So, too, social, affordable or build-to-rent housing projects.

Granted, GWA’s outlook is mixed, Part of housing will remain buoyant at least in the first half of FY24; others will have challenges. I can imagine more people putting off a pricey bathroom or kitchen renovation right now.

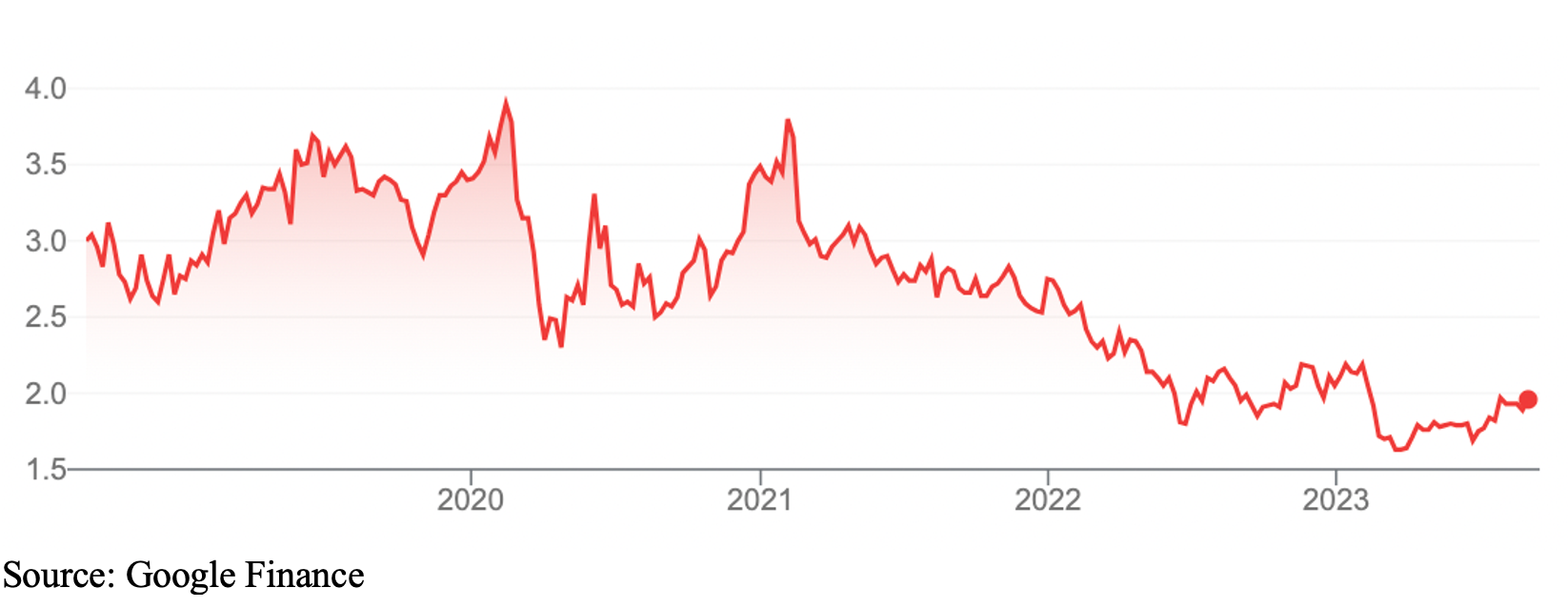

It all comes down to price. GWA almost halved in value since February 2021. Its current price of $1.94 is near a decade low. That’s what happens when the market obsesses about bearish news in a sector and over-reacts.

At $1.94, GWA trades on a forward Price Earnings (PE) multiple of about 11 times and has a forward dividend yield of about 7%, fully franked. That’s undemanding for a company of its quality and market position.

The key is looking forward. Yes, conditions for property-related stocks are tough now and likely to worsen before they improve. Yes, GWA could have another year of negative earnings growth and another modest dividend cut.

By this time next year, I suspect we’ll be talking about interest-rate cuts and improving consumer confidence. Unemployment will be a bit higher, but still low by historical standards. There will be more people wanting to ditch renting and buy a house – and more families, including new migrants, who want to build their own.

However, the market seems more interested in the gloom, and looking backwards, at least for GWA, judging by its share-price decline this year.

Chart 1: GWA Group

- Peet (ASX: PPC)

Peet, a long-established West Australian company, is a residential property developer in master planned communities, townhouses and apartments. Unlike GWA, Peet is in the thick of the building action.

Peet is currently working on 45 property projects, of which 18 are in WA. The end value of the projects is $13.5 billion.

Last week, Peet reported 25% revenue growth to $363.7 million in FY23. Operating profit after tax rose 34% to $70.1 million. The Net Tangible Assets per share (book value) was up 7% to $1.29.

Looking forward, Peet says residential property activity continues to adjust to higher interest rates and inflation, and lower consumer confidence.

Peet said property markets are close to bottoming and enquiry levels are improving. But it expects consumers to wait for interest rates to stabilise before buyer confidence returns.

Similar to my view, Peet said housing markets remain undersupplied, amid low unemployment, above-average wage growth and increasing overseas migration.

Like GWA, Peet sees another challenging year ahead as conditions normalise and then gradually improve. The market sees it differently: Peet is still trading below pre-pandemic levels and has gone mostly sideways for a long time.

Morningstar’s fair value of $1.40 suggests Peet is undervalued at the current $1.22. It trades on a single-digit PE and is expected to yield 6.25%, fully franked.

Peet has disappointed investors over the past decade. But it’s up 11% year-to-date, amid all the property gloom. A few good property judges I know are looking closer at Peet at its current valuation.

As a micro-cap stock, Peet suits experienced investors who understand the features, benefits and risks of this form of investing.

Chart 2: Peet

Tony Featherstone is a former managing editor of BRW, Shares and Personal Investor magazines. The information in this article should not be considered personal advice. It has been prepared without considering your objectives, financial situation or needs. Before acting on information in this article consider its appropriateness and accuracy, regarding your objectives, financial situation and needs. Do further research of your own and/or seek personal financial advice from a licensed adviser before making any financial or investment decisions based on this article. All prices and analysis at 30 August 2023.