For some investors, diversification means holding dozens of stocks in a portfolio often designed more by opportunity than careful risk management.

For others, diversification is achieved through Exchange Traded Funds that supposedly provide diversification from exposure to many stocks in an index.

Index concentration is becoming a problem for some ETFs and creating the illusion of diversification. The S&P 500 in the US, for example, is increasingly a bet on a handful of giant tech stocks that dominate the index’s performance.

Real diversification starts with asset allocation. That is, having a mix of assets that achieve different portfolio outcomes and are tailored to your goals. Ideally, assets with lower correlation, meaning they don’t all move in the same direction.

Portfolio diversification can be enhanced by including different investing styles. For example, low-cost passive funds that achieve the market return in the portfolio core; and higher-cost active funds or stocks that can deliver ‘alpha’ (a return greater than the market return) as portfolio satellites.

In my experience, too many retail investors limit asset allocation to the usual suspects: Australian equities, fixed interest, and cash. They are badly underweight global equities and global bonds due to a local investing bias.

Most retail investors are also underweight alternative assets that include private equity, private credit, infrastructure, commodities, hedge funds and real estate (on some definitions). Typically, alternative assets have a smaller portfolio allocation.

I’m writing about portfolio diversification this week for two reasons. First, because equity markets look frothy, with many exchanges trading at record highs.

Although I’m bullish on markets in the medium term (1-3 years), the risk of a correction or pullback is building. More passive money (inflows into ETFs) is piling into a narrow group of stocks, driving valuations too high.

The market is too bullish on the inflation outlook. Yes, inflation is retreating, but might be more persistent than markets have currently priced in. Higher inflation means delayed interest cuts – an outcome that hurts equity markets.

Now is a good time to ensure portfolios are adequately diversified and can withstand a correction in equities this year. Taking some profits and modestly increasing portfolio cash allocations makes sense. Having extra cash to buy stocks when markets fall is the key to producing attractive returns.

Ultimately, great investing is about capital preservation. Those who maintain their wealth live to fight another day and benefit from an equities market that outperforms most asset classes over time. Preserving wealth through sound portfolio diversification enables investors to take calculated risks.

Private credit

The other reason for this week’s column on diversification is opportunities in alternative assets. Consider private credit, a form of non-bank lending that is growing quickly overseas and to a lesser extent in Australia. Private credit is sometimes referred to as private debt.

A private-credit fund, for example, might lend to a property developer for a boutique apartment project. The developer cannot secure traditional bank funding because their bank has too much exposure to this type of property development or too much exposure in the project’s area.

Like a bank, the private-credit fund assesses the borrower and the project, tailors a loan and monitors it. Also like a bank, the private-credit fund has many loans in its portfolio to spread the risk of a loan default on a project.

Private credit covers more than property loans (although property is a key part of several local private-credit funds). These funds also lend directly to small and large firms in other sectors and can provide debt for special situations, such as buying distressed assets from a failed company.

Private credit has become a trillion-dollar industry overseas. On some estimates, this form of non-bank lending will more than double in size by 2028. This is partly due to tighter banking regulation, which is affecting how banks lend.

Simply, as banks reduce some forms of lending, to help meet regulatory requirements, opportunities for non-bank lenders will grow. For investors in private-credit funds, interest from these loans creates income.

Steady income from a private-credit fund is an attraction for income investors. Another plus is a lower correlation with equities, meaning a small allocation to private credit can add to the defensiveness of a portfolio.

The main risk is loan default. This is an important consideration as the economy slows further in the next 6-12 months and with more property developers going bust in the past 18 months. However, the largest local private-credit funds report no deterioration in the property component of their loan book.

Essentially, investors in private credit are backing the ability of the fund’s manager to issue and structure the right loans, to the right borrowers, and monitor them. So far, the big local private-credit funds have a good record in this regard.

As mentioned earlier, alternative assets should have a smaller allocation within a portfolio. For most investors, private credit would be less than 5% of a portfolio, depending on one’s risk profile, investment timeframe and goals. Think of private credit as providing a small amount of exposure to a different asset class in portfolios.

Before investing in private credit, understand the risks. Non-bank lending has good growth prospects, but also a different risk profile. Because they issue loans in private markets, private-credit portfolios are less transparent.

I prefer gaining private-credit exposure through Listed Investment Trusts (LITs) on ASX. As listed entities, these trusts are bound by the usual disclosure rules and governance expectations. Like other LITs and LICs, there can be opportunities to buy private-credit funds when they trade below their Net Tangible Assets.

Here are two ASX-listed private-credit funds to consider:

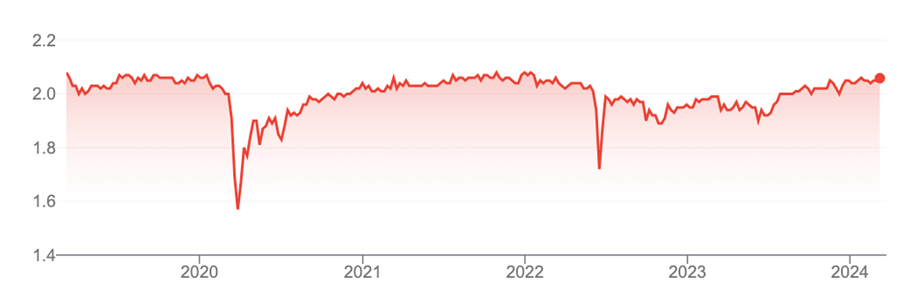

- Metrics Master Income Trust (ASX: MXT)

Listed in October 2017, Metrics is managed by Metric Credit Partners, a leading non-bank lender and alternative-assets manager in Australia.

Capitalised at $2.1 billion, MXT provides exposure to the Australian corporate-loan market – an area traditionally dominated by our big-four banks.

About 60% of Metrics’ portfolio is for real-estate lending, making it the country’s largest non-bank lender to that sector. Metrics recently publicly stated it had not seen any deterioration in the credit quality of its loan portfolio and noted strong demand for residential property developments.

MXT targets a return of the Reserve Bank cash rate plus 3.25%. At the current cash rate, the targeted return is 7.6% after fees, paid monthly.

For retirees and other income investors, that’s higher than term deposits (assuming the target return is achieved) and comparable to yield on many large-cap stocks (after franking) In theory, private credit has less risk than equities because debt sits higher in the capital structure (in the event of a liquidation).

Since inception, MXT has delivered an annualised 5.93% return, beating its target return by 1.14%. That explains why MXT, at its current $2.06 unit price, trades at a small premium to its net asset value (NAV) per unit of $2.

It’s arguable that Metric’s consistent outperformance (over its targeted return) should warrant a slightly larger premium. That might occur when short-term headwinds in property ease, as rates are cut later this year or early next.

Chart 1: Metrics Master Income Trust

Source: Google Finance

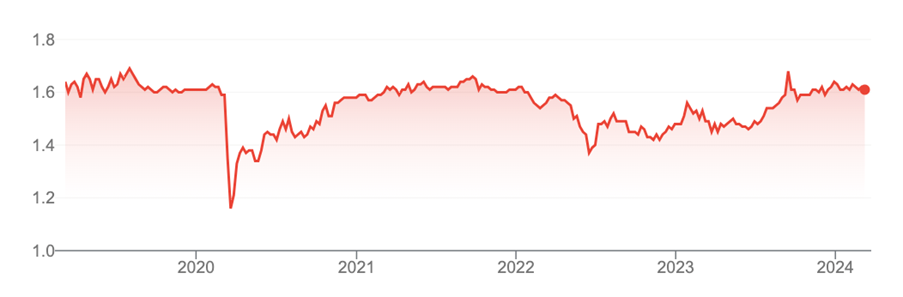

- Qualitas Real Estate Income Fund (ASX: QRI)

Capitalised at $648 million, QRI is the second-largest private-credit fund on ASX. Like Metrics, Qualitas focuses on the commercial real-estate market in Australia.

QRI targets the RBA cash rate plus a 5% to 6.5% annual return after fees, paid monthly. At the low end of its range, the targeted return is currently 9.35%.

QRI’s debt portfolio provides exposure to loans for Australia and New Zealand commercial real-estate projects. Only 20% of the portfolio can go to NZ.

QRI has achieved a net annualised return of 6.67% since inception in November 2018 (to end-January 2024). That’s slightly better than the target return of 6.4% over that period (at the 5% excess return). QRI is yet to achieve its target return of 6.5%, meaning investors should expect the low end of its target range.

Like MXT, QRI trades at a slight premium to its NAV at its current $1.62 unit price.

Prospective investors should note the fees in private-credit funds. QRI, for example, has a 1.84% management fee and a 20% performance fee (over an 8% annualised return hurdle).

Chart 2: Qualitas Real Estate Income Fund

Source: Google Finance

Tony Featherstone is a former managing editor of BRW, Shares and Personal Investor magazines. The information in this article should not be considered personal advice. It has been prepared without considering your objectives, financial situation, or needs. Before acting on information in this article consider its appropriateness and accuracy, regarding your objectives, financial situation, and needs. Do further research of your own and/or seek personal financial advice from a licensed adviser before making any financial or investment decisions based on this article. All prices and analysis at 6 March 202