I am always wary about making “‘sell” calls, particularly when it comes to key portfolio stocks. The reasons are straight forward.

Firstly, I am a great believer in “time in the market” rather than “timing”. I have learnt that I can’t expect to “buy at the bottom” or “sell at the top”, so believing in the idea that markets go up over the long term, selling is a somewhat dangerous strategy. I should qualify this statement:” dogs” and “mistakes” should be sold, but selling profitable, quality companies needs to be considered carefully. And secondly, when it comes to portfolio stocks, they are in there for a reason. They have been selected because they are great companies, generally leaders in their industry, and delivering a commendable return on equity. The risk with selling is having the discipline to get back in again. Easier said than done.

But like markets, stocks get way overbought and become too expensive. Two stocks in this category currently are JB Hi-Fi (JBH) and Commonwealth Bank (CBA). I am not advocating that they be dumped from your portfolio, but rather a modest de-weighting to lock in profit and potentially invest elsewhere (or take some money off the table). At some point, you will need to get back in again.

Here is why JB Hi-Fi and CBA meet the bill.

1. JB Hi-Fi (JBH)

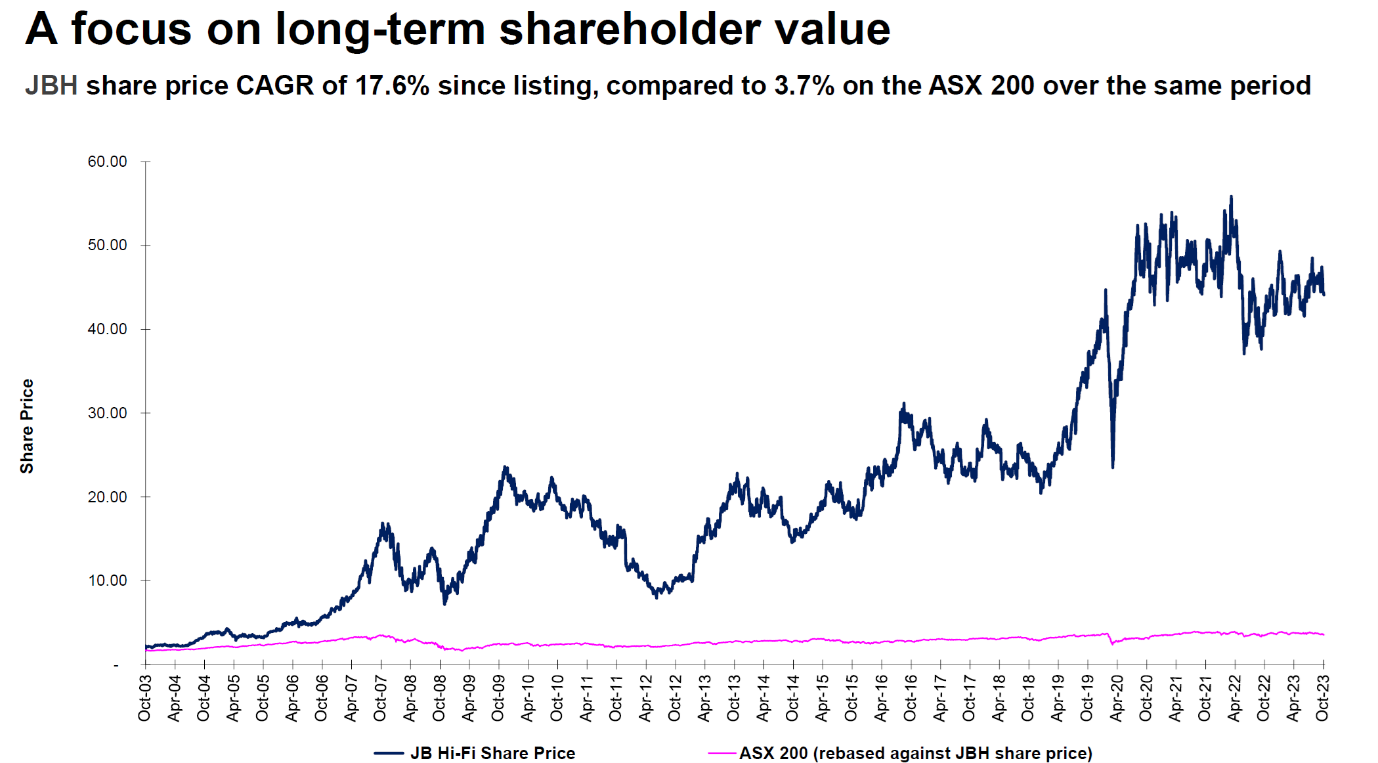

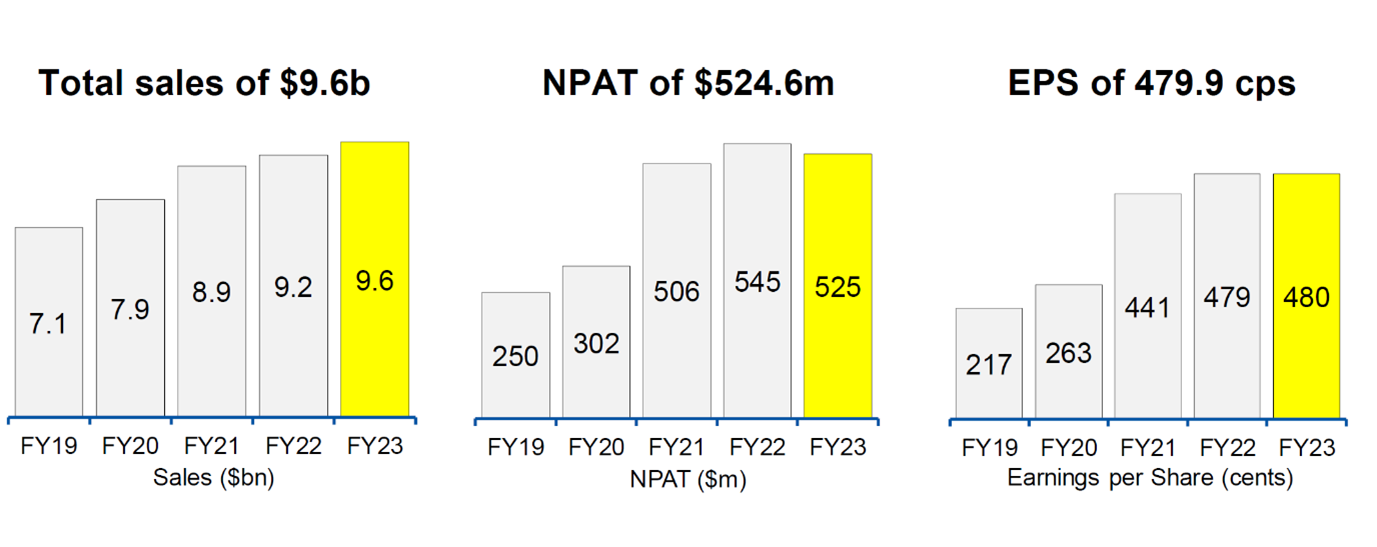

One of my favourite stocks, JB Hi-Fi is unquestionably Australia’s best retailer. The charts below tell the story.

When I last wrote about JB Hi-Fi just five weeks ago (see https://switzerreport.com.au/5-income-favourites-for-2024/ ), it was trading at $50.90. On Friday, it closed at $57.23, a gain of 12.4%. Over the same period, the S&P/ASX 200 has lost 2.2%.

JB Hi-Fi – last 12 months

Source: nabtrade

The broker analysts have been bearish (and wrong) on JB Hi-fi ‘since Adam was a boy’. One of their main theses has been that Amazon and other online retailers were going to eat “bricks and mortar” retailers like JB Hi-Fi. But Amazon arguably bungled its entry into Australia, JB Hi-Fi and other retailers introduced omni-channel retailing (same price for “instore”, “online” or “click and collect”) and in the case of JB Hi-Fi, proved remarkably flexible in adapting to changing consumer tastes in the categories of goods it sold. The brokers also underestimated JB Hi-Fi’s success in driving down the cost of doing business (selling and administrative costs).

The analysts are still bearish today. According to FN Arena, the consensus target price is $46.32, some 19.1% below Friday’s closing ASX price. Of the 6 major brokers, there are 4 “neutral” recommendations and two “sell” recommendations (no “buys”).

My concern with JB Hi-Fi is that its rise has been too rapid. Further, with Australia lagging compared to the UK and USA in its adoption of online shopping, Amazon and others will prove to be a headwind for JB Hi-Fi. I will look to buy back in, probably around $50, but at the moment, JB Hi-Fi is too expensive.

2. Commonwealth Bank (CBA)

Another stock that the broker analysts have been consistently wrong on is Commonwealth Bank. In fact, they have been “wrong” on CBA for more than two decades!

Their argument is straightforward: CBA is too expensive compared to the other major banks. ANZ, NAB and Westpac are “better buying”, and if investors were rational, they would sell CBA and buy the others. In an oligopolistic market where each bank has largely the same strategy, gains in market share are hard because customer inertia is high and balance sheets are relatively strong, the difference in price is too much.

This is best demonstrated by looking at relative PE (price earnings) multiples. CBA is trading on a PE for FY24 of around 19.6 times. ANZ is at 12.1 times, Westpac at 12.6 times and NAB at 14.2 times. On this measure, CBA is at premium of almost 62% to ANZ. To be on the same PE as ANZ, CBA’s share price would need to fall by almost 40%.

Why have the analysts come unstuck? I think they failed to take into account “execution ability” and technology, where CBA clearly leads. Further, I sense that some institutional investors have come unstuck by listening to the analysts, and there is now almost a “I just don’t sell CBA” attitude with some fund managers. Too much relative performance risk if underweight the stock.

True to form, the broker analysts remain bearish. According to FN Arena, there are 3 “neutral” recommendations and 3 “sell” recommendations (no “buy” recommendations). The consensus target price is $90.45, 20.2% lower than Friday’s closing price of S113.28.

CBA has performed well in 2024 – up from $111.80 and is up 17.3% since the end of October.

Commonwealth Bank (CBA) – last 12 months

I think the premium to the other banks is too high. Also, with banks likely to face declining earnings (or at best, negligible growth in earnings), I can’t see the argument to be overweight CBA. Take profits.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.