The latest profit-reporting season has so far been a touch better than expected, although it’s dangerous drawing trends with so many companies still to report.

My main takeout so far has been the deterioration in second-half earnings. The media often focuses on the full-year result, but it always pays to compare the two halves to get a better sense of the performance. On that score, it looks poor.

Myer Holdings, the department-store owner, is an example. In a trading update last week, Myer said it expects total sales for FY23 to be up 12.5% in FY23. Within that, second-half FY23 sales are only up 0.4%. Most growth came in the first half.

I suspect we’ll see this pattern repeated by more consumer stocks that report this week and next. A strong first half of FY23 when interest-rate hikes were yet to bite, then sharp deterioration in the second half as sales growth stalls and margins weaken.

This marked difference in the two halves speaks to the rapid deterioration in earnings growth – and the outlook – for many consumer-facing companies.

I still believe quality smaller retailers – such as Lovisa Holdings and Nick Scali – look interesting after recent price falls. And that the retail sector, generally, will provide opportunities in the next few months as valuations fall too far.

For now, it pays to remain defensive and focus on companies that can weather the economic slowdown. As I have argued many times in this column this year, Australia will narrowly avoid a technical recession this year due to its strength in exports.

I’m becoming more concerned due to recent problems emerging in China’s economy. It’s always hard to get a true read on China’s economic performance, but a slide into deflation from the world’s second-largest economy is a threat.

If it persists, the weakness of China’s COVID-19 rebound – or ‘long economic COVID-19’, as one forecaster put it – is bad news for minerals demand and commodity prices. It’s potentially an external shock for the global economy and, by default, Australia.

I favour owning stocks that don’t rely heavily on consumer discretionary spending and can weather global economic volatility. For many investors, that means healthcare and other defensive sectors where it is increasingly hard to find value.

Infrastructure services is an interesting defensive sector that gets less attention – and where valuations for some companies look attractive after recent falls.

These companies typically provide services for transport, energy, utility or other infrastructure assets via long-term contracts. These businesses aren’t going to star, but their steady returns and solid dividends appeal in this market. Here are two to watch:

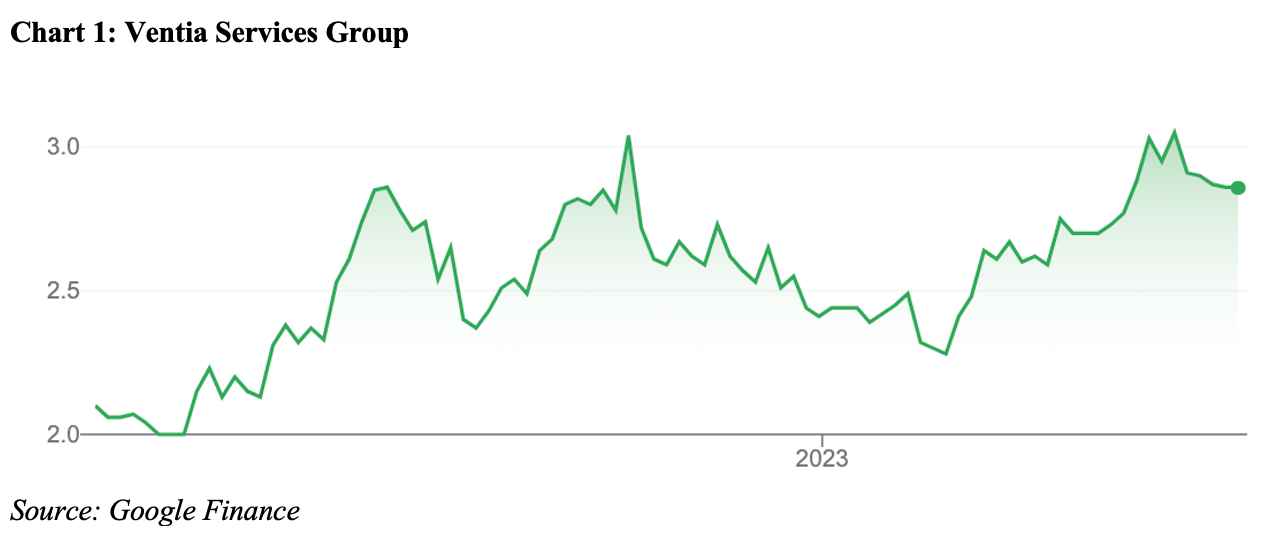

- Ventia Services Group (ASX: VNT)

Ventia, a stock I have previously written positively about for this report, is one of the largest essential-services providers in Australia and New Zealand.

Ventia was formed in 2015 through the integration of Visionstream, Leighton Contractor Services and Thiess Contractors. In November 2021, Ventia added Broadspectrum (formerly Transfield Services) and dual listed on ASX and NZX.

In FY22, Ventia had $5.2 billion in revenue from more than 400 project sites in Australia and NZ. Its workforce of around 16,000 employees provides a large base for essential-services contracts – and is an asset in a tight labour market.

Ventia had $18 billion of work in hand at end-December 2022. Typically, up to 80% of Ventia’s next 12 months of revenue is supported by work in hand, through an average contract tenure of over seven years. That creates high earnings transparency.

Ventia’s AGM presentation in May showed forecasts on the outsourced maintenance-services market in Australia and New Zealand. The market has forecast annual compound growth of 6.6% to FY26, with the market worth $88 billion by then.

Put another way, expected annual growth of Ventia’s industry (6.6%) will be at least a few times greater than the Australian economy in the next few years.

Population growth, increased outsourcing of essential-services work, the move to renewables and a large and growing infrastructure asset base are supporting demand for essential-services providers. Within that, infrastructure defence services are strong.

Ventia is targeting annual revenue growth of 7-10% with cash-flow conversion of 80-95%. In simple terms, this is a business growing faster than the economy in a defensive sector characterised by long-term contracts and clear growth drivers.

There are risks. Ventia operates in a highly competitive, price-sensitive market. Infrastructure costs and time blowouts – and growing scrutiny of government service providers – are other considerations. Parts of the industry are more commoditised.

Ventia has rallied from a 52-week low of $2.17 to $2.86. At $2.86, Ventia trades on a forward Price Earnings (PE) multiple of 13.7 times, consensus estimates show. The expected forward dividend yield is 5.5%.

An average share-price target of $3.09, based on the consensus of seven analysts who cover the stock, suggests Ventia is near full value at the current price. It’s no screaming buy but owning a defensive stock that can grow faster than the economy appeals.

More will be known when Ventia reports its full-year results on August 25.

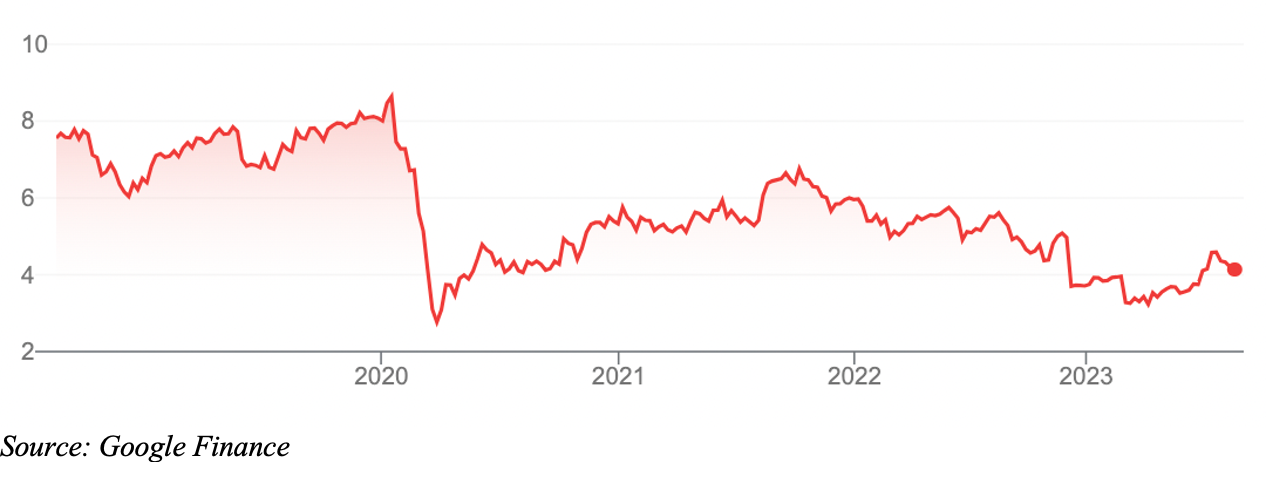

- Downer EDI (ASX: DOW)

Like Ventia, Downer EDI rallied this year (after terrible price falls last year) as investors re-rated its defensive qualities. But the rally stalled after Downer EDI’s results this month disappointed the market.

Downer operates a range of service businesses across engineering and maintenance, transport and utilities. The company has staked its future on urban services.

Downer’s underlying net profit declined 18.5% to $174 million in FY23, in line with its recent guidance. Downer shares slid on the news after the company warned that its turnaround would take time and that competition for defence projects was growing.

Downer has had a horrible 12 months. In December, it revealed shocking accounting irregularities and slashed full-year guidance, only to cut guidance again at its half-year result in February. Management changes and Downer’s participation in an NSW corruption enquiry fuelled concerns about the company’s governance. Downer’s reputation was deservedly in tatters.

That’s the bad news. The good news, for prospective investors at least, is that Downer’s valuation has almost halved from pre-pandemic levels in early 2020.

Make no mistake: Downer has been through a period of immense turmoil and transformation as it deals with restructuring, write-downs, project losses and other problems. One problem after another has battered Downer’s market reputation. It has huge work ahead to restore market confidence and rebuild investor faith.

Still, the company should, in time, benefit from growing revenue streams from its infrastructure-services business that help insulate the company from any downturn in mining work or rail-maintenance contracts.

If you believe in the contrarian approach of buying when news is at its worst, that is probably now for Downer. The latest profit result added more gloom after a shocking first half. But Downer’s turnaround should gather more momentum from FY24.

Morningstar’s valuation of $5.60 for Downer EDI shares suggests the stock is materially undervalued at the current $4.21. I’m not as bullish and think the consensus of $4.38 (based on seven forecasts) is closer to the money, although a touch bearish.

I can see why prominent contrarian investors, such as Allan Gray Australia, own a chunk of Downer EDI. Beneath a company wracked with problems and controversy is a business with a large position in the growing infrastructure-services market.

Of the two stocks, I prefer Ventia. For experienced long-term investors who have higher risk tolerance, Downer EDI is one to watch at its current valuation.

Chart 2: Downer EDI

Tony Featherstone is a former managing editor of BRW, Shares and Personal Investor magazines. The information in this article should not be considered personal advice. It has been prepared without considering your objectives, financial situation or needs. Before acting on information in this article consider its appropriateness and accuracy, regarding your objectives, financial situation and needs. Do further research of your own and/or seek personal financial advice from a licensed adviser before making any financial or investment decisions based on this article. All prices and analysis at 16 August 2023.