Industry trends are often amplified in the share prices of small-cap stocks. A small downturn in sector profits can batter stocks – and create opportunities for contrarians.

Australia’s legal industry is an example. Its boom times are over as revenue contracts and expenses rise, according to surveys. The industry faces a ‘recession’ of sorts.

The main headwinds are moderating demand for some legal services and wages pressure. In a market characterised by high staff turnover, law firms have had to pay higher wages and address work-life balance issues to keep their best talent.

Law firms are cautiously optimistic about 2023, according to industry surveys. But the overseas experience suggests more pain ahead for Australia’s legal industry.

Law firms in the United States and Europe had mass lay-offs of lawyers last year, partly to correct for overhiring during the COVID-19 pandemic.

It’s hard to see that trend changing anytime soon. Recession fears in the US and partly in Europe are rising, amid interest-rate rises. The collapse of a few smaller US banks and problems in the European banking sector will further dampen growth.

That suggests a challenging outlook for legal services in those markets and more pressure on firms to rein in fee increases and further reduce headcounts.

Australia is not immune to these trends. Our market has only a handful of law-related stocks, but the investor response to them this year has been telling.

Slater & Gordon is down 14% over one year. In February, Slater & Gordon’s Board recommended a takeover offer from private equity.

Shine Justice has fallen 41% over one year. The Brisbane-based firm was belted in February after reporting its interim result for FY23.

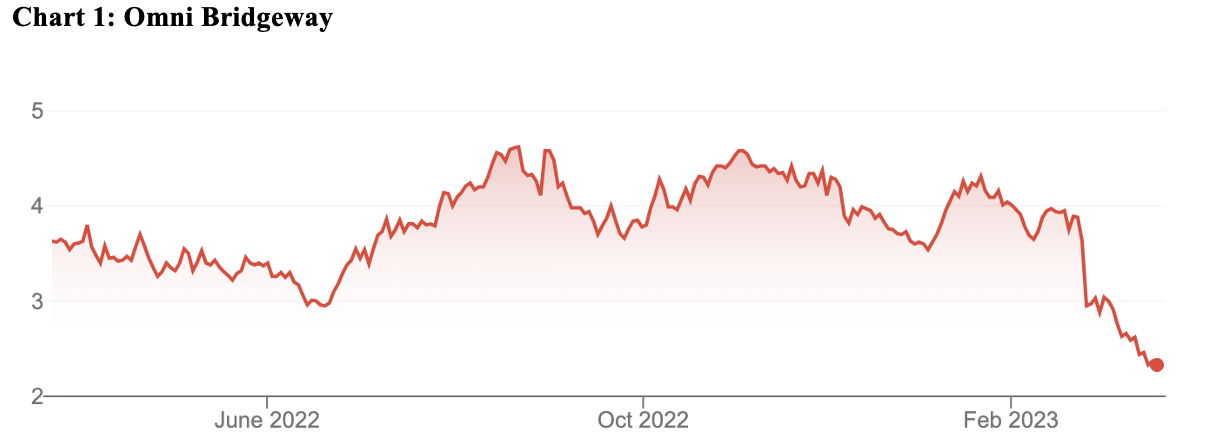

Litigation funder Omni Bridgeway is down 33% over one year. Its stock has tanked since February on a disappointing result and executive changes.

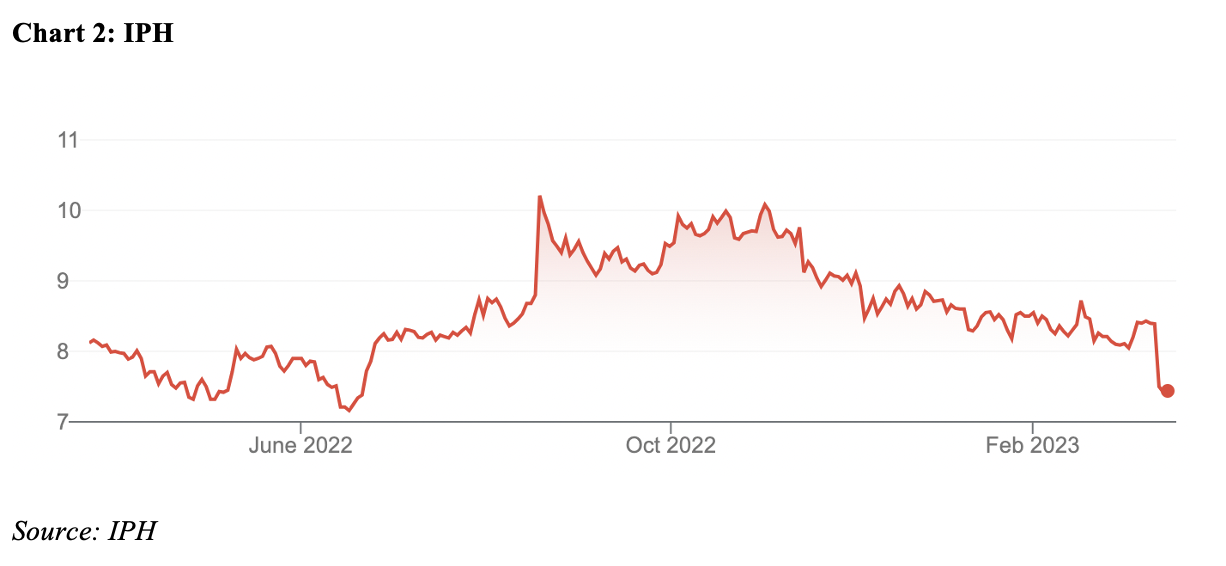

IPH, an intellectual-property firm, is down 12% year-to-date. IPH’s recent confirmation of a cyber-attack on its data added to the selling pressure.

A smaller rival, QANTM Intellectual Property, is down 22% over one year. I thought QANTM delivered an okay interim result for FY23, but the market disagreed.

Among micro-caps, AF Legal Group is down 66% over one year. The family-law specialist reported a small loss for the first half of FY23 after several one-off expenses.

Across the market, listed law-related firms are a sea of red ink. To be fair, many small-cap industrials were pummelled during the market sell-off in February and March.

Moreover, it’s dangerous drawing conclusions about an industry from such a small sample of stocks. But there were common themes in their interim results: a challenging revenue outlook and growing expense pressures. That hurts profit margins.

Contrarians might see things differently. Those buying listed law stocks now do so after savage price falls and when there is talk of legal-industry ‘recession’.

Often, the best time to buy is when news is all bad and the market overreacts. That could be true of some listed law-related stocks that have been harshly treated this year.

Before I highlight two firms to watch, a word of caution. Most listed law stocks are microcaps that suit experienced investors who understand the features, benefits and risks of this form of investing. They are not for conservative investors.

Also, I expect conditions will worsen before they improve. Contrarians might watch and wait for better value in listed law stocks over the next few months.

Here are two law-related stocks for portfolio watchlists.

- Omni Bridgeway (ASX: OBL)

I included the litigation funder in my December 2022 column on small-cap industrial ideas for 2023. Omni Bridgeway has fallen from $3.84 since then to $2.29.

Two main factors explain the fall. The first is Omni Bridgeway’s disappointing FY23 half-year result. The company reported a $30.1 million loss due to lower-than-expected case completions. It lost $8.7 million in the same half a year earlier.

The second factor was news that CEO Andrew Saker would retire. The well-regarded Saker was replaced by Raymond van Hulst.

The market expected more from Omni’s interim result, but such a large fall in the share price from the 52-week high feels excessive.

The size of the loss was partly due to timing. Omni noted that case completions were modest in the period due to a number of protracted settlement mediations.

The company estimated profit before tax of around $33 million in matters for which revenue had not been recognised at end-December 2022. That income could potentially be recognised in future periods, but the market focused mostly on the headline loss.

The CEO succession news also can’t explain the fall. After more than eight years in the top job, Saker was due to retire and his succession has been orderly. van Hulst is highly experienced and regarded in the global legal risk asset-management industry.

My favourable long-term view on Omni Bridgeway stems from a broader interest in litigation funding and its role as an alternative asset. The funding of class actions is a long-term growth market and Omni Bridgeway has an excellent position in it.

My other interest is Omni’s potential to return cash in the next few years. As I wrote in late 2022: “The market is underestimating how much cash Omni Bridgeway will return to shareholders due to the maturation of some of its key funds over the next four years.”

That view still holds. Beneath the interim loss, Omni said it was still on track to achieve target funding commitment for FY23. A case success rate of 76% suggests the firm’s ability to identify and back winning class actions is intact.

Omni deserved to fall after its interim result. Yet the reaction seems overdone and a consequence of a jittery market that dumps small-caps first and asks questions later.

Source: ASX

- IPH (ASX: IPH)

The intellectual property (IP) services provider is among the more impressive small-cap companies on ASX. IPH serves some of the world’s largest companies in more than 25 countries – and is the largest provider of its kind in the Asia Pacific.

In February, IPH reported 24% growth in underlying earnings (EBITDA) to $80.4 million for the first half of FY23, largely due to organic growth in its Asian operations and currency benefits. Revenue growth was flat.

IPH noted lower patient filings in the first half of FY23 in Australia compared to strong filings in the same half a year earlier. Growth in patent filings in Asia was flat.

As the global economy slows, IPH could face subdued activity in IP filings this year. More companies will cut back on research and IP filings to cut costs.

However, IPH can continue to grow through acquisitions as it adds more firms to its network, the latest being the Smart & Biggar purchase in October 2022.

IPH says it is assessing acquisition opportunities in Canada and other secondary IP markets. A strong balance sheet provides scope for more acquisitions.

Longer term, IPH has an excellent position in a reasonably defensive market. Faster growth from its Asian operations should continue in the next few years.

The immediate problem is a cyber-security incident that may have compromised documents at the company’s head office and two of its main member firms.

It’s too soon to know the outcome of IPH’s investigation into this incident. The market slashed about 10% off IPH’s share price on the news, continuing a period of price weakness for the stock. IPH’s 52-week high is $10.42.

Volatility in IPH could remain high as the market waits for more news on the cyber investigation. Beneath that issue is a firm delivering on its long-term strategy, growing its operations in Asia and other markets, and making astute acquisitions.

As with Omni Bridgeway and other law-related stocks, further price falls are possible in the next few months as the market digests more bad news for the sector. But for investors who look through short-term bad news, value is emerging in IPH.

Also, like Omni Bridgeway, IPH was included in my list of small-cap ideas for 2023. IPH has fallen from $8.82 in December 2022 to $7.50.

My core view on the stock hasn’t changed. On valuation grounds, IPH looks more attractive now than it did last year.

Tony Featherstone is a former managing editor of BRW, Shares and Personal Investor magazines. The information in this article should not be considered personal advice. It has been prepared without considering your objectives, financial situation or needs. Before acting on information in this article consider its appropriateness and accuracy, regarding your objectives, financial situation and needs. Do further research of your own and/or seek personal financial advice from a licensed adviser before making any financial or investment decisions based on this article. All prices and analysis at 15 March 2023.