Every reporting season gives vital clues on the state of the share market. This one is especially important with Australian equities trading near their record high.

Over the next few weeks, I’ll cover stocks from this earnings season that catch my eye and give broader comments on what results say about market valuations.

I’m surprised at the extent of volatility around earnings results these days. Even the slightest disappointment can see stocks whacked by investors. Still, this volatility creates opportunity for patient long-term investors who focus on value.

There is little room for error with earnings growth. On some broker estimates, the S&P/ASX 200 Index is trading on a forward Price Earnings (PE) multiple of about 18 times. The market’s historic average PE is about 15 times.

On Morningstar’s numbers, the Australian share market is 12% overvalued based on companies it researches. The market has progressively become more expensive as investors have paid higher PE multiples for stocks.

Higher earnings growth is needed to justify higher PE multiples. But with consumers facing cost-of-living pressures, the fear is that aggregate earnings per share could go backwards again in Fy225.

Something has to give. Either earnings grow to justify higher valuation multiples, or the market needs to reappraise valuations through a pullback or correction.

I favour the first scenario, believing the consumer is in a better state than many realise. JB Hi-Fi on Monday reported 9.8% growth in sales to $5.67 billion for the six months to December 31, above market expectation.

The electronics and white goods retailer said strong sales growth continued into January. If the consumer is doing it tough, it’s hard to see that in JB Hi-Fi’s result. People are still buying electronics and white goods, thanks partly to discounting.

The market, however, belted JB Hi Fi’s share price on Monday. The company warned that trading conditions will get tougher from here, and that JB Hi-FI’s upcoming results will cycle against stronger sales periods, weighing on like-for-like store growth.

Still, I can’t see how JB Hi-Fi’s result warranted a 4.5% fall on Monday. Perhaps the market was surprised by JB Hi-Fi’s view on future trading conditions, given the prospect of a rate cut this month by the Reserve Bank.

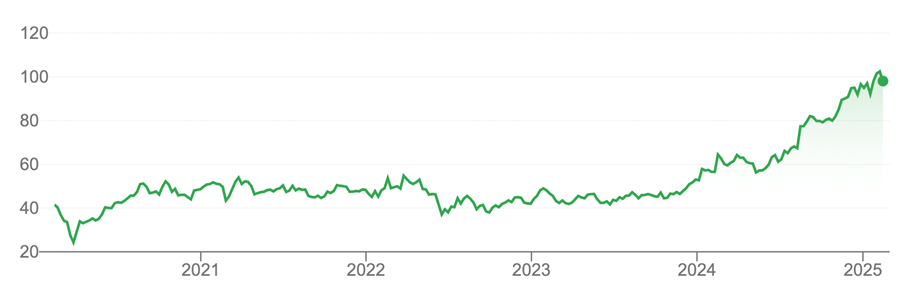

My sense is the market was itching to take profits on JB Hi-Fi given its 62% rise over 12 months. After a rally of that magnitude, active managers don’t need much of an excuse to take some profits, trim positions and allocate elsewhere.

Would I buy JB Hi-Fi at these levels? As I mentioned, the Australian consumer might not be doing it as tough as gloomy newspaper headlines suggest, judging by retail results. Also, the market has locked in a rate cut in February, although I’m not as convinced given the strength of the labour market and inflation pressures.

I also like JB Hi-Fi’s leverage to growth in Artificial Intelligence. As AI is incorporated into more laptops, computer tablets, smartphones, TVs and other devices, a stronger product replacement cycle will emerge. The possibilities of AI will give people more incentive to upgrade their old electronic devices.

Nevertheless, I can’t buy JB Hi-Fi after its soaring gains over the past year, putting it on a forward PE multiple of about 23 times, well above the average for consumer discretionary stores. I’d take a few profits on JB Hi-Fi and seek better value elsewhere.

Chart 1: JB Hi-Fi

Source: Google Finance

Like JB Hi-Fi, Car Group was belted on Monday by the market. The global car-advertising portal reported proforma revenue of $548 million for the six months ending December 31, up 12% on the prior corresponding period. Proforma underlying earnings (EBITDA) were $302 million, up 12%.

Car Group shares fell 6.5% on Monday. The concern with the result was Car Group downgrading full-year US revenue guidance from “good” to “solid”. That’s the company’s way of saying to expect single-digit rather than double-digit revenue growth from its US operations, its second-largest market.

Car Group announced a slight delay to its anticipated price rises in the US in FY25, amid challenging conditions for US car dealers. It looks like a sensible move and more of a timing issue than anything else. The market didn’t see it that way, even though Car Group said it still expects solid revenue and earnings growth from its US operations.

As long-time readers of this column know, I have long advocated to buy the main advertising portal stocks – REA Group, Car Group and, to a lesser extent, Seek – on any significant price weakness.

These stocks always look expensive for a reason: they have fabulous competitive advantages, business models and earnings growth. Investors just need to watch and wait for better value in the portal stocks during market corrections or when investors overreact to bad news.

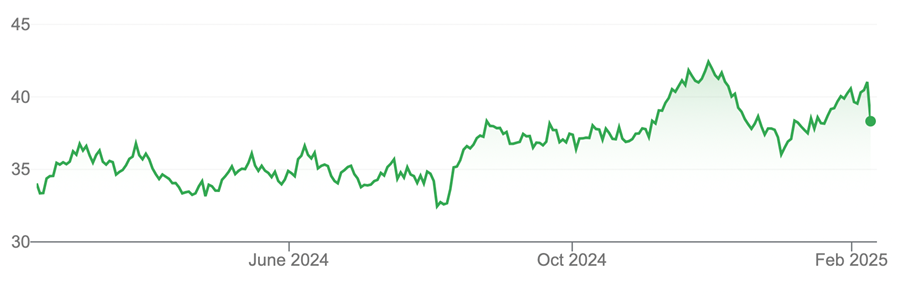

That could be the case with Car Group’s latest result. After strong gains over the past few years, Car Group was due for a pullback and further price weakness over the next months, which could be tricky for stocks, would not surprise.

I’d take advantage of any further volatility and weakness in Car Group to initiate a position or add to an existing position in the stock.

Share-price gains might be slower from here, but Car Group has years of growth ahead as it rolls out its business model to more markets, as vehicle advertising continues to migrate online in more markets.

Chart 2: Car Group

Source Google Finance

Among small-caps, I was interested in Dexus Convenience Retail REIT’s (DXC) result on Monday. I wrote positively last year about niche property trusts that own petrol stations and convenience stores but haven’t looked at them for a while.

I like petrol station assets for a few reasons. First, many are strategically located on major highways and other roads, meaning they have unrealised value for property developers, assuming the sites can be remediated.

Second, population growth is good for petrol stations with prime locations. My local 7-Eleven seems to get busier every year as more apartment blocks are built nearby and more kids load up on junk food there after school.

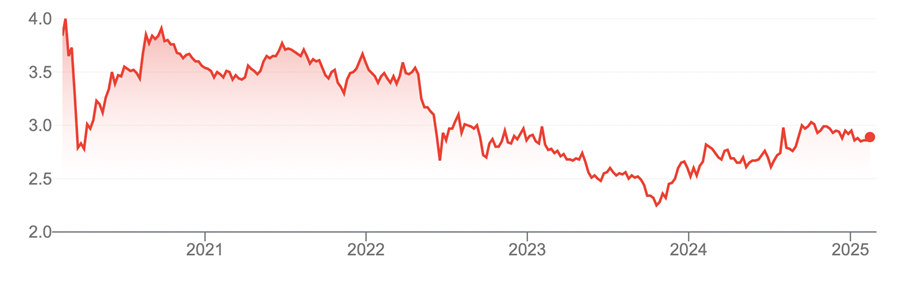

On page 14 of its earnings presentation, DXC noted strong growth in petrol sale transactions, with volumes almost back to pre-COVID-19 levels. Average yield on these transactions is also rising, suggesting more buyers are interested in the potential for long-term appreciation in property values for petrol stations, and the tenant lease renewal potential given demand for these assets.

An emerging recovery in petrol stations bodes well for greater price recovery and possibly stronger growth in DXC’s Net Tangible Assets (NTA), as assets are revalued higher. In spite of that good news on transaction volumes, DXC shares didn’t do much on Monday after its earnings result.

The market’s main concern with petrol station assets has been the potential effect of stronger growth in Electric Vehicles. More EVs means less demand for petrol station services and fewer people visiting their convenience stores.

I’ve always thought this concern was overstated, at least in the short to medium term. Coincidentally, Car Group’s latest EV survey suggests sentiment to buy an EV is waning. With Trump in the White House, expect EV sentiment to face more bumps in the road. Right or wrong, that’s good for petrol station owners.

Chart 3: Dexus Convenience Retail REIT

Source: Google Finance

Tony Featherstone is a former managing editor of BRW, Shares and Personal Investor magazines. The information in this article should not be considered personal advice. It has been prepared without considering your objectives, financial situation or needs. Before acting on information in this article consider its appropriateness and accuracy, regarding your objectives, financial situation and needs. Do further research of your own and/or seek personal financial advice from a licensed adviser before making any financial or investment decisions based on this article. All prices and analysis at 12 February 2025.