It was a good week for the true believers, with the S&P/ASX 200 index up 1.9% for the week, which was the best weekly result for 2017. For March, we added 2.7% and, over the quarter, it was a 3.5% rise.

The ASX 200 index finished the week at 5864.9 and having beaten the 5800 level and nearly seeing 5900 on Thursday, it now has the 6000 level in its sights. However this has been a challenge in the past, so I’m not too cocky right now.

The US market was a little negative overnight and we are about to start April but, happily, the month is in the best six-month group for stocks. Based on a 62-year study conducted by The Stock Trader’s Almanac, the five months of the year that produce significantly better and safer returns are November, December, January, March and April.

Looking for reasons for the enthusiasm for stocks has been the near $16 billion worth of dividends that have been earmarked for shareholders. The banks continue to be in favour, with NAB up around 4% for the week but material stocks had a lukewarm reception.

Helping positivity was M&A talk, with Myer and Fairfax in the sights of big hitter buyers. We also saw strongly shorted stocks, such as Myer and Mantra, force shorters to scramble to beat the squeeze.

Myer was the stellar performer, up about 14%, proving Solly Lew, with his Premier Investments, still has his market mojo!

Internationally, the UK started divorce proceedings from Europe and the word is that the Europeans will play hard ball to discourage other potential exit-contemplators. However, it didn’t hurt stocks in the UK and the continent.

Even CNBC added to the Euro-optimism with this headline: “Europe is suddenly the hot new trade in the stock market” and the latest rotation talk is about getting into Europe! I thought 2017 was the year of Euro-skepticism because of electoral fears.

In fact, Charlie Aitken is hopping on to the Brexit-play, buying into Henderson and Clydesdale. He’s also bullish on China and is going long on the world’s second biggest economy. His China-loving is shared with CMC’s Michael McCarthy.

Charlie reckons the Chinese leadership is going out of its way to show that they are pro-trade, just as President Donnie is going long protection.

Shane Oliver of AMP agrees with Charlie that a pullback has to be a chance but he’s on board with my mantra as well. “Putting short term uncertainties aside, with valuations remaining okay, global monetary conditions remaining easy and profits improving on the back of stronger global growth,” he pointed out. “We continue to see any pullback in shares as opportunities to ‘buy the dips’. Shares are likely to continue to trend higher on a 6-12 month horizon.”

That said, I’m not worried about anything big and scary and Michael Arone, the chief investment strategist at State Street Global Advisors, agrees with me. “There are three things I’m looking for to see whether the bull market is ending – a pick-up in the number of corrections, rising real interest rates and wider spreads in the credit market,” he said to CNBC. “None of those are flashing red, probably not even yellow at this point.”

What I liked

- Job vacancies rose by 1.8% to 185,600 in the three months to February – a 6-year high. Job vacancies are up 7.3% on a year ago.

- Total net wealth stood at a record $9,404.5 billion at the end of December 2016, up $328.1 billion (or 3.5% over the quarter), making it the largest quarterly increase in net wealth in seven years! (In per capita terms, CommSec estimates that wealth rose to a record $386,972 in the December quarter, up $12,227 over the quarter and up around $24,000 over the year.)

- China’s manufacturing sector expanded at the fastest pace in five years, with the official Purchasing Managers’ Index (PMI) rising to 51.8 in March from 51.7 in February.

- The Trump Administration has been signaling mostly modest changes to NAFTA in relation to Mexico, so the Mexican Peso is up 15% from its January low.

- US consumer confidence hit a 16-year high!

- AMP’s Shane Oliver pointed out: “Eurozone sentiment readings were strong, with overall economic sentiment about as high as it ever gets and strong readings for the German IFO business conditions index.”

- The final estimate of economic growth for the December quarter shows the US economy growing at a 2.1% annual rate (forecast 2.0%).

- US pending home sales rose by 5.5% in February to 112.3 – the highest reading since April 2016 and the second best reading in 11 years.

- The German Dax edging closer to record highs, with industrials, mining and energy leading the way.

- The quarterly gains from global stock markets, with the hi-tech Nasdaq up close to 5%! This chart from Factset tells the tale with the Nasdaq in the pink:

What I didn’t like

- Cyclone Debbie! Our thoughts and best wishes have to go north at this terrible time. She will hit GDP and raise inflation as well because fruit prices will spike!

- Talk of a US Government shutdown, possibly as early as April. (Only in America!)

- Japanese data for February was mixed, with strong industrial production and labour market data but household spending remained weak and core inflation was stuck around zero.

- Credit data in Oz showing lending to property investors was up 6.7% year-on-year. Over the three months to February, it grew at an annualized pace of 8.3% compared to just 4.3% a year ago! It’s why the RBA is concerned and APRA is imposing qualitative lending controls.

- Bellamy’s and its ability to attract more trouble than a rock singer on a big, bad binge!

The week in review:

- This week, I asked the question: will Trump soon lose his market mojo [1] with May looming?

- Speaking of The Donald, Charlie Aitken also shared his thoughts about the Trump trade and whether it’s time for a pullback [2].

- Paul Rickard revealed whether “feel good investing [3]” can make money.

- Tony Featherstone shared four quality stocks [4] that are trading below their true worth.

- The brokers placed Collins Foods [5] in the not-so-good books.

- In our second broker report [6], Senex was in the good books, while Metcash was downgraded.

- James Dunn revealed five stocks under 50 cents [7] to consider for the speculative side of your portfolio.

- And Graeme Colley [8] outlined some important considerations to keep in mind with the $1.6 million transfer balance cap if you receive more than one superannuation pension.

Top stocks – how they fared

What moved the market?

- The good economic story coming out of the US – with US consumer confidence rising to a 16-year high of 125.6 in March, ahead of a forecast 114!

- Hopes for Trump’s tax reforms having an easier time than the health care bill.

- Strong demand for the big four banks after out-of-cycle rate rises saw analysts upgrade their earnings forecasts.

- And a disruption to Libyan oil supplies – along with a possible extension of OPEC-led production cuts – drove the oil price higher, supporting energy stocks.

Calls of the week

- Solomon Lew’s Premier Investments took a “strategic” 10.8% stake in Myer, but said it’s not currently planning to make a takeover offer.

- The Productivity Commission released a report dealing with default super arrangements so that Aussies don’t end up with too many super accounts. Read Paul Rickard’s take on the report’s implications, and how to find the best super fund [9].

- UK Prime Minister Theresa May triggered Article 50 of the Lisbon Treaty – which begins Britain’s process to leave the EU.

- And on Switzer TV, political analyst Malcolm Mackerras said he’d never seen a worse bunch of Aussie politicians! Watch the interview here [10].

The week ahead

Australia

- Monday April 3 – Retail trade (February)

- Monday April 3 – Building approvals (February)

- Monday April 3 – Home value index (March)

- Monday April 3 – Performance of Manufacturing (March)

- Monday April 3 – ANZ job advertisements (March)

- Tuesday April 4 – Reserve Bank Board

- Tuesday April 4 – International trade (February)

- Wednesday April 5 – New vehicle sales (March)

Overseas

- Saturday April 1 – China Caixin manufacturing

- Monday April 3 – US ISM manufacturing (March)

- Monday April 3 – US Construction spending

- Monday April 3 – US New auto sales (March)

- Tuesday April 4 – US International trade (February)

- Wednesday April 5 – US ADP employment (March)

- Thursday April 6 – China Caixin services (March)

- Thursday April 6 – US Challenger job layoffs

- Friday April 7 – US Non-farm payrolls (March)

Food for thought

“Cash combined with courage in a time of crisis is priceless”.

Warren Buffett

Last week’s TV roundup

- 3P Learning is an education and technology company listed on the ASX, so to understand the business, CEO Rebekah O’Flaherty [11] joins Super TV.

- Bill Laister [12] from Contango joins the show to reveal the stocks he’s watching right now.

- Morgans’ Raymond Chan [13] explains why the market is so positive despite the Trump troubles in the US, and reveals the stocks he’s watching right now.

- Are we in a housing bubble? To discuss where to buy and where to avoid, Destiny’s Margaret Lomas [14] joins the show.

- And is Charlie Aitken [15] seeing a correction on the stock market out there? He discusses this and more on Super TV.

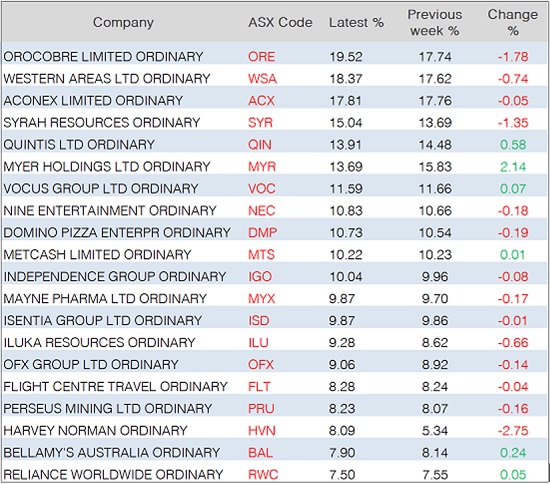

Stocks shorted

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before.

This week one of the biggest movers was Harvey Norman with a 2.75 percentage point increase in the amount of its shares sold short to 8.09%. Myer went the other way, with its short position decreasing from 15.83% to 13.69%.

Source: ASIC

Chart of the week

[16]

[16]According to CommSec, household wealth rose to a record $386,972 on a per capita basis in the December quarter. That’s up $12,227 over the quarter and roughly $24,000 over the year. Total household wealth (net) is at a record $9,404.5 billion – up 3.5% over the quarter and the biggest increase in seven years.

Top five most clicked stories

- Charlie Aitken: Trump trade – time for a pullback? [2]

- Tony Featherstone: Four quality stocks [4]

- Peter Switzer: Has Trump failure put “sell in May or before” back in play? [1]

- James Dunn: 5 under 50 cents [7]

- Charlie Aitken: Stock to watch: another small cap with a growing dividend yield [17]

Recent Switzer Super Reports

- Thursday 30 March 2017: Correction on the way? [18]

- Monday 27 March 2017: Sell in May? [19]

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.