Over the years, I have been a big fan of toll road operator Transurban. An absolute monopoly, tolls (and revenue) that go up each quarter at more than the inflation rate, and increasing patronage due to population growth and choked local roads in our major cities.

Covid-19 knocked the stuffing out of Transurban and caused the unthinkable – lockdowns, and “stay-at-home” motorists. Transurban’s reputation as a reliable, on-time, on-budget developer of toll roads also took a hit, firstly with the NorthConnex project in Sydney which came in 18 months’ late, and then with the troubled West Gate Tunnel Project in Melbourne. The market went a little cold on Transurban.

Transurban (TCL) – 4/17 to 4/22

Source: nabtrade

But after a well supported $4.22bn capital raising in October at $13.00 per share to part-fund the purchase of the remaining 49% of the WestConnex project in Sydney, plus settlement of the West Gare Tunnel dispute in December which will see Transurban contribute an additional $1.7bn into the project, Transurban‘s shares have been moving higher. On Friday, they closed at their highest level since 5 January.

One of the main reasons for the move higher is that the market has come to terms with the impact of rising interest rates on Transurban. Previously an Achilles heel for Transurban, the market now understands that when inflation is driving interest rate increases, Transurban is actually a short term winner.

Transurban distributes 100% of its ‘free cash flow’ to unitholders as a distribution. Free cash flow is essentially the revenue from tolls, less operating expenses and interest on its debt. On the expense side, its interest costs dwarf the operating expenses – so it is potentially very sensitive to interest rate increases. To mitigate against these, 99% of its total debt of $32.5bn is locked in at a fixed interest rate. The average term of the debt is 7.4 years. However, as debt matures, it has to be “rolled over” (or repaid), so the risk is a refinancing risk.

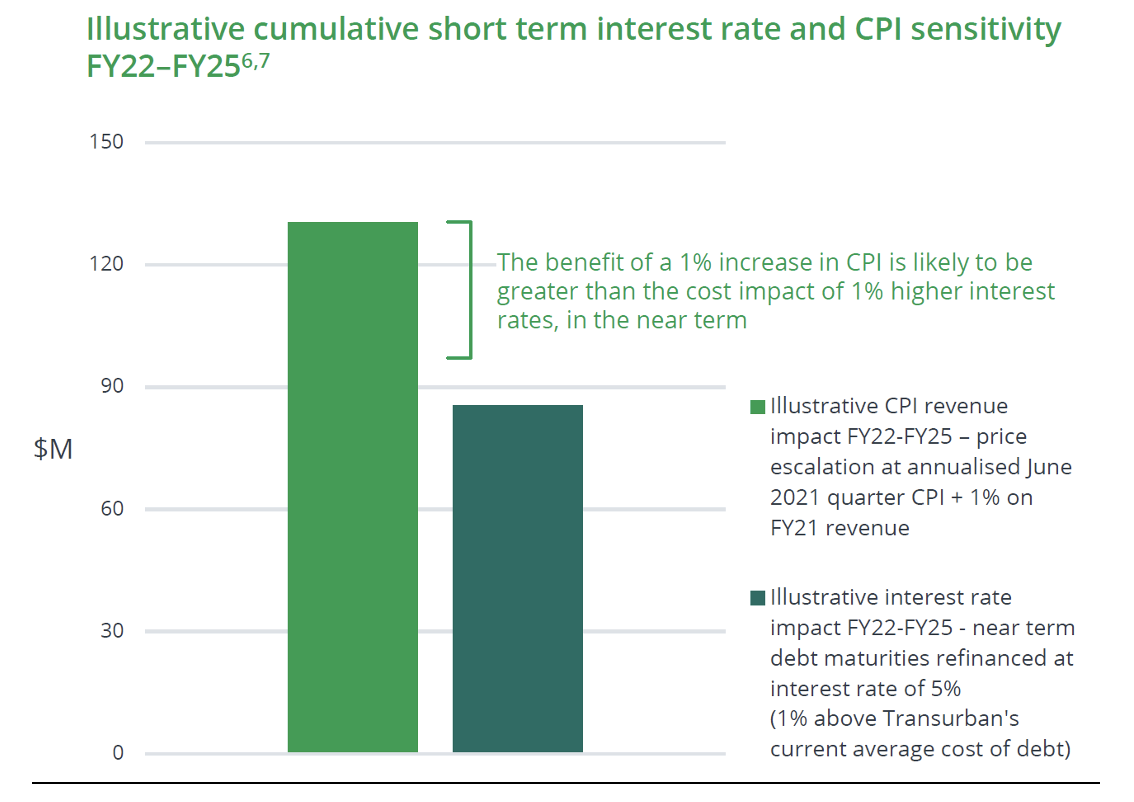

Most of the road tolls are linked to increases in the Consumer Price Index (68%). Another 27% are set at 4.25% pa, and 7% are “dynamic”. Transurban published the chart below in February which looks at the cost of higher interest rates compared to the revenue gain from higher inflation.

Considering debt maturities in the FY22-FY25 period, it concluded that the benefit of a 1% increase in the CPI is likely to be higher than the costs of refinancing at an interest rate 1% higher than its average cost of debt of 4%. In other words, it is a winner in the short term from higher inflation and higher interest rates.

Another risk for Transurban is patronage – in particular, will changes in the way people work, buy online and choose to spend their recreational time impact traffic on its toll road network?. So far, Transurban says that it’s holding up pretty well. Although the average daily number of trips was down 4.8% in the December half year compared to the corresponding period in FY21, both periods were impacted by lockdowns. Traffic in Sydney is now higher than it was two years ago (pre-Covid), while both Melbourne and Brisbane are improving and moving in the same direction.

Higher petrol prices could also impact demand, but Transurban expects this to be limited to the weekends rather than during peak periods. Offsetting this is the “e-commerce” driver, which is supporting the demand from (higher paying) commercial traffic.

Consumer disquiet over the high cost of tolls means that increased Government regulation or potentially price caps could be an issue. However, it is hard to believe that Governments have the fortitude to take on Transurban in this space.

What do the brokers say?

The major brokers are generally supportive of the stock, with 4 ‘buy’ recommendations and 2 ‘neutral’ recommendations. On a valuation basis, they see some upside, with a consensus target price of $14.46, about 6% higher than where it closed on Friday. The range is tight – from a low of $13.55 from Morgan Stanley to a high of $15.40 from Ord Minnett (JP Morgan).

They expect a final distribution of 25c per unit, taking the full year (FY22) distribution to 40c per unit. They forecast this to rise to 58.3c in FY23, putting Transurban on a prospective yield of 4.3%.

Bottom line

Although the distribution yield for Transurban is the “interesting” rather than the “compelling” category, the recent price action suggests that the market is comfortable with Transurban’s interest rate risk and that post-Covid, further recovery in traffic is expected.

Following the takeover of Sydney Airport, there is a shortage of infrastructure assets, particularly listed assets. Transurban has a strong pipeline of new projects – the West Gate Tunnel in Melbourne and West Connex in Sydney, as well as three North American projects – and a prospective list of other opportunities. Over time, it should be able to grow its revenue.

Transurban is no “steal” at $13.64. Definitely a “hold”, and one for the watchlist to consider buying in weakness. But it also looks pretty “safe”, and that’s why the price is edging higher.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.