With investing, you really have to be able to keep the faith when the market decides to sell off because it fears the idea of a President Biden or an unwelcome spike in COVID-19 in the US, Europe and the UK (the latter two are now going into lockdown). And the US could be pressured to do the same if Joe takes Donald’s job in a couple of days’ time!

So when you confront a sell off, you have to ask yourself: do I take action in the short term or do I just sit tight?

I keep telling my financial planning clients that we can’t be right all the time, especially in the short term. But if we screw up the long term, then we’ve done a bad job. It doesn’t stop some clients complaining but I simply put it down to their bad memories!

Generally, I’m happy with my portfolio, even though it copped it a bit last week, with the S&P/ASX 200 down 3.9% for the week. So I thought I should review my ZEET stocks:

- Zip Co (Z1P).

- Elmo Software (ELO).

- EML Payments (EML).

- Tyro (TYR).

I’m especially doing this as we’ve seen a tech-led sell off from the US as the election looms, the Coronavirus threatens economic growth again and the valuations for tech stocks are crazy.

Last Thursday I was invited to attend a socially-distanced drinks get together for an accounting firm and was asked to do a short speech, after which I was asked would I be a buyer of stocks, given the current drop in the market.

I replied that I’m toying with buying on Tuesday (tomorrow) our time, if there’s still a lot of negative selling going on. But this is simply me guessing on the timing of when the market says “enough is enough” and it’s time to buy again.

If it was election stuff only spooking the market, I might have more confidence. But as it’s also Coronavirus fears, I might wait until I see the result before I buy more of my ZEETs.

In case you missed it, on Friday, EML Payments lost 18.4% and Zip Co gave up 15.13%.

Interestingly, the analysts don’t agree with the market on Zip. And they also have pretty strong positive views on Tyro and ELO.

This what FNArena’s survey of analysts tells us:

- ELO’s target price is $9.30, which implies a 67% upside!

- Zip’s target price is $6.69, which suggests a 17% upside.

- Tyro’s target price is $4.20. That’s says it could have a 13.5% rise ahead.

- EML isn’t covered by the analysts, yet.

Let’s talk about EML for a minute. On October 14 after the share price had surged 11% and it followed its market show-and-tell, it reported that in FY20 the company generated:

- 54% growth in Gross Debit Volume.

- 25% growth in revenue to $121.6 million.

- 17% growth in Net Profit After Tax Adjusted to $24 million.

It was also pointed out that the space it plays in (the global e-commerce market) could experience sales of $6.5 trillion by 2023.

Friday’s sell off is linked to the closures and lockdowns overseas and EML is a player in these markets.

In the short term, I wouldn’t expect a quick pay-off but I always said that these ZEET stocks were for the medium term (at least). They simply surprised me about how quickly they took off after my writing.

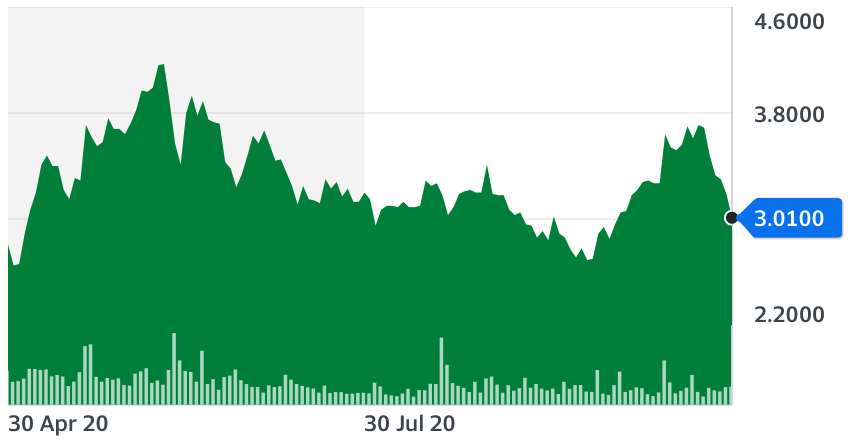

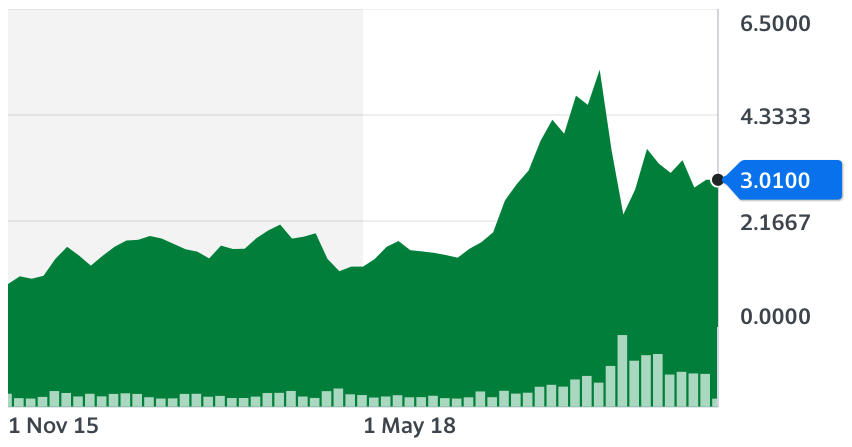

Both the six months and five-year charts make me think EML is a company in the right space. But it has been hit by the unusual circumstances of 2020.

EML six months

EML five years

The ELO story

I’m happy to keep the faith on ELO, if only for the 67% upside the analysts think is out there. I’d be happy with half or even a quarter of that!

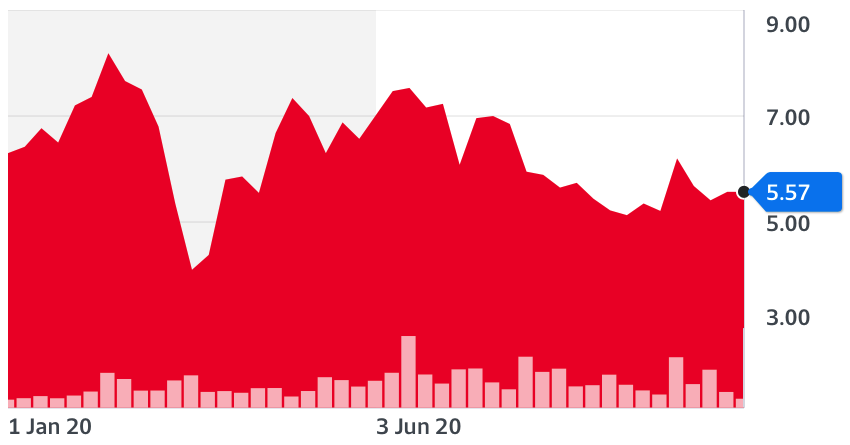

ELO year-to-date

I liked the way this company roared out of the Coronavirus crash in March. Its business in human resources and payroll provides scope for business growth.

What about ZIP?

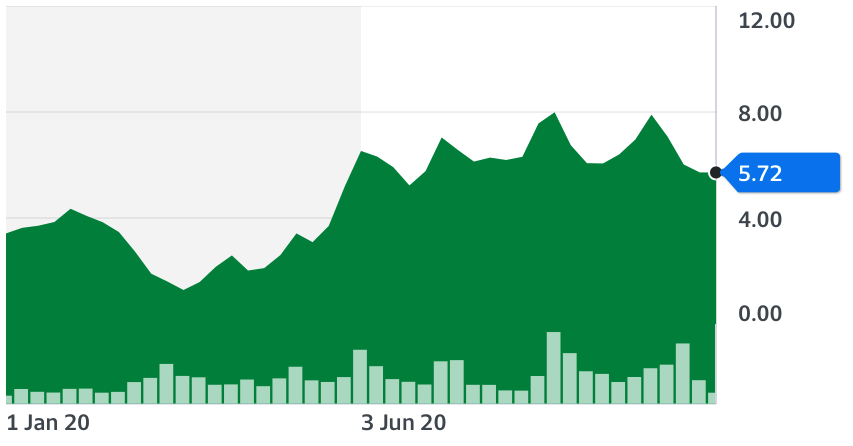

When it comes to Zip Co, it’s one-month chart isn’t great but this has been a tech sell off month. Its year-to-date chart makes it easy for me to keep the faith.

Z1P year-to-date

And finally, Tyro

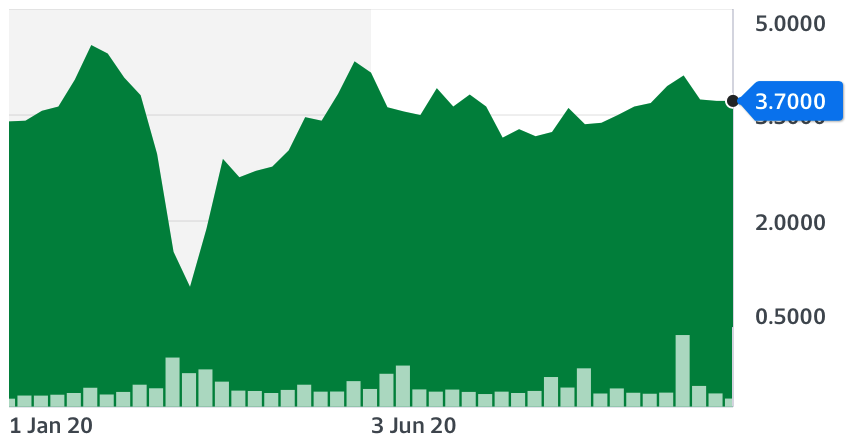

Tyro has an equally likeable year-to-date chart.

Tyro year-to-date

I like how the company roared out of the crash’s low point and got close to its all-time highs, even though the state that does hospitality with a capital H i.e. Victoria, was in lockdown. Tyro has a big chunk of the café, restaurant and pub sector and should benefit as Melbourne hots up for the holidays.

Remember, it was a bad week for tech stocks in the US. And for reasons best explained by the big fund managers who drive the local market, we play follow the leader. Last week, Facebook lost 6.3%, Netflix gave up 5.7%, Apple slipped 5.6% and Amazon dropped 5.5%. And what about Twitter being smashed by 21%!

I’m going to watch the market slip over the next week or so but I’m keen to add to my positions. But I’m not expecting a really big pay-off until normalcy comes to town. And that could be in late 2021!

I think my ZEET stocks will do OK over time.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.