The “buy the dip” strategy has worked very successfully since the Covid crash, and for the decade leading up to that. But as the Covid crash demonstrated, some dips turn into a rout.

I don’t think the current “dip” will turn into a rout, but it could be a little more protracted than some expect, and I don’t think we have bottomed.

Driving this dip are several factors, including:

- The chaotic administration of President Trump (most particular, with tariffs).

- Notwithstanding the tariffs, a fear that inflation is hanging around and combined with a low growth economy (or negative growth economy with tariffs), stagflation may be the order of the day.

- The US markets were due for a correction – on most metrics, they were well above long term fundamental value.

- In Australia, we are about to go to an election, with a highly possible outcome being a minority Government; and

- Again, more relevant to Australia, commodity prices (with the exception of precious metals) are flat, arguably still softening.

I think these factors have some time to play out and that’s why I don’t think the correction is over. But I am looking to buy, and these three stocks top my “buy” list.

- Promedicus (PME)

If you haven’t heard of Promedicus (PME), then mark it on your radar. It is shortly to join the ASX 50 and now makes up about 15% of the heath care index.

Pro Medicus is a leading provider of radiology information systems (RIS), Picture Archiving and Communication Systems (PACS) and advanced visualization solutions to hospitals, diagnostic imaging groups and other related health entities in Australia, North America and Europe.

Its Visage 7 product is used by 11 out of the top 20 hospitals in the USA. It recently signed a $330m 10 year contract with US provider Trinity Health and has $894m of forward revenue booked over the next 5 years.

PME’s business model is highly scalable. It is a software only model (so no capex), a contained cost base and the margin grows as the footprint increases. In the first half of FY25, on revenue of $97.2m (up 31.1%), it generated EBIT of $69.9m and NPAT of $51.7m.

Fans of the company point to the revenue opportunity for PME is the USA (current market share is estimated at 9%), it is yet to focus on Europe or Asia, it is debt free, and the fantastic operating leverage. There is a global shortage of radiologists and AI (which PME is embracing) is being applied in the next generation of products.

But PME is super expensive. Even after the recent fall in share price (from almost $300 to Friday’s close of $234.08), it is trading on a multiple of 206x forecast FY25 earnings and 139x forecast FY26 earnings.

Source: nabtrade

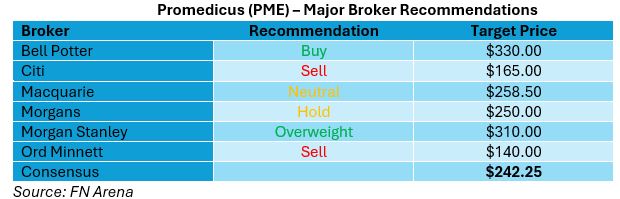

The brokers are generally positive on the stock, but feel it is expensive. Their target prices have been creeping up (as the stock price has been rising), and today the consensus sits at $242.25, 3.5% higher than Friday’s close. There is quite a range in targets – from Ord Minnett at $140.00 through to Bell Potter at $330.00.

Source: FN Arena

The two founders of PME (Dr Sam Hupert and Barry Hall) collectively own 48% of the company, meaning the free float is relatively small.

PME reminds me of the early days of Resmed. Super expensive, but you just have to “close your eyes” and buy.

- Goodman Group (GMG)

Unquestionably Australia’s premier property company. Goodman owns, develops and manages logistics properties and data centres in major global cities.

Goodman’s property portfolio is around $84bn, with $70bn of that in partnership with external providers. Its developmet portfolio is around $13bn. 64% of revenue is from outside Australia, with the Americas bringing in 36%, Europe 24% and Asia (ex ANZ) 10%.

In the first half, Goodman’s operating profit of $1,244m was up 8% on the first half of FY24. Operating earnings per unit of 63.8c were up 7.8%.

Goodman recently completed a $4.0bn equity raise to further its ambitions with its data centre offering. The raise at a price of $33.50 was completed at very tight discount of just 6.9% to its then current share price, showing enormous support from the institutional market.

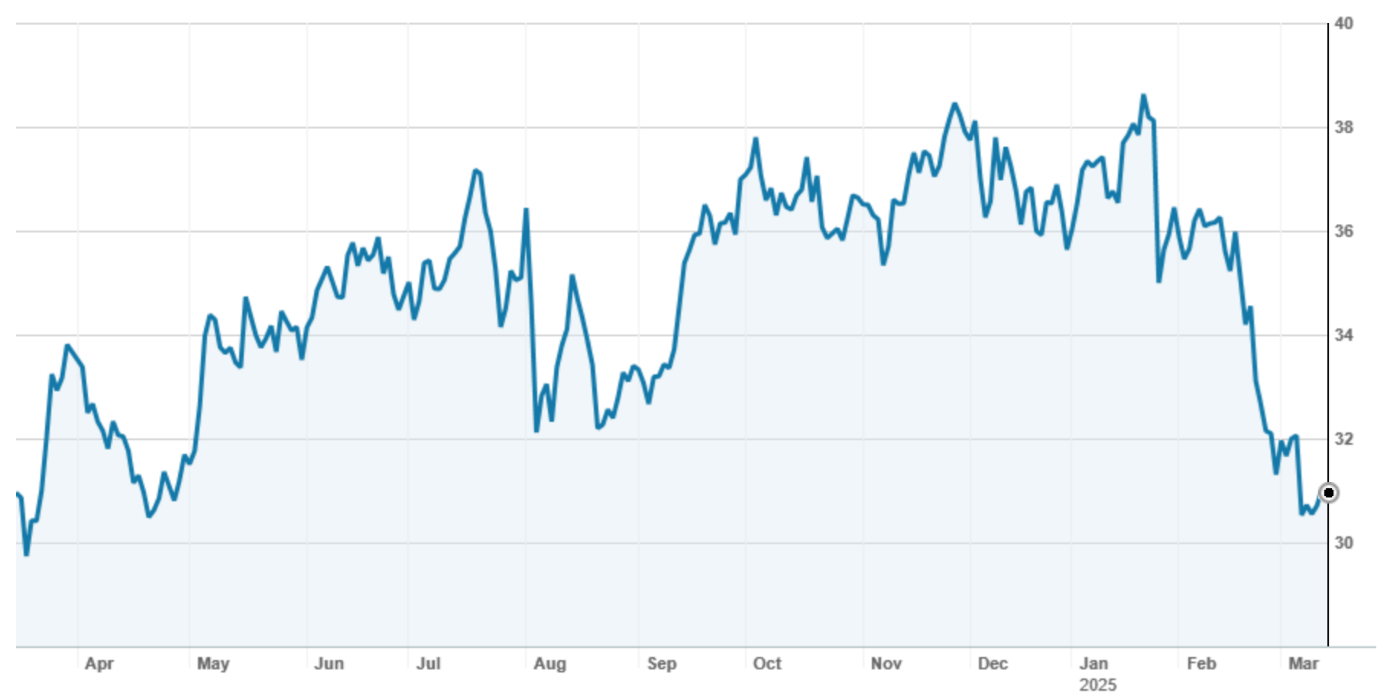

As is often the case following major capital raisngs, indigestion has meant that the price has drifted down, and on Friday, Gooman closed at price of $30.81.

Source: nabtrade

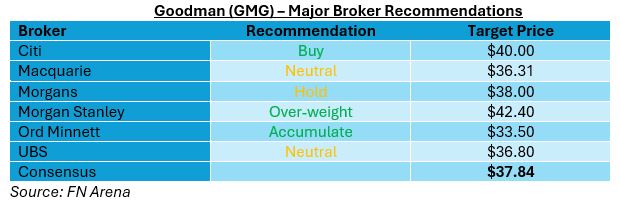

The major brokers are positive about the stock. The consensus target price is $37.84, 22.8% higher than Friday’s ASX closing price of $30.81.

Goodman got into the logistics trend early and has been a fast follower when it comes to data centres. The weight of institutional money that backed the recent capital raise is a strong recommendation. This share price correction looks temporary.

- Macquarie Group (MQG)

Macquarie needs no introduction, perhaps except to say that it is worth remembering that the majority of Macquarie’s revenue (and staff) are based offshore. It is a global investment bank. For super profits, it needs its commodities trading division (where it is arguably the global leader) to fire or be in the position to crystalize profits from its investments in infrastructure, green energy and other assets.

The correction has been pretty tough on Macquarie, with its share price falling from a high of $239.38 on 13 February to a low of $196.08 on 13 March, a fall of almost 20%. On Friday, it closed at $198.25.

Source: nabtrade

The major brokers are mixed on Macquarie. Although positive overall with a consensus target price of $225.71 (11.4% higher than Friday’s close), a couple of brokers are concerned that near term profitability may be impacted by subdued trading conditions in commodities.

On multiples, the brokers have Macquarie trading at 20.5x forecast FY25 earnings and 17.5x forecast FY26 earnings.

I think Macquarie looks good buying under $200, but because Macquarie will be “market sensitive” (that is, volatile) I think it is a stock that you can “average down” on. Leave yourself some room for another dip down.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.