Small-cap bulls often note the size of the valuation gap that emerged between small- and large-cap stocks this year. After being battered in a risk-averse market, small-caps traded at an unusually large discount.

Adding small-cap exposure to portfolios through Listed Investment Companies (LICs) takes that discount to a new level. Some LICs that specialise in small-cap investing are trading at a big discount to their Net Tangible Assets (NTA).

Investors can get exposure to the assets of some small-cap LICs at a 20-30% discount to their underlying value. Put another way, they can buy $1 of assets for 70-80 cents – at least in theory.

The bulls argue that investors are getting a double discount on some small-cap LICs. First, a discount on some small-cap LICs to their NTA. Then, a discount on small-cap equities to large-caps, although it is never that clear-cut in practice.

For starters, some LICs trade at large discounts to their pre-tax NTA because the market frets about the manager’s performance, dividend record, underlying asset class or share liquidity. Or because the LIC market has lost favour this year, amid rising competition from passive and active Exchange Traded Funds.

Hefty, persistent discounts to NTA frustrate shareholders and LIC managers – and make it hard for LICs to raise equity capital (without diluting investors).

Meanwhile, the underlying asset class – small-cap equities – historically trades at a discount to large-cap stocks because small-cap companies often have lower-quality franchises, weaker balance sheets, lower liquidity and lower market profile.

Yes, I’m generalising with small-cap LICs and small-cap equities. Some small-cap LICs trade at a premium to their NTA and some small-cap equities have outperformed. There’s always opportunity beneath indices and market averages.

But the core argument – small-cap LICs and small-cap equities generally trading at large valuation discounts – holds. Neither argument is unexpected. Small-cap equities (and funds) often underperform in risk-averse markets.

The reverse is also true. Small-cap investing is returning to favour, amid signs that Australian and US interest rates have peaked. More small-cap funds are being launched and asset allocators are expected to put more money to work in small-cap assets next year, to position for an eventual ‘risk-on’ market.

The upshot is some big headwinds for small-cap LICs could become tailwinds in 2024 as interest in this asset class – and funds that provide exposure – grows.

Investors who want to add or increase small-cap exposure in their portfolio should look at small-cap LICs. Many trade at deep discounts to their NTA, even though Australia has some terrific small-cap LIC managers.

However, caution is needed. LICs that invest in small-cap equities and trade at 20-30% discounts to their NTA are themselves tiny stocks with low share liquidity. Several small-cap LICs are capitalised at less than $100 million (meaning the LIC itself is a micro-cap).

Critics argue that too many LICs, including small-cap ones, are subscale. They lack internal resources to adequately market their LIC through investor relations and boost liquidity in their stock. This lack of profile constrains share demand and fuels discounts to NTA. Some small-cap LICs should be wound up or merged.

That said, growing small-cap interest in 2024 should provide some much-needed relief for small-cap LICs. More investors seeking more small-cap exposure should mean rising demand for shares of quality small-cap LICs. And perhaps a narrowing of the discount between their share price and NTA.

Here are three small-cap LICs to watch. I can’t stomach paying large double-digit premiums for LICs, so that rules out the WAM Research and WAM Microcap LICs, which are the market’s largest small/mid-cap LICs by capitalisation.

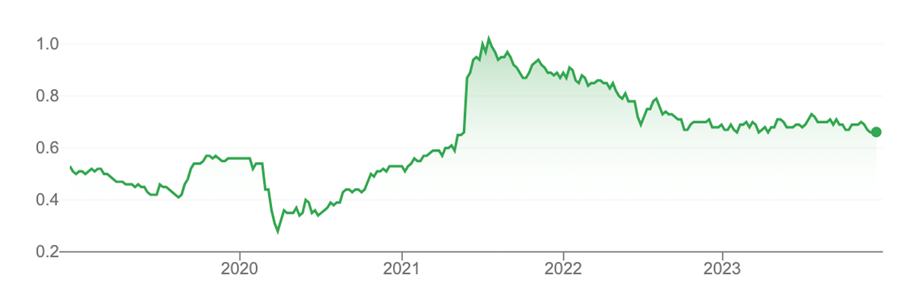

1. Spheria Emerging Companies (ASX: SEC)

Launched in 2017, SEC suits long-term investors seeking small-cap equities exposure through an LIC. The well-regarded SEC is less speculative than some LICs that have concentrated portfolios in micro-caps.

Capitalised at $113 million at end-November 2023, SEC had a strong November, its underlying portfolio up 8.6%. The fund has outperformed its index over one, three and five years – although absolute returns have mostly been low over those periods.

On Bell Potter’s latest LIC numbers, SEC is trading at a 14.6% discount to its pre-tax NTA. Its average discount over three years is almost 11%.

If you subscribe to the theory that LICs tend to revert to their longer-term average discount/premium, SEC looks a touch undervalued.

SEC looks well-placed to narrow the discount to its NTA as interest in small-cap investing grows next year. SEC’s gross yield of 7.8% (after franking) on Bell Potter’s numbers is another attraction for income-focused investors.

Chart 1: Spheria Emerging Companies (ASX: SEC)

Source: Google Finance

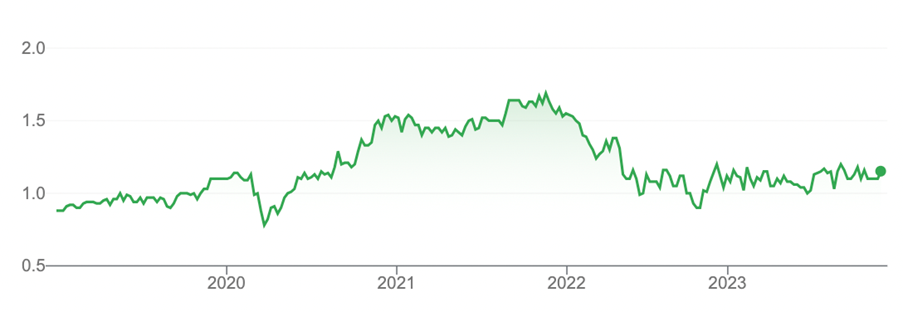

2. NAOS Small Cap Opportunities (ASX: NSC)

Launched in 2017, NSC holds a highly concentrated portfolio with just 10 stocks, most of which are micro-caps. Clearly, NSC is not for risk-averse investors or those with a short-term focus (the LIC is a long-term investor).

Several micro-caps in NSC’s portfolio appeal at current prices, notably Move Logistics Group, Maxiparts and Frontier Digital Ventures.

NSC has outperformed its benchmark (the Small Ordinaries Accumulation Index) over the past five years. Since inception, NSC has narrowly underperformed.

On Bell Potter’s numbers, NSC traded at a 10.5% discount to NTA in early December. The five-year average discount is 16%, meaning NSC is trading at a lower discount than it normally does.

That said, NSC’s discount to NTA has been as high as 25% over the years. The discount can be volatile due to the portfolio’s concentrated holdings.

NSC is a good judge of micro-cap stocks and over the years has been prepared to buy deeply-out-of-favour stocks trading at bottom-quartile valuation. More of that hard work could begin to pay off in 2024 and beyond as small caps improve.

Chart 2. NAOS Small Cap Opportunities

Source: Google Finance

3. ECP Emerging Growth (ASX: ECP)

Capitalised at about $20 million, ECP is working to lift its market profile through investor communications and other investor-relations activities.

ECP traded at a 15.6% discount to its pre-tax NTA at end-November 2023, ASX data shows.

It’s hard to reconcile the extent of ECP’s discount to NTA with its short- and long-term underlying investment performance. Some discount is required given ECP’s size, but the best explanation is the LIC’s low profile, size and liquidity have created a persistently large discount to its NTA.

On relative and absolute performance for its underlying portfolio, ECP has delivered better returns than many of its peers over one, three and five years. The portfolio has had significant outperformance since ECP’s inception in August 2014.

Moreover, I’ve written favourably this year about several of ECP’s holdings, notably GQG Partners, IDP Education and Carsales.com. I like its top portfolio holdings.

However, small-cap LICs ultimately need higher liquidity (more people buying their shares) to narrow the discount to NTA. That’s not easy for a micro-cap LIC in a market that has shunned small caps over the past few years. ECP suits experienced investors who understand the risks of micro-cap equities.

Chart 3: ECP Emerging Growth

Source: Google Finance

Tony Featherstone is a former managing editor of BRW, Shares and Personal Investor magazines. The information in this article should not be considered personal advice. It has been prepared without considering your objectives, financial situation or needs. Before acting on information in this article consider its appropriateness and accuracy, regarding your objectives, financial situation and needs. Do further research of your own and/or seek personal financial advice from a licensed adviser before making any financial or investment decisions based on this article. All prices and analysis at 13 December 2023.