The big question all investors must contemplate is what’s likely to happen to stocks now that the Trump U-turn on tariffs has led to a huge rebound of stock prices. Should this comeback of our portfolios based on a less aggressive tariff attitude from the US President and a 90-day pause on big tariff increases (as well as lower tariffs for both the US and China imposed on each other) be seen as a good time to go defensive ahead of another market slump?

CNBC looked at the history of stock markets after a crashing and big bounce back and suggested that “stocks could be primed for large gains!”

The starting point for this analysis is the fact that the S&P500 has soared more than 18% since hitting a closing low on April 8. “That marks only the fifth time since 1970 that the broad market index has surged that much over just 25 trading days,” the US business website reported. “If history is any guide, stocks should now see sizable gains over the coming year”.

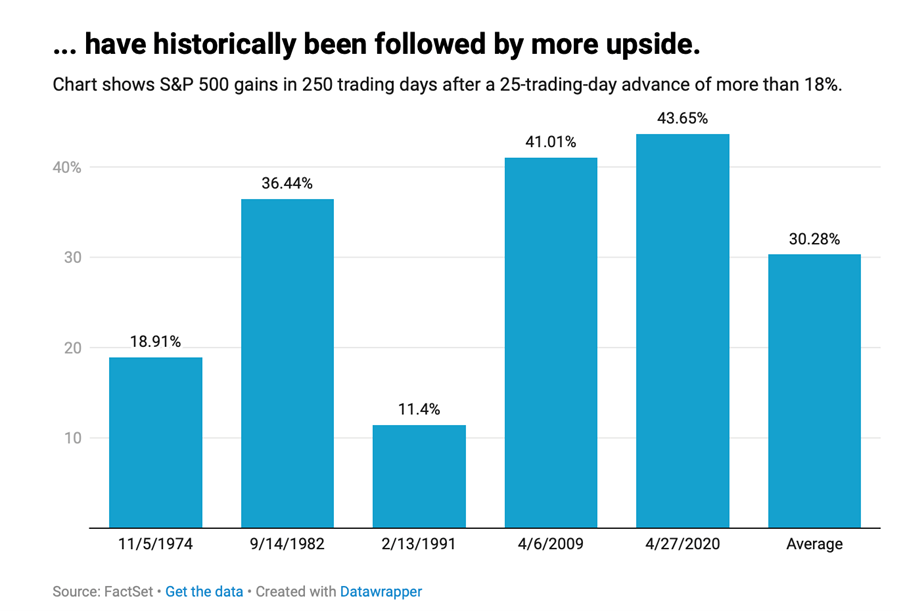

Looking back on the history of the S&P500, there has been an average rise of about 30% in the 250 trading days that followed such a strong 25 trading day run. In fact, in two instances, the benchmark market index has surged more than 40%.

The chart below sums it up neatly.

This morning on my Sky News report I referred to the history of US stocks after a big slide and then rebound but I made the point that this historical occurrence of a bigger-than-expected sustained rise in stock prices happened after a market smashing under more conventional US presidents.

In reality, Donald Trump is a human curve ball and therefore adds another question market over what happens to stock prices going forward. To be fair, a month ago, the US looked like facing a global retaliation to the Liberation Day list of retaliatory tariffs, which was expected to add to inflation and economies facing recession, as bond market yields/interest rates spiked higher.

Now, since the Trump U-turns on tariffs, stock prices have comeback strongly and confidence is being rekindled, albeit tentatively. There remains uncertainty linked to what deals might be struck with China, Japan, South Korea, Canada, Mexico and, of course, the European Union, which looks pretty annoyed at the Trump approach to global politics.

Tom Essaye of the US-based The Sevens Report summed it up succinctly with the following: “What a switch, even for this market — a month ago (and even much later than that) the outlook for the economy was stagflation and the outlook for stocks was bordering on a ‘lost decade’ similar to what was witnessed in the 1970s and 2001-2009. But, oh how things have changed.”

While Essaye acknowledged the surprise better outcomes for stocks, he still urged caution because, as he said: “There is a lot of uncertainty to dismiss.”

Personally, I’m betting Trump and his team have been taught a lesson by the stock market, and even more by the bond market, which drove up what the US Government had to pay to borrow other countries/peoples’ money, because Trump had made the US a less secure proposition to lend money to.

If reasonable trade deals are struck, and US interest rates still trend down (as is expected), especially as inflation is falling, and we recognise the President’s “big, beautiful bill” before Congress that delivers tax cuts as well as no tax on tips, overtime and social security, then Wall Street could easily remain positive.

The big worries will be the future of the US budget deficit because tariff revenues were expected to bankroll these tax cuts, so lower tariffs could create fiscal concerns. Last week, as the AFR reported, another debt rating agency downgraded US from AAA to AA1.

Moody’s said the move to AA1 “reflects the increase over more than a decade in government debt and interest payment ratios to levels that are significantly higher than similarly rated sovereigns”.

US debt could be a slow burn issue for the stock market, and I see the following as reasons for not going too negative on stocks for the present:

- Lower interest rates are coming.

- Better tariff outcomes are likely.

- China should have a better economic recovery if a reasonable trade deal is struck. (I liked the 5%+ rise for BHP and Rio Tinto last week.)

- Trump’s “big, beautiful bill” and references to deregulation changes for the US.

- Less chances of a US recession.

Locally, lower rates that we should see tomorrow (and over the year) with the RBA meeting, should help spark a rotation out of many big cap stocks into smaller cap stocks. That’s why I like an ETF such as EX20 and small cap fund managers like EGG Small Companies Fund, which did 9.59% for the past year. Lower interest rates historically favour smaller companies. There tends to be better returns for a time as rates fall but their time in the sun can end once rates rise again.

Because of the Trump uncertainty, I’d play IHVV for exposure to the US S&P500, which will be helped by a new uptrend for tech created by the Trump U-turns. I’m avoiding riskier tech plays such as HNDQ (the top 100 Nasdaq stocks ETF) that did well for us until Trump spooked tech investors.

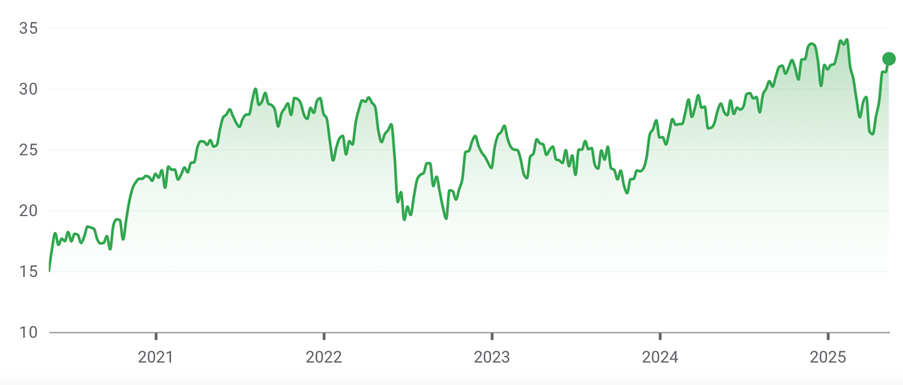

If the uncertainties weren’t so obvious, I might try GEAR again, but it has risen 17.12% over the past month and is near all-time highs.

Betashares Geared Australian Equities Complex ETF

The fact I’m avoiding GEAR and HNDQ, which I suspect could surprise on the high side, underlines my cautiously positive view on stocks for the rest of this year. I blame this unusual caution from yours truly on the unpredictable and historically unreadable Donald Trump.

On a toss of a coin, while I’d say he won’t hurt stocks, that’s gambling, not investing. That’s why I want new share plays that pay dividends. That’s the nature of my defensive stance with any new acquisitions to my portfolio.

I could change my mind and go back to pure growth investments, but President Trump will have to help me with that!