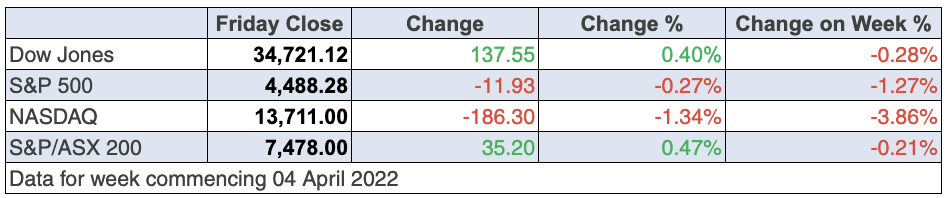

European stock markets were up strongly on Friday and the Dow was up 0.4%, while the Nasdaq lost 1.34%. However, that was understandable, given the resurrection of fears linked to the upcoming Fed tightening.

Driving a lot of those worries have been numerous sightings of inverted yield curves in the bond market, which have either been exaggerated or have disappeared after a number of days.

The concerns about negative yield curves are linked to some history that they run ahead of a recession, so we’re not only worrying about inflation, rapid rate rises from the Fed and now here with our RBA, but also the possibility it will create a recession.

AMP Capital’s Shane Oliver has joined the chorus of financial sector economists expecting our first official cash rate rise in June rather than August because of rising inflation. Shane remains realistic about negative yield curves. “In Australia, the yield curve has given numerous false recession signals – but it’s nowhere near signalling a recession, albeit the 10/2 year gap has been flattening,” he said this week.

Global share markets fell over the last week mainly on the back of hawkish central banks and ever-rising bond yields. And despite all these negatives that continue to get all the headlines and play into the hands of short-sellers (particularly those betting against tech stocks), Shane remains positive on shares. “We remain of the view that share markets will be higher on a 12-month horizon, but it’s still too early to be confident we have seen the bottom and volatility is likely to remain high,” he concluded on Friday.

Despite that, in the short term, he sees a strong case for expecting volatility. This is his list of concerns:

- Key central banks are continuing to sound more hawkish.

- Bond yields are continuing to rise.

- Uncertainty remains high around the war in Ukraine even if Russia is refocusing on the more limited objective of controlling the Donbas.

- Political risk may re-emerge in Europe with the French election, where the right-wing candidate for the presidency has a lot of support.

- The return of possible tax hikes in the US to fund a slimmed-down Build Back Better program may add to uncertainty ahead of the US mid-terms.

- The rebound in shares since early March has lacked the breadth often seen coming out of major market bottoms, with defensive stocks leading the charge.

These are all fair points, but Shane clearly sees that a lot of these are transitory and upcoming positive developments over 2022 must explain why he retains a positive view on stocks, similar (albeit it a little less optimistic) to yours truly.

The more positive future for stocks rests on an eventual peace settlement in Ukraine and China beating the virus and returning to a more normal supply chain. I know it looks like a stretch to believe it will happen this year, but we are only in April. If the current negatives driving inflation higher are still persisting in three months’ time, then I’ll have to do a Larry David and curb my enthusiasm!

One of the big market-moving events of the week was “comments from Fed Governor Lael Brainard, who set the cat amongst the pigeons of the equity and bond markets with some very hawkish comments. Ms Brainard suggested that a reduction of the Federal Reserve’s balance sheet, so-called quantitative tightening, could begin as early as next month and at a much faster pace than previous efforts”. (marketpulse.com)

Brainard is usually more dovish and that shocked a lot of market-watchers. On top of that, she’s tipping a 0.5% rate rise to boot in April from the Fed. All these negatives are fighting the historical pattern that this month is the best for US stocks.

Based on history, since 1945 there’s a 70% likelihood that a rise in stock prices will happen, though mid-term election years have tended to create some negative results for the market in April.

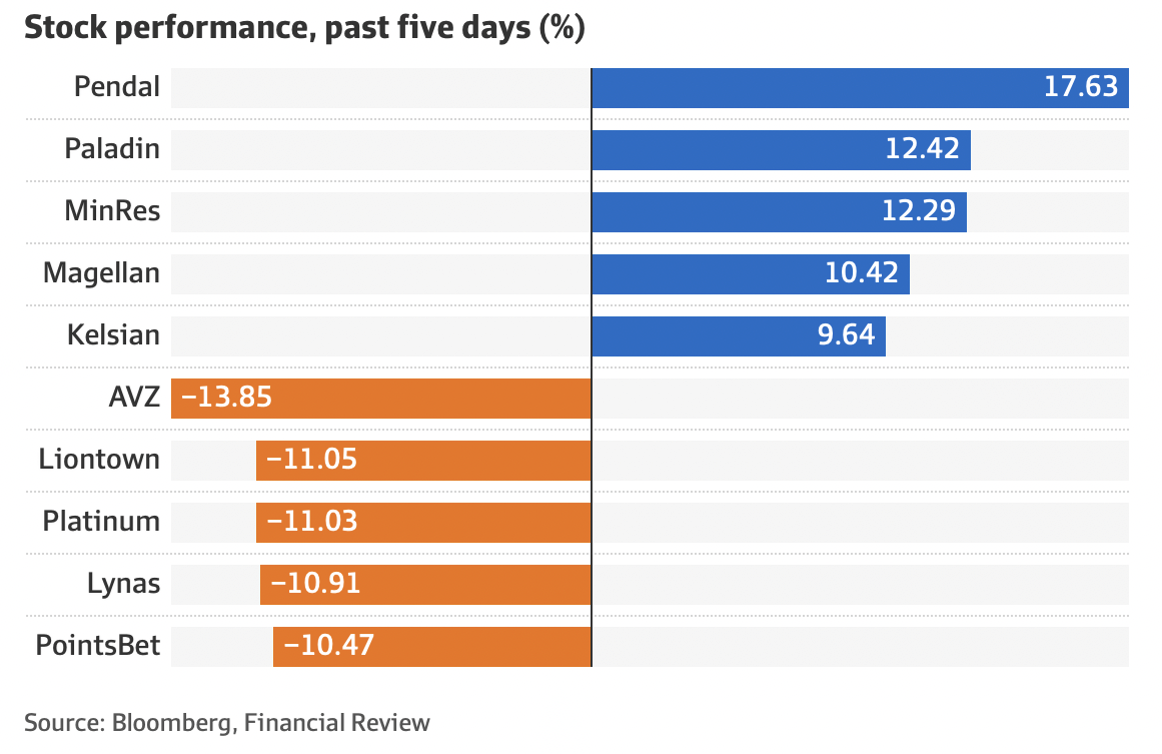

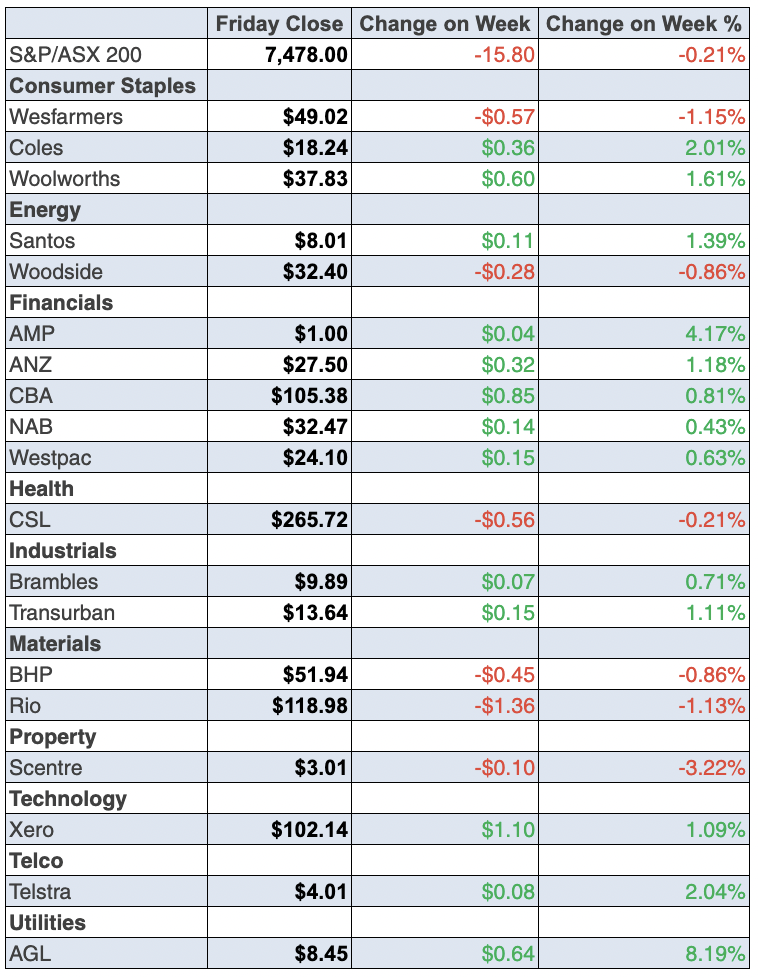

To the local story and the S&P/ASX 200 lost 0.2% this week after rising interest rate speculation hurt stocks here and overseas. Here were the winners and losers:

Pendal was up on a Perpetual play for the company, while Magellan reported some better news of reducing outflows. In contrast, Platinum is struggling; losing 12.27% to $1.90. It’s been a slide since early 2018 when it was an $8 plus stock.

Meanwhile, uranium has gained friends, with the challenges for oil and gas because of the Ukraine war.

Also benefitting from the war was Graincorp, which was up 5.15% for the week to $9.19.

What I liked

- In March, ANZ job ads rose by 0.4% to a 13½-year high of 245,891 available positions (the highest since July 2008). Job ads are up 32.5% on the year and are 57.5% above pre-Covid levels in January 2020.

- According to the Federal Chamber of Automotive Industries, new vehicle sales totalled 101,233 units in March, up 1.2% on a year ago. It was the strongest March sales in four years.

- The ANZ-Roy Morgan consumer confidence index rose by 2.5% to 93.4 points last week. Consumer inflation expectations over the next two years fell from a 9½-year high of 6.4% to 5.8% last week.

- In February, business turnover lifted in all 13 industries, according to the Australian Bureau of Statistics(ABS). Turnover rose the most for Transport, postal and warehousing (up 9.3%), Arts and recreation services (8%) and Construction (up 7.4%).

- The RBA said this: “It is important that lending standards do not slip and that borrowing and lending decisions are resilient to higher interest rates and the potential for falls in housing prices and/or real incomes.” But added that, “the majority of indebted households are well placed to manage higher minimum loan repayments.”

- The trade surplus fell by $4.3 billion to $7.46 billion in February but Australia has posted 50 successive monthly trade surpluses. And imports rose by 12.1% (the biggest lift in 21½ years) in February to a record $41.3 billion. Imports rising is a good sign for future economic growth, not recession!

- The AiGroup Performance of Services index (PSI) fell by 3.8 points in March to 56.2 points, indicating growth but at a slower pace of expansion in activity.

- The AiGroup and Housing Industry (HIA) Association Performance of Construction Index (PCI) rose from 53.4 in February to 56.5 in March, indicating a stronger expansion in activity.

- Australian petrol prices have fallen sharply over the last three weeks reflecting lower oil prices, the higher Australian dollar and the 22.1 cents a litre fuel excise cut.

- The ISM services index in the US rose from 56.5 to 58.3 in March (survey: 58.5).

- The final S&P Global Australia Services Purchasing Managers’ Index (PMI) eased from 57.4 in February to 55.6 in March. A reading above 50 denotes an expansion in activity.

What I didn’t like

- The RBA Board has dropped its comment that it is “prepared to be patient” previously seen in monetary policy statements between 2 November 2021 and 1 March 2022. This led to this week’s ‘rates will rise in June’ speculation.

- The Melbourne Institute monthly inflation gauge rose by 0.8% in March to be up 4% on the year, the largest yearly increase since September 2008. The ‘underlying’ or trimmed mean measure lifted 0.6% – the most in 5 years (since January 2017) to be up 2.5% on the year.

- France’s CAC 40 index fell by 1.3% on investor concerns on Thursday that far-right candidate Marine Le Pen may win this month’s French presidential elections.

Keep rate rises in proportion

I think ‘interest rates will rise’ talk and fears are out of proportion. One of the best market callers I’ve followed in my 30 years plus of stock-watching is Jim Paulsen of The Leuthold Group in the US. Jim makes the point that a bear market historically “does not start on day one of Fed tightening”. He says tightening happens in every recovery but it doesn’t mean we have to assume the recovery will end. He says economic growth is strong, estimates of earnings are growing, job creation and the households’ balance sheets are looking like the best he’s seen. He told CNBC that the “odds are good that inflation rolls over in the second half of this year, mainly because we’ve got supply coming back with the labour force surging in recent months, that we’ve been missing, and if that happens, a lot of these fears about the Fed and rates have to go up, dissipate and optimism returns”.

This is at odds with what the market is thinking, but as J.K. Galbraith taught me (when I interviewed him during the 1987 stock market crash): “In economics the majority is often wrong.”

The week in review:

- This week in the Switzer Report, I delve into the tech sector, which has been battered in Australia so far this year. Tech stocks are growth stocks. Historically the period after a crash of an economy as well as a stock market is positive for value stocks but, eventually, growth stocks reassert themselves. That’s why I think tech stocks will make a comeback. Here’s my group of 13 tech [1]stocks for the cautious and the risk-taking thrill seekers!

- Paul (Rickard) says defensive’ stocks make great income stocks because you can almost “bank” their dividends, and provided they can grow earnings over time, their capital price should also grow. As such, Paul gives you five of his favourites. [2] In his second article, Paul considers whether Aussie stocks will continue to rise in [3]April and sustain the commodity-driven run.

- James Dunn says there are always interesting and exciting stories in the small-share-price end of the ASX and gives you three stocks in very different industries that James thinks are worth a punt. [4]

- Tony Featherstone says that as inflation rises and purchasing power falls, investors will look further afield for yield. Tony says the resource sector stands out for two reasons. In his article this week, he examines three mining stocks with attractive yields. [5]

- In our “HOT” stock column this week, Raymond Chan, Head of Retail at Morgans, gives his reasons for [6]why he thinks BHP should be added to an investor’s portfolio, and Michael Gable, Managing Director of Fairmont Equities [7], explains why he’s watching Incitec Pivot (IPL). [8]

- In Buy, Hold, Sell — Brokers Say, there were seven upgrades and five [9]downgrades in the first edition and nine upgrades and five downgrades [10] in the second edition.

- And finally, in Questions of the Week, [11] Paul Rickard answers subscribers’ queries about adding Woolworths to your grandchildren’s small investment portfolio? Paladin Energy has a share purchase plan – should I sell on the market first and buyback through the SPP? Is it time to take profits on oil stocks? I have been watching Super Retail as a dividend play – is it a buy?

Our videos of the week:

- The negative effects of smoking marijuana recreationally | The Check Up [12]

- Should we be worried that a recession is coming + Xero, Fortescue & Seek in the buy zone? | Switzer Investing [13]

- Interest rates speculation and recession talk is scaring the pants off people! | Mad about Money [14]

- Will stocks rise in April? Domain’s CEO tells us why slowing house prices won’t hurt his company [15]

- Boom! Doom! Zoom! | 7 April 2022 [16]

Top Stocks – how they fared:

The Week Ahead:

Australia

Monday April 11 – Skilled internet job vacancies (March)

Tuesday April 12 – CBA Household Spending Intentions (March)

Tuesday April 12 – Weekly consumer confidence (April 10)

Tuesday April 12 – NAB Business survey (March)

Tuesday April 12 – Overseas arrivals & departures (Feb)

Wednesday April 13 – Monthly consumer confidence (April)

Wednesday April 13 – Building activity (Dec quarter 2021)

Thursday April 14 – Labour force (March)

Tuesday April 19 – Reserve Bank Board meeting minutes (April 5)

Wednesday April 20 – Weekly consumer confidence (April 17)

Friday April 22 – S&P Global purchasing managers’ indexes (April)

Overseas

Monday April 11 – China Inflation (March)

Tuesday April 12 – US NFIB small business optimism index (March)

Tuesday April 12 – US consumer prices (March)

Wednesday April 13 – China international trade (March)

Wednesday April 13 – US Producer prices (March)

Thursday April 14 – US Retail sales (March)

Thursday April 14 – US Import/export prices (March)

Thursday April 14 – US Uni. Of Michigan consumer confidence (April)

Friday April 15 – US Industrial production (March)

Monday April 18 – China Economic (GDP) growth (March quarter)

Tuesday April 19 – US Housing starts & building permits (March)

Wednesday April 20 – US Federal Reserve Beige Book

Thursday April 21 – US Philadelphia Fed manufacturing index (April)

Friday April 22 – US S&P Global purchasing managers (April)

Food for thought: “Our chief want in life, is someone who shall make us do what we can. This is the service of a friend. With him, we are easily great.” – Ralph Waldo Emerson

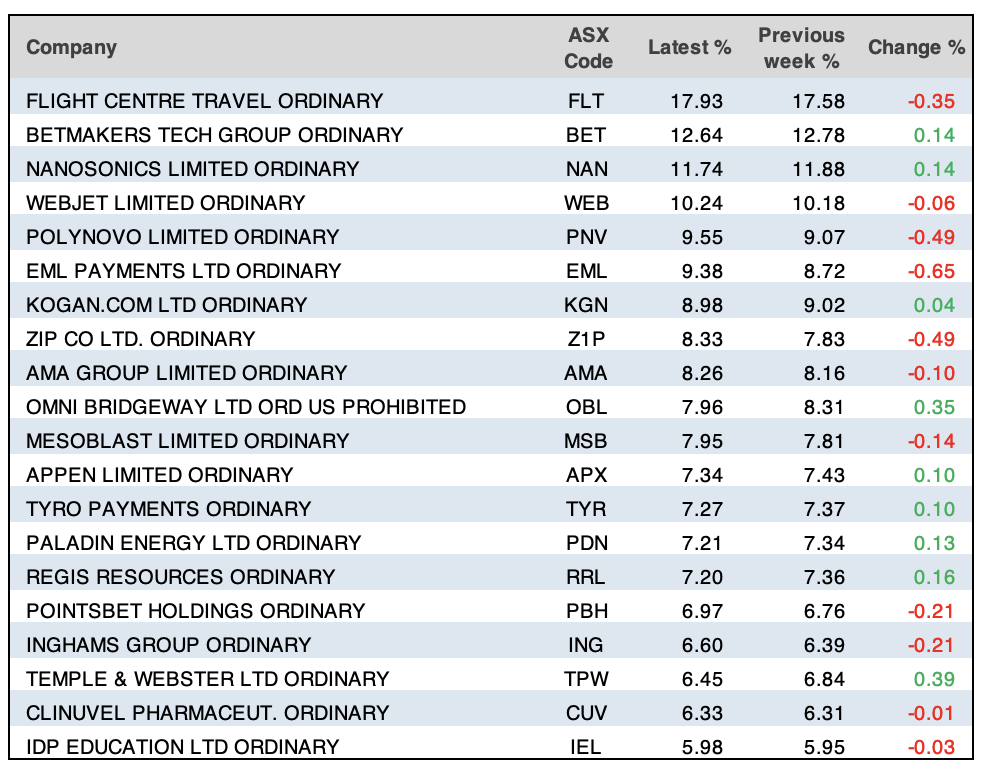

Stocks shorted:

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before.

Chart of the week:

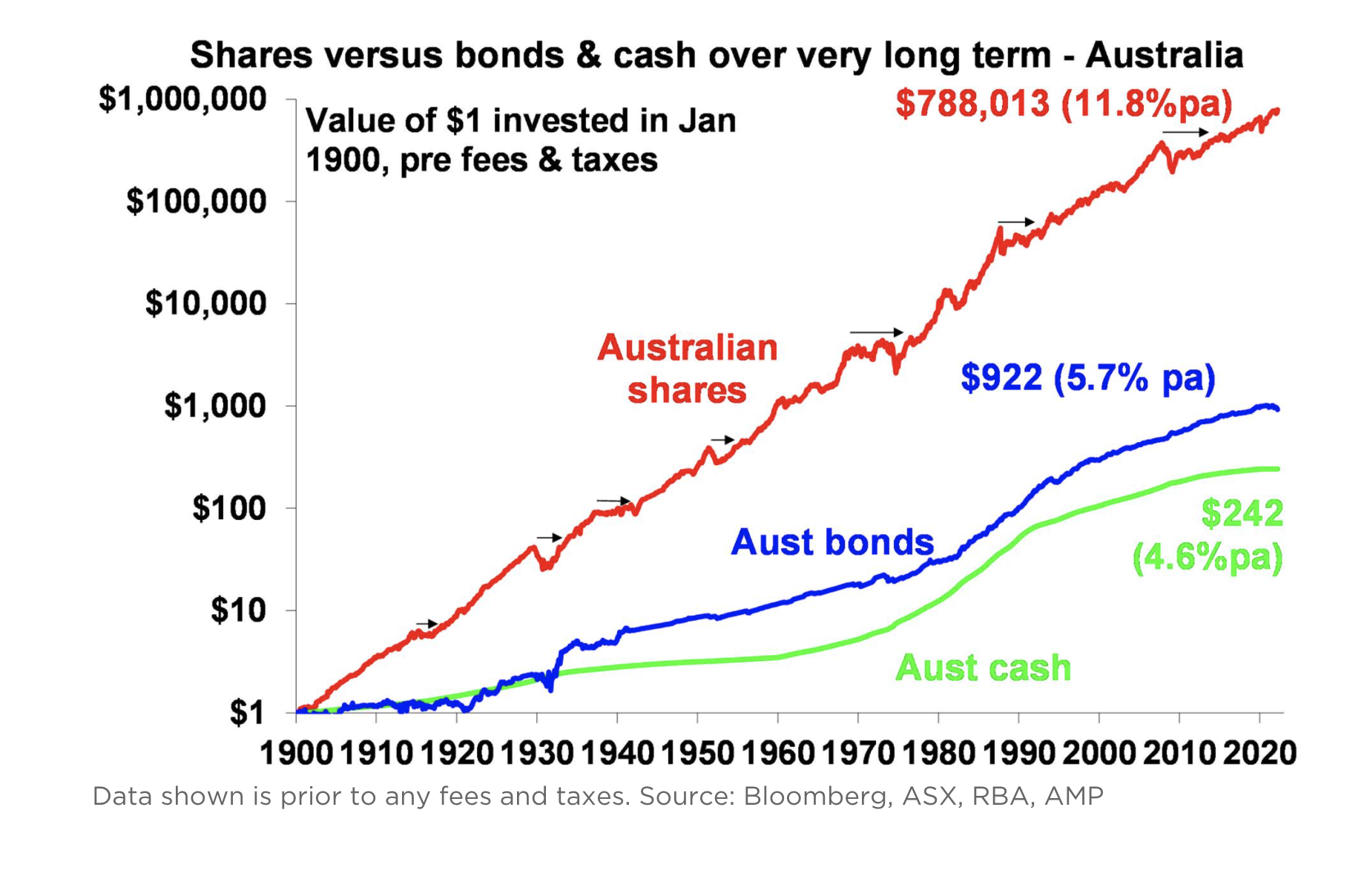

In our chart of the week, we show an investing masterclass from AMP Capital’s chief economist, Shane Oliver, on the magic of compound interest.

“[The chart below] is my absolute favourite and became ingrained in my thinking after many years of hearing my good friend, the well-known economist Dr Don Stammer, expound on the magic of compounding. He is right – compound interest which sees returns compound on top of past returns is like magic!

“The chart shows the value of $1 invested in various Australian assets in 1900 allowing for the reinvestment of dividends and interest along the way. That $1 would have grown to $242 if invested in cash, to $922 if invested in bonds and to $788,013 if invested in shares. While the average return since 1900 is only double that in shares relative to bonds, the huge difference between the two at the end owes to the impact of compounding or earning returns on top of returns. So, any interest or return earned in one period is added to the original investment so that it all earns a return in the next period. And so on.

“The ‘Law of 72’ is a useful tool to understanding how long it takes an investment to double in value using compounding. Just divide the rate of return into 72 and that’s the answer (roughly). For example, if the rate of return is 1% pa (eg, the interest rate on a bank term deposit if you’re lucky), it will take 72 years to double in value (= 72 divided by 1). But if it’s, say, 8% pa (eg, the expected return from Australian shares including dividends), then it will take just 9 years (= 72 divided by 8).

“Key message: if we want to grow our wealth, we must have exposure to growth assets like shares and property.”

Top 5 most clicked:

- The lucky 13 tech stocks [17] – Peter Switzer

- Five defensive stocks that pay good dividends [18] – Paul Rickard

- 3 mining stocks with attractive yields [19] – Tony Featherstone

- Three under 30 cents [20] – James Dunn

- “HOT” stock: BHP [21] – Maureen Jordan

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.