The only thing I don’t like about summer and daylight saving is that Wall Street doesn’t stop trading until 8am and I have to get this to my sub-editor by 7am!

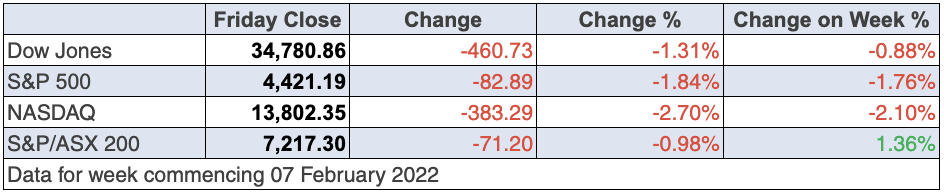

As I put fingers to the keyboard, the Dow is down only 89 points (or 0.25%) but it easily could be a lot worse in three hours’ time, as I’m writing three hours before the close. And predictably, the Nasdaq was off 151 points (or 1%) but who knows where that best gauge of love or disdain for tech stocks might end?

As my headline says — it’s been a week of tech stocks craziness. Sure, the reaction to the 0.6% rise in the CPI for January was more logical, as the 7.5% for the year was the biggest since February 1982. Anyone with a memory of that time knows how persistently bad inflation was then.

However, expert economists thought the rise would be 7.3%, so it’s not a big miss in the unreliable and inaccurate world of statistics! I can say that because I’m someone who has analysed our national economy every week in media outlets since 1985.

And by the way, 1982 was very different from 2022. Trade protection hadn’t been seriously reduced and there was no such thing as digital disruption that no longer lets big businesses have unchallenged pricing power. Also, unions don’t have the same wage clout, though demands to save the planet will be a new factor that means we have to accept higher energy prices, at least for a time.

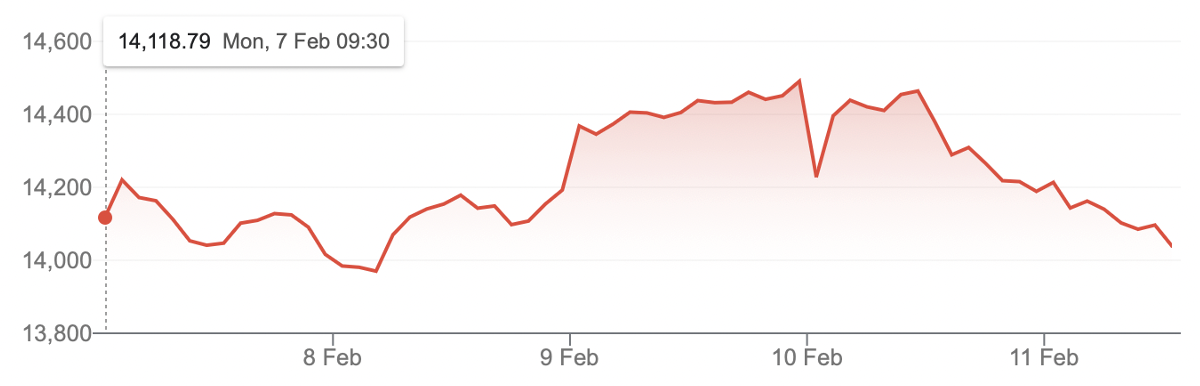

That said, we are still using coal and the world is gradually talking about how we can tap into nuclear ore safely. I suspect the world’s need for energy will come up with lower-priced alternatives over time that won’t keep inflation high for a long time. But back to the crazy tech price movements this week. Let’s check out the Nasdaq for the week.

Nasdaq Composite

Monday tech stocks were on the outer and the index fell to 13,970 but by Wednesday’s close, it had shot up to 14,490. That was a 3.7% gain, which then was virtually wiped out when the inflation reading came in at 0.6% rather than 0.5% — oh, come one!

This is what Craig James told me in his morning note on Thursday, which helps us comprehend this tech stocks craziness: “Upbeat earnings and an easing of Russia-Ukraine tensions supported investor sentiment. Of the 316 companies in the S&P 500 that have reported earnings to date, 77.8% reported above analyst expectations, according to Refinitiv data. Shares in Microsoft rose 2.2% with Apple up 0.8% and Tesla up 1.1%.”

The fear from the inflation number is all about how many interest rate rises are coming from the Fed and how quickly they’ll come. And if the inflation number was 0.4% (for the month) and say 6.8% (for the year), then investor concerns might not have been so negative. But in reality, we have a battle going on and only time will tell who wins.

On one side are those who think the Fed will be dumb enough to be too aggressive with rate rises versus those who think inflation will start to fall as the Omicron threat to the supply chain dissipates, and what will prevail will be a strong US economy with companies continuing to report better than expected.

Many US experts think the Fed is behind the curve on interest rate rises and the St. Louis Fed President James Bullard wants a one percentage point rise in July! Meanwhile, the 10-year Treasury yield on Thursday jumped above 2% for the first time since 2019, but on Friday it fell below 2%! However, against this, “the rate-sensitive 2-year yield soared more than 26 basis points at one point in its biggest intraday move since 2009”. (CNBC)

As you can see, this guesswork-meets-fear on the subject of rates partly explains why tech stocks are up and down.

Helping positivity for growth/tech stocks is the US economy’s strength, which is good, as those 467,000 new job numbers indicated last week, and as the Refinitiv figures show how US companies are reporting well.

And thankfully, similar stories are emerging here as the CBA profit report showed this week and I bet our economic numbers start to spike higher when we get the February and March data rollout in coming weeks.

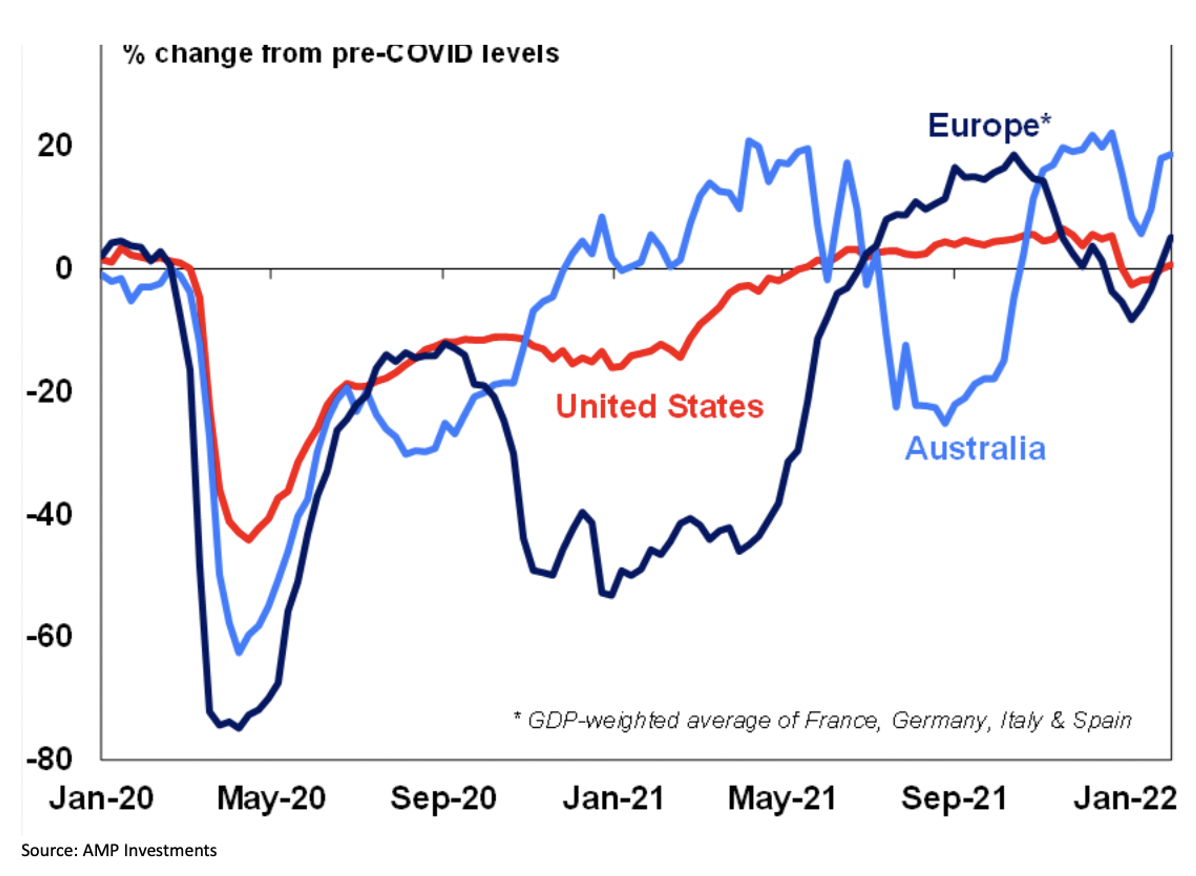

See below how recent recruitment, payroll, business confidence and card spending stats all point to a rebounding economy.

Let’s check out AMP Capital’s economic activity tracker chart, which is a more up-to-date look at what’s going on in the economy. If the blue line is going up, then my suspicions about an economy making a comeback could be on the money.

And bingo, the blue line is on the rise!

You can see the dip from the Omicron hit to the economy in January this year but it has quickly turned around.

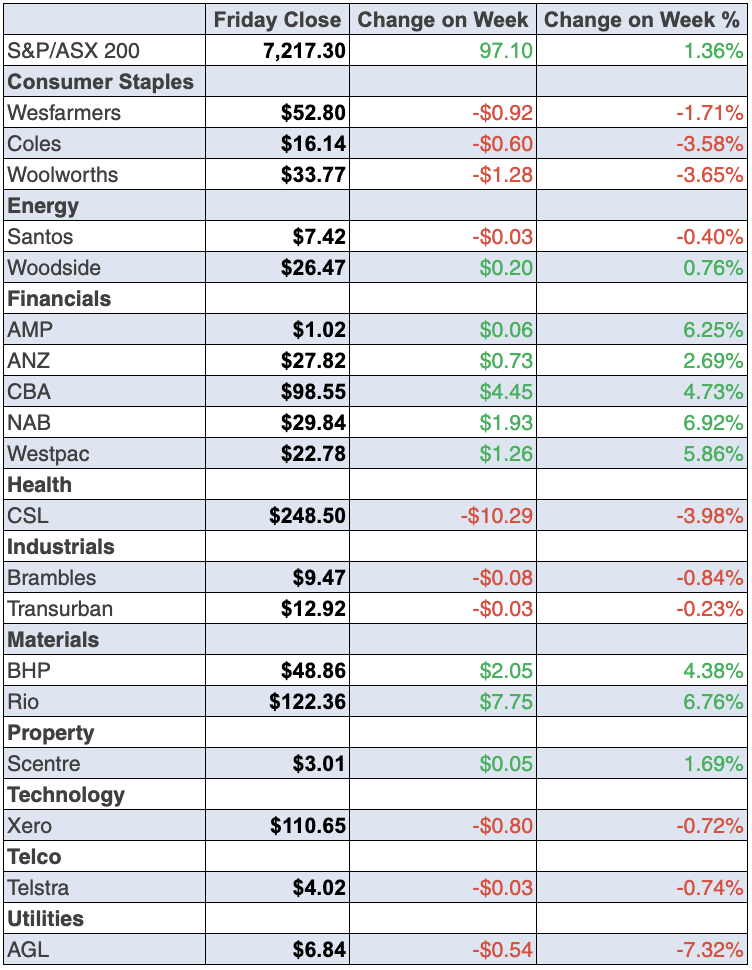

To the local story and despite a disappointing Friday for the stock market losing 71 points when the US booked a bigger-than-expected inflation number, the S&P/ASX 200 rose 1.4% for the week.

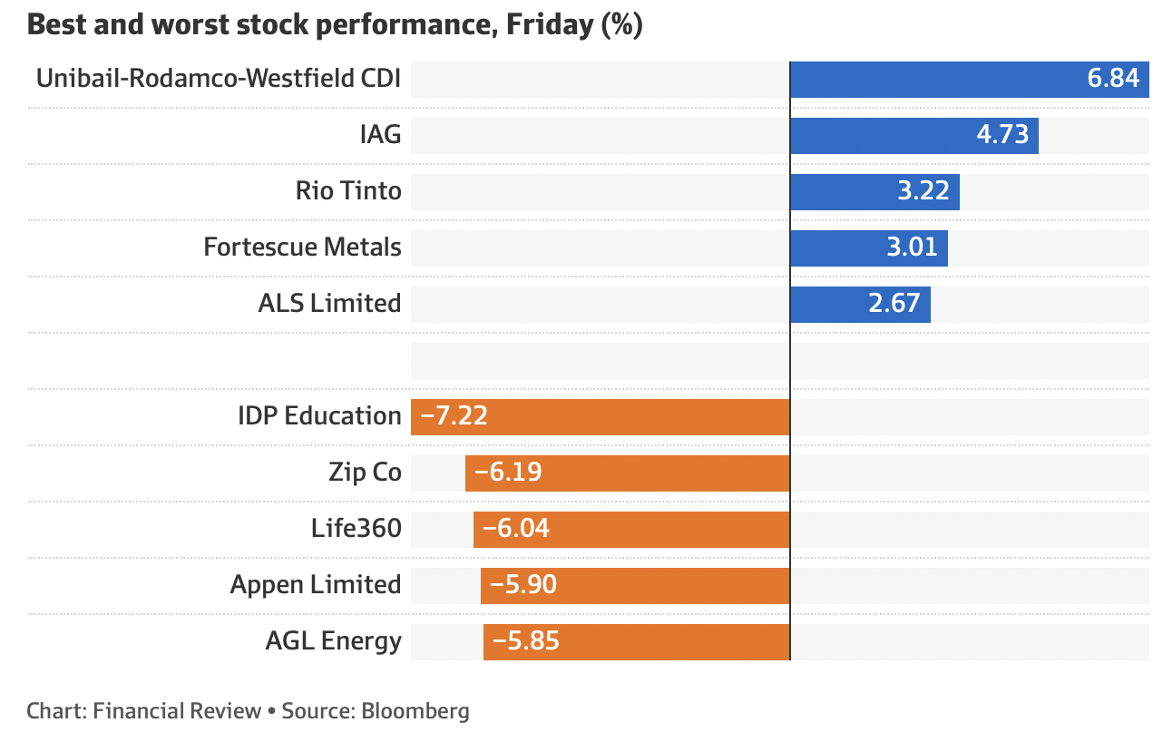

The inflation’s link to interest rates really hurt tech stocks, with Appen down 11.3% for the week to $8.42, which also fell because of its business with Facebook, whose parent has lost 29% since February 2! Block, the new parent of Afterpay, was down 3.5% for the week, while Megaport lost 6.48% on Friday but was up 5.3% to $13.70 for the week.

Did I say tech stocks had a crazy week?

Here are the winners and losers on Friday:

Helping the index were the iron ore miners, and this is how the AFR’s Alex Gluyas summed it up: “Gains by the major miners cushioned the market as the price of the bulk commodity breached $US150 a tonne; Rio Tinto added 2.9 per cent to $122.36, BHP rose 1.2 per cent to $48.86 and Fortescue Metals Group climbed 2.5 per cent to $22.83.”

Another big help was CBA’s good report and the bank’s share price reaction. CBA was up 5.5% to $98.55, NAB saw an 8.47% gain to $29.84, Westpac rose 5.9% to $22.78, while ANZ put on 5.2% to $27.82.

Some months ago, I tipped financials, iron ore miners and oil stocks would have a good 2022 and it looks like the market is following the script.

Woodside lost 0.19% on Friday and 0.11% for the week but for the month it’s up 8.71% and 20.2% for the past six months!

What I liked

- The NAB Business Confidence number rose strongly in January to +3.5, after a -12 reading in December. You can blame Omicron for that. The 15.5 point rise was the fourth biggest rise on record.

- The ABS reported that national payroll jobs rose by 1% over the fortnight to January 15.

- In December, business turnover lifted in seven out of 13 industries, according to the Australian Bureau of Statistics (ABS). Turnover rose the most for Accommodation and Food services (up 10.1%) but fell by 5.2% for “other services” and fell 3.5% for retail trade.

- The preliminary Internet Vacancy Index (IVI) from the National Skills Commission rose by 4.4% in January (or 10,918 available positions) to a 13-year high of 259,027 available positions. Recruitment activity is up 40.8% over the year to January. Job ads are also at 13-year highs in both Queensland and Western Australia.

- According to Commonwealth Bank economists, “CBA’s internal card spending data for the week ending 4 February 2022 show another pick-up in the pace of spending growth.”

- Overseas mining stocks rose on Thursday in response to higher metal and iron ore prices.

- Of the 316 companies in the S&P 500 that have reported earnings to date, 77.8% reported above analyst expectations, according to Refinitiv data.

- The Economic Optimism gauge in the US fell from 44.7 to 44 in February (survey: 46). The Business Optimism gauge fell from 98.9 to 97.1 in January (survey: 98). They are falls but not by much, which is OK given the pesky Omicron issue.

What I didn’t like

- The Westpac-Melbourne Institute Index of Consumer Sentiment fell by 1.3% to a 17-month low of 100.8 points in February and you can blame Omicron for that.

- The Commonwealth Bank (CBA) Household Spending Intentions (HSI) report fell by 10% in January to 103.8.

- Construction industry wages lifted 8.8% in the first two weeks of 2022.

- Retail trade fell by 4.4% in December after rising 13.6% in the three previous months. You have to blame the Omicron problem for this fall but retail trade rose by a record 8.2% in the December quarter after falling 4.4% in the September quarter during lockdowns.

- Job advertisements (as tracked by ANZ) fell by 0.3% in January.

- The US Consumer Price Index rose by 0.6% in January (survey: 0.5%) to be up 7.5% over the year (survey: 7.3%) — a 40-year high.

The headline I want to see

Over the next month, I want to see more media headlines like this one from The Guardian: ‘US appears to shake off Omicron and adds nearly half a million January jobs’.

I’m writing this from The Langham in Melbourne because a covid challenge meant we couldn’t stay with family, though the actual health threat was low. It was great to easily check into a hotel and then wander the streets of Melbourne with revellers out walking, shops open at 8pm and shoppers buying and dining inside and outside everywhere.

We could see normalcy making a comeback. Provided we don’t see another Omicron-like business-killer this year, we will see economic growth, better-than-expected company profits, which won’t only help stock prices but even tech stocks will rebound, as we saw earlier this week.

Of course, we need the Fed and other central banks to act cautiously (like our own Dr Phil Lowe and Christine Lagarde at the European Central Bank), but if they get their rate rise strategy right, it will be another good year for stocks.

P.S.: It’s now 5.53am and the Dow is now down 395 points and the Nasdaq is off 2% — did I say this tech stocks stuff is crazy?

P.P.S: It’s now 7am and the Dow is down 503 crazy points!

The week in review:

- This week in the Switzer Report, I ask why [1] tech stocks have recently been getting smashed, and whether some of the largest Australian stocks in this sector are worth keeping and even buying more in this dip.

- Paul Rickard had a keen eye on the banks this week following the release of their earnings reports, namely whether Westpac (WBC) can cost-cut its way to greatness [2] and the outlook for Commonwealth Bank (CBA) [3] after its profit-leading report.

- James Dunn follows my lead with the tech sector and lists 4 beaten-up tech stocks [4] for your consideration.

- Tony Featherstone’s article is one for investors’ watchlists as he gives us an alternative to banking stocks with 2 online lenders [5] that disappointed somewhat soon after IPO but show promising signs for the future.

- For our “Hot” stocks this week, Raymond Chan of Morgans explores [6] the potential of Westpac (WBC) despite the contraction of Net Interest Margin (NIM), while Managing Director at Fairmont Equities, Michael Gable says Metals X (MLX) presents a buying opportunity [7] at its current levels.

- This week in Buy, Hold, Sell – What the Brokers Say, there were 19 upgrades and 9 downgrades [8] in the first edition, and an equal number (six) of upgrades and downgrades [9] in the second edition.

- And finally, in Questions of the Week, [10] Paul answers your questions on Magellan Financial Group (MFG), Suncorp Group (SUN), the impact on major indices when stocks go ex-dividend, and the latest you can buy Commonwealth Bank (CBA) shares to receive the $1.75 fully franked dividend.

Our videos of the week:

- Taking a look at the medical therapies that are being developed for dementia | The Check Up [11]

- Chris Joye tips 30-60% market crash. Julia tips agri-stocks. Jun Bei Liu tips 4 tech stocks & more! [12]

- Chris Joye’s 30-60 % market crash + how high will rates go? & more! | Mad about Money [13]

- What tech stocks are in the buy zone? Michael Wayne’s one great stock for 2022 + interest rates [14]

- Boom! Doom! Zoom! | Thursday 10 February [15]

Top Stocks – how they fared:

The Week Ahead:

Australia

Tuesday February 15 – Weekly consumer confidence (Feb 13)

Tuesday February 15 – Reserve Bank Board meeting minutes

Wednesday February 16 – Land and housing supply indicators (Feb)

Wednesday February 16 – Skilled job vacancies (Jan)

Thursday February 17 – Labour force (Jan)

Thursday February 17 – Overseas arrivals & departures (Dec)

Overseas

Monday February 14 – US Consumer inflation expectations (Jan)

Tuesday February 15 – US Empire State manufacturing index (Feb)

Tuesday February 15 – US Producer prices (Jan)

Wednesday February 16 – China inflation (Jan)

Wednesday February 16 – US Federal Reserve (FOMC) meeting minutes

Wednesday February 16 – US Retail sales (Jan)

Wednesday February 16 – US Import/Export prices (Jan)

Wednesday February 16 – US Industrial production (Jan)

Wednesday February 16 – US NAHB housing market index (Feb)

Thursday February 17 – US Housing starts/building permits (Jan)

Thursday February 17 – US Philadelphia Fed manufacturing index (Feb)

Friday February 18 – US Existing home sales (Jan)

Friday February 18 – US Conference Board leading index (Jan)

Food for thought: “Spend each day trying to be a little wiser than you were when you woke up.” – Charlie Munger

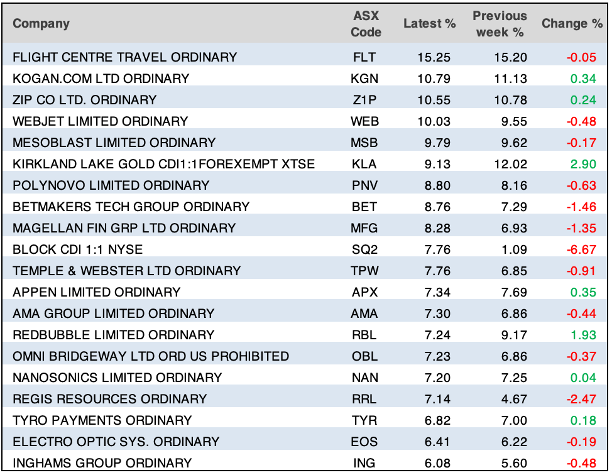

Stocks shorted:

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before.

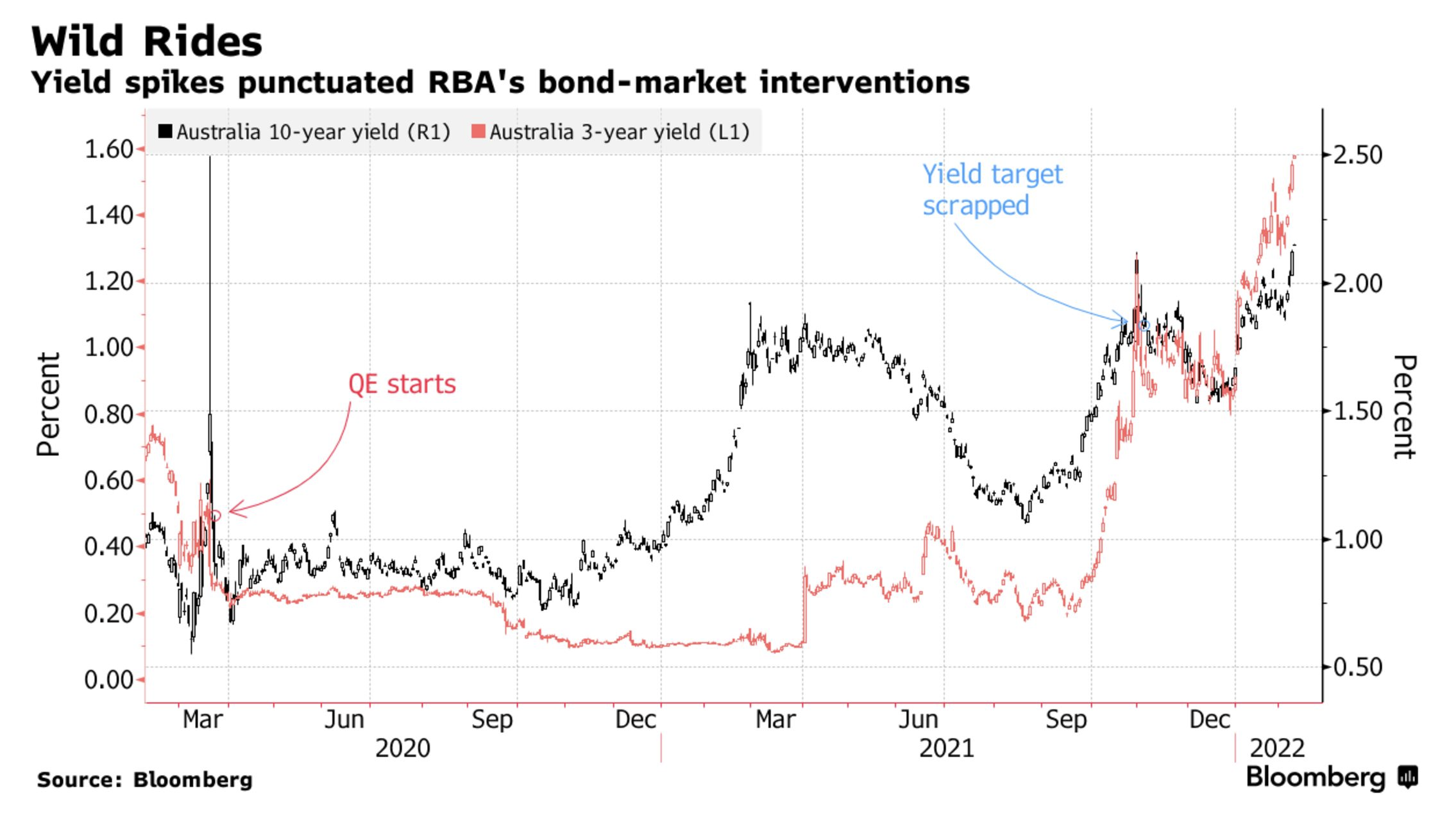

Chart of the week:

As the RBA ceased its all-important quantitative easing program this week, it’s important to take a look at the interventions made by our central bank through its bond purchasing program to prop up the economy since the onset of the pandemic. “The RBA on Thursday conducted its final A$1.6 billion purchase of securities under a program that tripled its balance sheet to about A$650 billion ($465 billion). Indeed in 2021, it bought more than three times more debt than the government issued, the largest ratio across the world’s six largest developed bond markets,” Bloomberg reports.

“Yet against a backdrop of Australia tipping into its first recession in 28-1/2 years, unorthodox policies helped. The job market is tightening quickly, confidence is holding up amid another virus outbreak and core inflation has returned to the RBA’s 2-3% target.” As for the net result of this economic recovery measure, “The RBA insists that ceasing bond purchases doesn’t mean a tightening of monetary policy. It maintains that the stock of bonds bought, not the flow, provides the economic support.”

Top 5 most clicked:

Top 5 most clicked:- Why have tech stocks been smashed? Are these 5 worth keeping or buying more? [1] – Peter Switzer

- 4 beaten-up tech stocks [4] – James Dunn

- Can Westpac cost-cut its way to greatness? [2] – Paul Rickard

- “Hot” stocks: Westpac (WBC) [6] – Maureen Jordan

- Buy, Hold, Sell – What the Brokers Say [8] – Rudi Filapek-Vandyck

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.