Following last week’s Boom, Doom, Zoom webinar, I promised to look at some left field stocks that were thrown at Paul and me, so I thought I’d toss in another group of speculators to keep the theme consistent.

-

HMCapital (HMC)

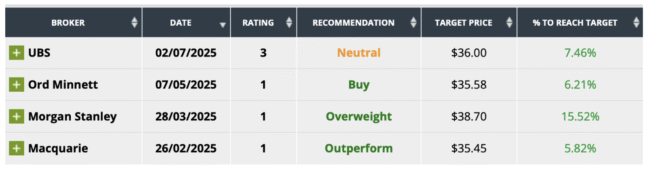

The first one is one I haven’t heard of called HMCapital (HMC). While it has been on a slide since the start of the year, what the analysts are thinking had me intrigued:

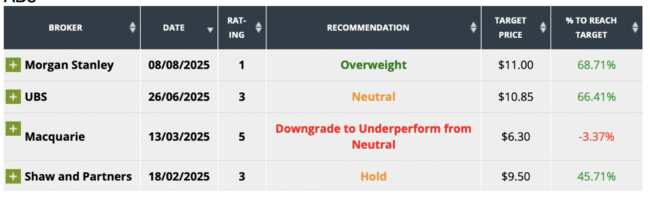

HMC

Despite recent problems with the stock price, the consensus view is that this company could go 70.1% higher from its current price of $3.57! And that’s with four company assessors looking at the business.

Looking at UBS, the second most positive analyst, you can see why HMC could benefit from upcoming RBA actions.

This is what FNArena’s report noted: “UBS believes the backdrop is positive for the REIT sector from a likely trough in asset valuations, falling interest rates and robust rental growth. However, headwinds remain from both residential and commercial construction, making completed assets/core real estate more valuable. The broker is forecasting a terminal RBA policy rate of 3.6% (from 4% before) but notes market pricing is for a 3.1% rate by December. If that materialises, its FY26 EPS forecasts for stocks would rise by 2%. The analyst cut HMC Capital’s earnings forecasts by -15% over FY26-29 on fund restructuring, including a revised performance fee hurdle.”

While these guys had a target of $12.40, they’ve sliced it back to $8. But on a $3.57 price, it still looks interesting. Even the most cautious Morgans sees a 17%+ gain ahead.

By the way, in December last year, this was a $12.54 stock!

-

AUB Group (AUB)

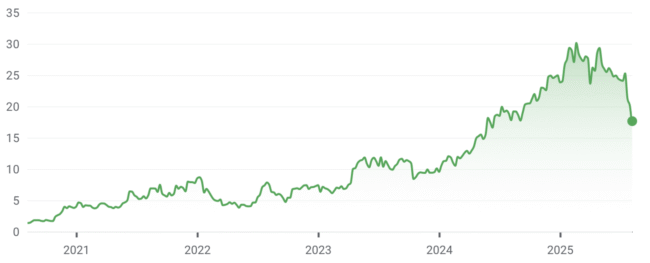

Another stock I haven’t been across is AUB Group (AUB). It has had a nice five-year run, rising 167%. However, over the past year, it has only sneaked up 2.1%.

Its website says AUB Group “is a leading provider of insurance solutions in Australia and New Zealand, with over 5,500 team members and 700,000 clients. It operates in various business areas, such as retail and wholesale broking, underwriting agencies, and strata management.”

The analysts are positive on the company, with an 8.8% gain expected on a consensus basis. While it is a $33.50 stock and the target price is $36.43, Morgan Stanley sees a possible price to $38.70, implying a 15.5% gain if they’re on the money.

This what FNArena reported:

“Morgan Stanley is more confident about the prospect for AUB Group’s Tysers business and international growth following meetings in the UK and EU finance conference. The broker notes the premium rate cycle is slowing across 85% of Tysers’ revenue, but the business is able to protect revenues via higher commission or fee negotiations.”

For the record, Tysers is a leading independent Lloyd’s insurance broker. Headquartered in London with offices and associates around the world, Tysers trades in 130+ countries across the globe and has circa 1,000 experienced and talented employees. Tysers is part of the AUB Group, an ASX200 listed group of retail & wholesale insurance brokers and underwriting agencies & MGAs operating in ~595 locations globally.

This is an interesting company worthy to be on a watchlist, though it doesn’t look like a big-return share, but one for a core holding in a portfolio.

-

Telix Pharmaceuticals (TLX)

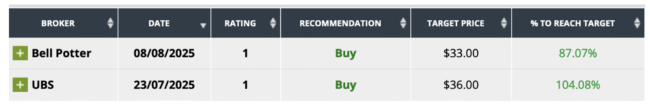

In contrast, Telix Pharmaceuticals is for the 100% thrill seeker with analysts tipping a potential 95.6% gain! Only two analysts cover the company, but they’re in the cheer squad for Telix.

Note, the company lost 12.63% last week and 27.91% over the past month. Over the year, the drop has been only 1.95%. And on a five-year basis, the share price is up a whopping 1,197%!

Now a $17.64 stock, it was a $30.12 stock in February, so what are the experts telling us?

The company has issues, with one being a subpoena from the US Securities and Exchange Commission (SEC) related to disclosures about its prostate cancer therapies. It also has challenges about changing its reporting from Australian dollar to US dollar numbers.

Despite all that, on Friday, Bell Potter re-evaluated the company and announced no change to its target price of $33. That’s an interesting call.

After considering what’s out there troubling the company, as I said earlier, this is one for the thrill seeker.

-

Lindsay Australia Ltd (LAU)

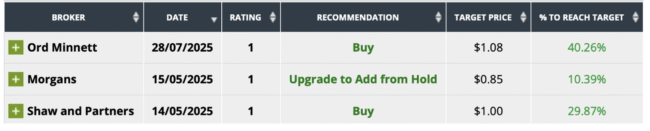

Here’s another that might look like a speculator play, but Lindsay Australia Ltd (LAU) has a more down-to-earth business feeling about it, while the analysts see its share price heading skyward.

Ord Minnett was the most positive on the company and told us in late July that “Lindsay Australia acquired SRT, which is viewed by Ord Minnett as offering increased diversification across the company’s customer base and regional exposure, and is a notable complement to other recent investments, the analyst states, in WA, SA, and Vic.”

Meanwhile, Shaw and Partners observed: “Lindsay Australia is acquiring Tasmanian refrigerated transport solutions company SRT Logistics for $108.2m, which Shaw and Partners believes makes sound strategic sense.”

Over a five-year period, the share price is up 112.50%, though it has slipped 18% since November last year.

-

Audinate (AD8)

Finally, I couldn’t end this piece without seeing what the analysts think of Audinate (AD8), which has lost 28.59% this year. The analysts are keeping the faith with a 44.4% call for the company’s share price.

This is now at $6.52, and the target price is $9.43. But in March 2024 it was a $23.31 stock! Here’s the analysts’ overall ‘guess’ on the company going forward.

For those wanting to take a punt before AD8 reports, this is the Morgan Stanley view for speculators: “Morgan Stanley highlights Audinate Group as a high-risk, high-reward pick ahead of upcoming FY25 results, with positive risk-reward skew despite a wide range of potential outcomes. With low buy-side expectations for FY25 and FY26, particularly regarding FY26 outlook, the company is tracking in line with FY25 gross profit expectations, with the potential for upside, suggest the analysts. Even if FY26 estimates are revised lower, the stock could still perform well, in Morgan Stanley’s opinion, due to continued improvements and cycle stabilisation. Trading at the low end of its historical range, Audinate’s price does not fully reflect its structural growth potential, competitive position, or long-term profitability, highlights the broker. Risks relate to a more muted FY26 outlook and potential higher cash burn.”

This makes me think I should dollar cost average my punt on AD8, given the fact that Morgan Stanley said all that on Friday, meaning it’s not an aged view on the company. That said, this is another thrill-seeker play but I think it looks less risky compared to TLX.

If any of these stocks make appeal, good luck with what you select.