Nearly three and a half months down for 2023 and believe it or not but economic developments are heading in the right direction, despite growing talk of recession from the heavies on Wall Street and the boffins at the International Monetary Fund (IMF).

That said, who you are as an investor will determine what you do in coming months with your money and investments. And playing the short game will be harder than being a long-term investor, who understands the long and winding road to wealth.

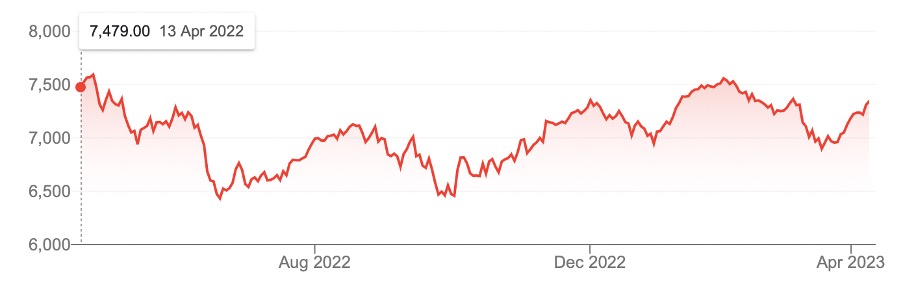

In fact, this chart below shows that ‘buying the dip’ as a long-term player has worked since mid-2022.

S&P/ASX 200

If you bought in either June or October last year, you would be up about 13% — that’s the reward for those who believe in the likes of Warren Buffett, who has advised us to “…be greedy when others are fearful”.

I wasn’t courageous enough to be greedy in June but I’d been telling you and my financial planning clients that the December quarter should bring a rebound — and it did.

From October last year to February this year, the gain was about 16.7%, but then we saw a 7% sell-off until 20 March. Since then, there has been a 6.3% comeback.

If you want to see positive signs for investing, take a look at the chart above and see how the market has been sloping up since mid-June, despite the ups and downs.

And, unsurprisingly, we’re seeing the same trends in US stock markets. According to ycharts.com, US investor sentiment bullishness is at 33.3%, compared to 22.5% last week and 31.88% last year. However, this is lower than the long-term average of 37.53% but it’s heading there and the procession of data drops in coming weeks and months will determine where our stock prices go.

Spooking a lot of us now will be increasing talk about recession, especially in the US. However, I must add that if the RBA keeps rising rates, then we could see it here too. At this stage I doubt it, but I’m not ruling it out. If that happened, we’d see rate cuts sooner than currently expected, and that would be a real boost to stocks, especially tech/growth ones.

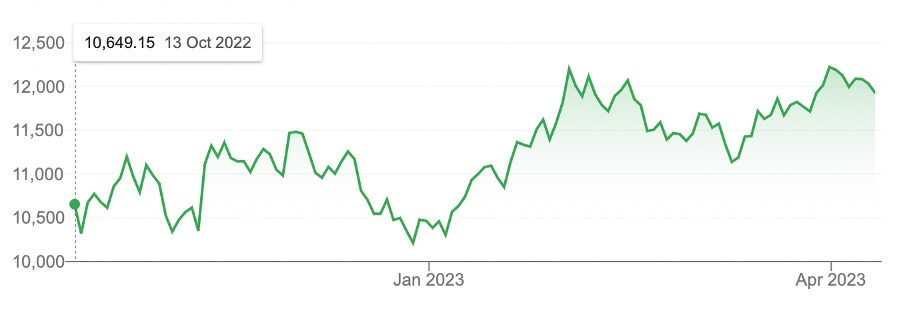

These high hopes for tech stocks once rate rises stop shows up in the six-month chart below for the Nasdaq Composite index, which has popped 15.5% since early October.

Nasdaq Composite

Overnight, the Yanks got a better-than-expected inflation reading with the CPI coming in at 0.1% rather than the predicted 0.2% for the month of March. Of course, now the market is worried about a recession but the sell-off was tame, with the Dow down only 38 points.

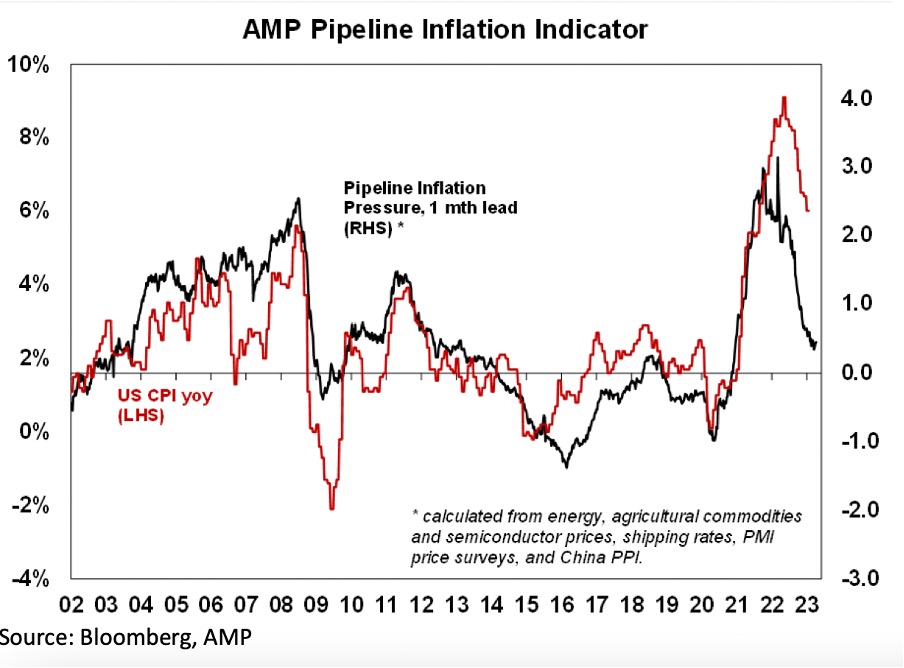

I expect ups and downs for stocks. US reporting season, which starts this week, will be important for what happens to share prices. My approach will be to believe that US and local inflation will keep falling and this chart below from AMP’s Shane Oliver helps me do that.

Note how the red line for services inflation is starting to really dive, while goods inflation has really slumped.

We’re now in the hands of central banks and even Treasurers, like our own Dr Jim Chalmers. If they can help us avoid serious slowdowns or recessions, then we’ll see another serious bounce-back of stocks later in the year.

The SMH reported today that the CBA’s chief economist Stephen Halmarick said “…the Reserve Bank of Australia may have to start cutting interest rates by year’s end because the financial crunch facing the country is likely to result in a sharp fall in inflation and almost 150,000 extra people out of work”.

Sure, an economic crunch will hit profits and share prices, but once investors think central banks like ours will soon cut rates, tech and other growth stocks will surge.

I will buy on dips, looking to have exposure to growth-oriented companies and ETFs, but I might have to dollar-cost-average and buy on bigger-than-expected dips, if the recession news ends up being worse than I expect.

Either way, I expect to make money on stocks by year’s end because stock markets generally buy ahead of a recovery, which will come after rates are cut.

It sounds like a gamble but that’s what investing is. But it all works out to your advantage when you invest in quality stocks and you accompany this with patience.

If you’re patient investor, you buy the dips. If you’re a scaredy cat, maybe wait until the December quarter starts in October.

My best tip? Watch this space!

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances