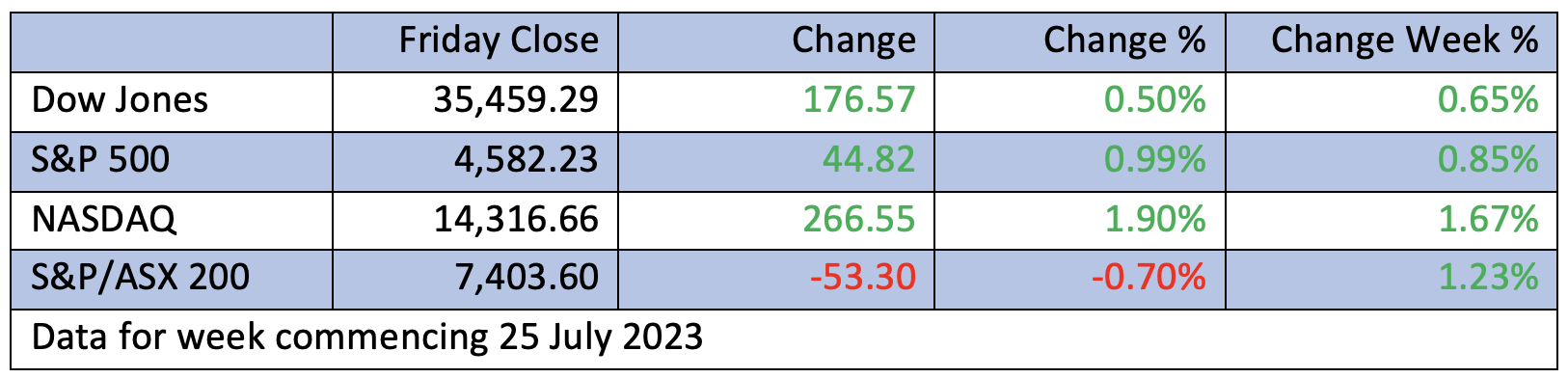

The Dow Jones Industrial Average was up again, and this week registered the 13th day of rises on the trot, which hasn’t happened since 1987. However, if it had made it 14 consecutive days, it would have matched what happened in 1897!

Don’t let anyone tell you that we aren’t living through a unique period of economics and markets, despite the fact it’s historically unwise for someone like me to argue that “this time it’s different.”

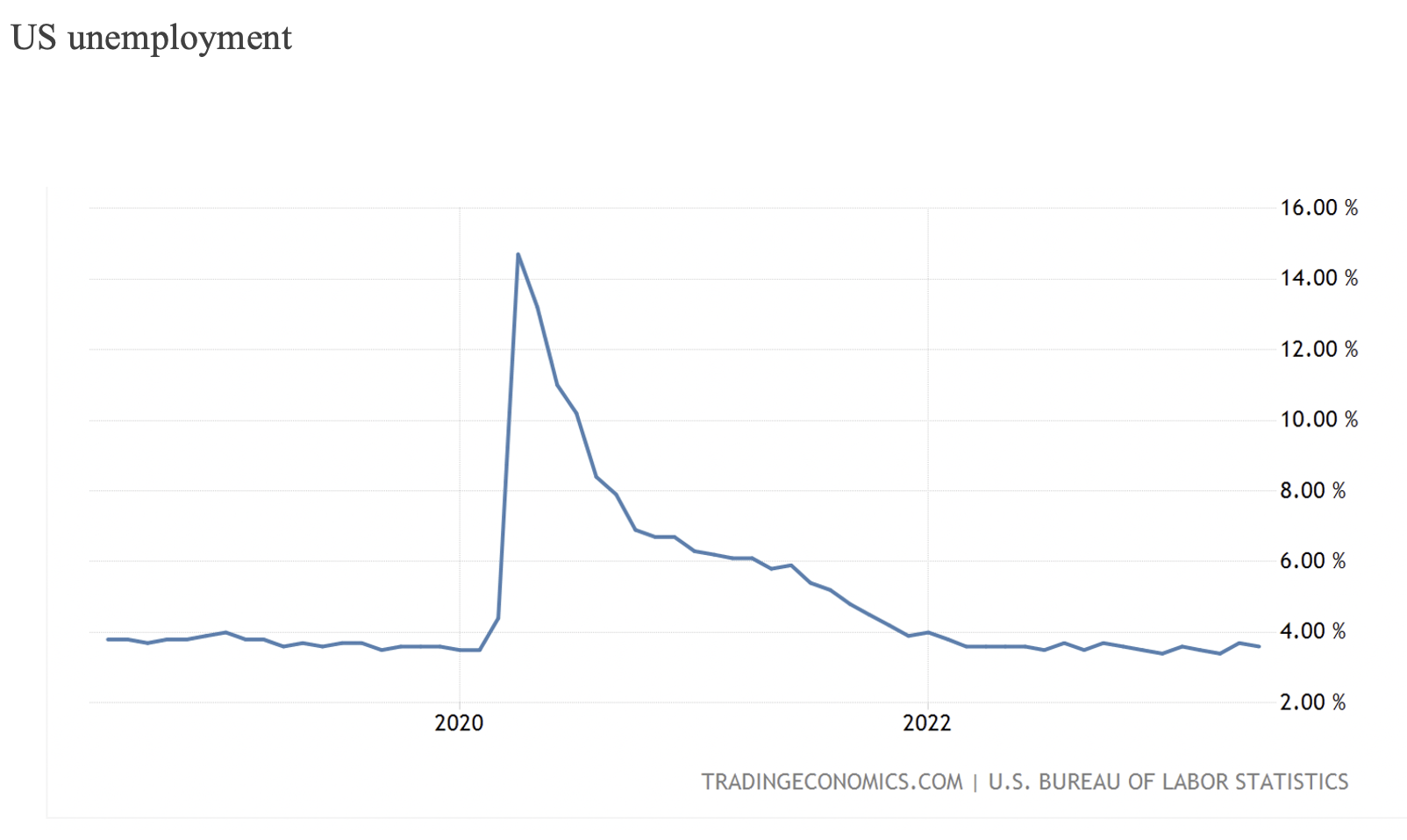

That said, this time it is different! Last Saturday I showed you these two charts of unemployment in the US and Australia, and posed this question: if the Yanks can get lower inflation, why can’t we?

Let me remind you what I showed.

Usually, unemployment rises to help inflation fall but in the US they now have 3% inflation and unemployment is flatlining. The case here is the same. While we’re not at 3% (but 6% instead), if we annualise our June quarter inflation result of 0.8%, it comes in at 3.2% (and 3.6% if you use the core inflation figure).

Economists now think our inflation should keep trending down and that’s at odds with what many were thinking not long ago. I still think there’ll be a sting in the tail for the economy from all these rate rises, which we should see later this year. However, I’m betting it will be manageable and not too big a spanner in the works for stocks.

Right now, Wall Street agrees that we’re in for a positive market situation going forward, provided the data keeps pointing to lower inflation. That’s what happened again overnight as we saw the Fed’s preferred inflation indicator (the Personal Consumption Expenditures Price Index or PCE) come in at 0.2% on a month-on-month basis. The Core PCE rose 4.1%, which was less than the expected 4.2%, which the market liked, as Jerome Powell indicated that data will be critical to whether the Fed raises rates again.

“In the wake of stronger-than-expected GDP, and a better-than-expected earnings season, this could be the catalyst to send the market to new highs,” wrote Gina Bolvin, president of Bolvin Wealth Management Group, as reported by CNBC.

On the subject of US earnings, they continue to defy expert predictions of a significant pullback. Around 50% of S&P 500 companies have now reported, with 81% beating earnings expectations (compared to the norm of 76%) with an average beat of 6%.

“Consensus earnings expectations for a 7% decline in earnings over the year to the June quarter still look too pessimistic,” Shane Oliver noted on Friday.

CNBC’s Jim Cramer is on the same ‘train’ as yours truly, this week saying: “I think it means that we may be back in business-as-usual mode, not back to pre-covid, not pre-financial crisis, but back to the ’80s and ’90s when stocks were the best asset class and everything else seemed like a waste of time.”

Of course, time will tell but if he’s right, it adds to my case that we could be living through a different time for economies and markets. By the way, I’m not saying a recession won’t eventually show up, but it could be a lot further away than what those US market and economic experts had been predicting about the States being on the slide by now.

If you worry that the US market gain that has been driving our market higher is based on seven stocks (Apple, Amazon, Alphabet, Nvidia, Meta, Microsoft and Tesla) well, even on an equal-weighted S&P 500, this index is up 11%.

I think the end of rate rises will send market influencers (fund managers) looking at ignored stocks that have been victims of rising interest rates that were expected to kill economies, which hasn’t come to fruition.

After big rate rises, the economies have been more resilient than was expected and stocks have been able to recover. That certainly is different, big time!

I like this assessment from Jim Cramer: “I think it is time to recognize that something has changed with this market, and I think it’s a change for the better. For the first time since the 1980s and let’s say early to mid-1990s, we have a lot of legitimate stocks belonging to many companies with amazing balance sheets and terrific prospects that are flat out doing very well. Sure, the Magnificent Seven are so big relative to everything else that it is tempting to only watch them, but there are tons of other excellent stocks, belonging to companies with amazing stories to tell…”

This reinforces my view that there are lots of unfairly beaten-up companies that will play share price catch up for some time.

This Dow surge is a case in point. Even now the Dow is up only 9% over the year, while the Nasdaq is up 17.7% and the S&P 500 is 12.5% higher. In simple terms, the Dow’s big run was driven by data saying that the economy isn’t heading for a recession, inflation is falling, and corporate earnings are much better than expected.

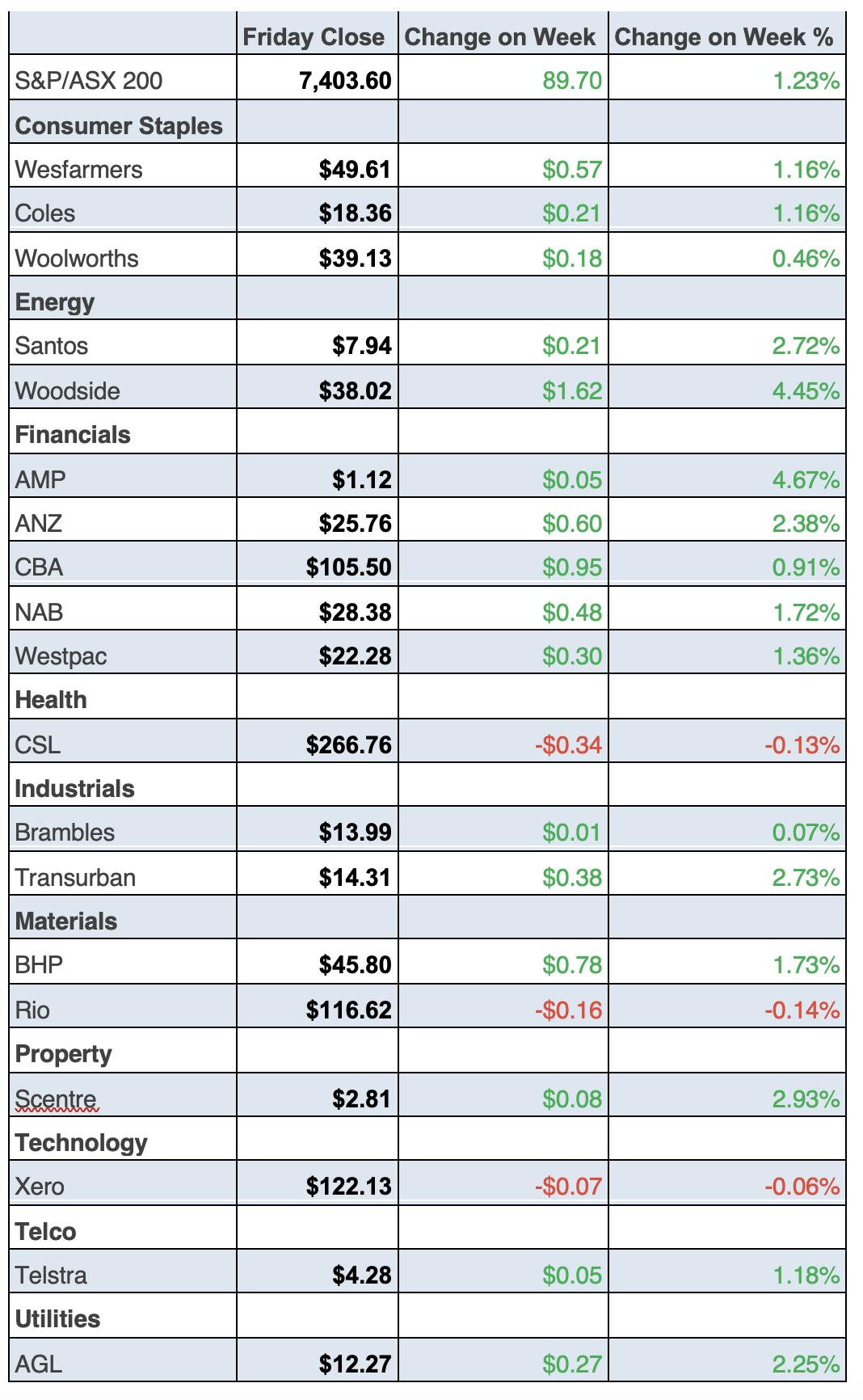

To the local story and the S&P/ASX 200 lost 0.7% (or 52.3 points) to finish at 7403.6 on Friday, but for the week the Index put on a nice 1.2%. That sell-off followed a predictable opportunity for fund managers taking profit after that 13-day inspired stocks spike from the Dow, and they often use a month’s close to show what progress they’ve made managing other people’s money.

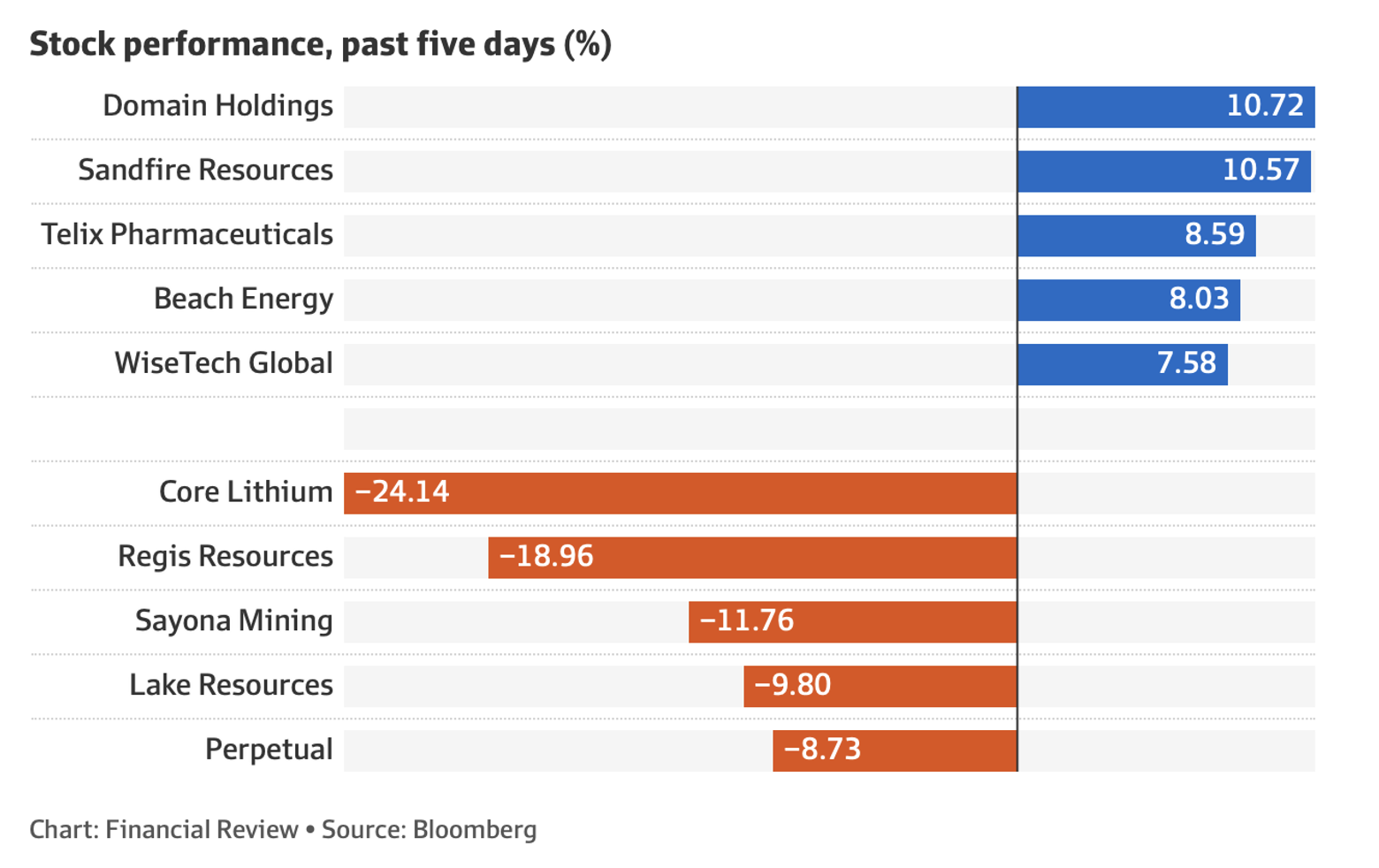

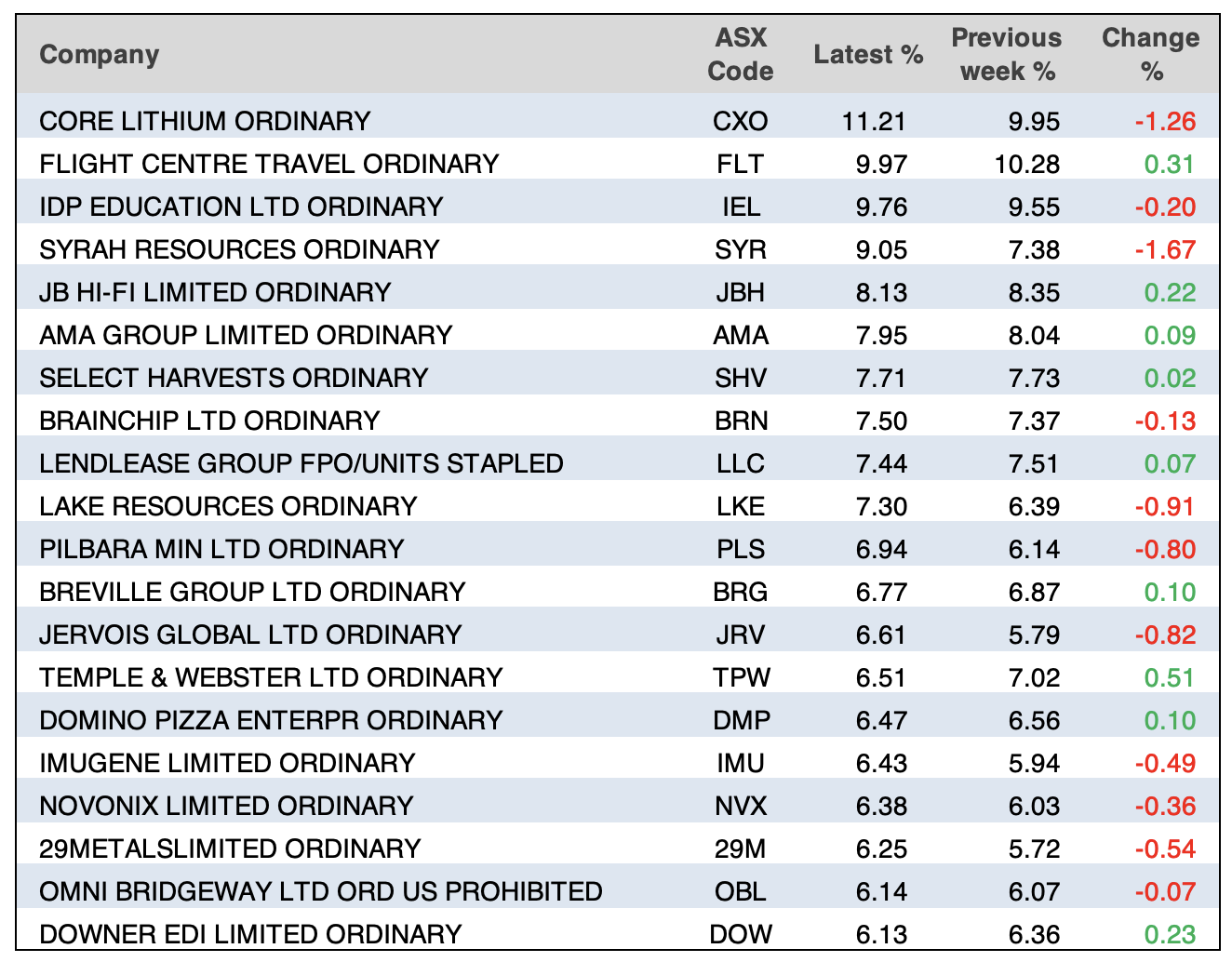

Here are the big winners and losers of the week:

For those wondering why Fortescue copped it on Friday (down 5.4% to $21.68), well, its quarterly production report didn’t help, as iron ore prices in Singapore fell close to 3%.

(The chart below shows how the top stocks performed this week.)

What I liked

- Retail trade fell by 0.8% in June, which the RBA would be glad to see. “Consumer spending is slowing, more so in goods rather than services at this stage. We expect further weakness in H2 23,” CommSec’s Craig James said.

- The headline CPI rose by a lower-than-expected 0.8% for the quarter in quarter two 2023 and the annual rate dipped to 6%, from 7% in the first quarter of 2023.

- This from AMP’s Shane Oliver: “Australian inflation fell more than expected in the June quarter with underlying inflation now just 3.6% annualised.”

- The ECB says European rate movements will be data-driven, meaning rate rises on virtual auto-pilot are over.

- I liked this headline: IMF upgrades the global outlook slightly. Reflecting the relative resilience in global growth this year, the IMF revised up its 2023 global growth forecast to 3% and continues to see 3% next year, which is good for stocks.

- On US data: June quarter GDP growth was a faster-than-expected 2.4% annualised, with solid consumer spending and capex confirming that the US economy is continuing to grow. Underlying capital goods orders saw modest growth. Jobless claims fell. The Conference Board’s measure of consumer confidence rose sharply in July, taking it well above average, in contrast to the University of Michigan confidence index, which is up but remains well below its long-run average. Home prices also continued to bounce back in May, but new home sales and new mortgage applications fell, with the latter remaining very weak.

What I didn’t like

- The Fed raised its Fed Funds rate by 0.25% to 5.25% -5.5% as expected but it was unnecessary, as future months should prove.

- July business conditions PMIs were stable in Japan but fell again in the US, Europe and UK, with manufacturing conditions in Europe and Australia in negative territory. Their rebound since late last year looks to be over as rate hikes continue to bear down on economic activity.

- Australia’s terms of trade is on the way back down after surging with the post-pandemic economic recovery.

Next week’s rates decision

The RBA should hold fire on rate rises even though our inflation rate is 6%, while the US is 3%. The annualised rate of 3.2% is a better indication of inflation over the past three months and the Yanks started raising interest rates more aggressively than us. The combined impact of higher rates, bigger power bills and other rising prices will slow both the economy and inflation in coming months.

The bond market is now saying “rates on hold” on Tuesday is a 75% chance. I hope they’re right.

The Week in Review

Switzer TV

- Switzer Investing: What do the charts say about these stocks: CSL, RMD, S32, TPG, IEL, QUBE, Santos? [1]

- Boom Doom Zoom: 27th July 2023 [2]

Switzer Report

- Go long oil and coal stocks — seriously? [3]

- Two small-cap transport stocks to consider [4]

- “HOT” stock: Whitehaven Coal (WHC) [5]

- Questions of the Week [6]

- How did your super fund fare last year? [7]

- HOT stock: Santos Ltd (STO) [8]

- 4 exciting copper plays [9]

- Buy, Hold, Sell — What the Brokers Say [10]

Switzer Daily

- Stop my subscription I want to get out! [11]

- The RBA should stop rate rises but I fear they won’t! [12]

- Will today’s inflation force Dr Phil to raise rates again before he leaves? [13]

- Albo has a big budget surplus but he’s not sharing it until next year [14]

- New Zealand will change its Government in October – by Malcolm Mackerras [15]

Top Stocks — how they fared.

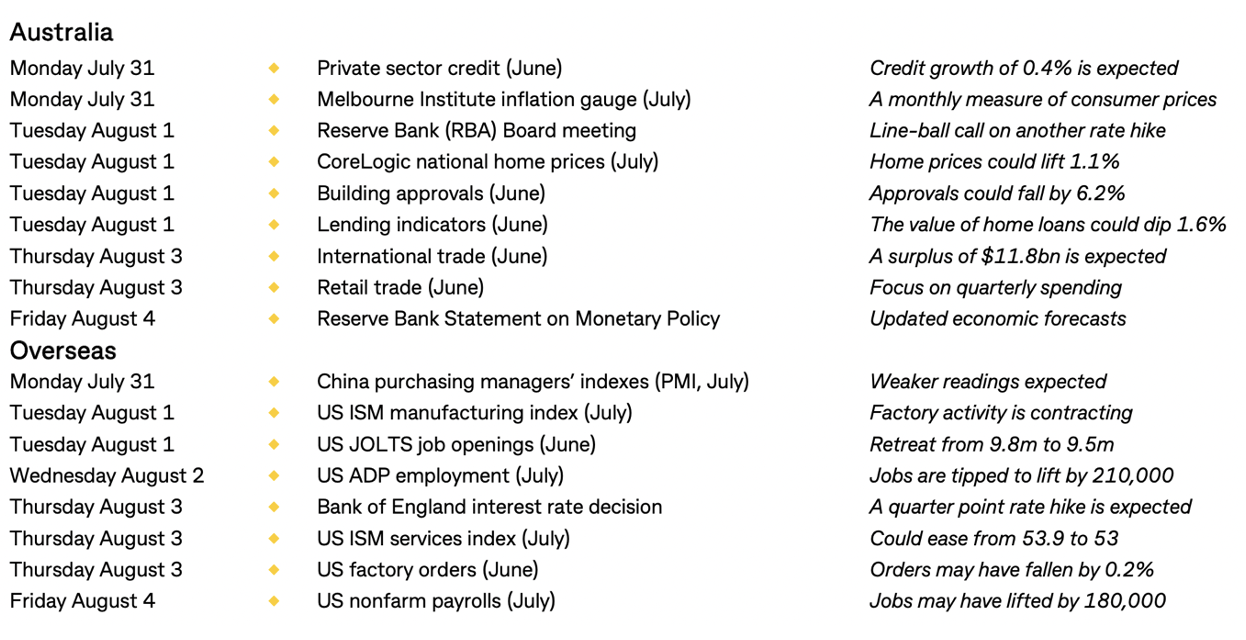

The Week Ahead

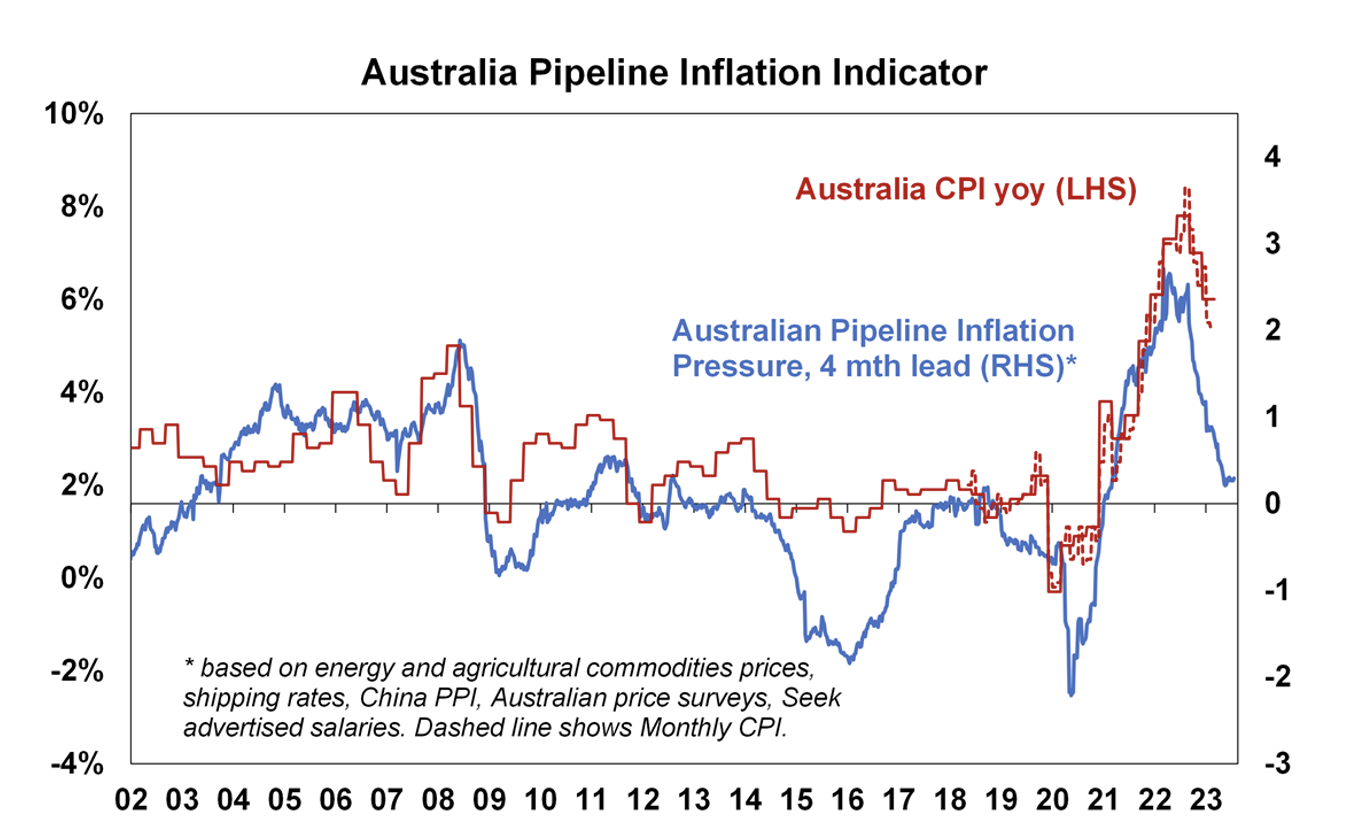

Chart of the Week

Two charts instead of one are worth thinking about.

That blue line shows us where inflation is heading and it screams to the RBA to keep pausing, first and stop raising second!

Stocks Shorted

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before

Quote of the Week

“The RBA may have reached the end of the fastest tightening cycle in decades after soft inflation figures confirmed it was making progress taming price rises.” AFR’s Michael Read.

Economist Chris Richardson: ““It may well be the peak in rates, but it’s not the peak in pain,” Mr Richardson said.”

Disclaimer

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.