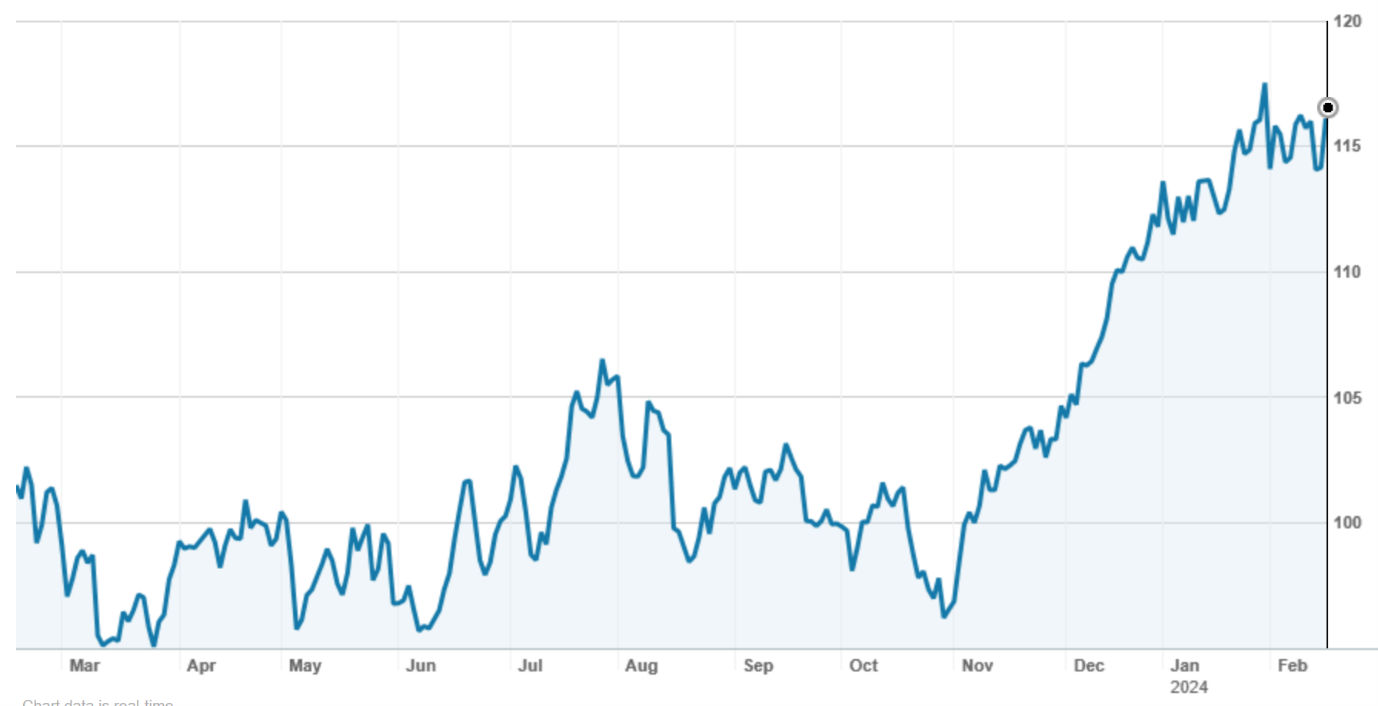

1. Commonwealth Bank (CBA)

CBA’s cash profit of $5bn broadly met expectations. That said, operating performance was down 3% on the corresponding half in FY23 thanks to a further decline in net interest margin and almost no volume growth. Reasonable discipline on costs and reduced bad debt write-offs kept the bottom line decline to less than three percent.

Despite a lower profit, CBA increased the dividend from $2.10 per share to $2.15 per share. In its presentation, CBA kept the focus on its leadership in digital, strong customer satisfaction ratings and share of wallet, disciplined cost control and strong balance sheet – very little mention of volumes.

Source: nabtrade

Market & analysts

CBA finished at $116.80 on Friday, up 0.5% for the week. (ASX 200 up 0.2%, NAB up 2.2%). Consensus broker target price at $91.55 (largely unchanged), but 2 analysts downgraded (Morgans and UBS). Now 6 out of the 7 major brokers have a “sell” recommendation (other is “neutral”).

My take…

Market is afraid to sell CBA. I guess I am a little too – so light profit taking. I will be turning off my DRP and taking the dividend in cash. Expect market underperformance.

2. CSL

CSL reported a first half profit of US$2.06bn (at constant currency), in line with guidance and market expectations. It re-affirmed its full year profit guidance of between US$2.9bn and US$3.0bn, representing growth over FY23 at constant currency of between 13% and 17%. (CSL’s profit is weighted to the first half because its influenza vaccine business mainly generates revenue in the northern hemisphere winter and makes money in the first half but loses money in the second half).

A strong performance from its main business, CSL Behring (blood plasma products), and better than expected performance from CSL Seqirus (influenza vaccines) was offset by a disappointing outcome from CSL Vifor (kidney disease treatments), where sales fell by 19%.

Earlier in the week, CSL announced that its Phase 3 trial of a drug to reduce the risk of major adverse cardiovascular events following a heart attack had produced disappointing top line results (in other words, the drug didn’t do what it was designed to do). The double blind, randomized placebo controlled trial had involved 18,200 patients from 850 sites in 49 countries.

Source: nabtrade

Market & analysts

CSL finished at $284 on Friday, down 6.9% on the week (ASX 200 up 0.2%).

Most brokers lowered their target price by around 5%, with consensus now sitting at $316.74. Citi downgraded from “buy” to “neutral”. However, all other major brokers remain bullish and have “buy” ratings.

My take…

CSL has again “failed” the $300 mark. I can’t see an immediate catalyst to take it back there. On the other hand, it is not a stock that the institutions are going to abandon. Expect market performance.

3. Macquarie Group (MQG)

Macquarie issued a third quarter update (its fiscal year ends 30 September) and didn’t report any numbers. It said that FY24 year to date NPAT was “substantially down” on FY23 which included an “exceptional quarterly result” for 3Q23. This was mainly due to the performance of its market facing businesses, in particular commodities and global markets. Macquarie didn’t provide any guidance but did detail factors impacting the short and medium term outlook. It also noted that it has a $2bn on-market buyback underway, of which $1.7bn was outstanding at as 31 December.

Source: nabtrade

Market & analysts

Macquarie finished at $192.70 on Friday, up 1.0% on the week (ASX 200 up 0.2%).

Most brokers thought the update was “steady as she goes”, but also noted the absence of any positive news. Target prices and ratings were unchanged. The consensus price is $181.66, about 6.0% lower than Friday’s close. There are two “buy” recommendations and 3 “neutral” recommendations.

My take…

On the basis of track record, I expect outperformance.

4. Telstra (TLS)

Telstra’s first half underlying EBITDA of $4.0bn was up 3% on 1H23. A fraction short of market consensus, strong growth in mobiles (now 62.4% of EBITDA) was offset by a disappointing performance by its network application and services business (NAS) which supports wholesale customers.

Telstra re-affirmed guidance but narrowed the range for full year EBITDA from $8.2bn to $8.4bn down to $8.2bn to $8.3bn. Demonstrating confidence in the business, the interim dividend was somewhat surprisingly increased from 8.5c to 9.0c per share, taking the payout ratio to 107%.

Source: nabtrade

Market & analysts

Telstra finished at $3.86 on Friday, down 3.0% on the week (ASX 200 up 0.2%).

The brokers were largely neutral on the result, although 3 raised their target price and 1 lowered it. The consensus target price sits at $4.38, some 13.6% above Friday’s closing price. According to FN Arena, there are 4 “buy” recommendations and two “neutral” recommendations.

My take…

You can pencil in an 18c full year fully franked dividend for Telstra, which puts it on a yield of almost 4.7%. Given its defensive characteristics, this is starting to look attractive. It is “Telstra”, however, so don’t get carried away, but there is value emerging. Market performance.

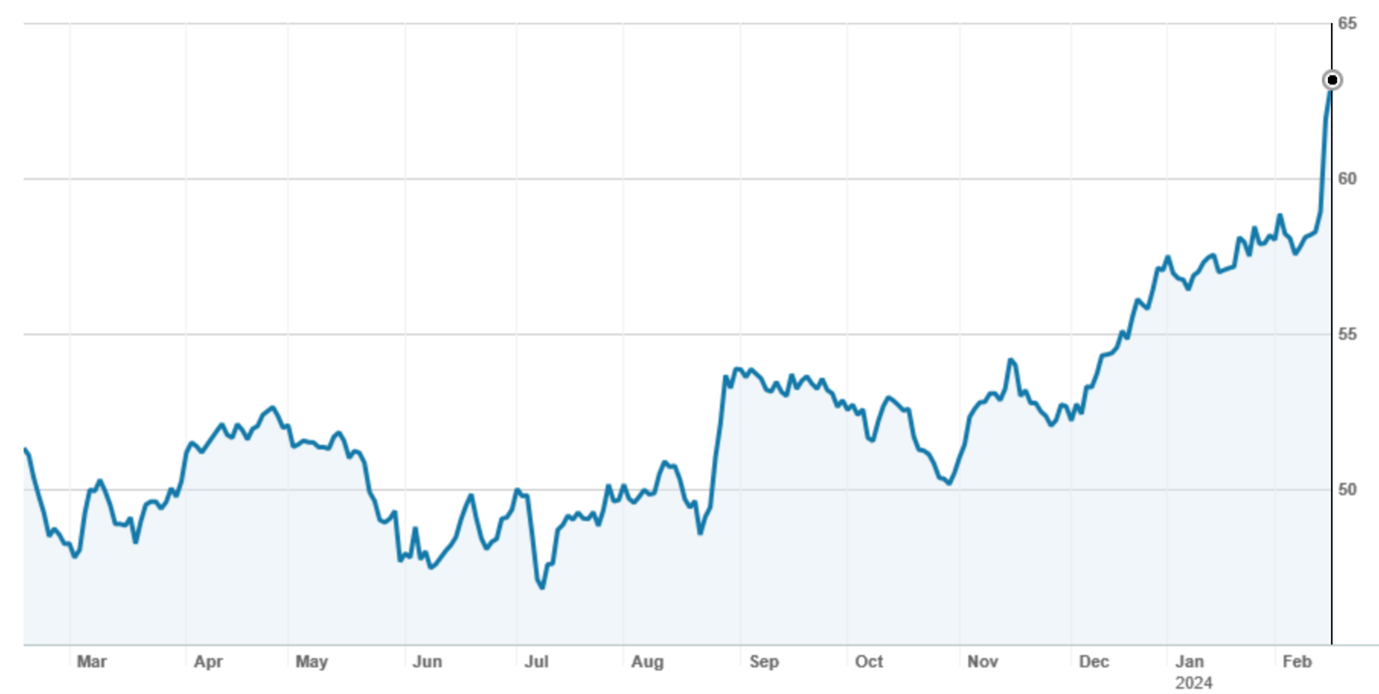

5. Wesfarmers (WES)

A “beat”, revenue growth of 0.5% led to Wesfarmers increasing first half profit by 3.0% to $1.4bn. The interim dividend was increased from 88c per share to 91c per share.

The highlight was Kmart Group, where on sales growth of 5.0% (7.8% for Kmart and -5.1% for Target), EBT (earnings before tax) increased by 26.5% to $601m. Bunnings also performed credibly in a tough environment, achieving a very modest increase in sales and flat earnings of $1,282m. Wesfarmers CEF (chemicals energy and fertiliser) division saw earnings crunch by 46.9% due to lower commodity prices and higher input costs.

Source: nabtrade

Market & analysts

Wesfarmers finished at $62.95 on Friday, up 8.3% on the week (ASX 200 up 0.2%).

Considered a “beat”, one upgrade and one downgrade resulted with target prices being raised. Overall, most brokers see Wesfarmers as fully priced. The consensus target price is $56.73, about 10% lower. The range is quite wide – from a low of $43.00 from Ord Minnett up to a high of $62.30 from Morgans. According to FN arena, all recommendations are “neutral”.

My take…

Another stock that is “hard to sell’, the market’s reaction was partly a result of looking forward to lower interest rates and the positive impact that should have on Bunnings. But Wesfarmers is now trading on a pretty high multiple (27.7x forecast FY24 earnings and 25.5x forecast FY25 earnings), and with a yield of just over 3.1%, doesn’t inspire. I think there will be another opportunity to buy Wesfarmers. Market underperformance.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.