Every major bank is now offering a headline rate of 4% for a 12 month term deposit. And with the RBA likely to increase interest rates by another 0.5%, with potentially the next rate increase of 0.25% coming as early as a fortnight on Tuesday, big figure “4” rates are here to stay.

However, as expectations grow that inflation has peaked and the interest rate tightening cycle is drawing to an end, the term deposit yield curve is starting to invert. This means that longer-term deposit rates are lower than shorter term deposit rates.

The term deposit yield curve is following the government bond market. In the US market, which is the global benchmark and to whom the Australian bond market is highly correlated, longer term bond yields have fallen considerably. The US 10-year government bond is currently 3.48%, down from a high of over 4.25% last October. The US two year government bond rate is now 4.13%.

While banks set term deposit rates relative to government bond yields (or more correctly, the bank bill swap rate curve), their “keenness” to attract retail funds depends on several factors. One of these, working in favour of depositors, is that the Australian banks have had access to very cheap term funding from the RBA.

Introduced as an emergency measure during Covid, banks will have to repay the funds over the next 9 to 18 months. This is likely to keep upward pressure on term deposit rates as the banks compete to replace these funds.

So while market pressures will act to keep a lid on deposit rates, competition for funds will work the other way. My best guess is that shorter term deposit rates have a little higher to go, longer term deposit rates (past 2 years) may have already peaked.

The best term deposit rates

With more than 140 ADIs (Authorised Deposit-taking Institutions) covered by the Government Guarantee on depositors’ funds, it can pay to shop around to secure the best rate. Don’t be put off by security concerns because with the effective Commonwealth Government guarantee on deposits of $250,000 on a per client per financial institution basis through the Financial Claims Scheme, Bank A is as good as Bank B up to $250,000.

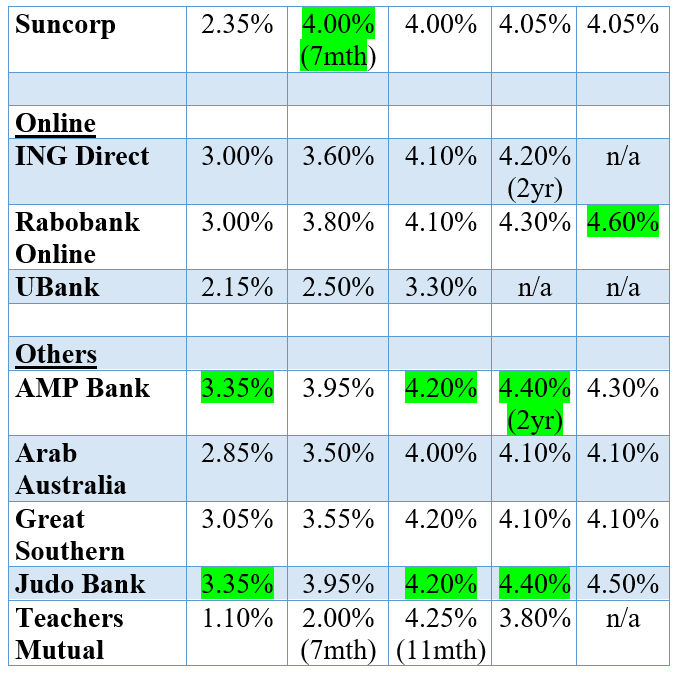

Listed in the table below are rates on offer for the popular terms of 3 months, 6 months, 1 year, 3 years and 5 years. Rates are current as of 20 January and are based on a deposit of $50,000 with interest paid on maturity, or annually for terms of 3 or 5 years.

Rates are shown for the four major banks and 15 regional/significant/on-line other banks. The major banks typically pay lower rates than the online banks and the regional banks. The highest rate is highlighted in green.

Judo and AMP Bank have the best rates across the board. For 3 months they are paying 3.35% and for 12 months, 4.20%. The best 6 month rate is 3.95%, and for 7 months, Suncorp is paying 4.0%. For 5 years, you can get 4.60% with RaboBank.

Noteworthy is that the term deposit rate curve has almost started to invert, for example, Macquarie’s 3 year and 5 year term deposit rates are below what they are paying for 12 months. The point of inversion (peak rate) is around two years.

Term Deposit Rates

Rates as at 20 January 2023 for deposits of $50,000 and upwards. Interest paid on maturity, or annually for 3 and 5 year terms. Advance notice (31 day) products selected when offered. Teachers Mutual is “member” rate, non-members receive 0.05% lower.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.