My most hopeful dreams came true this week and Diana Mousina captured it all here: “Concerns about the banking system have eased this week but have not been completely erased.”

Last week I told you that the black clouds over banks had to dissipate for stocks to go higher. Diana wasn’t alone in seeing some banking blue skies, as this headline from CNBC shows: “European stocks close higher as banking concerns continue to ease; H&M up 16%…”

That story quoted the chair of the European Union’s banking Single Resolution Board, Dominique Laboureix, who said: “During the three last years, the resilience of the European banking system was very strong based on very good solvency and very good liquidity and very good profitability. Based on that, I really believe there is good resiliency in our banking system.”

Also helping stocks are the growing expectations for fewer central bank interest rate hikes because the banking question marks and the reaction of banks to be more careful with their lending is effectively more monetary tightening.

This week, our market added 3.1%, while the Eurozone and Japan had similar rises. Bond yields rose over the week on fewer banking sector concerns, while commodity prices were also mostly higher, with oil back up to nearly $80/barrel after declining to $72 in recent weeks. All this is good for the Aussie dollar, which is 66.82 US cents today.

Let’s hope all this good news is sustained but there are a few curve balls out there. Here is AMP’s near-term outlook, which hasn’t missed the negatives: “The outlook for equities in the near term is constrained because there could be more strains in the banking system, global inflation has been surprising to the upside in the US and Europe, which may keep central banks more hawkish than expected and the geopolitical environment remains very tense, with news this week that Russia is planning to station tactical nuclear weapons in Belarus in retaliation for the UK providing Ukraine with tank shells with depleted uranium and the relationship between the US/China is deteriorating again, with further progress on the potential US TikTok ban”.

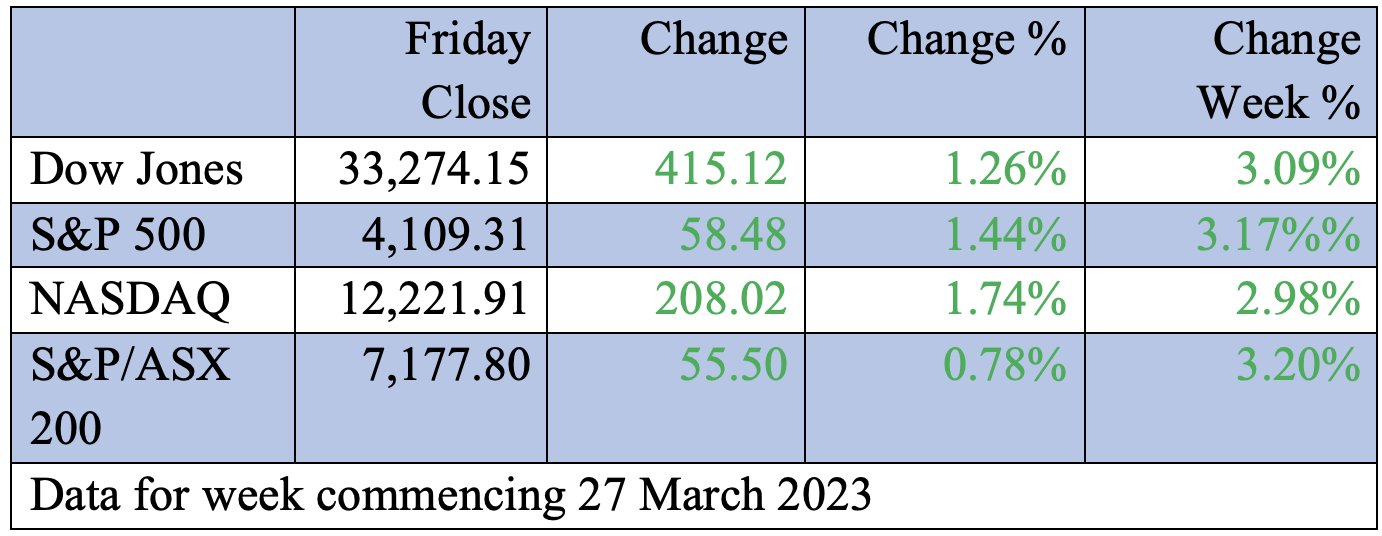

Meantime, Wall Street kept the positivity going with all market indexes up strongly, which were not only helped by less banking concerns but also lower inflation worries.

The Federal Reserve’s preferred inflation gauge — the Personal Consumption Expenditure index — went up by 0.3% compared to an economists’ survey expectation of a 0.4% rise. The current re-loving of tech stocks is a good sign that the risk on trade is back but you must be realistic about this because one bad banking story and all this could turn on a dime. Helping is the fact that April is a very good month for stocks historically speaking. I’ll look at this on Monday.

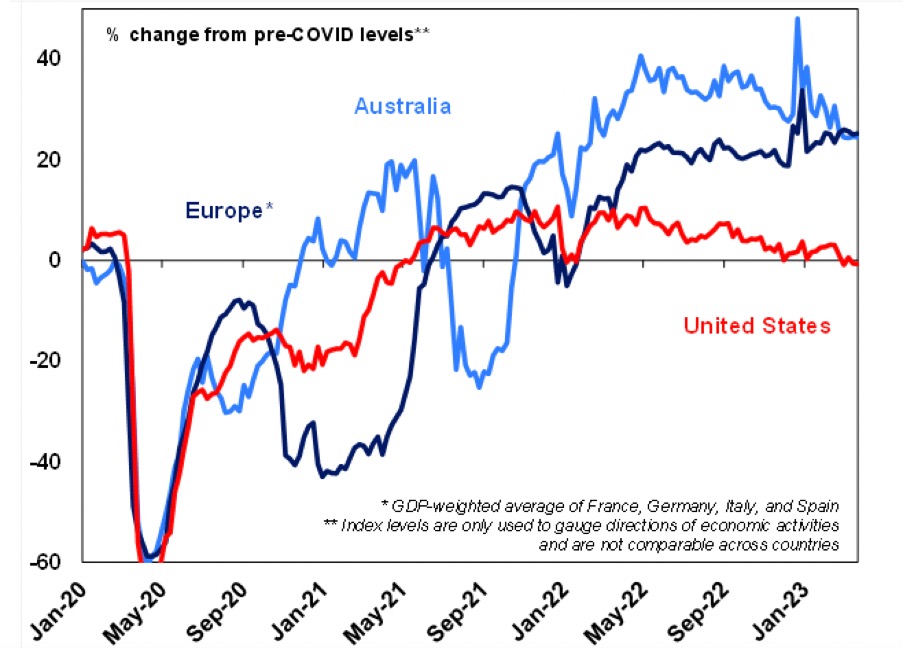

Also, AMP’s economic activity tracker shows the US (the red line) is slowing and so are we, which looks good for seeing lower inflation in the future.

Given all the above, you shouldn’t be surprised to learn that retail stock market optimism is on the rise in the US. The American Association of Individual Investors (AAII) survey showed these market players had grown more positive, with the bullish reading up from 20.9% to 22.5%. But as you can see, the number is still on the low side. That has been the case for six weeks in a row. Over the past 65 weeks, 46 of them were relatively pessimistic.

The historical bullish average is 37.5% but you must remember that these sentiment surveys are contrarian indicators, with above-average optimism suggesting more risk in stocks and above-average pessimism signalling the possibility there’s less risk in markets. The idea is that when bullishness is high, most investors have already bought, and when bearishness is high, most have already sold. So, bad news is good news!

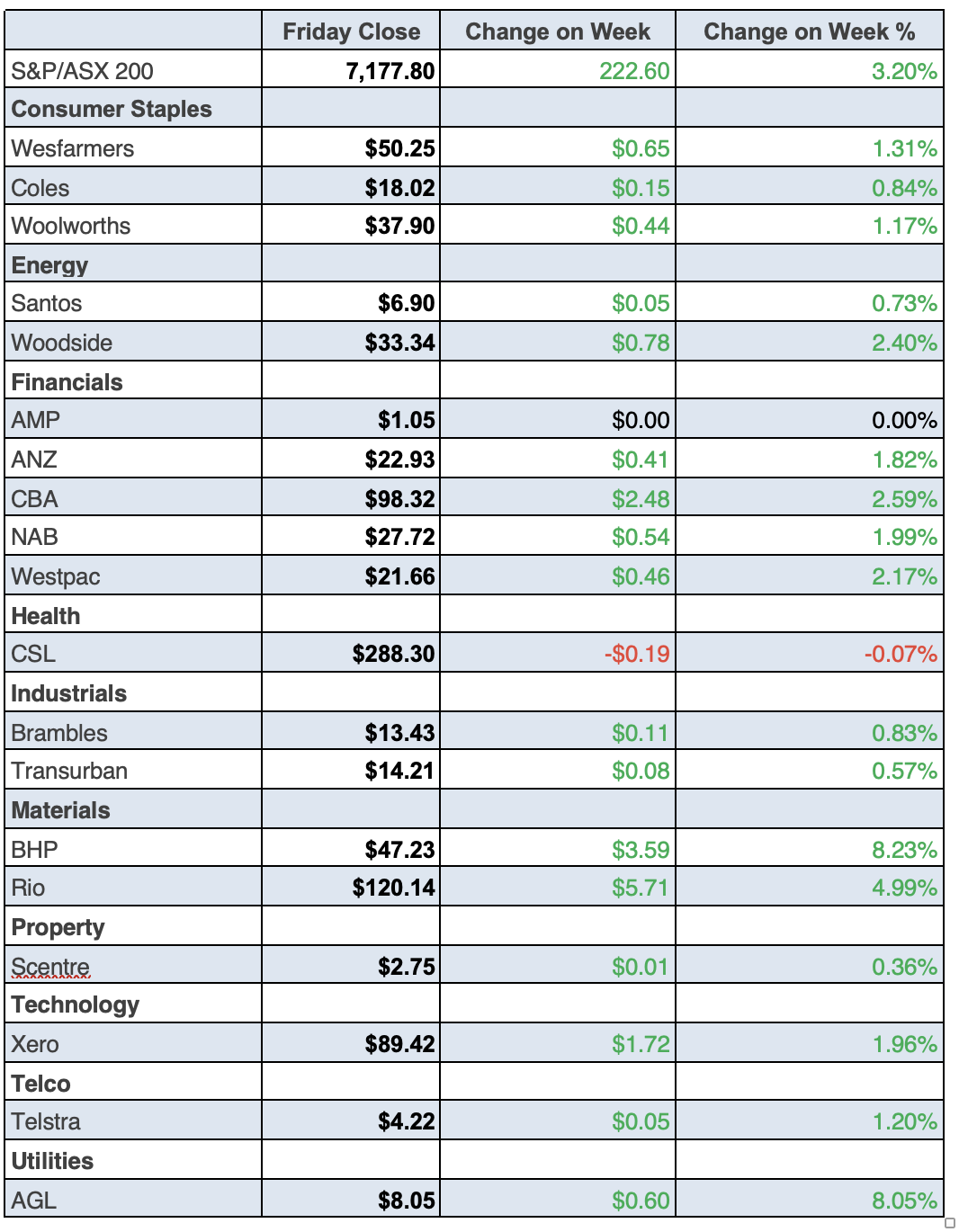

To the local story and the S&P/ASX 200 Index rose 3.2% for the week (or 222.6 points) to 7177.80, which reflects the dissipating black banking clouds over financial markets.

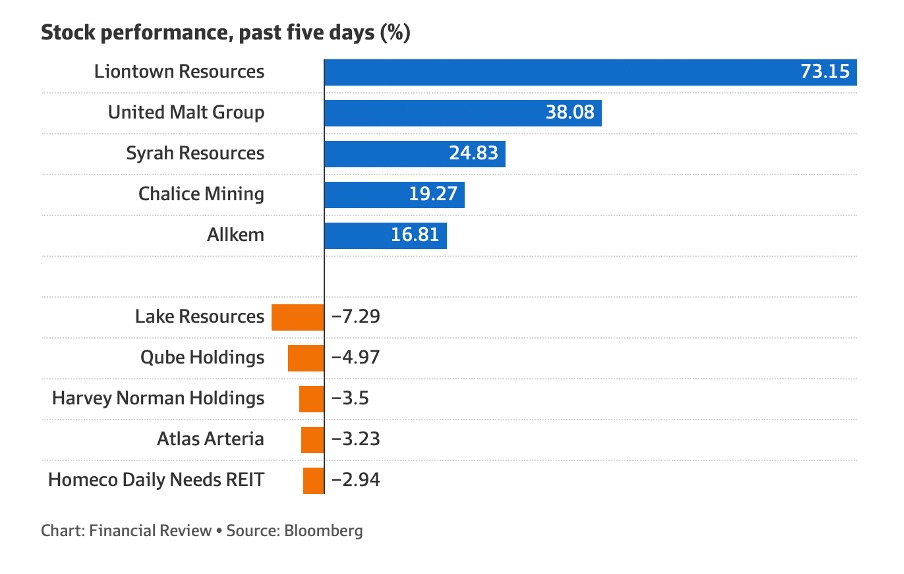

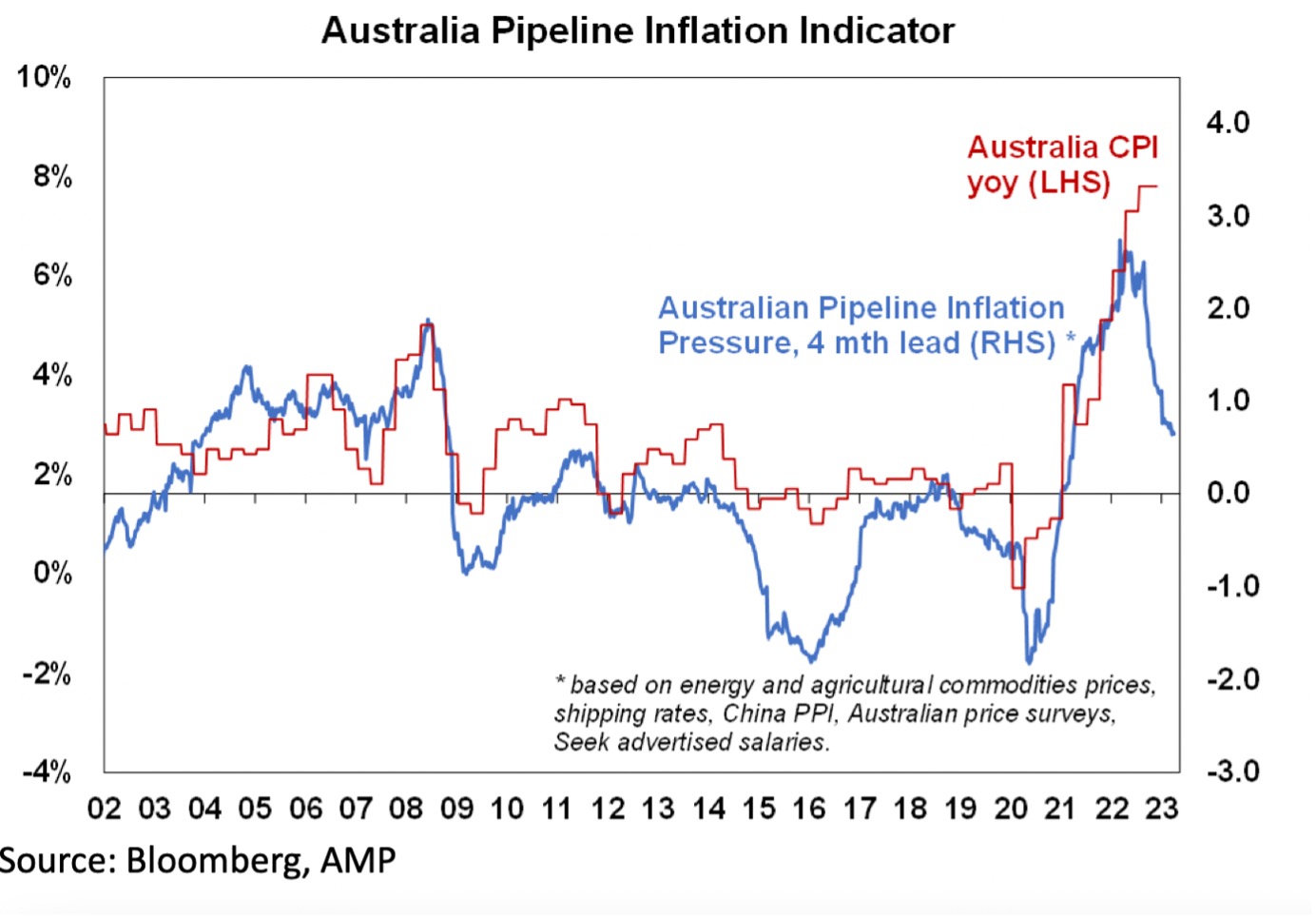

Here are the winners and losers for the week:

Long-suffering EML shareholders got a break this week, as the AFR explained: “EML Payments shares jumped 31 per cent to 55 cents. The company confirmed that its Irish subsidiary, PFS Card Services, was going to be placed under a nil per cent growth cap by the Central Bank of Ireland. The company confirmed that after close of trading on Thursday. Irish authorities applied the growth cap on its Irish subsidiary, PFS Card Services for 12 months until March 31 next year.”

And for those wondering why Bravura Solutions had a good week, here is the AFR’s explanation: “Software provider Bravura Solutions shares rose 8.1 per cent to 40 cents. The company said chairman Neil Broekhuizen was retiring, with Andrew Russell immediately appointed to step in as interim chairman.”

What I liked

- Retail trade increased by a low 0.2% in February, which could help the RBA pause on rate rises next Tuesday.

- Private sector credit is basically outstanding loans. Lending has slowed in response to higher interest rates, and that slowdown will be reflected with a lag in credit. Credit has slowed to 0.3% growth per month, down from 0.6% per month just three months ago and 0.9% around nine months ago. Annual growth of credit of 7.6% hit a 13-month low. This is good for making the RBA pause on its rate rises.

- The ABS measure of job ads fell by 1.5% for the three months to February 2023, but remains at a very high level. Good for inflation but also good for saying we’ll avoid a recession.

- This from the CBA: “In what we believe is a very close call, we now expect the RBA to leave the cash rate on hold at 3.6% at the April Board meeting.”

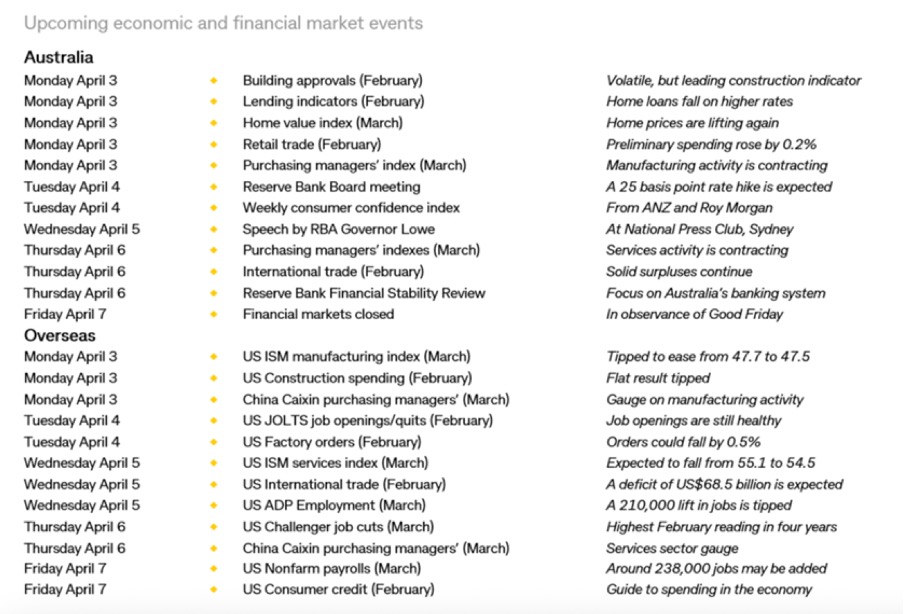

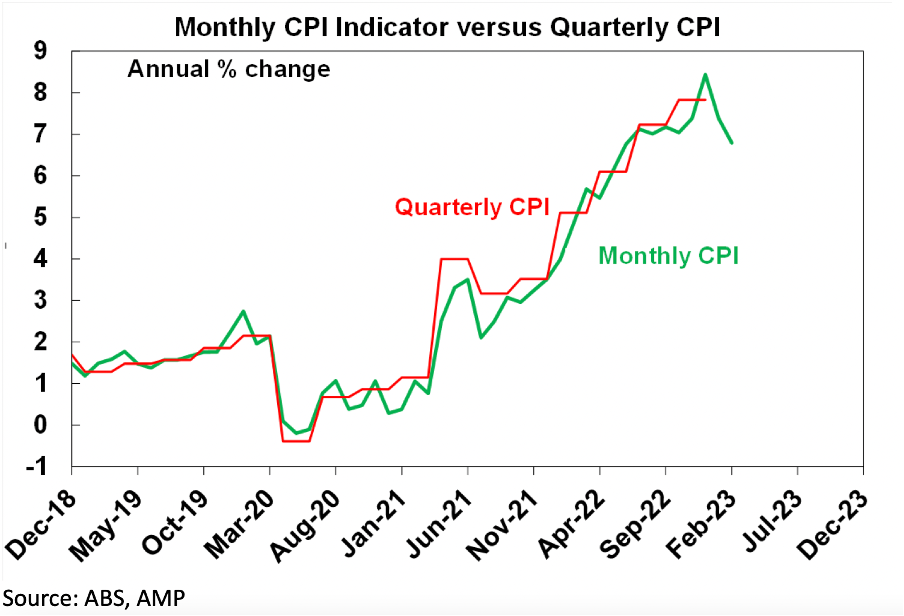

- Prices rose by 0.6% in February 2023 and the annual rate stepped down to 6.8% from 7.4%. This is the AMP’s take on the number: “The monthly February consumer price data came inbelowexpectations, rising by 0.2% or 6.8% over the year (market consensus was for annual growth at 7.2% and we were expecting 6.9%) down from 7.4% year on year last month. This is another confirmation that inflation peaked in December, (at 7.8% year on year on the quarterly data or 8.4% year on year on the monthly data). We expect headline inflation to be around 4% by the end of the year.”

- Another positive view from the AMP economics team: “Predictions of an approaching recession have become a consensus forecast. However, global growth has mostly surprised to the upside in early 2023, especially in the US and Eurozone, which reflects the plunge in energy prices, the turn-up in real wages and some one-off tax refunds for US households. The reopening of the Chinese economy has also been positive.”

- Local business credit expanded 0.4% in the month. This was slower than the average growth of 0.7% recorded over the past six months but in line with the 10-year average.

- The German IFO business climate index firmed to 93.3 in March from 91.1 in February. The assessment of both current conditions and the outlook improved, reflecting the recent resilience of the German economy. This was the fifth consecutive monthly improvement in business conditions. However, the index remains subdued relative to history.

What I didn’t like

- Consumer confidence in the US surprised to the upside in March, increasing to 104.2, from 103.4 in February. This was above consensus expectations for a decline to 101. The increase was surprising as the survey was undertaken post the failure of the Silicon Valley Bank, which appears to have had little immediate impact on consumer confidence. This isn’t good for interest rates.

- German inflation eased in March, but still came in above analyst forecasts. German consumer prices harmonized to compare with other European Union countries and rose by 7.8% compared to the previous year and increased by 1.1% compared to February. Analysts had anticipated harmonized inflation would reach 7.5% in March, as reported by Reuters.

- US initial jobless claims in the week that ended March 25 rose to 198,000, compared to analyst consensus of 196,000. This year, initial jobless claims have mostly remained below the 200,000 level as the job market remains strong. The labour market needs to loosen to help inflation fall.

- The Fed’s Susan Collins said the banking system is sound but more rate hikes are needed to bring down inflation. Rates will be crucial for what stocks do.

The AMP outlook for stocks

Global shares are expected to return around 7% this year. The post mid-term election year normally results in above average gains in US shares, but US shares are likely to be a relative underperformer compared to non-US shares reflecting still higher price to earnings multiples versus non-US shares. The US dollar is also likely to weaken further, which should benefit emerging and Asian shares.

Australian shares are likely to outperform again, helped by stronger economic growth than in other developed countries and stronger growth in China, supporting commodity prices. And investors continue to like the grossed-up dividend yield of around 5.5%.

The Week in Review

The TV Show

Boom Doom Zoom

My Stories

- https://switzer.com.au/the-experts/peter-switzer/what-the-rba-should-learn-from-revered-doctor-doug-mulray-rip/ [3]

- https://switzer.com.au/the-experts/peter-switzer/if-dr-phil-doesnt-pause-these-rate-rises-hes-crackers/ [4]

- https://switzer.com.au/the-experts/peter-switzer/westpacs-ceo-makes-the-case-for-the-rba-to-stop-rate-rises/ [5]

- https://switzer.com.au/the-experts/peter-switzer/is-this-banking-crisis-fear-waning/ [6]

Malcolm Mackerras on Aston by-election

Top Stocks — how they fared

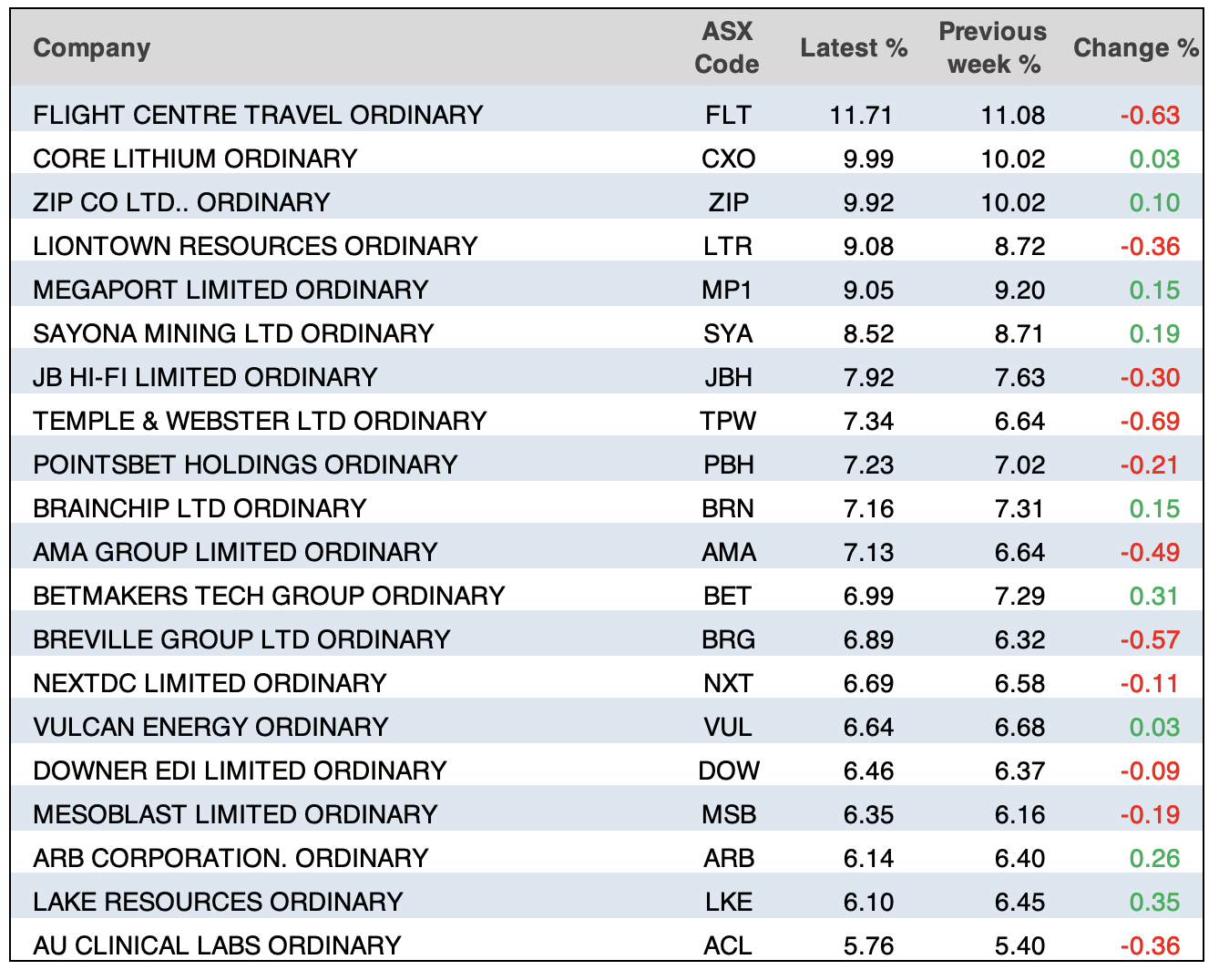

The Week Ahead

Charts of the Week

Stocks Shorted

Revelation of the Week

From CNBC: “A recent forecast from Goldman Sachs projects that the broadest definition of AI could generate about $7 trillion [8] in global economic growth over the next 10 years. Bernstein calculated in a recent note that ChatGPT could spark a new market generating “ten of billions [9]” annually.

“It’s not necessarily a negative for Nvidia,” said Raymond James analyst Srini Pajjuri. “The pie is expanding, even if they lose a little bit of share, they’ll still grow very rapidly.”

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.