I made what in the trade is known as a ‘courageous call’ on Telstra back in October. Telstra has been a chronic underperformer, and many an analyst has come astray putting a “buy” on Telstra. While not brimming with confidence, I concluded: “ I will stick my neck out and say that Telstra is in the buy zone. I think the risk on the downside is limited, and that’s primarily what makes it a buy.” (see https://switzersuperreport.com.au/is-telstra-now-a-buy [1])

Telstra was $2.84 at the time. On Friday, it closed at $3.25. That’s a gain of 14.4%, and while it is a bull market, that is a respectable performance.

Last Thursday, Telstra released its first half year profit report. While not shooting the lights out with any numbers, there was definitely a more upbeat tone from management about the way forward. So, is Telstra still a buy, a hold, or a sell?

The bull case

Let’s start with the dividend. At the half year result briefing, Telstra confirmed that “it expects to pay a fully franked full year dividend of 16c per share”. At a price of $3.25, this puts Telstra on a prospective yield of 4.9%

The important point to note is that it didn’t need to provide a full year dividend forecast, as it is only half- way through the year. The fact that the Board chose to say this is a sign of confidence in the business.

This bring us to Telstra’s key challenge – growing income and earnings (EBITDA). The continuing payment of a dividend 16c per share is integrally linked, with Telstra re-affirming its position in respect of dividends:

“The factors the Board would consider include:

- whether an underlying EBITDA of $7.5bn to $8.5bn post the rollout of the NBN is achievable.

- whether the free cash flow dividend payout ratio remains supportive and we retain a strong capital position; and

- whether there are other factors that would make the payment of the dividend at that level imprudent.”

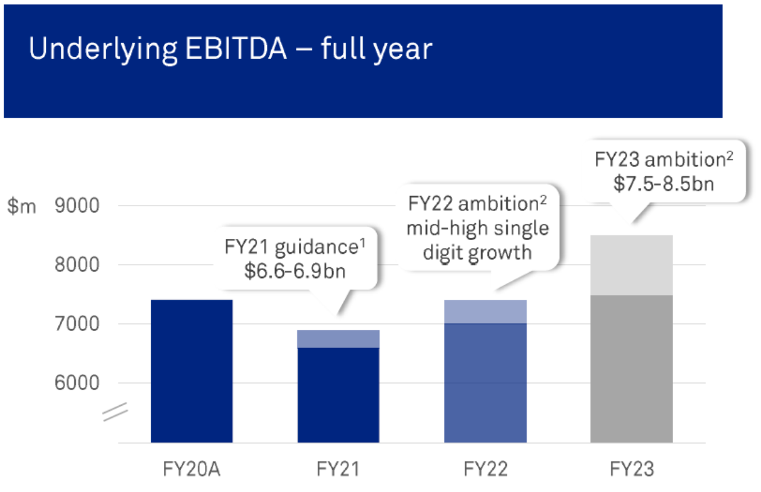

Telstra’s underlying EBITDA has been in decline due to the headwinds of the NBN rollout (it loses its position as both a wholesaler and retailer of fixed line broadband and telephony services, and becomes just a retailer), and competitive pressures in the mobile market. CEO Penn’s challenge is illustrated by the following slide, which shows underlying EBITA declining from $7.4bn in FY20 to between $6.6bn and $6.9bn in FY21.

Source: Telstra

Because Telstra’s dividend has been supported by ‘one-off’ receipts from NBN connections, which are declining rapidly as the NBN rollout concludes, it can only maintain payment of 16c per share if it grows underlying EBITDA to $7.5bn to $8.5bn by FY23. From (say) a midpoint of $6.75bn in FY21, this represents a compound annual growth rate of 5.5% to 12.2% pa.

For a company that has had declining earnings for years, this is a big target.

CEO Penn expressed considerable confidence, saying that “I am optimistic we are at a turning point financially”. He cited a lead indicator for mobile revenue (transacting minimum monthly commitment) increasing by $3 in the half year, saying that he was confident that “mobile ARPU (average revenue per user) has also reached a turning point and will return to growth in the second half of FY21”. Mobiles is Telstra’s biggest and most profitable product, accounting for 42% of underlying income and 52% of underlying earnings.

Penn suggested that the in-year NBN headwinds had peaked in the second half of FY20, reduced in 1H21 and will be substantially less in FY22. Covid-19 related costs (a $400m impact in FY21) are expected to reverse over time.

Telstra is also making good progress with its ‘cost-out’ program, with the target now increased to $2.7bn by FY22.

In terms of areas for new revenue growth, Penn sees Telstra Health as being a key opportunity.

Last year, Telstra announced a corporate restructure which will split the company into three entities: InfaCo Fixed which would own and operate Telstra’s passive infrastructure assets (ducts, fibre, data centres etc); InfaCo Towers (which would own and operate Telstra’s mobile towers); and ServeCo, essentially the rest of Telstra without the physical assets. Separation is due to be completed by December in 2021.

InfraCo Towers is being “monetised”, with Macquarie hired to advise on how this is executed. This transaction has excited analysts (see below) because there is strong demand and compelling valuations for this type of high quality infrastructure. If this proceeds, this could result in a capital return or in-specie distribution to shareholders.

The last bull point relates to Telstra’s recent share price history. Technically, the chart below appears to be quite supportive.

Telstra Share Price – last 12 months

Source: nabtrade

The bear case

Most importantly, it is Telstra. A company with an abysmal track record, where income and earnings have been in decline for years. Notwithstanding the “optimism” in the half year report, Telstra still managed to reduce guidance on total income for FY21 by $1.2bn to a range of between $22.6bn and $23.2bn. Although a large part of the guidance reduction was due to mobile hardware sales, a comparison to total income of $26.1bn in FY20 highlights the challenges the company faces.

Another bear factor is competition. While the merger of Vodafone and TPG was initially seen as a positive for Telstra, a powerful third competitor, together with a re-invigorated Optus, could pressure margins.

Finally, if Telstra can’t grow earnings, a dividend cut in FY22 or FY23 remains a distinct possibility.

What do the brokers say?

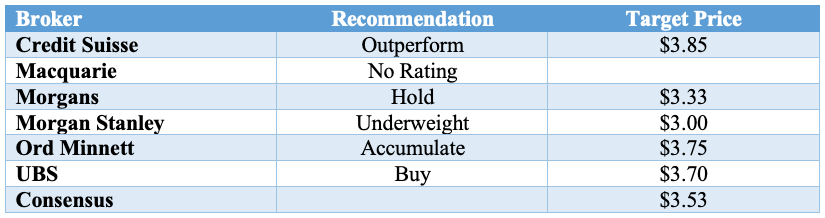

On the whole, the major brokers remain supportive of Telstra. Part of this thinking is that they see value in the monetisation of TowerCo, the other appears to be a feeling that Telstra has turned the corner.

On target prices, the major broker consensus is $3.53, 8.6% higher than Friday’s close. The range is a low of $3.00 from Morgan Stanley to a high of $3.85 from Credit Suisse. There are 3 buy recommendations, 1 neutral recommendation and 1 sell recommendation (Macquarie has withdrawn its recommendation). Details are shown in the table below.

Source: FN Arena

On dividends, the brokers forecast 16c for FY21, dropping to 15.4c in FY22.

Here’s my view

I am going to stick my neck out again and say that there is more upside with Telstra. The support from dividend thirsty income seekers, plus others expecting some form of distribution in relation to the sale of TowerCo, will keep a floor on the price.

I am not looking for much, maybe over time up to $3.75. I do not see a lot of downside risk in the short term, which makes it a buy/hold rather than a sell.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.