I nominated Telstra (TLS) as one of my two top picks for 2025 a couple of weeks back (see https://switzerreport.com.au/two-top-picks-for-2025/ [1]), so I was quite relieved when it announced a marginally better-than-expected profit result last Thursday and the stock rallied.

To recap, I don’t see Telstra as a growth stock or expect major price appreciation, but it is a great income play, paying better dividends than the major banks and arguably, with greater security.

I like Telstra because:

- It is the dominant player in its industry, with only two substantive competitors.

- It has held its market position and managed to achieve net gains in customers and share.

- Earnings are increasing.

- The dividend is increasing, and it is yielding 4.6% (fully franked).

- It is not a volatile stock.

- There is potential upside for shareholders should it divest its half share in Amplitel (the company that owns the mobile towers) or its fixed infrastructure business.

Telstra’s first half profit of $4,248m in EBITDA beat consensus by around $70m and was up 5.8% on the corresponding half (1H24). The market really liked the announcement of a $750m on-market share buyback, and the stock rallied from around $3.90 to $4.15.

Let’s have a closer look at the result and see whether there is more immediate upside in the share price.

Revenue and earnings growth

Revenue grew by 1.0% (not a big increase, but significant for a company where for the better part of the last decade it has gone backwards), with the mobile division up 4.5% and the haemorrhaging in the NAS (network application services) division easing. The international division, which includes Digital Pacific, was impacted by headwinds in Papua New Guinea.

Earnings from the mobile division rose by 3.7% to $2,602m, just over 61% of Telstra’s earnings. Telstra added a net 119K customers over the half year, with average revenue per user increasing from $52.49 to $52.85 for postpaid customers. All other divisions, except fixed active wholesale, increased earnings.

At a group level, a highlight was the reduction in operating costs, with underlying costs down $113m (or 1.5%) on the corresponding half in FY24. This was despite the impact of wage rises and inflation and achieved in an environment where customer satisfaction (as measured by the company’s net promoter score) increased by 3 points over the period to +47.

On the investment side, Telstra continues to invest in connectivity, with 60% of total network traffic over the 5G network in December. It has announced a partnership with Ericsson to deliver advanced 5G performance. It is building an intercity fibre network which will be used to support the Viasat satellite service. A $1.6bn capex investment over 5 years, seven routes are under construction connecting the major capital cities. The Sydney to Canberra and Melbourne to Canberra routes will come into service later this year.

For shareholders, Telstra announced a higher fully franked interim dividend of 9.5c per share, representing a payout ratio of 107% of earnings per share. Telstra’s strong liquidity and balance sheet is allowing it to conduct an on-market share buyback of $750m. The return on invested capital (ROIC) improved by 0.2% to 8.0%.

Looking ahead, Telstra re-affirmed guidance for FY25:

- Underlying EBITDA $8.5bn to $8.7bn ($8.2bn in FY24)

- Business as usual capex $3.2bn to $3.4bn ($3.4bn in FY24)

- Strategic investment in intercity fibre $0.3bn to $0.5bn ($0.3bn in FY24)

- Free cash flow before strategic investment of $3.0bn to $3.4bn ($3.2bn in FY24).

What do the brokers say?

The brokers are relatively positive on Telstra. According to FN Arena, the consensus target price is $4.19, about 1% higher than the last ASX price of $4.15. Most brokers have a target price around $4.40 to $4.50. Morgans is the odd one out with a target of just $3.20, arguing (in research from last August, before last week’s profit announcement) that Telstra is “expensive” on a PE basis compared to its 10-year historical average and that of incumbent international peers.

The brokers have Telstra trading on a multiple of 22 times FY25 earnings and 20 times FY26 earnings. The expected dividend for FY25 is 19 cents per share (putting Telstra on a prospective yield of 4.6%) and rising again in FY26 to 20 cents per share.

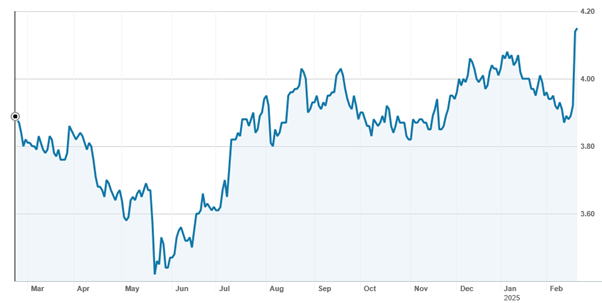

Telstra (TLS) – last 12 months

Source: nabtrade

What’s the bottom line?

Telstra is a classic defensive stock. High income, low volatility and limited downside risk. While it is not as cheap as it was before the profit announcement, I think it has room to go higher. $4.40 would still see it yielding an attractive 4.3%.

To get there, we probably have to see the scenario of money continuing to exit the banks. If banks get bought again, Telstra will get left behind for a while, but in time, the money will return. The buyback should also lend some support. Telstra remains attractive.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.