Just in case the inflation news and tech sell off this week spooked you, get ready for the latest from Wall Street, with US stocks up overnight led by, wait for it, tech stocks! The Nasdaq was up about 2.3% for the trading day but was down about 2.3% for the week.

Seriously, the antics of short-term players in the silly money-making arena called the stock market, really should be used to the advantage of patient long-term investors, but I know you’ve seen me say this before.

Recall on Tuesday an inflation number of 4.2% in the US shocked the market and sent tech stocks down. Economists expected a big 3.6% inflation reading because of the pricing oddities of the lockdowns and then the reopening of the US economy. One of the biggest drivers of that CPI number was the price spike for used cars!

Central bankers have been telling us that these price rises will be temporary though the market didn’t believe them early in the week. But in New York overnight they now do! Why?

Well, consumer sentiment in the US came in at 82.8 rather than an expected 90.1. Retail sales in April were flat against an estimated rise of 0.8%.

And yields in the bond market were a bit softer.

What we’re seeing is a series of short sell offs triggered by something that is temporarily concerning. However, the longer-term influence of a strong economy ahead, driven by huge stimulus and low interest rates, also helped by vaccinations that help the reopening of economies and the normalisation of businesses, forces investors and speculators back into the market.

Tech stocks will remain under pressure because there is a rotation into value and cyclical companies that will benefit from the reopening phase for economies. But as I said on Monday, these tech stocks are companies of the future bringing digital solutions, artificial intelligence solutions, new payment systems and alternative energy businesses.

Sell offs are buying opportunities but the timing of it is always tricky. It’s impossible to always get it right so sometimes you just have to be patient. Those who bought banks after the Coronavirus crash might have felt like dummies until September when our economic rebound shocked everyone into realising that banks won’t have to be squeezed to save the economy. The CBA’s share price has gone from $63 to $96 in eight months — that’s a rise of 52%, which is the reward for patience.

To keep the tech sell-off into perspective, Tesla was down 11% this week and is down 33% this year, but this is a very volatile stock. On the other hand, the local FANG ETF is down only 13% over the same time. And Apple is down 10%, so the tech sell off isn’t as scary as you think, unless you’re less diversified and hooked up on the big risers, which now are the big fallers.

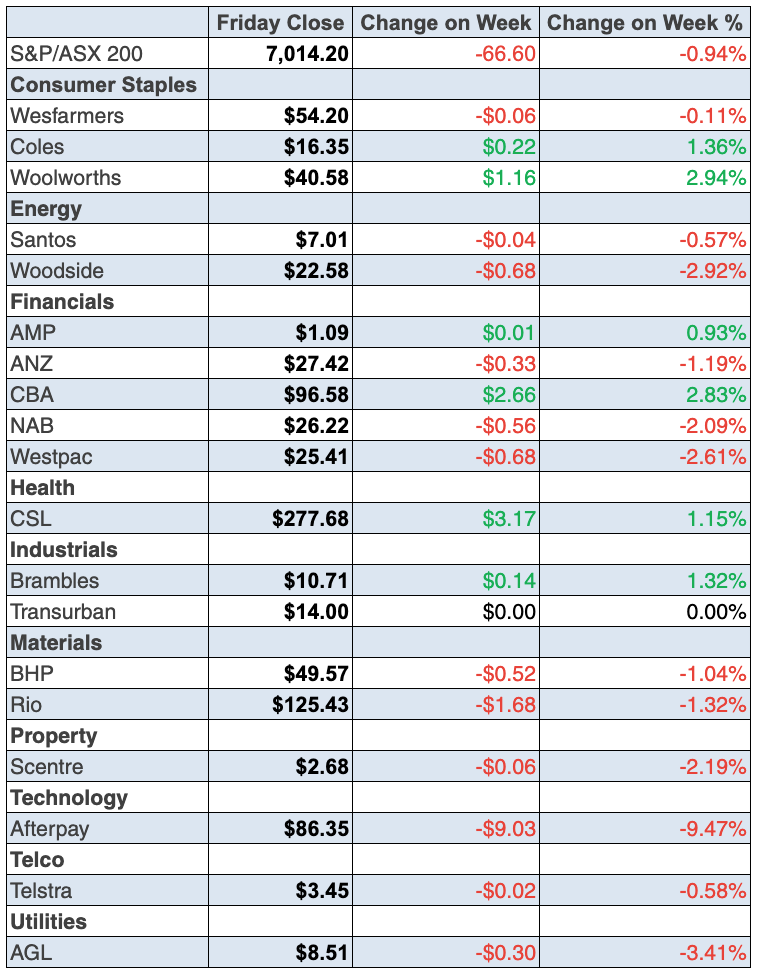

To the local story this week and the S&P/ASX 200 Index lost 66.6 points (is that the devil’s number?) or 0.9% to finish at 7014.2. But at least we finished positively putting on 31 points on Friday.

Tech stocks copped it because the Yanks overreacted to inflation data that surprised some investors, but a big number was expected because of the craziness of the Coronavirus, the lockdowns, the infection rates and then the vaccinations.

Economic stats are less readable and less reliable for helping us understand the future so any surprise result can be overreacted to. And Americans, especially on Wall Street, are professional overreactors!

The AFR summed up the tech losers this way: “Xero slid 15.9 per cent to $112.5, Afterpay fell 9.5 per cent to $86.35, WiseTech Global dropped 7.9 per cent to $26.00, Appen declined 10.5 per cent to $11.00 and Zip Co. lost 6.8 per cent to end the week at $6.83.”

I think our tech stock reaction is often an overreaction, which creates buying opportunities.

Meanwhile, a lack of new financial handouts to the travel industry in the Budget and all the vaccination issues, as well as international border question marks, saw Qantas lose 6.7%, Webjet 2.5%, Flight Centre 2.8% and Sydney Airport 3.7%, which again creates buying opportunities for the patient long-term investor.

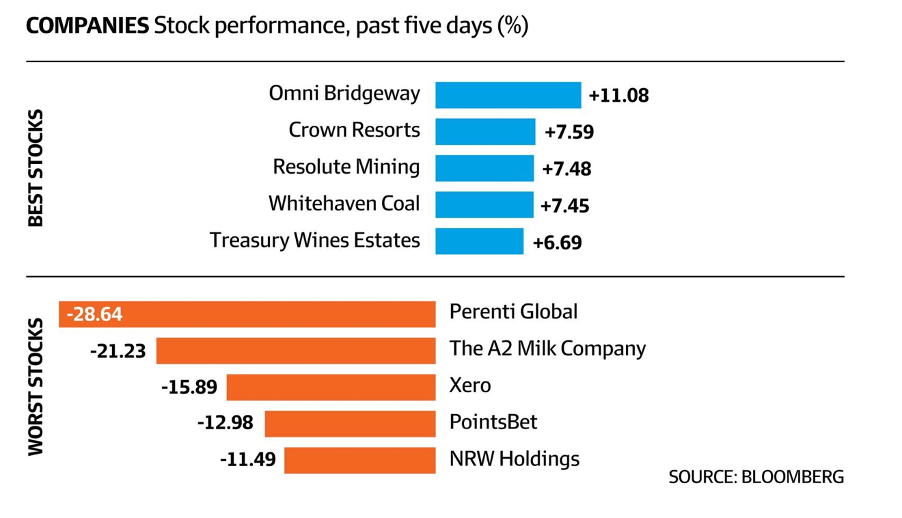

Here are the winners and losers, thanks to Bloomberg.

Most of us understand why Crown has spiked, with Star and possibly Oaktree joining in the looming bidding war for the gambling and resorts business.

Miners and banks were slightly out of favour, but gee they’ve had a great run.

Look at CBA, up 2.8% to $96.58 for the week. I see that as a great bellwether indicator for the overall economy.

What I liked

- Budget deficit of $161 billion (7.8% of GDP) expected this year (2020/21), when $213.7 billion was tipped!

- The Budget generally.

- The weekly ANZ-Roy Morgan consumer confidence rating fell by 1% to 111.6 (long-run average since 1990 is 112.6). It’s a fall but still at high levels. Consumer views on ‘current economic conditions’ rose 2.8%, with a record low 12.1% of respondents expecting ‘bad times’ in the next 12 months.

- The Commonwealth Bank (CBA) measure of household card spending in the week to 7 May 2021 was up by 18.5% on 2019.

- The Bureau of Statistics (ABS) reported that national payroll jobs rose by 0.4% over the fortnight ended 24 April 2021. And wages were up 0.3% over the period.

- SEEK job advertisements rose by 11.9% in April – with ads at all-time highs (since records began over 23 years ago). Ads have lifted for 12 successive months to be up 263.7% from a year ago. Vacancies are up 30.9% compared to April 2019.

- The NFIB business optimism index in the US rose from 98.2 to 99.8 in April (survey: 98.7).

What I didn’t like

- US consumer prices (CPI) lifted 0.8% (the biggest gain since June 2009) in April to be up 4.2% on a year ago (survey: 3.6%). The core CPI rose by 0.9% (the most since 1982) in April to be 3% higher on a year ago (survey: 2.3%).

- The US producer price index (PPI) rose by 0.6% in April (survey: 0.3%) to be up 6.2% on the year (the strongest annual growth rate since November 2010). The core PPI rose by 0.7% in April (survey: 0.4%) to be up 4.1% on the year.

- US consumer inflation expectations rose from 3.2% to 3.4% in April (the highest level since September 2013) (survey: 3.3%).

- The fact that the market used the temporary spike in inflation to sell off and then buy back in.

Out of sync with young investors

I have a young colleague who’s become a committed investor and is doing really well. He reckons it’s because he hangs out with us and reads the Switzer Report and does a lot of stuff that a lot of young people don’t do. That said, he says his mates who’ve recently got into playing stocks simply want the name of stocks and don’t want to read/think too much. I guess that’s a salient difference between an investor and a speculator.

Enjoy the rest of this Report and make sure you catch up on the best ideas of the week below.

The week in review:

- I shared the views of world’s biggest tech and innovation investor [1], Cathie Wood from the ARK Innovation ETF (ARKK), and looked at what’s ‘appening with Appen (APX).

- Paul Rickard suggested 6 simple ways to protect your share portfolio [2].

- Tony Featherstone wrote about 2 retirement-accommodation providers to watch as property prices boom [3]: Lifestyle Communities (LIC) and Ingenia Communities Group (INA).

- James Dunn suggested even more ways play the housing boom [4], including: Domain Holdings (DHG), Australian Finance Group (AFG), GWA Group (GWA), Nick Scali (NCK), Adairs (ADH), Beacon Lighting (BLX), Temple & Webster (TPW) and Rent.com.au (RNT).

- In our two “HOT” stock articles this week, Michael Gable from Fairmont Equities highlighted BHP (BHP) [5] and Julia Lee from Burman Invest selected Stockland (SGP) [6].

- Tim Miller from SuperGuardian wrote that the transfer balance caps for super monies going into pension phase go up from July 1 [7] and so do the amounts for yearly concessional contributions to super

- There were 10 upgrades and 13 downgrades [8] in the first Buy, Hold, Sell – What the Brokers Say this week, and 2 upgrades and 4 downgrades [9] in the second edition.

- In Questions of the Week [10], Paul Rickard answered your question about hanging on to Treasury Wine Estate (TWE) shares, how ETFs distribute income and franking credits, whether WAM Strategic Value (WAR) is worth looking at, and if A2 Milk (A2M) is too sour to buy.

- Catch up on the recording of this week’s Boom! Doom! Zoom! session [11] to hear Paul Rickard and Jon Riley from Switzer Advisory discuss A2 Milk (A2M), BHP (BHP), Qantas (QAN), Santos (STO) and more.

Our videos of the week:

- Boom! Doom! Zoom! | May 13, 2021 [11]

- ASX tech stocks: buy or Sell – ALU, APX, MP1? Plus, is Wesfarmers a buy? [12] | Switzer Investing

- How to invest ethically in one company + The companies to invest in due to the budget + tech stocks? [13] | Switzer Investing

- 2021 Budget – winners everywhere! But what about investors? [14] | Switzer TV

Top Stocks – how they fared:

The Week Ahead:

Australia

Tuesday May 18 – ANZ-Roy Morgan consumer sentiment (May 16)

Tuesday May 18 – Reserve Bank Board meeting minutes

Tuesday May 18 – CBA Household Spending Intentions (April)

Tuesday May 18 – Household impacts of Covid-19 survey (April)

Wednesday May 19 – Wage Price Index (March quarter)

Wednesday May 19 – Skilled job vacancies (April)

Wednesday May 19 – Monthly consumer confidence index (May)

Thursday May 20 – Labour force (April)

Friday May 21 – Preliminary retail trade (April)

Friday May 21 – IHS-Markit purchasing managers’ indexes (May)

Overseas

Monday May 17 – China retail sales/production/investment (April)

Monday May 17 – US New York Empire State factory index (May)

Monday May 17 – US NAHB housing market index (May)

Tuesday May 18 – US Housing starts (April)

Tuesday May 18 – US Building permits (April)

Wednesday May 19 – US Federal Reserve (FOMC) meeting minutes

Thursday May 20 – US Philadelphia Fed manufacturing index (May)

Thursday May 20 – US Conference Board leading index (April)

Friday May 21 – US Existing home sales (April)

Friday May 21 – IHS-Markit purchasing managers’ indexes (May)

Food for thought:

“Owning stocks is like having children—don’t get involved with more than you can handle.” – Peter Lynch

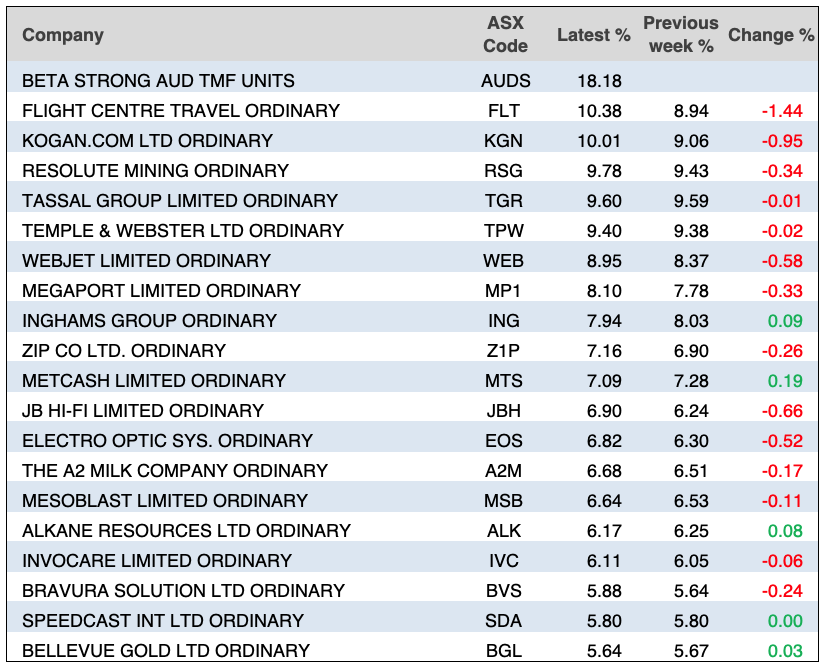

Stocks shorted:

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before.

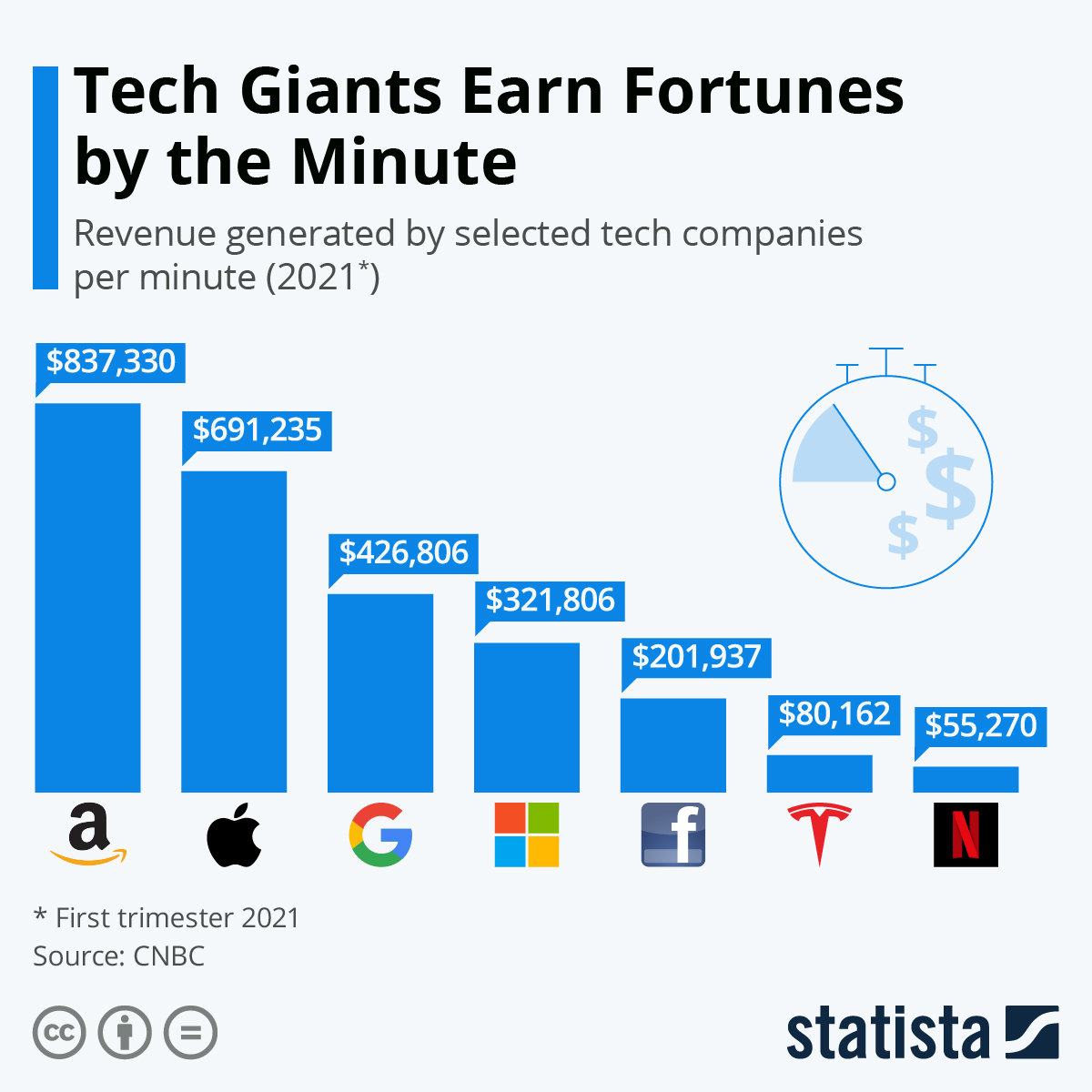

Chart of the week:

The following chart by Statista using data from CNBC shows how much revenue some of America’s biggest tech companies generate per minute (in USD):

Top 5 most clicked:

- 6 simple ways to protect your share portfolio [2] – Paul Rickard

- Who’s Cathie Wood and why is she such a big supporter of tech stocks? And what’s going to ‘appen to Appen? [1] – Peter Switzer

- Buy, Hold, Sell – What the Brokers Say [8] – Rudi Filapek-Vandyck

- 2 stocks beneficiaries of property boom [3] – Tony Featherstone

- How to play the home building boom [4] – James Dunn

Recent Switzer Reports:

- Monday 10 May: Cathie Wood, the world’s biggest tech and innovation investor, on the future of tech stocks [15]

- Thursday 13 May: 2 retirement accommodation strategies to watch [16]

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.