The solid start to the financial year continued, with the stock market adding to July’s gain of 5.2% with a rise of 1.64% in August. Most of the action was again in the ‘cyclical’ sectors of energy, materials, industrials and consumer discretionary, with the so-called ‘yield’ sectors either standing still or going backwards.

Despite this environment, our portfolios continued to perform well, maintaining their relative outperformance to the benchmark indices.

Portfolio recap

In January, we made some adjustments to our Australian share ‘Income Portfolio [1]’, and introduced a ‘Growth Oriented Portfolio [2]’.

The income portfolio is forecast to generate a yield of 5.23% in 2013, franked to 98.3%.

To construct the income portfolio, the processes we applied included:

- Using a ‘top down approach’ and introducing biases that favour lower-PE, higher-yielding industry sectors;

- To minimise the market tracking risk, adopting a rule that says our sector biases in the major sectors (financials, materials and consumer staples) will not be more than 33% away from index;

- Identifying 15 to 20 stocks (less than 10 is insufficient diversification, over 25 it is too hard to monitor), with a stock universe confined to the ASX 100;

- Within a sector, weighting the stocks broadly to their respective index weights, although there are some biases; and

- Of course, we looked for companies that pay franked dividends and have a consistent earnings record.

The growth-oriented portfolio takes a very different approach to the sectors in that it introduces biases that favour the sectors that we judge to have the best medium-term growth prospects. Critically, it also confines the stock universe to the ASX 100 (there are many great growth companies outside the top 100).

Performance

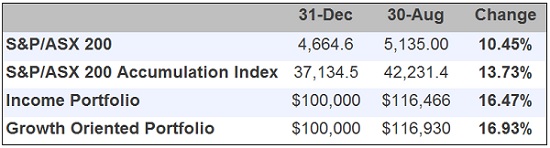

The income-oriented portfolio for the eight months to 30 August is up by 16.47% and the growth-oriented portfolio is up by 16.93% (see tables at the end). Compared to the benchmark S&P/ASX 200 Accumulation Index (which adds back income from dividends), the income portfolio has outperformed by 2.7% and the growth-oriented portfolio has outperformed by 3.2%.

[3]Yield sectors struggle in August

[3]Yield sectors struggle in August

The largely defensive sectors (financials, property trusts, and utilities) struggled during August. Telecommunications was negative (largely due to Telstra standing still and going ex-dividend), while Woolworth’s standout performance drove the consumer staples sector higher.

Improving iron ore prices helped the materials sector, while the energy sector benefited from higher oil and gas prices. On a year to date basis, consumer discretionary, financials and the health care sectors are up by over 20%.

[4]Income portfolio

[4]Income portfolio

The income portfolio is overweight financials, consumer staples and telco, and underweight materials. It also has some stock biases – in particular, underweight CBA and overweight NAB.

On the stock selection side, UGL and Coca Cola Amatil have disappointed, the latter in part due to the margin pressure being applied by the large supermarkets. While we obviously got the call wrong on UGL, at around $7.41, we feel it is too cheap to sell.

For income, the portfolio has so far returned 3.62%, franked to 95.2%. With many of the stocks yet to either declare or go ex-dividend their final dividend, the portfolio should comfortably exceed the forecast 5.23% pa. Details of the portfolio and its performance are listed below.

Growth-oriented portfolio

The growth-oriented portfolio is overweight stocks in the materials, energy and healthcare sectors, underweight financials and consumer staples, and broadly index weight the other sectors. Stock selection in the financials (strong bias towards NAB and the selection of a regional in BOQ), as well as in the health care and industrials sectors, is offsetting the underperformance of the material stocks. Orica, in particular has disappointed. Current sector weights are within the parameters of the portfolio construction rules. The portfolio is:

[6]Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.

[6]Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.

Also in the Switzer Super Report:

- Peter Switzer: What would

Rudd/Abbott/Buffett do? [7] - James Dunn: Election play opportunities – Qube and the airlines [8]

- Penny Pryor: Sydney and Melbourne property fires ahead [9]

- Rudi Filapek-Vandyck: Buy, Sell, Hold – what the brokers say [10]