Back in November, before the US Presidential election, I looked at two potential stocks for a Joe Biden victory [1]: rare earths producer Lynas Corporation (ASX: LYC) and iron ore-lithium miner Mineral Resources (ASX: MIN).

The theme didn’t exactly rely on a Biden win – the increased demand for rare earths and lithium would also have continued had Donald Trump retained the US Presidency – but the new President has certainly captured the imagination of clean-energy advocates with his plans for “green” stimulus, due to be fully unveiled in February.

Biden is proposing at least a US$2 trillion ($2.6 trillion) Federal investment in green technologies, and wants the US to reach “net zero” carbon-dioxide emissions by 2050 – which pre-supposes a huge shift to renewable, low-carbon energy sources. President Biden wants to use climate change as a wedge for economic development, focused on rebuilding roads and bridges and expanding zero-emission mass transit and electric-car infrastructure. In all, the new US administration has been projected as spending up to US$7 trillion ($9.1 trillion) over a decade to combat climate change, his campaign and third-party experts have said.

While it may not satisfy those who expected the full “Green New Deal” that has been advocated by some Democrats, the Biden green stimulus plan is expected to make, call for and stimulate an historic level of investment in clean energy and electric vehicles.

That well and truly covers Lynas, which mines and produces the so-called “rare earths,” which are a basket of minerals that are crucial to the manufacture of permanent magnets that are essential for electric motors, batteries, lasers and wind-power generators.

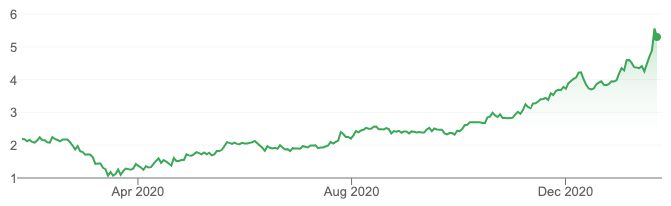

Source: Google

Not only does Lynas’ menu of exotic metals – which includes neodymium, praseodymium, dysprosium, cerium, terbium and lanthanum – have a very broad range of potential uses in electric vehicles and green technologies, rare earths also have major uses in fast-growing areas such as robotics, medical devices and consumer electronics.

And just as important for the US – in defence applications.

The attraction of Lynas is that at the moment, it is the only non-Chinese supplier of rare earths – China accounts for 80% of world supply.

Lynas is well on the way to becoming a major supplier of rare earths metals to the US defence industry: it has struck a deal with the US government to build a commercial light rare earths separation plant in Texas. The facility, expected to produce about 5,000 tonnes of rare earths a year, would help Washington’s push to secure domestic supply of essential minerals for military uses, as well as clean-energy uses.

The good news for LYC investors is that it has almost doubled from its pre-election price, moving to $5.56, and has pushed beyond fair value: the consensus of analysts’ valuations (at both FN Arena and Thomson Reuters) is $4.25. But it is a stock that will benefit from Biden’s spending plans – both through the strategic value of its position as the only non-Chinese producer of separated rare earth products, and its exposure to electric vehicles. Broker UBS expects the electric-vehicle market for LYC’s neodymium-praseodymium (NdPr) product to triple in size over the next ten years.

Mineral sands heavyweight Iluka Resources (ASX: ILU) began shipping a rare-earths concentrate containing neodymium, praseodymium, dysprosium, terbium, cerium and lanthanum from its mothballed Eneabba mine in WA in the September quarter, so it also qualifies as a producer.

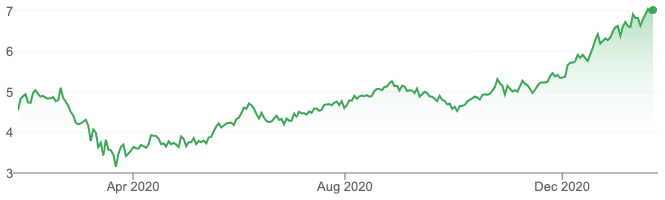

Source: Google

Speculative-minded investors could look at other ASX-listed potential rare earth producers, such as Australian Strategic Materials (ASX: ASM), RareX (ASX: REE), Greenland Minerals (GGG) and Arafura Resources (ASX: ARU), with the caveat that these are not yet producing.

The Mineral Resources call from November reflected the fact that is a major lithium producer, and the ASX’s lithium producers – which we looked at last June [2] – will all benefit from the demand for battery metals stimulated by the huge expansion in the US electric-vehicle market that is implied by the Biden plans. As will the three ASX-listed electric vehicle stocks I looked at last week [3].

Some of the ASX’s big infrastructure and building materials stocks could also prosper from increased US infrastructure spending – Biden’s US$2 trillion ($2.6 trillion) plan to invest in clean energy also comprises more typical infrastructure spending on roads, highways, airports and ports. UBS estimates that the outlay on “green infrastructure” could potentially be worth $US5.4 trillion ($7.7 trillion) over the next ten years. This will be good for building materials companies and developers, toll road operators, and steelmakers: ASX stocks in this sweet-spot include Boral (ASX: BLD), James Hardie (ASX: JHX), CSR (ASX: CSR), BlueScope Steel (ASX: BSL), Transurban (ASX: TCL), Atlas Arteria (ASX: ALX), Lendlease (ASX: LLC) and Goodman Group (ASX: GMG), and Sims (ASX: SGM) could also benefit if scrap-metal prices rise.

President Biden’s intention to make COVID-19 the initial focus of his administration should boost the ASX healthcare firms with significant exposure to the US, including CSL (ASX: CSL), ResMed (ASX: RMD), Cochlear (ASX: COH), Fisher & Paykel (ASX: FPH), Ansell (ANN) and Mayne Pharma (ASX: MYP).

Two other mini-sectors that could also enjoy news emanating from Washington over the four-year Biden term are uranium mining hopefuls, and medicinal cannabis stocks.

The former might surprise many of Biden’s voters who want the full “Green New Deal,” but the new Administration apparently lives in the real world – it recognises that nuclear power will be needed to actually achieve an energy supply that is truly “decarbonised,” and moreover, to cope with powering larger numbers of EVs.

The Biden energy plan calls for the establishment of a new cross-departmental Advanced Research Projects Agency (ARPA-C) focused on climate and developing technologies, to help the US meet the administration’s target of 100% clean electricity by 2035, including the production of small modular nuclear reactors.

While that would probably horrify many Democrat voters – when they come to realise it – conversely it would be music to the ears of Australia’s uranium hopefuls, which include Paladin Energy (ASX: PDN, which mines uranium in Namibia), Vimy Resources (ASX: VMY), Bannerman Resources (ASX: BMN), Toro Energy (ASX: TOE), Alligator Energy (ASX: AGE), Boss Energy (ASX: BOE), Thor Mining (ASX: THR), Deep Yellow (ASX: DYL), Peninsula Energy (ASX: PEN), GTI Resources (GTR), TNT Mines (ASX: TIN) and Marenica Energy (ASX: MEY).

The other ASX mini-sector that could receive a shot in the arm is the medicinal cannabis stocks, based on Vice-President Kamala Harris’ promise to decriminalise marijuana in the United States, at the federal level (a promise that would require a 60-vote majority in the Senate.) Such a legislative imprimatur would be a boost to ASX-listed medicinal cannabis stocks such as Elixinol Global (ASX: EXL), Creso Pharma (ASX: CPH), Little Green Pharma (ASX: LGP), THC Global (ASX: THC), Cann Group (ASX: CAN), AusCann Group (ASX: AC8) and Althea Group (ASX: AGH).

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.