The big and very positive news out of the US overnight was that there was a better-than-expected inflation reading, which was good news for tech stocks. The Nasdaq ended up 3.33% in the trading session!

It’s early days, and I won’t be crowing, yet, but I’ve supported the economists who thought inflation would be more temporary and that it would dissipate over 2022. That said, I was much stronger in my belief of this view before the Ukraine war happened and oil prices spiked. And then China going back into lockdowns again, which extended the time that global businesses had to cope with higher supply chain costs, was no help to my inflation view either.

The news is that the core personal consumption expenditures price index (PCE) went up 4.9% in April, which was less than the 5.2% rate registered in March. The PCE is seen as a key inflation indicator for the Fed.

Importantly, this has helped the 10-year Treasury yield drop under 2.75% after it surged to 3.25% earlier in the year when inflation expectations were very high. Reality is biting in bond markets with this lower inflation reading and worries about recession all bringing yields down.

It’s early days but if the economic data over the next few months says falling inflation and no recession — maybe just slower, acceptable growth is on the way — then tech stocks’ prices just might start to improve.

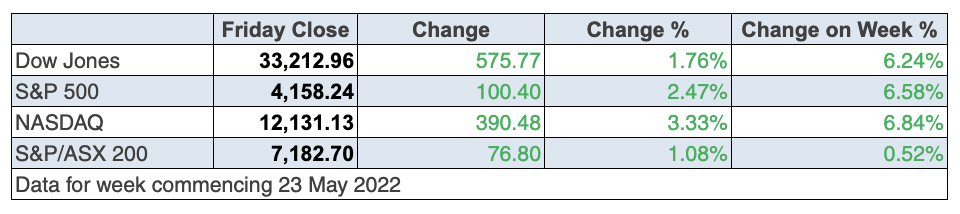

Last week I pondered if stock markets were trying to bottom. And while the jury was less convincing about Wall Street’s efforts, albeit that they have had a better week this week after eight weeks straight of losses for the Dow, in contrast, our market has gone up for the second week in a row.

The inflation news overnight will certainly help US market indexes to start defying gravity in a more sustainable way.

Locally, it has only been a 1.5% gain for the S&P/ASX 200 Index, meaning our market is down 5.36% year-to-date, while the S&P 500 was off 15.4% before this better inflation news overnight.

Pessimists might see this as a bear market rally and they could be right. We might need to see better tidings out of China and Ukraine before a cyclical rally takes root but at least data is heading in the right direction for anyone long stocks.

Other positive news that could help the S&P 500 go further to the positive, are some good reports from retailers such as Nordstrom which rose 14% on the back of an upbeat annual profit and revenue story.

Meanwhile, Macy’s jumped 19.1% after it raised its annual profit forecast and so the US consumer is still shopping but it’s not for everything.

“The consumer appears to have a ‘barbell’ approach to spending: low-end necessities and higher-end experiences/luxury items are doing fine, while general merchandise spending is being delayed, i.e., getting one more year out of that worn-down patio furniture is okay,” Wells Fargo senior equity analyst Christopher Harvey told CNBC on Friday.

This kind of news works against recession talk in the States, especially when the US consumer is responsible for nearly 70% of GDP and clearly is the biggest driver of US economic growth.

Also, company earnings should be a plus for the bottoming process. According to Refinitiv data, after 474 of the companies in the S&P 500 posted their results, 78% beat expectations.

It will be progressively better-than-expected news that will mean the Fed won’t go crazy mad with its interest rate rises and the market will lap that up.

By the way, the average stock market correction takes about six months to find a bottom. We’ve now had five months of falling times for the S&P 500 and over 72 years there have been 39 corrections, and Motley Fool says that “there’s an average of one double-digit decline in the S&P 500 every 1.85 years”.

(Technically, a correction is a market pullback of 10% but less than 20%, which defines the start of a bear market.)

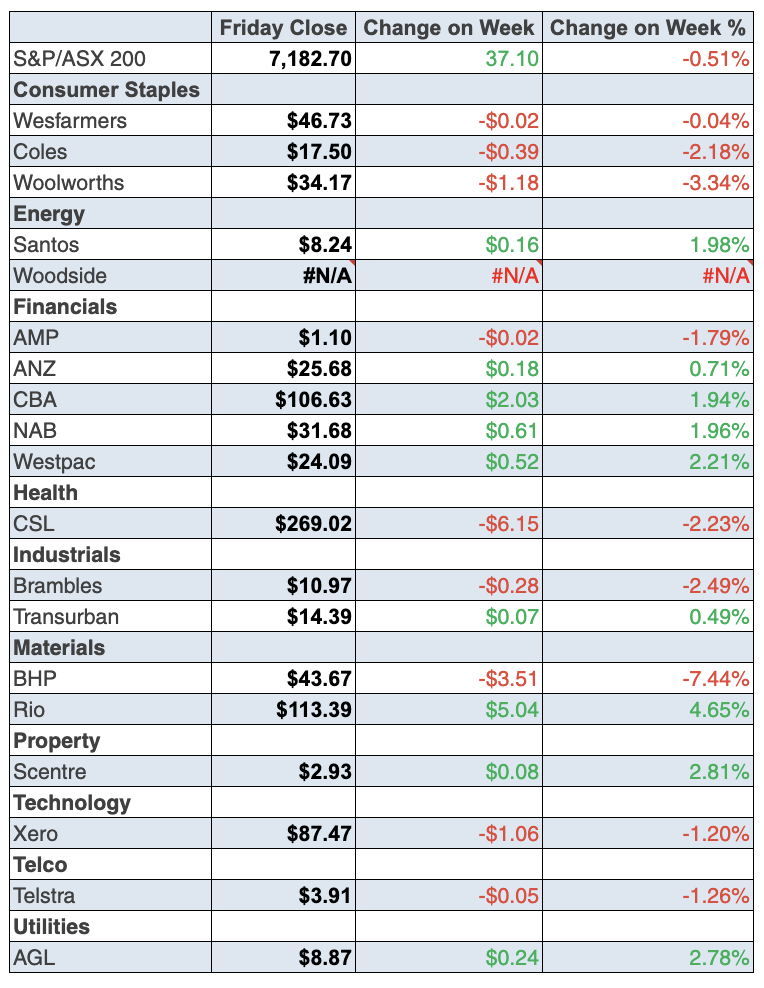

To the local story for the week, the S&P/ASX 200 Index was up 1.08% on Friday — 76.8 points — to finish at 7182.7, which means a 0.52% gain for the week.

Ironically, it was a good trading session on Thursday for Wall Street that spurred on our market with banks, big miners and retailers back in vogue, at least for the moment.

The likes of Harvey Norman gained 1.4% to close at $4.37, while JB HI-FI put on 2.5% after strong reports for retailers in the US were followed up by a good jump in retail sales here. (More on that below.)

The shock story of the week has to be the perennial disappointment — Appen — that saw a 30% rise on Thursday at one stage, after a takeover offer of $9.50 from Canadian tech giant Telus. However, while the management was telling us a higher price was needed to ink a deal, the buyer got cold feet and withdrew the offer!

This resulted in a 20.9% slump in the stock’s price, leaving a lot of shareholders wondering if it’s time to give the chairman and CEO the boot. It should be fun and games at next Friday’s AGM and by then the board might be able to explain how that ‘fish’ got away.

The share price was as high as $8.36 this week and is now languishing at $6.54. Not ‘appy’ Appen’s board and CEO, not ‘appy’!

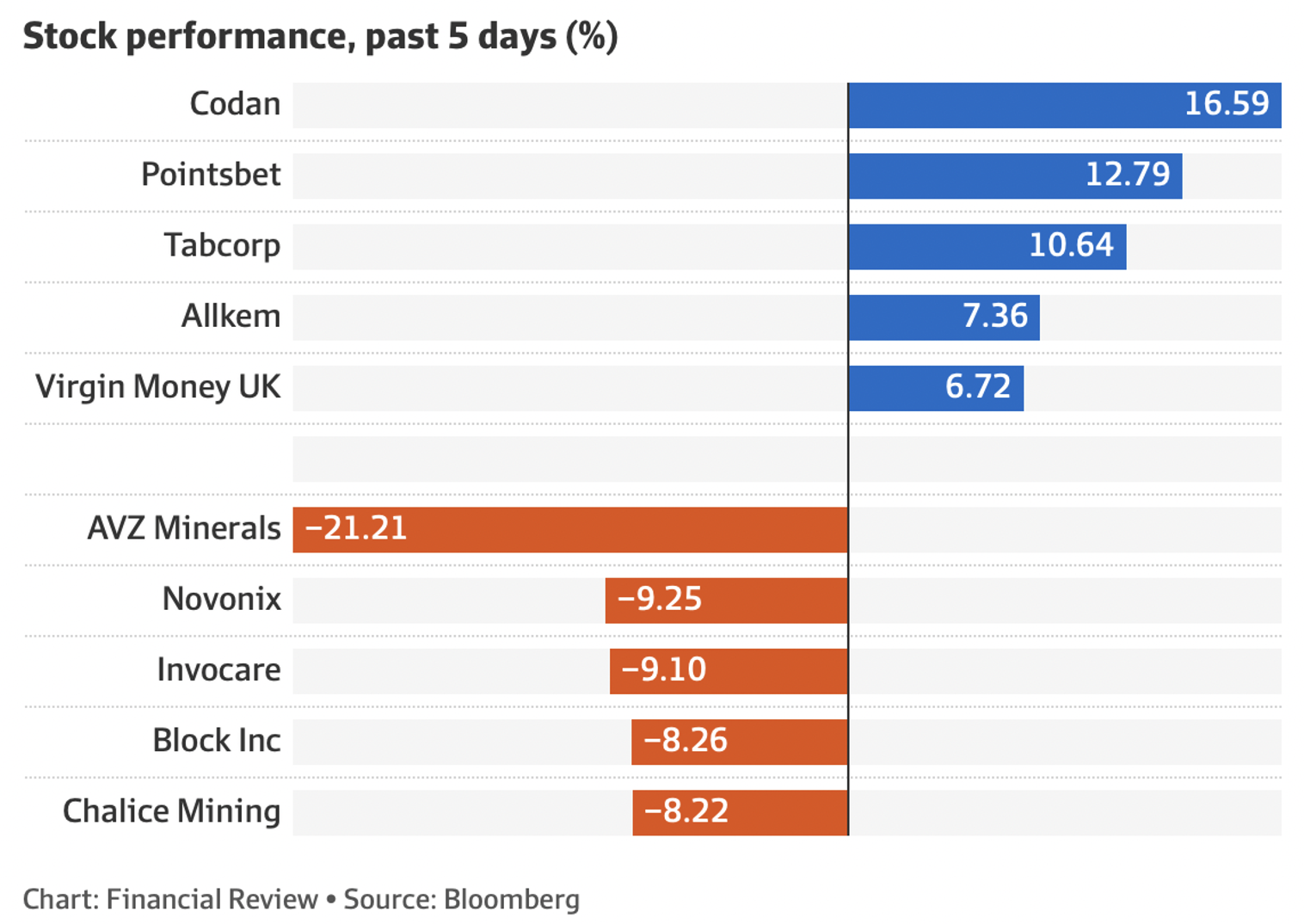

Here are the winners and losers of the week:

Appen aside, tech had a good day on Friday with Block (Afterpay/Square) up 5.89% to $117.10, but it was still down for the week for the stock.

Energy companies fared well with Beach Energy up 3.8% on Friday to $1.64, while Santos went to $8.24 with a 2.11% rise for the week.

Infomedia (IFM) is an intriguing story, with three potential buyers on its tail and the stock price was up 6.5% for the week to $1.72.

Are these prowling buyers telling us that a number of smart people think these tech companies look ripe for the picking? Before the Coronavirus changed the world, IFM was a $2.38 stock.

What I liked

- Retail trade rose by 0.9% in April after rising 1.6% in March, 1.8% in February and 1.6% in January. Retail trade was up by 9.6% on a year ago to a record $33.9 billion. The consumer is alive and spending!

- The weekly ANZ-Roy Morgan consumer confidence index rose by 1.7% to 90.8 (long-run average since 1990 is 112.4). The rise follows four successive weeks of decline.

- The Australian Bureau of Statistics said new business investment (spending on buildings and equipment) fell by 0.3% in the March quarter but was still up by 4.5% on the year.

- The sixth estimate of expected investment in 2021/22 is 15.5% higher than the equivalent estimate for 2020/21. And the second estimate of expected investment in 2022/23 is up 11.8% on the first estimate and 15% higher than the equivalent estimate for 2021/22. What does this mean? This is the strongest result in a decade for planned business investment!

- The ABS says a measure of housing affordability for homeowners paying off a mortgage has improved to its best level in almost 30 years.

- Skilled vacancies rose by 8% in April to a record (16-year) high of 311,100.

- The German economy rose 0.2% in the March quarter, easing recession fears, plus a survey from the Ifo Institute showed that German business morale unexpectedly rose in May.

- The S&P Global manufacturing index fell from 59.2 to 57.5 in May (survey: 57.5) and services fell from 55.6 to 53.5 (survey: 55.2) but any number over 50 still means expansion.

- The Chicago Federal Reserve national activity index rose from 0.36 to 0.47 in April (survey: 0.35).

What I didn’t like

- The value of construction work done here fell by 0.9% in the March quarter but it was still up 1.4% on a year ago.

- Building costs rose by 2.8% in the March quarter – the biggest lift in 21½ years.

- US new home sales fell from a 0.709 million annual rate to 0.591m in April (survey: 0.75m). The Richmond Federal Reserve manufacturing index fell from +14 to -9 in May (survey: +12).

- The survey of purchasing managers for the eurozone showed slower business activity and more firms reporting shortages of raw materials.

- The US economy, as measured by GDP, contracted at a 1.5% annual pace in the March quarter (second estimate, survey: -1.3%) This is not really new news but it’s the latest reading on March quarter growth. This fall was seen as temporary, with the June quarter expected to see a rebound.

For a tech-comeback believer, I like this

I’m not saying we’re out of the woods yet but the Nasdaq has gone up over 6% for the week and this helps the bottoming process. But more importantly for the long-term investor, I think we’ve seen a sneak preview of what will happen to growth stocks if inflation does fall over the year ahead and recession does not happen.

The week in review:

- If we didn’t have enough headwinds already, we now have to factor in locally this huge kick in the pants for the Coalition. And it’s made even harder to play, with the Independents possibly holding 10 seats! So how does a stock market react post-election? And now the Federal election is out of the way, this week in Switzer Report I asked the question: how do you invest for the year ahead? [1]

- Paul (Rickard) takes a walk through a world that’s not familiar to many of us who tend to stick with what we know. So are you up for investing in crypto but not sure how to do it? Paul says there’s an easy way through ETFs. [2]

- James Dunn says that it’s certainly that kind of time in the markets when investors look to defensive investments. But what does that really mean, and how difficult is it to achieve? In his article today James looks at his top 5 defensive stock plays. [3]

- Tony Featherstone examines two small-cap industrials that he says look interesting at current prices, [4] as underlying demand for their products or services strengthens after COVID-19.

- In our “HOT” stock column this week, Raymond Chan, Head of Retail at Morgans, gives his reasons for why he thinks Aristocrat Leisure Ltd (ALL) should be added to an investor’s portfolio [5] while Michael Gable, Managing Director of Fairmont Equities, explains why JB Hi-Fi (JBH) is a buy but not just yet. [6]

- In Buy, Hold, Sell — Brokers Say, there were 5 upgrades and 4 [7]downgrades in the first edition and 3 upgrades and 5 downgrades [8] in the second edition.

- In Questions of the Week, [9] Paul Rickard answers subscribers’ queries about how are joint accounts treated when it comes to the Government Guarantee on bank term deposits? Should I cut my losses on the NB Global Corporate Income Trust, which is trading at a big discount? Why is Goodman’s share price “plunging”? What is the new stock code for Woodside, and what will be the cost price for CGT purposes for Woodside shares issued under the BHP demerger?

- And finally, Paul notes that if you’re trying to run a balanced portfolio, you may also be invested in bonds through a fund. As Paul says, bonds are the classic “defensive” asset but they have been clobbered. And he asks: could they now do better? [10]

Our videos of the week:

- A new, better treatment for high blood pressure | The Check Up [11]

- Michael Davidson from Propell (PHL) | The CEO Masterclass [12]

- Stocks to buy with a Labor victory! Why Worley, APA & G8 Education look like winners! | Switzer Investing (Monday) [13]

- Bond yields are falling! Is this a good sign?! & Do you have the guts to ZOOM into tech stocks? | Mad about Money [14]

- Is it time to invest in Bitcoin? + What is Anna Porter seeing in the property market right now? | Switzer Investing (Thursday) [15]

- Boom! Doom! Zoom! | 26 May 2022 [16]

Top Stocks – how they fared:

The Week Ahead:

Australia

Tuesday May 31 – Business Indicators (March quarter)

Tuesday May 31 – Balance of Payments (March quarter)

Tuesday May 31 – Government Finance (March quarter)

Tuesday May 31 – Building approvals (April)

Tuesday May 31 – Private sector credit (April)

Wednesday June 1 – CoreLogic Home Value Index (May)

Wednesday June 1 – S&P Global Purchasing Managers’ Index (May)

Wednesday June 1 – National accounts (GDP, March quarter)

Thursday June 2 – International trade (April)

Friday June 3 – Lending indicators (April)

Friday June 3 – S&P Global Purchasing Managers’ Index (May)

Friday June 3 – New vehicle sales (April)

Overseas

Tuesday May 31 – China Purchasing managers’ indexes (May)

Tuesday May 31 – US Home prices (March)

Tuesday May 31 – US Conference Board consumer confidence (May)

Wednesday June 1 – US ISM manufacturing index (May)

Wednesday June 1 – US JOLTS job openings (April)

Wednesday June 1 – US Federal Reserve Beige Book

Thursday June 2 – US Challenger job cuts (May)

Thursday June 2 – US ADP employment change (May)

Thursday June 2 – US Factory orders (April)

Thursday June 2 – US ISM services index (May)

Friday June 3 – US Non-farm payrolls (May)

Food for thought: “Today’s “best practices” lead to dead ends; the best paths are new and untried.” ― Peter Thiel

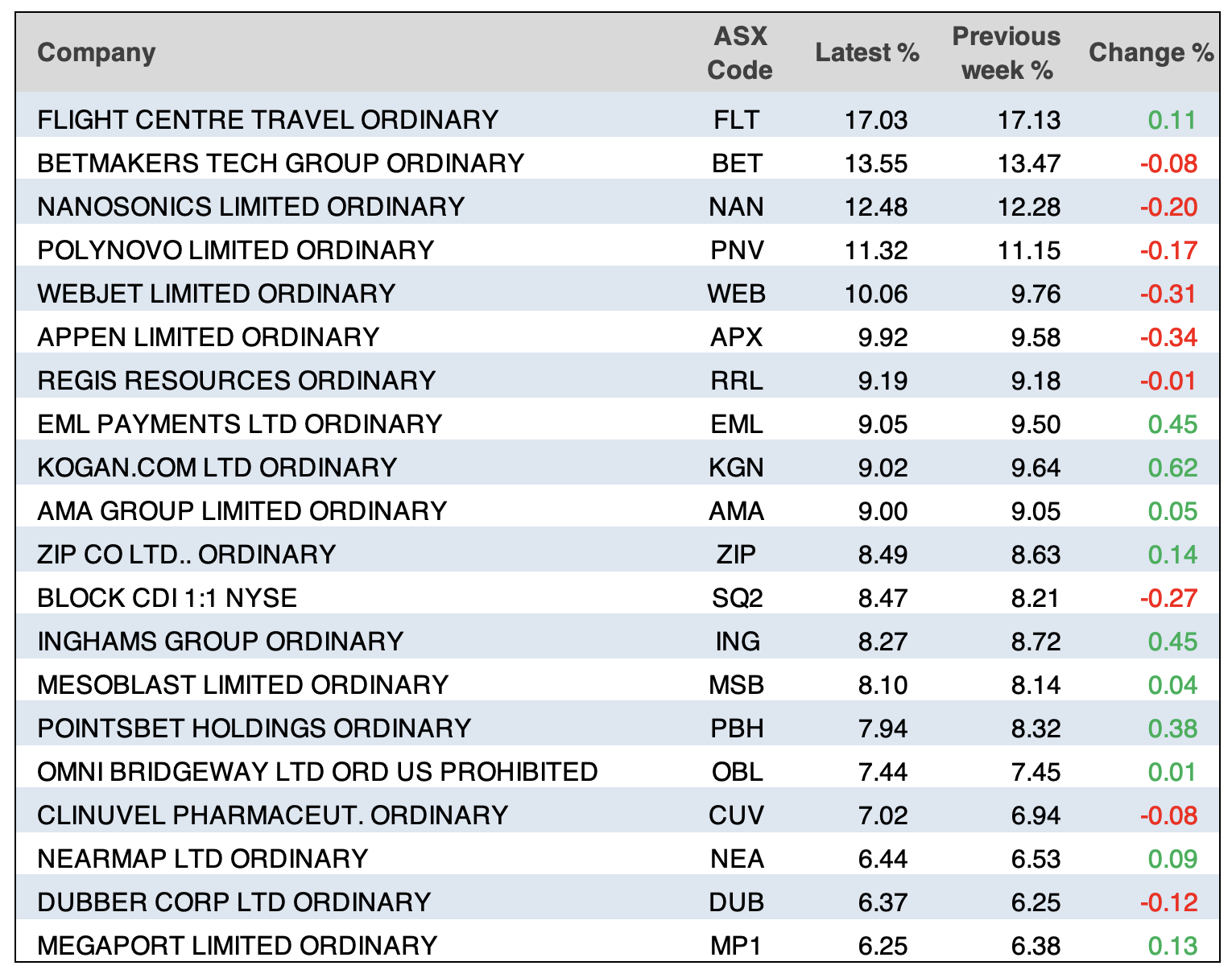

Stocks shorted:

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before.

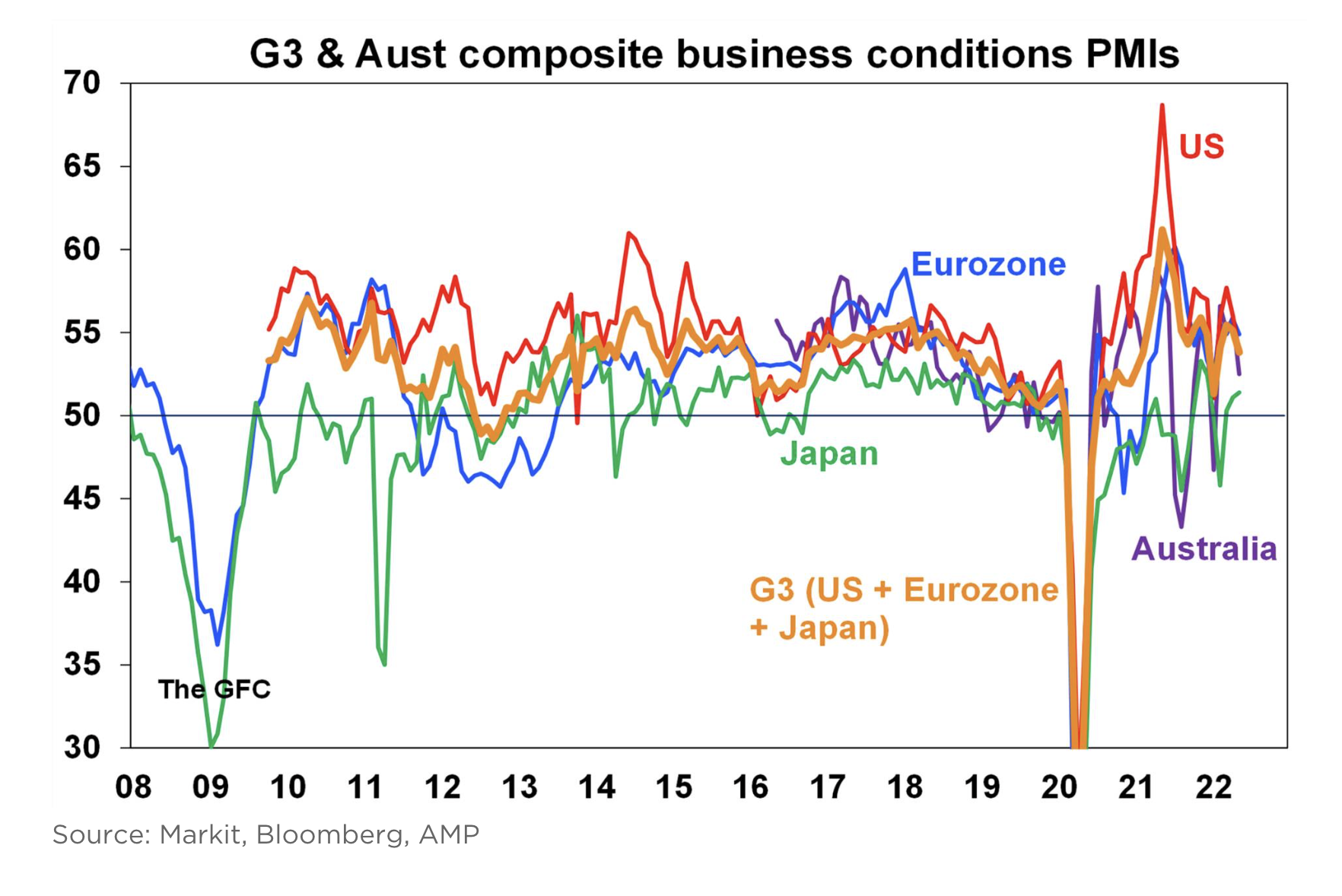

Chart of the week:

Our chart of the week shows that business conditions PMIs remain strong but slowed a bit further in May. Recent activity has seen a rise in Japan but declines in the US, UK, Europe and Australia. The G3 average composite PMI fell 1.3pts but to a still strong 53.8.

Top 5 most clicked:

- 5 defensive stocks that could withstand a bear market [17] – James Dunn

- How does a stock market react post-election? [18] – Peter Switzer

- Buy, Hold, Sell – What the Brokers Say [19] – Rudi Filapek-Vandyck

- Up for investing in crypto? An easy way through ETFs [20] – Paul Rickard

- Take a look at these two small-cap industrials [21] – Tony Featherstone

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.