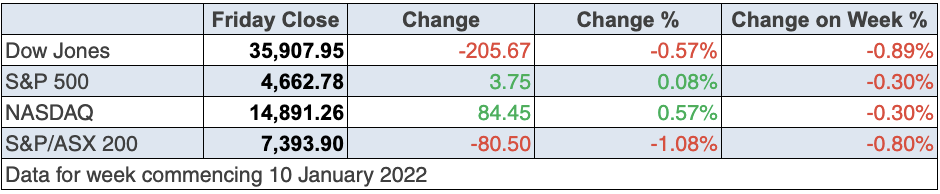

US stocks fell overnight after some of the world’s biggest banks beat expectations but gave out signs that the future isn’t as rosy as market pundits had been predicting. Recall that the consensus view is that 2022 will be bad for tech as interest rates rise. Financial, energy and commodity stocks will be winners.

Of course, we’ve already seen those trends play out so you can never be surprised that profit-takers do what comes naturally to them and pocket their gains.

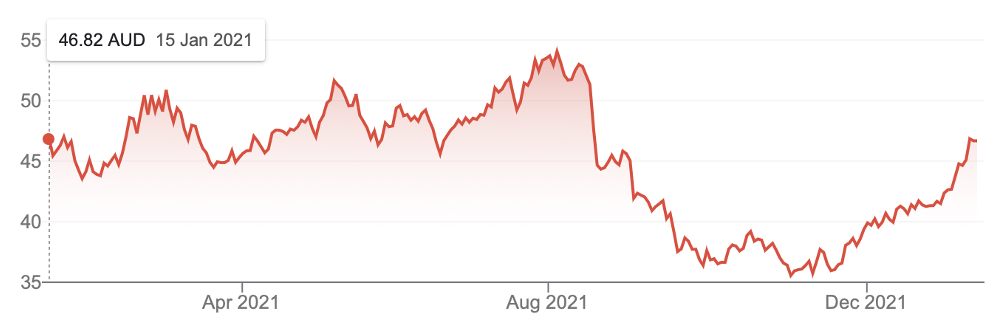

I know Paul Rickard and yours truly have been supporters of these stocks doing well, with BHP, in particular, making us look smart!

BHP

JPMorgan Chase and Citigroup saw stock price slides, despite Citigroup beating estimates on revenue and profit but the CEO said that there would be some profit problems over the next two years. Wells Fargo reported well and showed a plan for cost-cutting, which the market liked. Its share price was up 4% at one stage.

Adding to the negativity overnight was a weak retail number for December (down 1.9%), while the University of Michigan’s consumer sentiment reading came in less than expected. Interestingly, Omicron has not been cited as a big market concern, but it is clearly affecting the US economy.

This from the New York Times tells a story worth noting: “The number of Americans hospitalized with Covid-19 has surpassed last winter’s peak, underscoring the severity of the threat the virus continues to pose as the extremely contagious Omicron variant tears through the United States.

“As of Sunday, 142,388 people with the virus were hospitalized nationwide, according to data from the U.S. Department of Health and Human Services, surpassing the single-day peak of 142,315 reported on Jan. 14 of last year. The seven-day average of daily hospitalizations was 132,086, an increase of 83 per cent from two weeks ago.”

Markets in the US have been more worried about inflation and the Fed raising interest rates probably in March, and it’s why tech stocks have been copping it. And putting Omicron with the interest rates scenario, it’s no surprise that the World Bank trimmed its forecast for 2022 global economic growth from 4.3% to 4.1%, which incidentally is still a good number.

Epidemiologists think that Omicron will burn out by March and I suspect this is helping to keep markets less negative on the subject but it still probably has affected retail sales and consumer confidence.

This is the short-term story. But the mid-term story is about rising interest rates and the problem that causes tech stocks for now. However, like the inflation threat, it should prove temporary and provides a buying opportunity for the long-term investor, though buying now could be a tad early.

Remember, short-term players rotate chasing the momentum and right now that favours value stocks compared to growth-companies, such as tech. As I said earlier, the consensus of experts are keen on energy, financial and commodity stocks and this should favour our market index, which I think will do well over 2022. Recall, our market index is only 4% higher compared to our pre-pandemic high, while the US market equivalent is up 38%!

If you need proof of the fickleness of short-term players, well, look at tech stocks this week. The likes of Apple, Tesla and Amazon were up Tuesday and again on Wednesday but then sold off big time on Thursday.

This testimony by US Federal Reserve Chair Jerome Powell before the US Senate Banking Committee was not great for tech stocks: “If we have to raise interest rates more over time, we will. We will use our tools to get inflation back.” He also said that at some point this year, officials will allow the Fed’s US$8.77 trillion balance sheet to run-off, which means the central bank will sell bonds rather than buy them, which starts to soak up liquidity, which is consistent with rising interest rates.

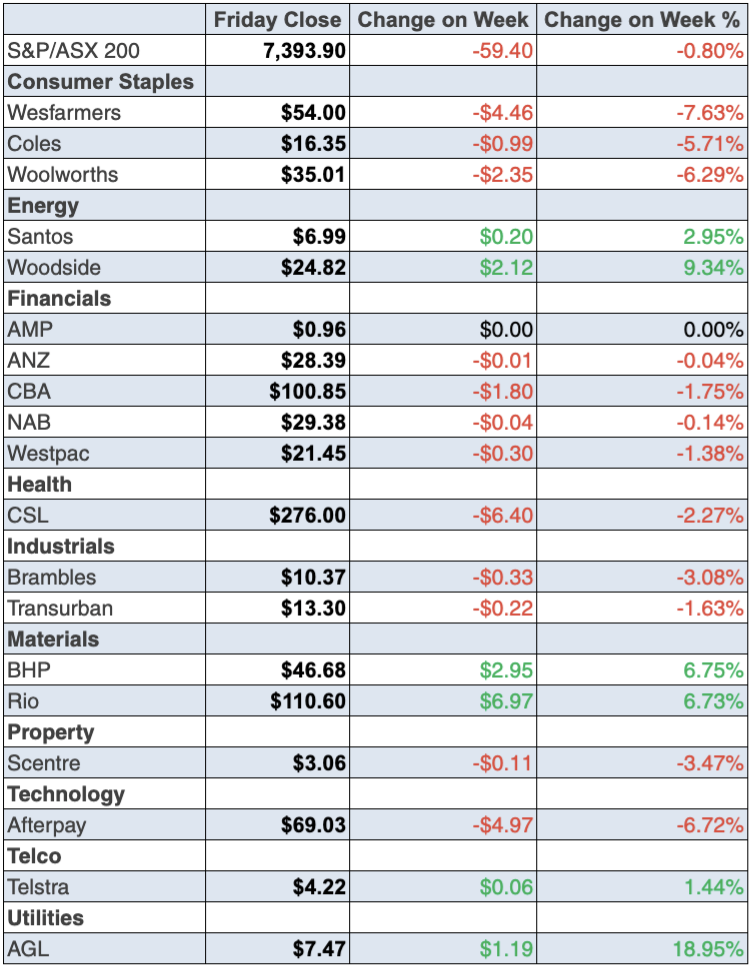

To the local story and with all the above, it’s no surprise the S&P/ASX 200 Index lost 0.8% (or 59.4 points) to 7393.9 for the week. And our tech stocks played follow the leader, with Xero down 7.58% $119.11 for the week, Nuix down 3.37% to $2.01 and Wisetech gave up 4.35% to $52.13.

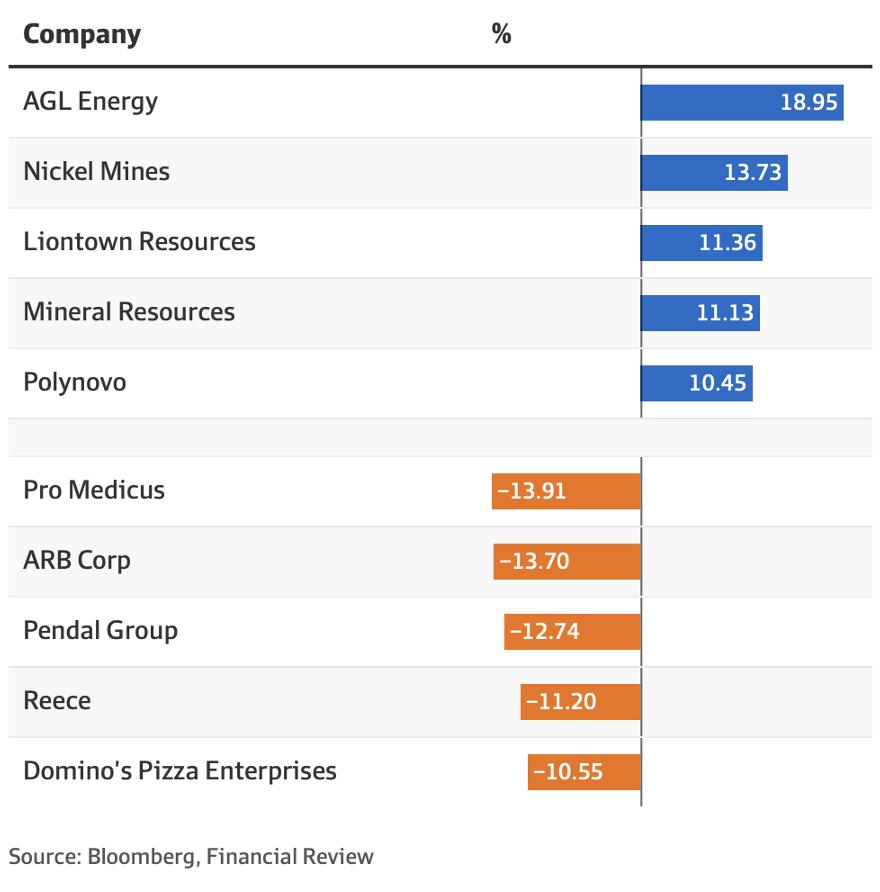

That said, tech stocks weren’t the biggest losers, as the following chart shows:

Supply chain difficulties are hurting companies like Reece and ARB, while the latter could be losing ground. Like Domino’s, ARB did well out of lockdown as people ate in and spent money on their cars and homes.

As the Omicron fears subside over February, I suspect reopening trade stocks will benefit. Tyro lost 3.07% this week and while it’s in the tech-payments space, which is copping it right now, it also suffers because Omicron is hurting pubs, restaurants and other hospitality businesses, where this company plays a big role.

It was a good week for miners, with BHP up 4.99% to $46.68. But the standout story is AGL, which has been a disappointing company for five years. The AFR explained its share price surge: “AGL Energy helped offset some market losses, soaring 18.9 per cent to $7.47. Mid-week, Credit Suisse said [1] it was its top pick among Australian energy sector equities because of its advantage in low-cost coal supply.”

What I liked

- Dwelling approvals rose by 3.6% in November after falling by 13.6% in October. The value of all residential and commercial building approvals stood at a record $146.05bn in the year to November.

- Retail trade rose by 7.3% in November to record highs.

- Job vacancies rose by 18.5% or 61,900 to a record 396,100 available positions in the three months to November. Vacancies are up by 56.1% or 142,400 available positions in November.

- The preliminary National Skills Commission’s Internet Vacancy Index (IVI) fell by 2.5% (or 6,173 available positions) in December to 245,602 available positions. Recruitment activity in December is still up by 37.4% (or 66,897 ads) on a year ago and is up 46% (or about 77,400 available positions) higher than pre-Covid levels. Job ads are at 13-year highs in Queensland and 9½-year highs in Western Australia.

- The trade surplus fell by $1.36bn to $9.42bn in November. Australia has posted 47 successive monthly trade surpluses. The rolling annual surplus rose from $118.5bn in the year to October to a record $122.6bn in the year to November.

- In a testimony before the US Senate Banking Committee, US Federal Reserve Governor Lael Brainard said the US central bank could raise interest rates as early as March. Dr Brainard said, “The committee has projected several hikes over the course of the year”. This says the Fed has confidence that the US economy is on the comeback trail.

- The US Federal Reserve Beige Book noted that “Economic activity across the US expanded at a modest pace in the final weeks of 2021”. This is good, given the Omicron threat.

- The US NFIB small business optimism index rose from 98.4 to 98.9 in December (survey 98.7).

Reuters reported that stocks recorded the biggest fall since November: “as rising bond yields weighed on the heavyweight technology sector, while the rapid spread of the Omicron COVID-19 variant also dented sentiment”.

What I didn’t like

- The ANZ-Roy Morgan consumer confidence index fell by 2.4 points (2.2%) in the first week of January. I blame Omicron. And the media reporting doesn’t help!

- The value of engineering construction (this includes structures like bridges, roads and dams) fell by 2.3% in real terms (inflation-adjusted) in the September quarter of 2021.

- The US CPI lifted 0.5% in December to be up 7% on the year (survey: 7%) — the highest result since June 1982.

- The producer price index (PPI) lifted 0.2% in December to be up by a near-record 9.7% on the year (survey: 9.8%). The core measure (ex-food and energy) rose 0.5% to be up by a record 8.3% on a year ago (survey: 8%). It’s big and I think it’s temporary, but I still don’t like it!

2022

This year will be volatile, but I still think we will have a good year for the index, with some of our biggest companies set to be in the sectors that will be in favour in the early part of the year. There will be rotations into other sectors and we’ll try to help you see them before they happen.

The week in review:

- This week in our first Switzer Report editions of 2022, I break down my investment strategy [2] for the year as we grapple with headwinds such as the Omicron variant, rising interest rates and the upcoming Federal Election. I then took a deeper dive [3] into some of these headwinds on Thursday despite my being bullish on stocks for 2022.

- Paul Rickard outlines how we’ve rebalanced our portfolio for 2022 [4] at Switzer Financial Group by addressing each of our portfolio’s objectives and construction rules as well as the investment themes for the year ahead. And in his bonus article [5] this week, Paul considers whether star performers of 2021 Telstra Corporation (TLS) and REA Group (REA) will continue their form in 2022.

- As our palates for good quality alcohol such as wine and spirits continue to evolve in this country, James Dunn explores the world of up-and-coming stocks in the spirit industry and gives us his three picks [6] for investors to consider in the current market.

- Tony Featherstone believes that the luxury item and jewellery industry has greatly benefited from the continuous lockdowns and travel restrictions that have beset us over the last two years. His thesis being that with everyone locked inside and unable to spend excess income on things like overseas travel, consumers have sought to spend their cash on items such as jewellery. And as we continue to grapple with covid restrictions, Tony suggests two jewellery stocks [7] that could continue to see some higher returns.

- For our “Hot” stocks this week, Managing Director at Fairmont Equities, Michael Gable tells us why Beach Energy (BPT) is currently sitting in a great buying opportunity [8] using his expert technical analysis

- This week in Buy, Hold, Sell – What the Brokers Say, there were 2 upgrades and 6 downgrades [9] from the 7 stockbrokers tabulated by FNArena

- And finally in Questions of the Week [10], Paul answers your questions on whether big US stocks such as Microsoft, Apple and Amazon that have experienced significant lows recently are a good buy, the revised share buyback offer from Westpac (WBC), whether there is more hurt in stall for Magellan Financial Group (MFG), and his thoughts on using leverage (borrowed money) when investing.

Our videos of the week:

- Boom! Doom! Zoom! | 13 January 2022 [11]

- Danny Lessem from ELMO Software – Switzer Small and Micro Cap Investor Strategy Day 2021 [12]

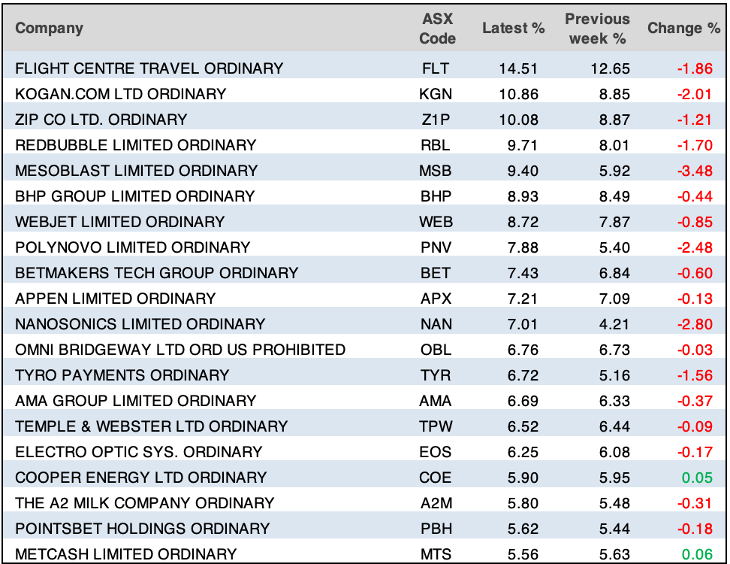

Top Stocks – how they fared:

The Week Ahead:

Australia

Tuesday January 18 – Weekly consumer confidence (Jan 16)

Tuesday January 18 – Overseas arrivals/departures (Nov)

Wednesday January 19 – Dwelling starts (Sept quarter)

Wednesday January 19 – Monthly consumer confidence (Jan)

Wednesday January 19 – Weekly payroll jobs & wages

Wednesday January 19 – Skilled job vacancies (Dec)

Thursday January 20 – Employment/unemployment (Dec)

Friday January 21 – Business turnover (Nov)

Overseas

Monday January 17 – China Economic (GDP) growth (Dec quarter)

Monday January 17 – China retails sales/production/investment (Dec)

Monday January 17 – US financial markets closed

Tuesday January 18 – US Empire State manufacturing index (Jan)

Tuesday January 18 – US NAHB Housing market index (Jan)

Wednesday January 19 – US Housing starts/building permits (Dec)

Thursday January 20 – US Philadelphia Federal Reserve index (Jan)

Thursday January 20 – US Existing home sales (Dec)

Thursday January 20 – China Loan Prime Rate setting

Friday January 21 – US Leading index (Dec)

Food for thought: “How many millionaires do you know who have become wealthy by investing in savings accounts? I rest my case.” — Robert G. Allen

Stocks shorted:

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before.

Chart of the week:

In our chart of the week, Bloomberg shows the impact that the Omicron surge is having on the Australian economy, particularly in the building sector. “Residential building approvals dropped 7.7% in November from a year earlier, data from the Australian Bureau of Statistics showed [13] on Monday. Private-sector homes declined an annual 8.1%.” This is rather problematic given that housing construction contributes to approximately 5% of our GDP, and while there is much talk of the Fed raising interest rates in the US, “one important ongoing support for the housing industry [in Australia] is record-low interest rates, with the central bank saying it doesn’t expect conditions for a hike to emerge this year”.

Top 5 most clicked:

- How I’m investing this year [2] – Peter Switzer

- Our portfolios for 2022 [4] – Paul Rickard

- 3 spirit stocks! [6] – James Dunn

- Buy, Hold, Sell – What the Brokers Say [9] – Rudi Filapek-Vandyck

- Two jewellery stocks getting their sparkle back [7] – Tony Featherstone

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.