Recently I revealed that a short-term sell off of stocks was on the cards, ahead of a bounce back that could easily straddle December to April if history is any guide. I’m not sure if we’ll see another “sell in May and go away” year in 2022 but locally it seems there hasn’t been much of a reward for being long stocks since the middle of the year.

Let’s see if that really was the case. It certainly feels that way and I sense it when I look at new financial planning clients’ portfolios after we look at them after six months, compared to those who’ve had a full year exposed to the market. Some have earned between 18% to 24% but that was thanks to the reopening effects after our earlier lockdowns in 2020.

The middle of this year was railroaded by big lockdowns in Victoria and New South Wales, which brought a three-month ‘recession’, which understandably didn’t help the overall market indexes and good diversified portfolios, which match or even better the S&P/ASX 200 Index.

It’s been a time for stock pickers and risk takers with less diversification and with an appetite for risk and who gambled on great returns or shockers. But the question is: do we have to keep picking stocks, which we help you do, or could playing the index be an OK strategy?

If you were a Yank, I’d be less optimistic from big returns from an ETF play for the S&P 500 Index. One reason is that Goldman Sachs is tipping a 9% gain, which is pretty good but I reckon our market will do better. These two charts explain why I think being long Aussie stocks will pay off this year.

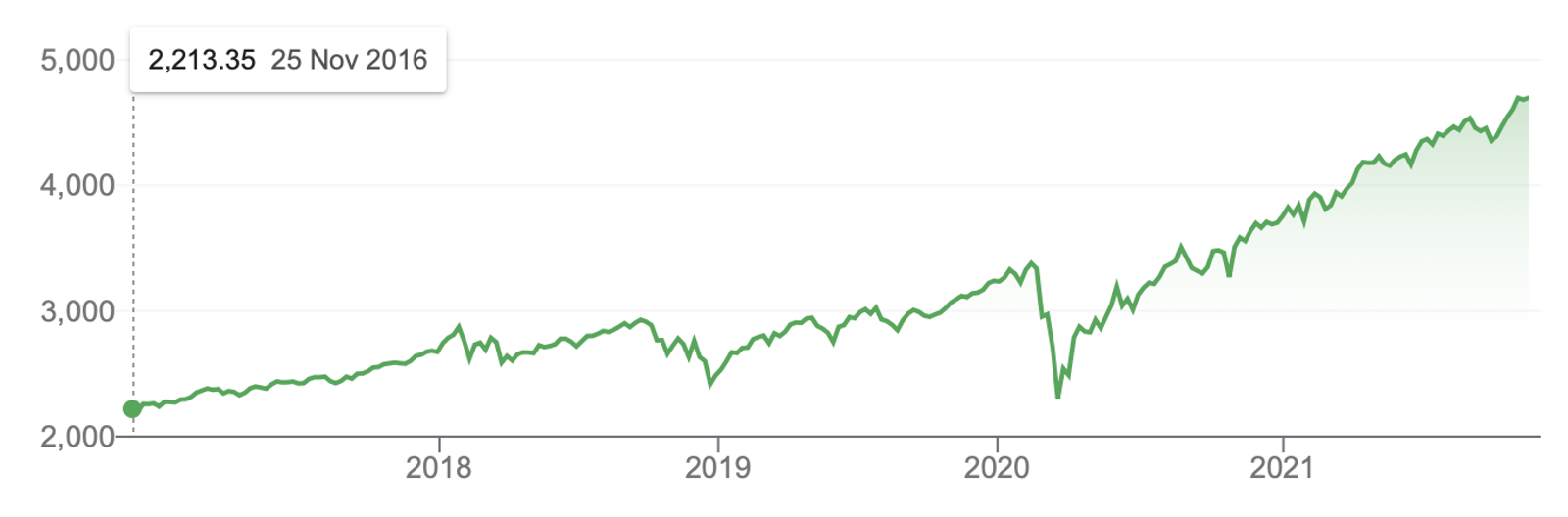

S&P 500

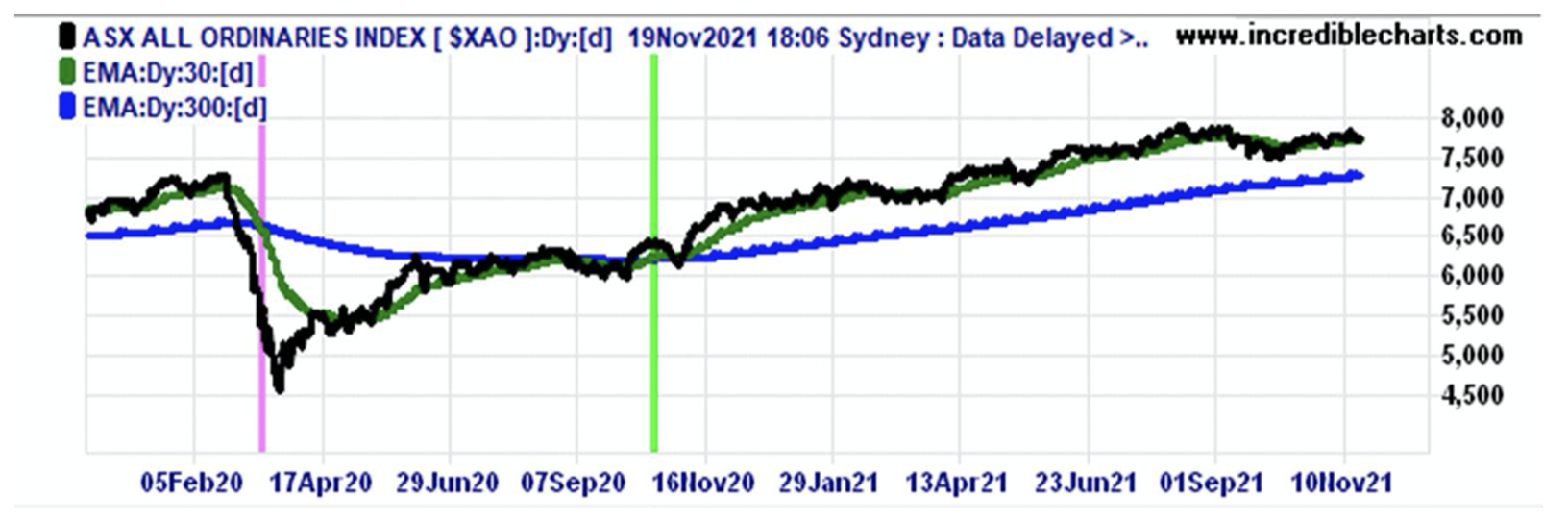

Look at the pre-pandemic peak before the March 2020 crash. Now look at the magnitude of the bounce back — it’s a hockey stick that went very vertical until the recent sell off. Now look at our market’s bounce back.

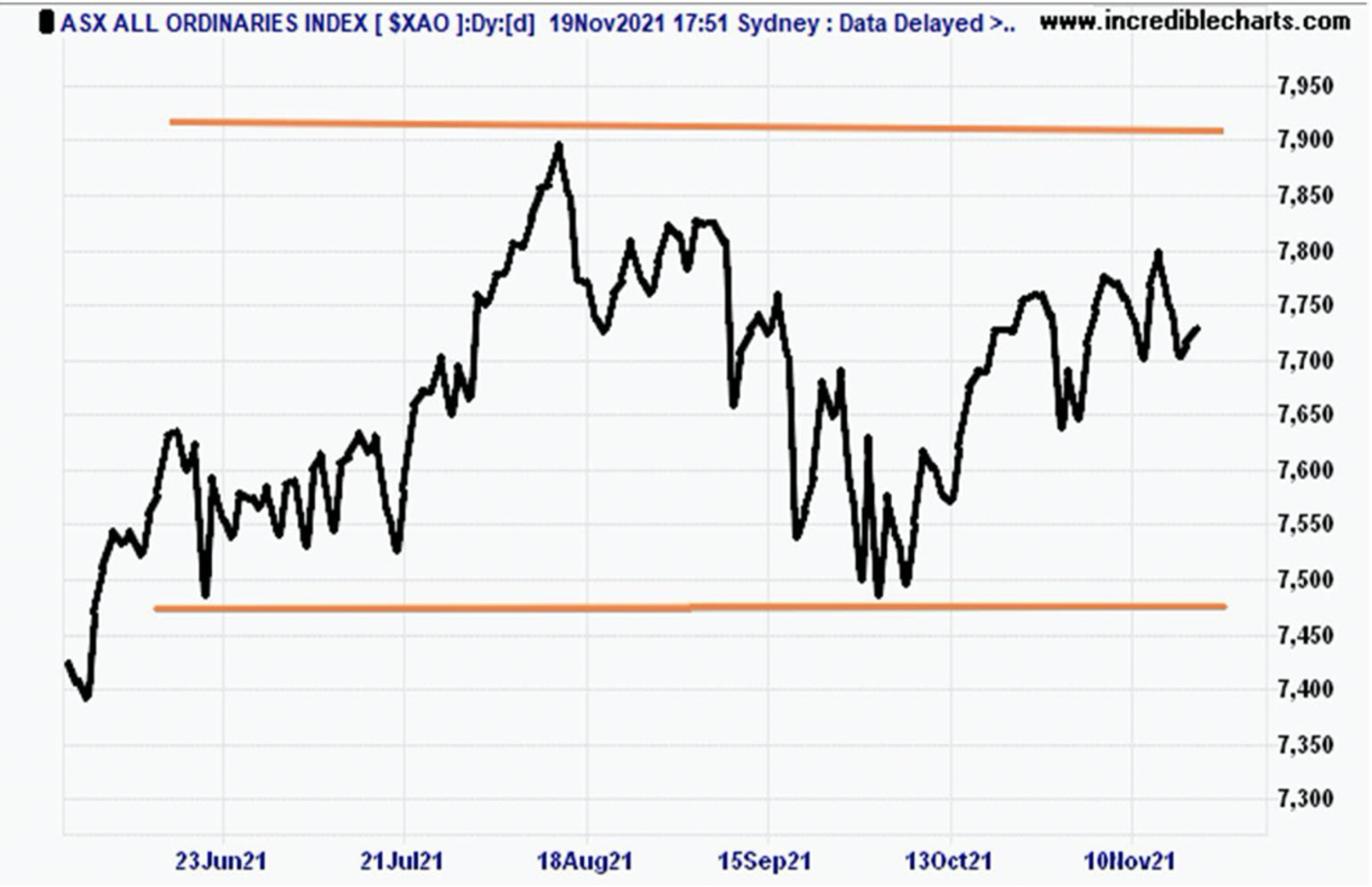

S&P/ASX 200

We’re up about 3.7% from our pre-pandemic peak while the Yanks are up 38%! I think we should play catch up with room to move higher over 2022.

The very objective market-watcher and former NSW Treasury Secretary, Percy Allan, helps my case for positivity on stocks. “On short-medium term trend analysis the Australian market went bullish on October 20th this year,” he pointed out in his most recent note. “On long-term trend analysis, it has been bullish since 20th October 2020.”

But concerns over inflation, interest rate rises before expectations and now virus-related lockdowns in Europe are starting to spook stock markets. On Friday, European and even US stock markets worried about a full lockdown in Austria of all places! But it followed new restrictions in Germany as anti-vaxxers are threatening the strength of the global economic recovery.

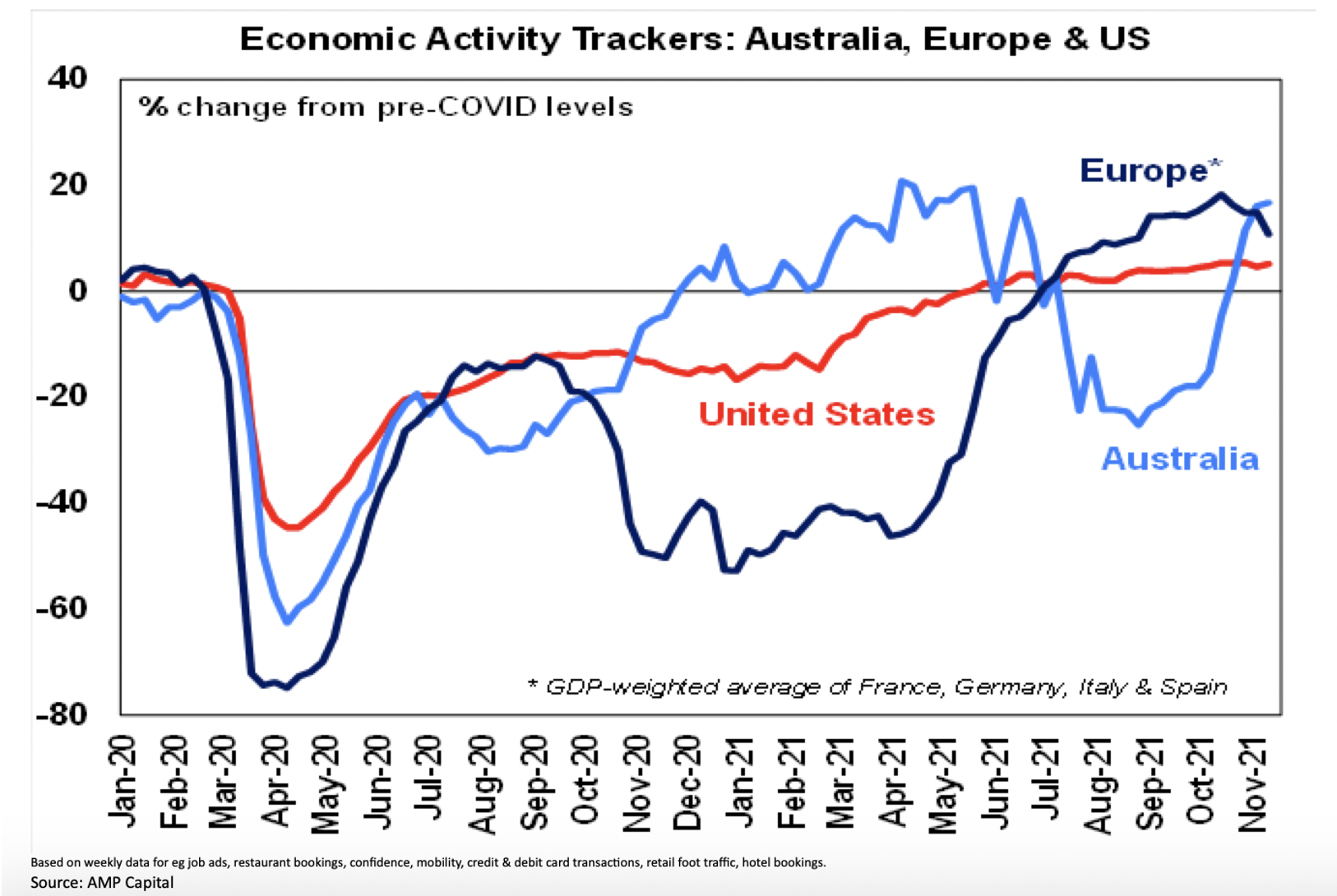

Vaccinations and the end of lockdowns have a big impact on the economy as AMP Capital’s Shane Oliver shows weekly with his Economic Activity Tracker chart.

Look how the blue line for Australia has U-turned up since the end of lockdown. And see how Europe is turning down.

Right now, recalculations about the global and national economic recoveries are posing negative questions for stocks, at least for the moment. The pressure on populations to get vaccinated and then get booster shots will escalate, especially if stock markets sell off worse than I expect.

My base case is to expect a bit of a pullback, creating a buying opportunity that should play out as a smart play over December to April.

Here’s Shane Oliver’s take on Europe right now: “The surge in new cases is a significant threat to the economic outlook in Europe and the US – but the key to watch is whether vaccinations are successful in keeping hospitalisations down, such that hospital systems can cope so hard long lockdowns can be avoided. If so, it will then be part of a process of ‘learning to live with Covid’ where it goes from being an epidemic to being endemic (like the flu). So far hospitalisations in Europe remain subdued relative to the wave a year ago.”

The recent Pfizer pill for treating Covid-19 could also be an important game-changer helping us to “live with Covid”.

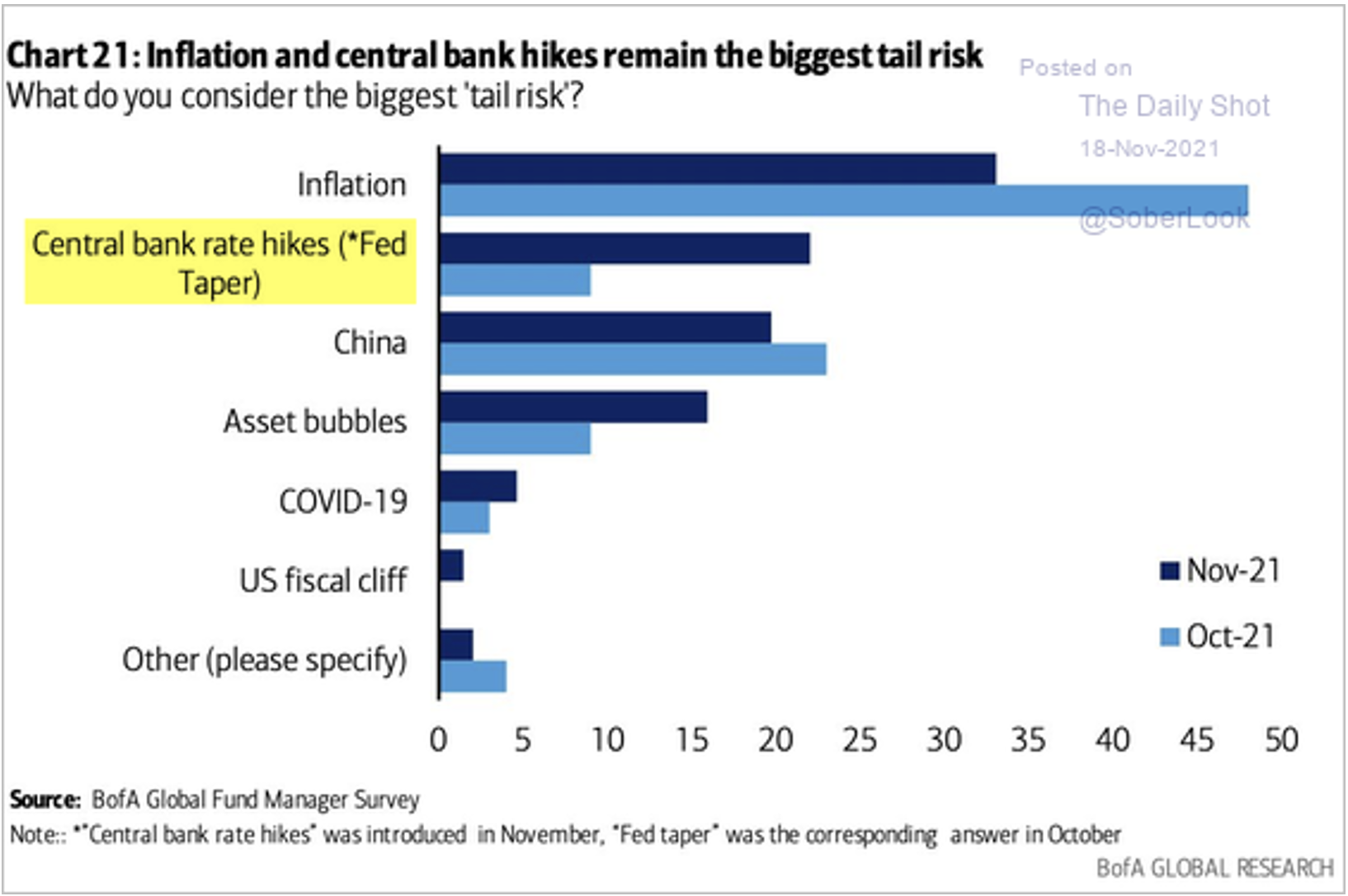

Here’s an interesting chart weighing up the risks according to a Bank of America survey of US fund managers.

It’s interesting to see the Covid threat so low on the list of worries. I hope they’re right.

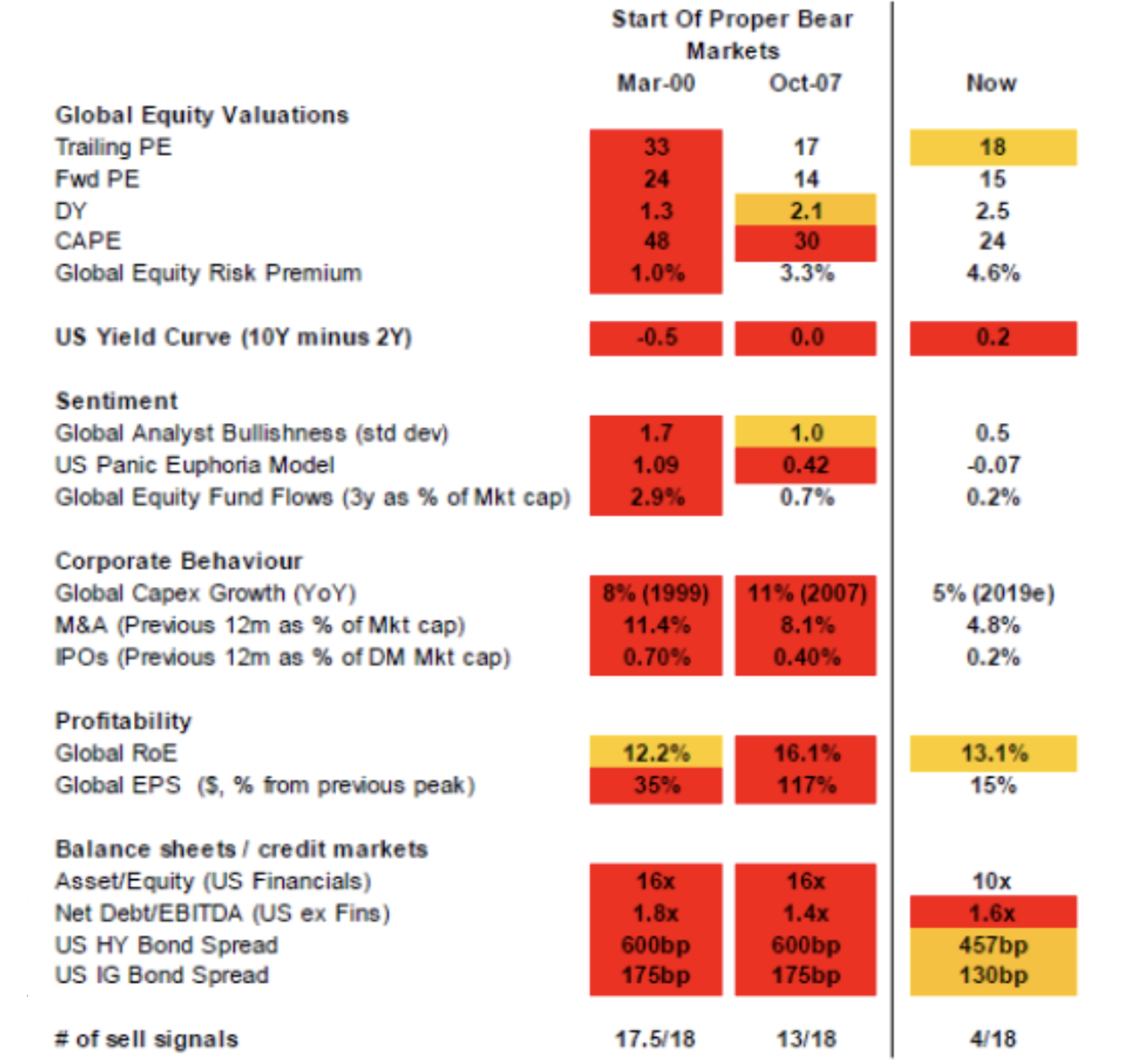

Right now I’d like to see the latest Citi Bear Market Checklist but it has not been released yet.

The July version is worth summing up. Of the 18 indicators that tell you to beware of a bear market, only four are red-flagged. In 2000 before the dotcom bust, 17.5 were red. And in 2007 ahead of the GFC crash, it was 13.

This isn’t a market-timing tool but it does give you good reasons to get nervous or be confident.

Let’s look at the period August to November to see if possibly more negatives have come along to increase the number of red flags.

Since August, the S&P 500 was up 6.8%, which is big but not excessive, while the Nasdaq was up a strong 8.8%. However, US corporate earnings have been very big.

“US September quarter earnings have come in up 38.9% on a year ago which is nearly 10% greater than expected a month ago,” Oliver reported last week. “95% of S&P 500 companies have reported September quarter earnings and 81% have exceeded expectations.”

Plus US earnings growth at 38.9% year-on-year is running at a similar pace to that in Europe, Australasia and the Far East, which is running at about 40% year-on-year, which is a really good thumbs up for playing stocks beyond any short-term pullback.

Undoubtedly over the past four months, bond yields have been rising. These can be red flags but they’re not rising enough to start thinking about bear markets.

Usually, the first rise or two can spook the stock market but it takes a lot more hikes and more time before a bull market turns and drops 20% plus. I reckon that’s more a risk for late 2023 or even later in 2024, but it will depend on how strong economic growth is after we well and truly nail this damn virus!

On Saturday I pointed to Tom Lee, who founded Fundstrat Global Advisers, and who this week tipped a pullback before a rebound into a higher finish for the year. He pointed to uncertainty around leadership within the Federal Reserve, with Jerome Powell possibly dumped this week from his Fed Governor’s gig this weekend “and some technical factors”.

We have to add in the European concerns but I think over the next three months that vaccinations, stronger government restrictions on the unvaccinated, as well as new Covid-19 treatments will help to make 2022 a strong economic rebound year. This in turn will help stock prices.

Australia was slow out of the blocks with vaccines but we’re now setting a hot pace in Victoria and NSW, in particular. This should cement the foundations of the economic and stock market surge next year.

One final chart keeps me positive.

And I like Percy Allan’s view on this chart: “There remains a big buffer between the market’s 30-day trend line and its 300-day one, meaning the All-Ords index would need to fall a long way before it became bearish on medium-to-long term trend analysis. If that happened, the market would be in a correction (10-20% drop) not just a pullback (under 10% drop).”

Right now I’m looking for quality companies that will do well in a strong economic growth year that are currently out of favour with the shorter-term influencers of the market.

It’s why I like the likes of BHP (analysts tip upside of 20.4%) and Bluescope (up 32%), Qantas (up 9.6%) and Westpac (up 18.9%) now for a pay-off in 2022 and beyond. And given my positive view on our economy and the global economy next year, I don’t think these stocks are a gamble at all.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.