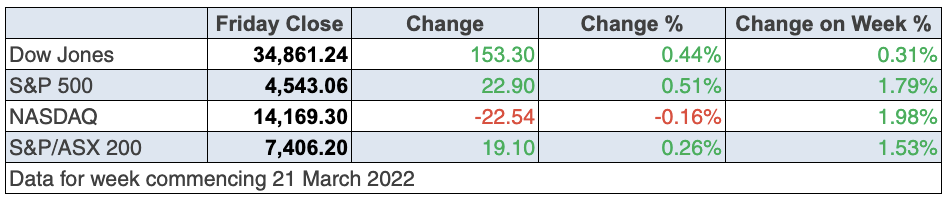

Despite headwinds of the Ukraine war, rising inflation, the threat of a 0.5% interest rate rise in the US next month and China locking down cities as BA.2 spreads, Europe and US markets keep on defying gravity. And here in Oz, we’ve had another positive week, with the S&P/ASX 200 index at a two-month high.

I think NAB’s David de Garis got it right trying to explain a mixed and confusing day of trading in promoting his podcast when he said: “It’s rare that you see equities and bond yields rise at the same time.”

Some market watchers suggest that maybe markets have a growing optimism that the Fed’s aggressive stance (i.e. an expected 50 basis points rise in the official rate of interest) will put a cork in the bottle where the inflation genie lives!

Helping investors stay in the market is a hope/belief that peace talks will eventually happen and stocks will soar, with oil prices bound to slump, along with other commodities, which have seen their prices spike since hostilities began in Europe.

As CNBC pointed out overnight: “Global markets have been tracking negotiations over Russia’s invasion of Ukraine closely, and Thursday saw a host of high-level meetings between world leaders and international bodies.”

Meanwhile, the war hasn’t spread actual business chaos, with PMIs (Purchasing Managers Indexes) a little softer but still in growth territory, most notably for services in Europe. This guarded optimism about peace is in conflict with NATO committing extra troops along its eastern border, as fighting intensifies. But hope springs eternal, so let’s hope it’s not too optimistic.

Adding to the confusion has been the odd days when tech stocks were back in favour in the US and here.

This was CommSec’s Craig James’ take on tech stocks in the US on Thursday: “Technology led sector gains, up 2.7% with communication services up 1.7%. Shares in chipmakers rose with Nvidia up 9.8% and Intel up 6.9%. Shares in Apple rose by 2.3% with Microsoft up 1.5%.” But why?

That’s my question for Monday’s story but I did go fishing for something on last Monday’s TV show [1] when I asked Julia Lee if she was starting to look at tech stocks.

She hasn’t favoured them for some time and you have to remember that she is a momentum trading fund manager so she’s on the lookout for new trends that could build. Her answer was memorable: “Tech stocks are starting to look more interesting.” That’s Julia’s code for, “I’m starting to add some to the fund” but she is selective.

Ahead of the close and Wall Street was just in positive territory, similar to European markets but things could change before the close. (I do file this analysis before the bell rings on the close of the New York Stock Exchange.)

That said, US stock markets looked poised for another up-week to add to last week’s rise. Financials did well but tech stocks lost some of their supporters, who were enthusiastic buyers earlier in the week.

Here is one view on what’s going on: “Equities are rallying despite a hawkish Fed and stagflation concerns, as many believe there is no alternative to stocks,” Mark Haefele, chief investment officer at UBS Global Wealth Management told CNBC.

But I disagree — it’s more than that.

Right now, the majority of stock market players think that eventual peace plus the potentially big economic rebound out there waiting to happen will trump the negatives from rising inflation and interest rates on top of the BA.2 threat and talk of recession.

It’s a close call and my positivity would be helped by better peace talks and fewer BA.2 fears. My fingers are crossed big time!

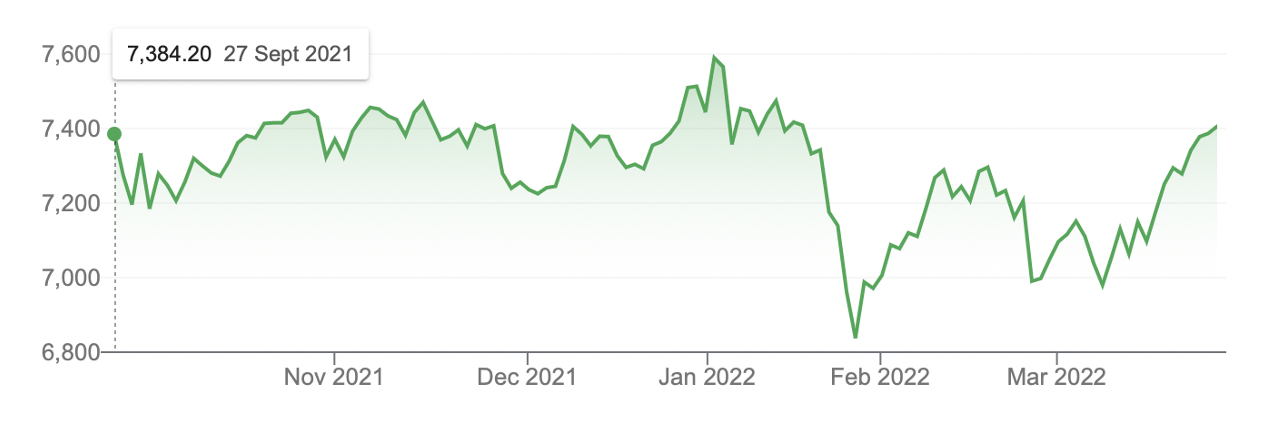

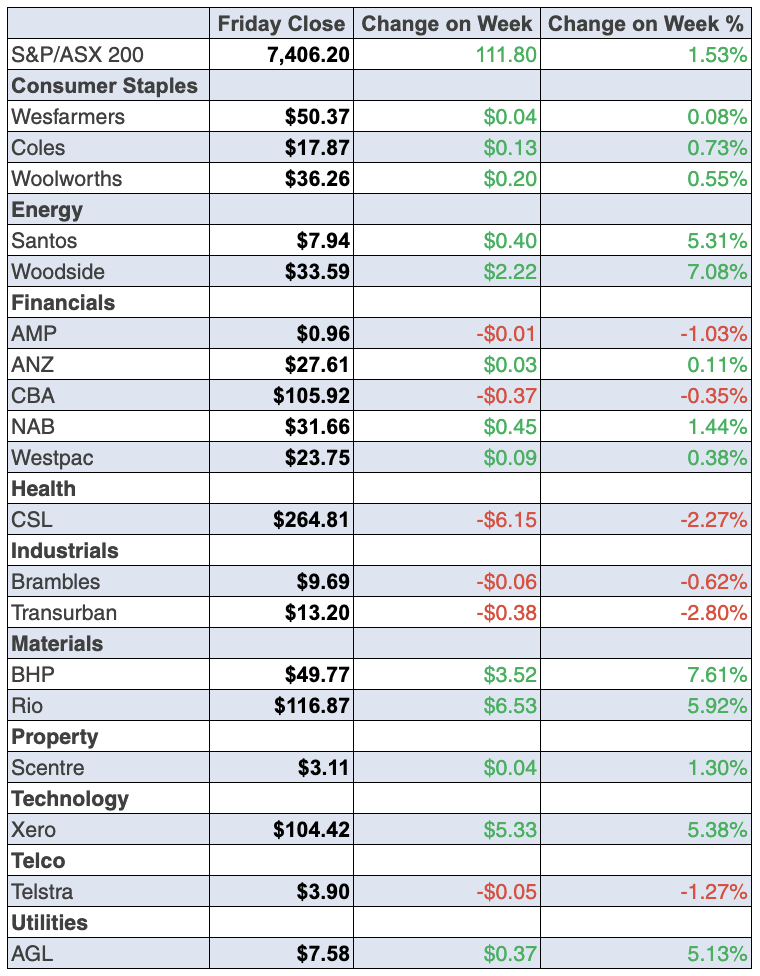

Back to the local story and the S&P/ASX 200 Index was up 111.8 points (or 1.53%) for the week to 7406.2. And mining, energy and financials (sectors I always argued would help us possibly outperform Wall Street this year) are delivering.

Our Index has lagged the S&P 500 Index since the Coronavirus sell-off and especially last year, but the US markets have had a love affair with tech companies such as Tesla, Apple, Amazon and others powering their indices to crazy levels. Reality has been biting via the Fed’s decision that it’s time to fight inflation.

Our Index is now at its best level for two months and the rebound is worth viewing.

S&P/ASX 200

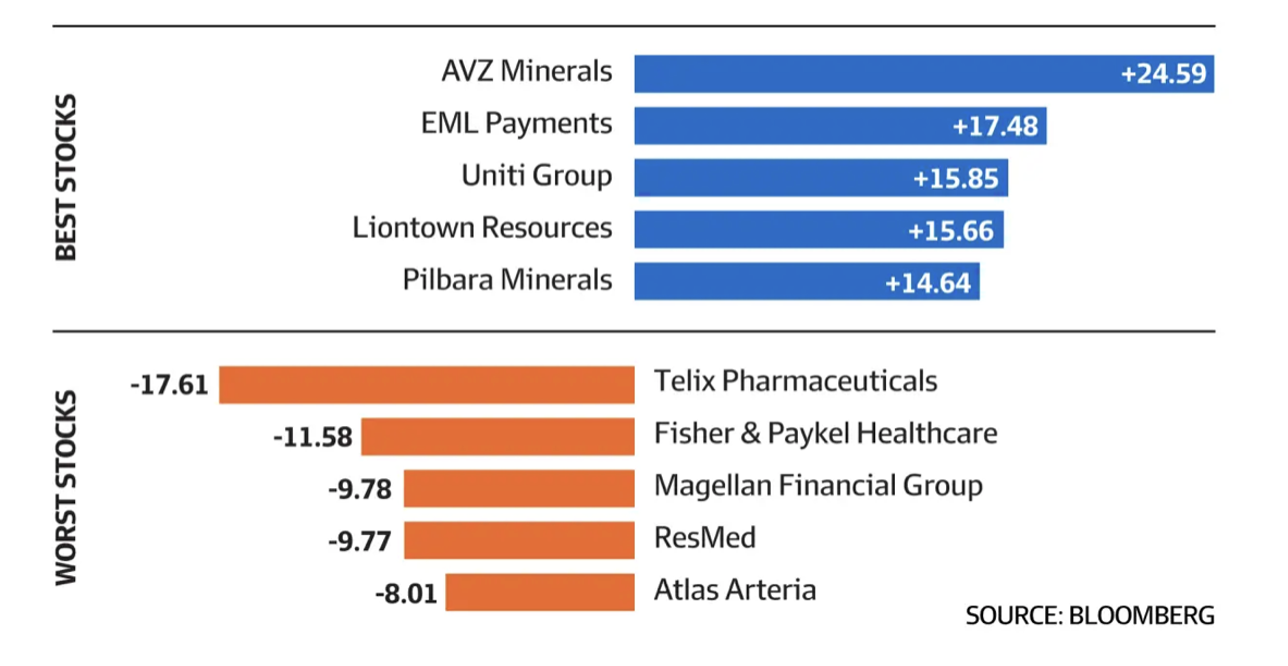

Let’s start with the big miners, which did well, especially BHP, up 7.12% to $49.77. Meanwhile, Rio put on 5.12% to $116.87 but Fortescue only added 2.07% to $19.27.

On the bank front, NAB was up 1% to $31.66, while the others had small gains or falls but they did their heavy lifting in the previous two weeks, with the likes of Macquarie up 12.5% and CBA up 11.9% over that time. But let’s look at winners and losers of the week.

AVZ Minerals is a newly-listed lithium miner and these diggers for the new age ‘gold’ used in batteries all had a good week. Liontown Resources added 6% for the week, Pilbara Resources put on 12.6% to $3.21 and Allkem rose 9.88% to $11.01.

Uniti Group’s share price spike was on the back of a Macquarie Asset Management and PSP Investment takeover offer to compete with the Morrison & Co bid on the table.

Healthcare hasn’t made a convincing turning of the corner and the spread of BA.2 can’t be a big help. The virus has competed with what the businesses usually do and has hurt their share price. CSL was down 2.9% to $264.81, Resmed was off 10.36% to $31.58 but Ramsay Health was only down 0.72% to $63.48.

Along with other fund managers, Magellan Financial Group is still struggling, down 10.69% to $14.20. They need a good investment performance result ASAP to convince the market that the company can re-find its mojo or else the adviser dumping will escalate.

What I liked

- The National Skills Commission’s Internet Vacancy Index (IVI) rose by 3.6% in February (or 9,264 available positions) to a 13½-year high of 269,746 available positions. Recruitment activity is up 36.2% over the year to February. Job vacancies were at all-time highs (since January 2006) in February for 15 occupations.

- The S&P Global factory purchasing managers index rose from 57.3 to 58.5 in March (survey: 56.3). The services gauge rose from 56.5 to 58.9 (survey 56).

- First-time jobless claims last week in the US were the lowest tally since 1969, the Labor Department reported Thursday — the latest sign of a resilient labor market.

What I didn’t like

- In February 2022, a record 28.8% of unemployed people left their last job to join the ranks of the unemployed, in order to get a better job, start a business or for family reasons. And for the first time, the number of unemployed people that left their last job now exceeds the number of people that lost their last job.

- This headline from CNBC: ‘Omicron “stealth” variant BA.2 is spreading rapidly in China.’

- Speeches by Federal Reserve officials cemented market views that the next rate hike in the US will be 50 basis points.

- In the US, new home sales fell by 2% from 788,000 to 772.000 in February (survey: 810,000). Mortgage applications fell 8.1% in the past week after falling 1.2% in the previous week.

- Data showed that annual UK inflation lifted from 5.5% to a new 30-year high of 6.2% in February.

Note negativity!

My “What I didn’t like” outnumbers “What I liked”, which is unusual and could be worth watching.

The week in review:

- This week in the Switzer Report, it’s that time of the year where I resurrect the old saying: “Sell in May and go away, come back on St. Leger’s Day,” and take a look at its relevance in the current market. This year I reckon we should tweak it, and instead say “Buy before May and stay!” This is what I put to the test in my article today. [2]

- Paul (Rickard) warns not to get too carried away about “‘talk” that the banks are big winners from rising interest rates. He says they are winners, but the things they have most going for them at the moment are relatively stable earnings. And in his article today Paul gives his ranking on the big four banks. [3] And with the polls squarely in Opposition Leader Anthony Albanese’s favour in the run-up to the federal election, Paul considers what the future may hold for [4]investors with a Labor Government in Office.

- James Dunn reckons there’s a lot going on in the nickel market, with the nickel price has been gyrating like crazy. As befitting the trend, he examines how six nickel producers look right now in the context of higher nickel prices. [5]

- Tony Featherstone has long argued that retail investors should allocate a small part of their portfolio to alternate assets, including infrastructure. Tony says they should not only look globally because Australia has limited choices in listed infrastructure, but they also should take a fund approach to improve diversification and focus on funds that own listed infrastructure stocks. In his article this week, Tony shows you two ways to increase your portfolio allocations using infrastructure ETFs. [6]

- In our “HOT” stocks column this week, Raymond Chan, Head of Asian Desk, Retail at Morgans gives his reasons [7]why he thinks Macquarie Group (MQG) & Tabcorp (TAH) are buys, and Michael Gable, Managing Director of Fairmont Equities [8], explains why he thinks ResMed (RMD) is a buy.

- In Buy, Hold, Sell — What the Brokers Say, there were four upgrades and eleven downgrades [9] in the first edition, and three upgrades and one downgrade [10] in the second edition.

- And finally, in Questions of the Week, [11] Paul Rickard answers subscribers’ queries about whether they are catching a “falling knife” with Magellan? Why doesn’t GEAR double the performance of the ASX 200 over the long term? Why Appen hasn’t risen despite positive news? Is LiveTiles a long term hold?

Our videos of the week:

- Tech stocks on the rise? We rate these 10 stocks + are the worst days for Magellan over? | Switzer Investing [12]

- Discussing the treatments of cholesterol | The Check Up [13]

- Rudi Filapek-Vandyck on should you buy stocks now? + secret Sydney suburbs that are great value! | Switzer Investing [14]

- Boom! Doom! Zoom! | 24 March 2022 [15]

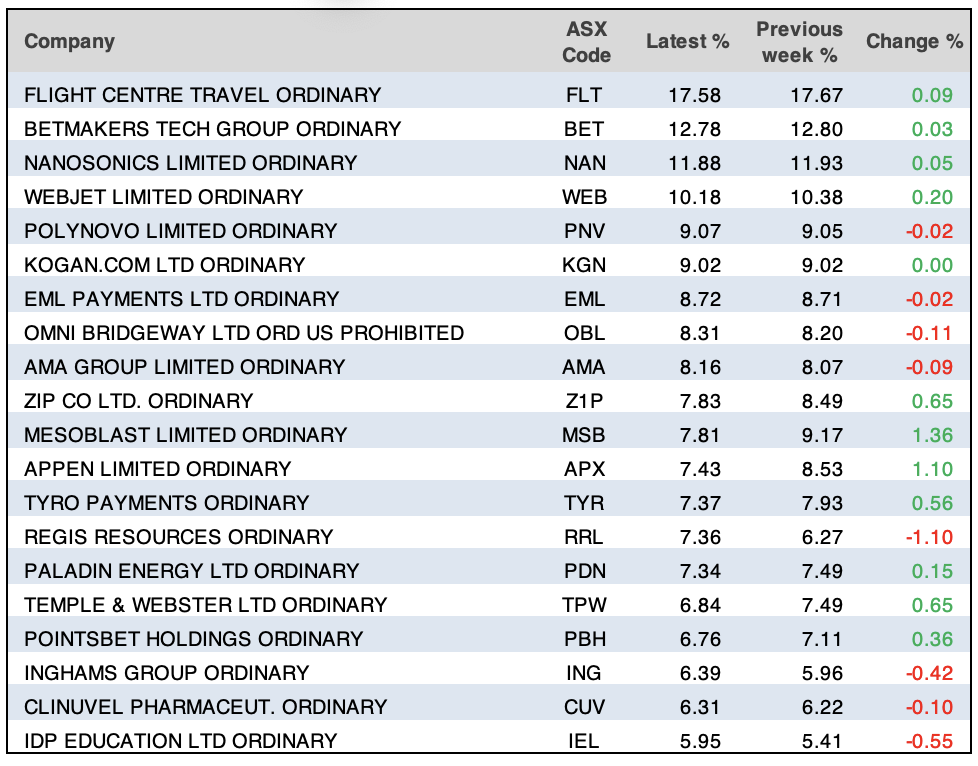

Top Stocks – how they fared:

The Week Ahead:

Australia

Tuesday March 29 – Retail trade (Feb)

Tuesday March 29 – Weekly consumer confidence (March 27)

Tuesday March 29 – Federal budget 2022

Wednesday March 30 – Engineering construction activity (Dec quarter)

Thursday March 31 – Private sector credit (Feb)

Thursday March 31 – Building approvals (Feb)

Thursday March 31 – Job vacancies (Feb)

Thursday March 31 – Finance & Wealth (Dec quarter)

Friday April 1 – CoreLogic Home Value Index (March)

Friday April 1 – Lending indicators (Feb)

Friday April 1 – Factory purchasing managers indexes (March)

Overseas

Sunday March 27 – China industrial profits (Feb)

Monday March 28 – US Advance goods trade balance (Feb)

Monday March 28 – US Dallas Fed manufacturing index (March)

Tuesday March 29 – US Home prices (Jan)

Tuesday March 29 – US Conference Board consumer confidence (March)

Tuesday March 29 – US JOLTS job openings (Feb)

Wednesday March 30 – US ADP employment change (March)

Wednesday March 30 – US Economic (GDP) growth (Dec quarter)

Thursday March 31 – China Purchasing managers indexes (March)

Thursday March 31 – US Personal income and spending (Feb)

Thursday March 31 – US Challenger job cuts (March)

Friday April 1 – US Non-farm payrolls (March)

Friday April 1 – US ISM manufacturing index (March)

Friday April 1 – US Constructions spending (Feb)

Food for thought: “Innovation distinguishes between a leader and a follower” – Steve Jobs

Stocks shorted:

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before.

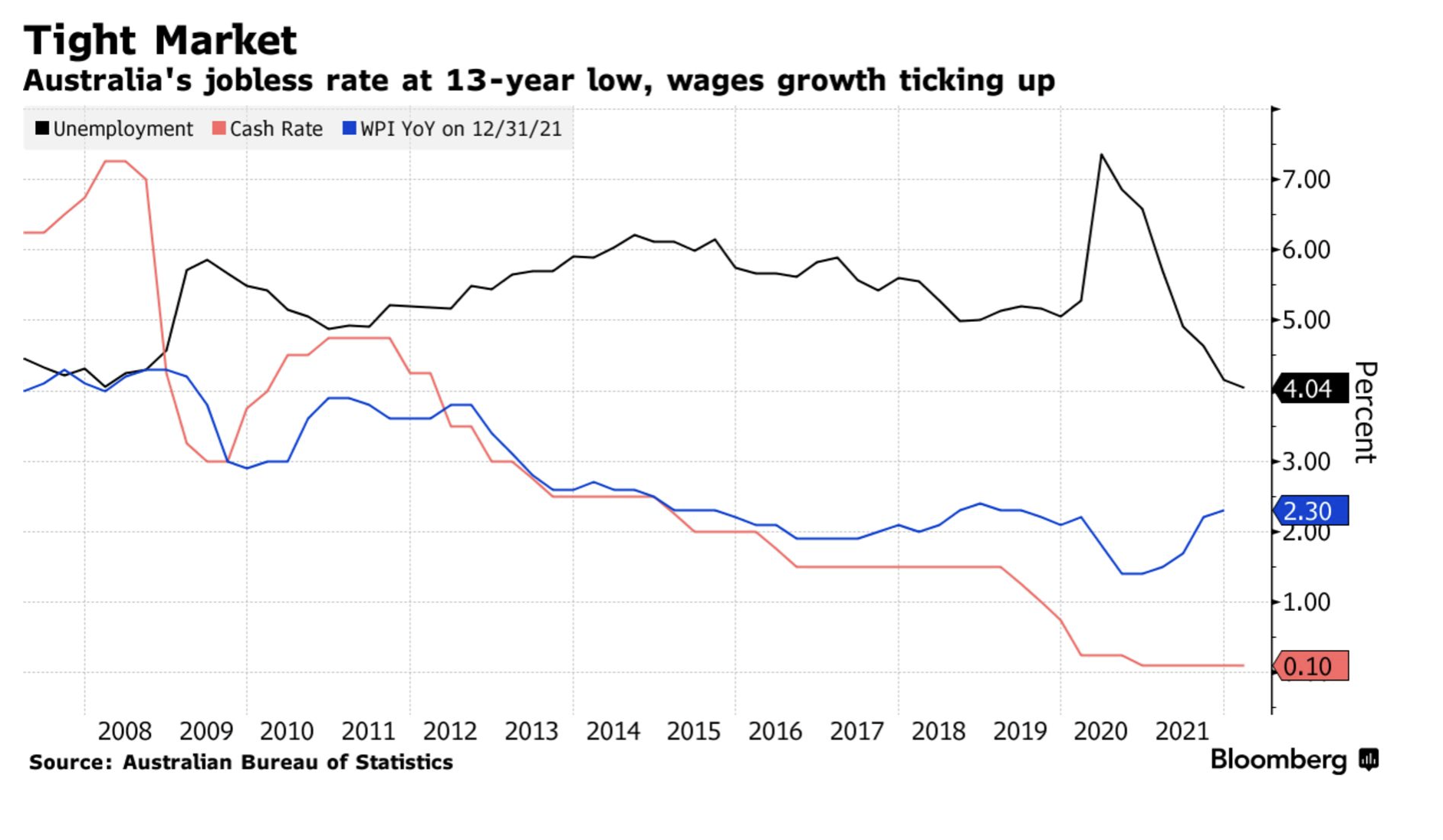

Chart of the week:

Our chart of the week shows the major factors at play in the Aussie economy that is compounding the inflation pressures of the Ukraine war and China’s ongoing covid woes.

“Based on most measures, a rate hike Down Under should be coming in the near-term. The labor market is tightening, core inflation threatens to burst through the top of the RBA’s 2-3% target, property is hovering near all-time highs and key commodity export prices are soaring.,” Bloomberg reports.

“But so far this has failed to translate into stronger aggregate wages growth.

“That’s a political problem for Morrison ahead of an election due by the end of May. He is likely to try to address [16] some of the pain for households — caught between faster inflation and still tepid pay gains — in Tuesday’s budget.”

Top 5 most clicked:

- Buy before May and stay! [17] – Peter Switzer

- Will the banks win from higher interest rates? [18] – Paul Rickard

- My two “HOT” stocks: Macquarie Group (MQG) & Tabcorp (TAH) [19] – Maureen Jordan

- 6 nickel stocks during higher nickel prices [20] – James Dunn

- Two infrastructure ETFs [21] – Tony Featherstone

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.