There’s a tug-of-war going on between the positive stock market forces linked to the growing economic recovery that’s pointing to a global boom and the rising tide of Coronavirus infections in places like India, Brazil and other non-first world economies.

It comes as the latest Purchasing Managers Indexes and consumer readings in Europe and the UK are all pointing to their economies getting stronger, as vaccinations on top of recent lockdowns are creating very strong economic readings.

The UK’s composite PMI reading surged to 60 in April from 56.4 in March, as the country rolls out its vaccination programme while gradually exiting lockdown. “This morning’s PMI figures continue to show the impact of the easing of restrictions, with positive sentiment increasingly evident in the UK’s dominant service sector,” said Dean Turner, economist at UBS Global Wealth Management. “With all sectors showing an improvement relative to March, we believe this points to further strength in the economy in the months ahead.” (CNBC)

By the way, retail sales zoomed up 5.4% in March, which is a good indicator about what vaccinations can create.

On Wall Street, the good market and economic news is trumping Covid-19 concerns, with all three stock indexes higher. The Dow was up 0.7%, the S&P 500 rose 1.09%, while the NASDAQ jumped 1.4%.

The recent rejection of tech stocks is old news and banks were in favour, which all points to a belief that President Joe Biden’s push for tax hikes (the capital gains tax could go from 20% to 39.6% for those earning over $1 million) won’t hurt the rising trajectory for stock prices.

Wall Street is gambling that the Democrats’ slim majority in the Congress will make a market-killing tax change hard to get across the line. Goldman Sachs has taken this all on board and speculates a more tolerable 28% capital gains tax might eventually surface, after a lot of time-consuming political wrangling over the issue.

I hope the market is getting this right!

Interestingly, some analysts point out that only 25% of US investors pay capital gains tax, so the others (retirees, endowment investors and foreigners) would be buyers if stock prices initially fell because of a big tax hike. That’s analysis Wall Street-style for you!

By the way, the threat of a capital gains tax hike hurt the bitcoin price, which slumped 17.6% this week.

And for those wondering if they should play bitcoin, have a look at this headline on CNBC: “Turkish crypto exchange boss goes missing, reportedly taking $2 billion of investors’ funds with him…” Cryptocurrency is giving the wild, wild West a great name!

To the local story and the best news had to be the continued strength in the iron ore price, which hit a 10-year high of $US189.61 a tonne on Tuesday. However, the S&P/ASX 200 Index still lost nearly 3 points for the week to finish at 7060.7, after hitting its highest level on Monday since February last year, before stocks and the world were spooked by something called the Coronavirus.

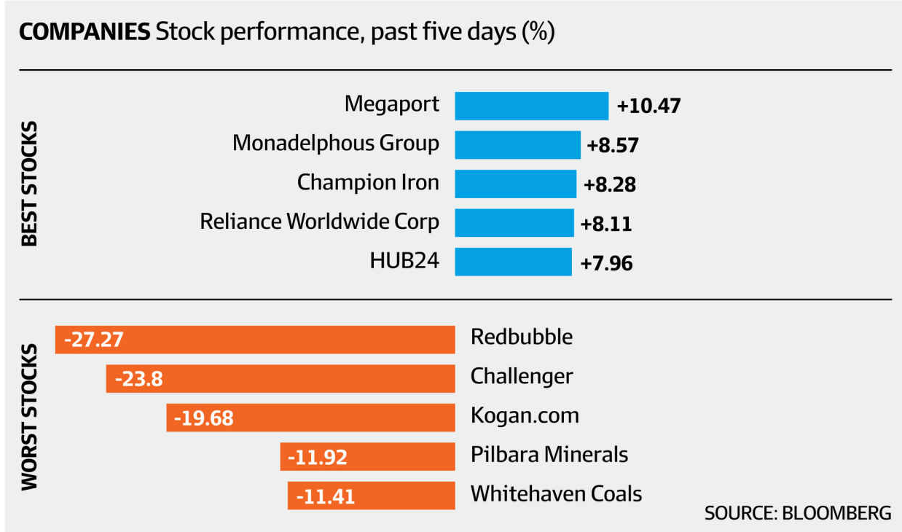

Here’s the Bloomberg/AFR take on the best and worst performers:

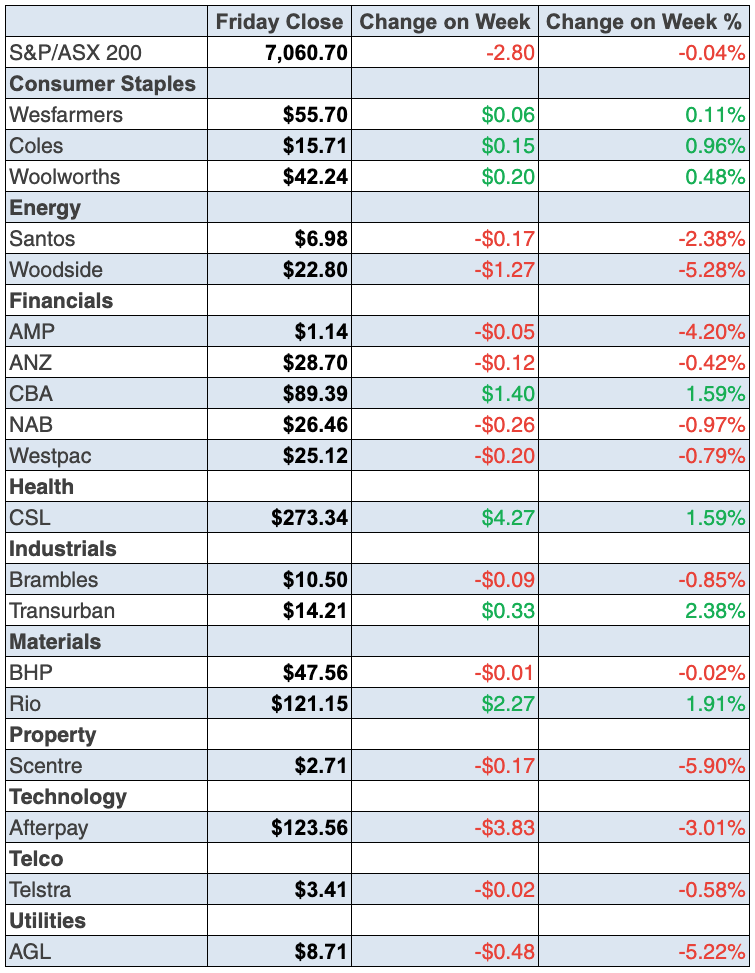

CBA had a nice rise of 1.4% to $89.23 but the other three big banks lost ground, with NAB down 1% to $26.45, Westpac off 0.8% to $25.13 and ANZ gave up 0.4% to $28.70, but they have had a nice run lately.

Westpac six-month chart

(Anyone who wants a reason to buy Westpac or to hang on to it, should see my TV show from Thursday night [1]).

In fact, that show is a “must look at” if you’re a dividend stock chaser, as I introduce Marcus Bogdan of Blackmore Capital, who’ll now run my Switzer Dividend Growth Fund. It has performed well since inception but I wanted to raise its returns and Marcus has been averaging 8% or so since 2014 with his fund (after franking and fees). He shared with us some of the stocks he has in the fund that he thinks are must-holds.

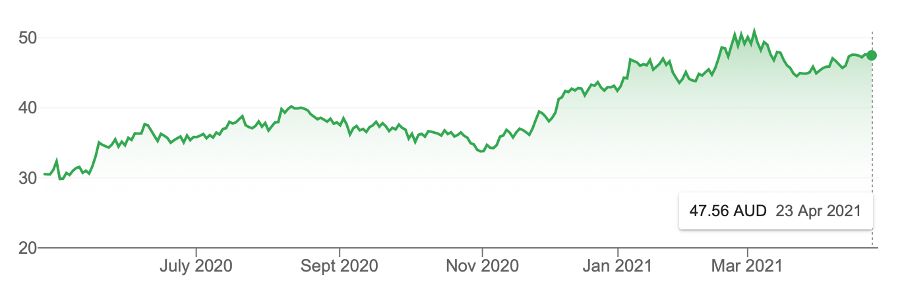

Back to iron ore stocks for the week and Fortescue rose 3.9% to $21.64, Rio put on 1.8% to $121.07 but BHP actually lost 0.3% to $47.43 but it’s had a great year.

BHP one-year

And given the virus troubles in Brazil and the outlook for global growth, thanks to the vaccination rollout, it looks like iron ore and related stock prices still have upside. Personally, I find it hard to take profit with my miners with the dividend being so attractive and with the outlook for dividends looking so strong.

What I liked

- The weekly ANZ-Roy Morgan consumer confidence rating edged lower by a very small 0.1% from a 17-month high of 114.1 to 114 (long-run average since 1990 is 112.6). Confidence is up by 74.6% since hitting record lows of 65.3 on March 29 last year (lowest since 1973).

- Preliminary’ retail trade rose by 1.4% in March to stand 2.3% higher than a year ago.

- The National Skills Commission reported that skilled internet vacancies rose by 19.1% in March to be up 96.4% on the year. Vacancies are at 12½-year highs. Job advertisements increased across all eight broad occupational groups and the 48 detailed occupational groups during March this year.

- In seasonally-adjusted terms, private new detached home sales surged by 90.3% in March to 9,691 units – the second highest level since 2004. Sales were 39.4% higher in the March quarter when compared with a year ago. Over the year to March, sales were 42.6% higher than the previous year.

- The RBA report from the April 6 Board meeting when Reserve Bank policymakers reiterated that the cash rate would remain at 0.10% (10 basis points) “for as long as necessary”.

- More regions reported annual job gains in March than those reporting job losses. Overall, 46 of 87 regions reported gains, led by Melbourne West (up 41,700).

- The Commonwealth Bank Household Spending Intentions series for March 2021 showed improvement across five of the seven spending categories. March 2021 saw strong gains in spending intentions for Home Buying, Travel, Entertainment, Education and Motor vehicles. Health & fitness spending intentions consolidated recent gains, while Retail spending intentions were weak, but this was largely a payback for the spike higher seen in March last year.

- The Conference Board leading index rose 1.3% in March (survey: 1%). The Kansas City Fed manufacturing index lifted from 26 to 31 in April (survey: 28). The Chicago Fed national activity index rose from -1.20 to 1.71 in March (survey: 1.25).

- In the US,initial jobless claims fell by 39,000 to 547,000 last week (survey: 610,000).

- The UK’s composite PMI surged to 60 in April from 56.4 in March as the country embarks on a phased exit from lockdown.

- A GfK survey showed British consumer sentiment this month rising to its highest point since the pandemic, as the economy begins to partially reopen.

- The preliminary composite reading of the European IHS Markit’s Purchasing Managers Index, which combines services and manufacturing, came in at 53.7 in April versus 53.2 in March, with anything above 50 representing expansion.

- Food giant Nestle reported its strongest quarterly sales growth in 10 years.

- The European Central Bank kept its monetary policy unchanged.

- Shares in Italian football club Juventus slumped 13.7% after the breakaway European Super League founder said the league can no longer go ahead. Earlier in the week the club’s share price spiked on the news that a Super League was coming for top clubs in Europe and the UK. Fans had their way!

What I didn’t like

- The global lift in Coronavirus cases, with India recording 300,000 in one day!

- US investor sentiment was dampened after Reuters reported that US President Joe Biden will propose raising the top marginal income tax rate to 39.6% from 37% and nearly double taxes on capital gains to 39.6% for people earning more than US$1 million.

What luxury car sales tell me

The CommSec measure of luxury vehicles represented a record 12.56% of overall passenger vehicle and SUV sales in the year to March. Porsche sales are at 3-year highs. This can’t help but make me believe my big boom story. Imagine when the world can more easily deliver luxury cars!

The week in review:

- To arrive at my 5 best of breed stocks with more than 10% upside inside a year, I’ve selected an industry and asked what company is the king pin. Then I looked to see what the analysts surveyed by FNArena think lies ahead for these companies [2]: CSL (CSL), A2 Milk (A2M), Qantas (QAN), NEXTDC (NXT) and Telstra (TLS).

- Paul Rickard wrote that share markets are predictors of what’s to come so when markets are setting records, we shouldn’t be surprised to see that the lead economic indicators are so strong. But the obvious questions are “is this as good as it gets?” and “should I take some money off the table?” [3]

- James Dunn had 3 stocks that look to have significant room for their share price to rise [4]: com (KGN), Adore Beauty (ABY) and Booktopia (BKG).

- Tony Featherstone said that, as the COVID-19 vaccine is rolled out, funeral restrictions will continue to ease. Higher-margin funeral services will resume, helping the industry to slowly recover over the next few years. Here’s a snapshot of InvoCare (IVC) and Propel (PFP) [5].

- For our “HOT” stocks this week, Julia Lee from Burman Invest chose Lynas (LYC) [6] and Michael Gable from Fairmont Equities selected Fortescue (FMG) [7].

- There were 12 upgrades and 7 downgrades in this week’s first [8] Buy, Hold, Sell – What the Brokers Say, while there were 5 upgrades and 3 downgrades in the second edition [9].

- In Questions of the Week [10], Paul Rickard answered questions about stocks with exposure to copper, Nuix (NXL), A2 Milk (A2M) and Altura Mining (AJM).

- And in our weekly Boom! Doom! Zoom! session [11], we discuss Nuix (NXL), Appen (APX), AMP (AMP), the big miners and more.

Our videos of the week:

- Boom! Doom! Zoom! | April 22, 2021 [11]

- Do the charts say buy EML, IVC, Z1P, GXY. Julia’s latest buy & Jun Bei’s 5 long term holds [12] | Switzer Investing

- Top income stocks + 12 tech stocks you have to own! Why Westpac is a screaming buy?! [1] | Switzer Investing

Top Stocks – how they fared:

The Week Ahead:

Australia

Tuesday April 27 – State of the States

Tuesday April 27 – Weekly consumer sentiment (April 25)

Wednesday April 28 – Consumer price index (March quarter)

Wednesday April 28 – International trade in goods (March)

Wednesday April 28 – Weekly payroll & jobs (April 10)

Thursday April 29 – International trade prices (March quarter)

Friday April 30 – Producer price indexes (March quarter)

Friday April 30 – Business conditions & sentiments (April)

Friday April 30 – Private sector credit (March)

Overseas

Monday April 26 – US Durable goods orders (March)

Tuesday April 27 – US Home price indexes (February)

Tuesday April 27 – US Consumer confidence (April)

Tuesday April 27 – US Richmond Federal Reserve index (April)

Wednesday April 28 – US International goods (March)

Wednesday April 28 – US Federal Reserve rate decision

Thursday April 29 – US Economic growth (advance, March qtr.)

Thursday April 29 – US Pending home sales (March)

Friday April 30 – US Personal income/spending (March)

Friday April 30 – China purchasing managers’ indexes (April)

Food for thought:

“Successful investing is anticipating the anticipations of others.” – John Maynard Keynes

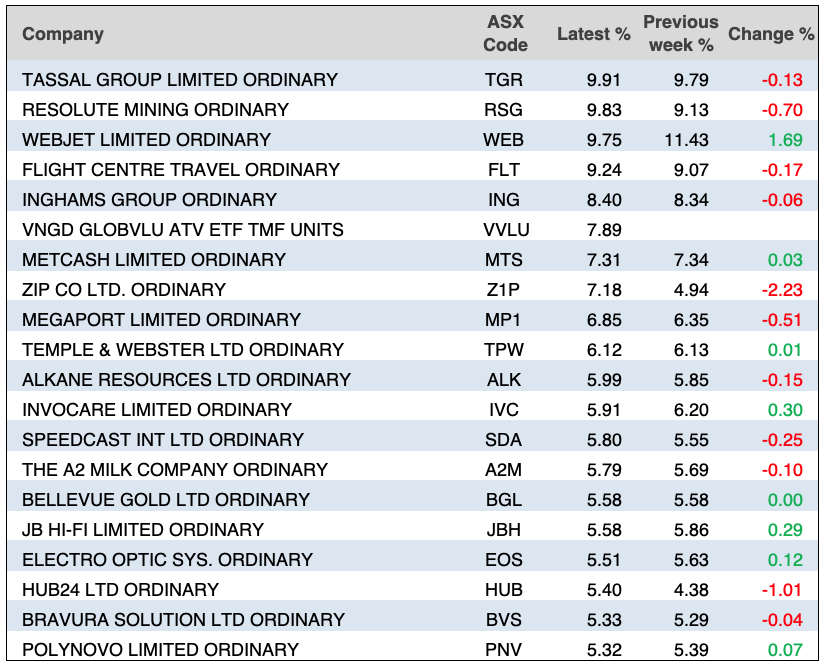

Stocks shorted:

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before.

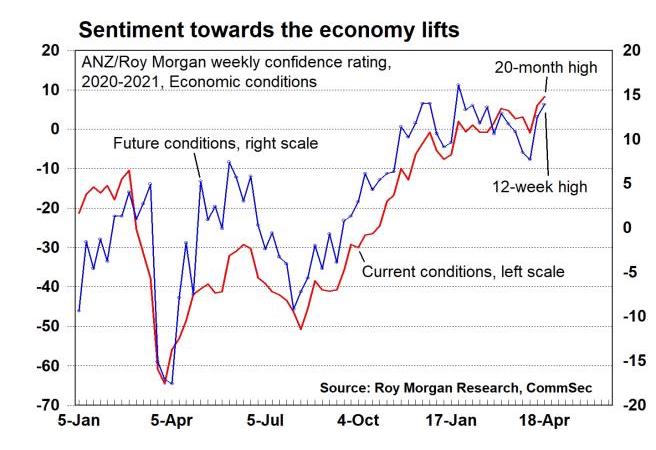

Chart of the week:

CommSec’s Ryan Felsman published the following chart this week, noting that consumer views on current economic conditions rose 2.0% to a 20-month high, while views of future economic conditions reached a 12-week high:

Top 5 most clicked:

- My 5 best-of-breed stocks with more than 10% upside inside a year [2] – Peter Switzer

- Is it time to take some money off the table, and if so, where? [3] – Paul Rickard

- 3 retailers with room for their share price to rise [4] – James Dunn

- Buy, Hold, Sell – What the Brokers Say [8] – Rudi Filapek-Vandyck

- My “HOT” stock: LYC [6] – Maureen Jordan

Recent Switzer Reports:

- Monday 19 April: My 5 best-of-breed stocks with more than 10% upside inside a year [13]

- Thursday 22 April: Are these 2 funeral companies a buy? [14]

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.