When you start a self-managed super fund, you and any other person with whom you start the fund – such as your spouse – become trustees. Trustees are ultimately responsible for the running of the fund and must act in accordance with:

- The fund’s trust deed;

- The provisions of the Superannuation Industry (Supervision) Act;

- The Corporations Act (if a corporate trustee); and

- Other rules imposed under tax and trust law.

The responsibilities and obligations of trustees are set out in trustee obligations [1].

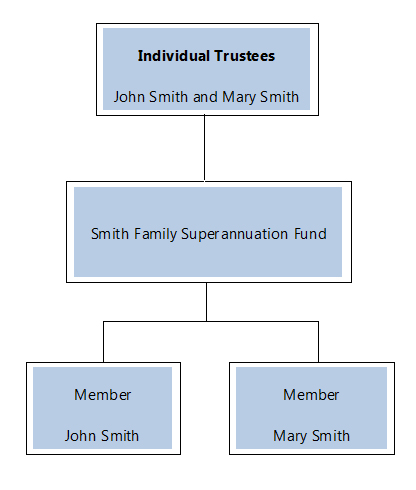

As an SMSF is in part defined by the rules relating to trustees (broadly, all fund members must be trustees and all trustees must be members of the fund, let’s start with the permissible trust structures. An SMSF can either have individual trustees or a corporate trustee. An SMSF with individual trustees looks like this:

The above fund meets the requirements for an SMSF because all of the trustees are members, and all of the members are trustees.

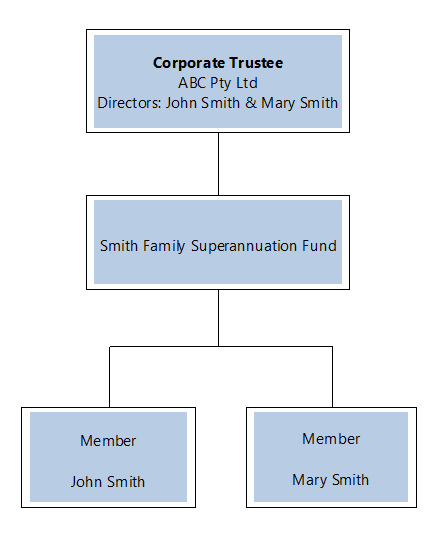

A corporate trustee structure will look like this:

In the above example, the participants are as follows:

In the above example, the participants are as follows:

| Symbol | Company Name | Sentiment indicator | Number of Recs | Target price | Target price upside/downside* | Dividend Yield forecast |

|---|---|---|---|---|---|---|

| AOV | AMOTIV LIMITED | 1 | 4 | $13.02 | 22.63% | 4.22% |

| FLT | FLIGHT CENTRE TRAVEL GROUP LIMITED | 1 | 6 | $22.68 | 30.02% | 2.87% |

| FPR | FLEETPARTNERS GROUP LIMITED | 1 | 4 | $3.76 | 35.36% | 0.00% |

| CSL | CSL LIMITED | 1 | 6 | $333.79 | 20.83% | 1.67% |

| IPH | IPH LIMITED | 1 | 5 | $7.21 | 46.59% | 6.96% |

| PMT | PATRIOT BATTERY METALS INC | 1 | 5 | $0.80 | 150.00% | 0.00% |

| RDY | READYTECH HOLDINGS LIMITED | 1 | 4 | $4.08 | 27.44% | 0.34% |

| SDF | STEADFAST GROUP LIMITED | 1 | 4 | $6.95 | 21.63% | 3.50% |

| SDR | SITEMINDER LIMITED | 1 | 5 | $6.94 | 17.63% | 0.00% |

| SLC | SUPERLOOP LIMITED | 1 | 4 | $2.28 | 0.22% | 0.00% |

| STO | SANTOS LIMITED | 1 | 5 | $8.16 | 16.46% | 5.59% |

| WHC | WHITEHAVEN COAL LIMITED | 1 | 6 | $8.98 | 49.09% | 3.43% |

| WOR | WORLEY LIMITED | 1 | 5 | $18.25 | 28.22% | 3.60% |

| WTC | WISETECH GLOBAL LIMITED | 0.9 | 7 | $141.39 | 17.97% | 0.18% |

| UNI | UNIVERSAL STORE HOLDINGS LIMITED | 0.9 | 6 | $8.69 | 2.90% | 3.93% |

| NXT | NEXTDC LIMITED | 0.9 | 6 | $20.12 | 38.07% | 0.00% |

| MMS | MCMILLAN SHAKESPEARE LIMITED | 0.9 | 5 | $19.84 | 30.33% | 9.42% |

| ALQ | ALS LIMITED | 0.9 | 5 | $16.54 | 2.48% | 2.35% |

| SEK | SEEK LIMITED | 0.9 | 5 | $26.92 | 18.96% | 1.64% |

| SGH | SGH LIMITED | 0.9 | 4 | $52.98 | 10.48% | 1.02% |

This fund also meets the requirements of an SMSF because all of the members of the fund are directors of the trustee company and there are no other directors of the trustee company.

Single Member Funds

Under trust law, it isn’t possible for an individual to be both the sole trustee and the sole beneficiary of the fund. Accordingly, special provisions have been introduced for single member funds, which can have one of the following trustee structures:

- A corporate trustee, provided the member is the sole director of the trustee company; or

- A corporate trustee, provided the member is one of only two directors of the trustee company, and the member is not an employee of the other director unless related; or

- Two individual trustees, provided the member is one of the trustees and the member is not an employee of the other trustee unless they are related.

Non-member trustees

There are also some permitted circumstances where an individual who is not a member of the fund can act as a trustee. This applies where:

- the member has died – in which case, the member’s legal personal representative can usually act as a trustee;

- the member is under a legal disability – the member’s legal personal representative or person holding enduring power of attorney can act as a trustee;

- the member has granted another person an enduring power of attorney; or

- the member is a minor – the minor’s parent can act as a trustee.

Who can’t be a trustee?

An individual can’t be a trustee if they are a ‘disqualified person’. This includes people who have been convicted of an offence involving dishonest conduct, are insolvent under administration or an undischarged bankrupt, have been subject to a civil penalty imposed under the SIS Act, or have been disqualified from acting as a trustee by the regulator.

A company can’t be a trustee if a responsible officer of the company is a disqualified person, a receiver or provisional liquidator has been appointed or the company is being wound up.

What’s better, a corporate trustee or an individual trustee?

According to the ATO, 76% of Australian SMSFs use an ‘individual trustee’ structure and in the most recent period, almost 90% of new SMSFs were established with an individual trustee structure. So, what are the advantages and disadvantages of the two structures?

Provided the trust deed is properly constructed, there really isn’t too much to choose between a corporate trustee or individual trustee structure. On a practical note, a corporate trustee structure can be a lot simpler when administering the fund, particularly in relation to the recording and registering of assets. As the assets are held in the name of the company, rather than in the names of the individual trustees, it can be both easier to register assets and record distributions (and make fewer errors) if held in the name of the company.

A corporate trustee structure can also be simpler when the membership of the fund changes – there is no need to change the ownership details of the assets. For example, where a fund’s assets are held in the names of all individual trustees and one member leaves the fund, the ownership details of all the assets will need to be changed, which can potentially be both time-consuming and expensive. And if you are thinking about borrowing inside your fund to invest in property through a limited recourse borrowing arrangement, some banks will not lend your fund the money unless you have a corporate trustee.

The main disadvantage of a corporate trustee is that it is more expensive to set up, and marginally more expensive to maintain. A fee to ASIC must be paid to establish the company (currently $463), and an annual review fee (currently $46) is also payable. There may also be some costs payable to your solicitor or external provider to establish the company’s constitution.

Despite the additional cost and work at set-up, we at Switzer prefer a corporate trustee structure for reasons of longevity and simplicity.