Well, the “market” has won again! Brokers, institutions and short sellers have “forced” a company into a hurried capital raising at a bargain basement price.

The company, of course, is the beleaguered Star Entertainment Group (SGR), operator of casinos in Sydney, The Gold Coast and Brisbane. It has just raised $595m from institutions at $1.20 per share, which a day later on Friday, were trading on the ASX at $1.52 per share. On paper, the “market” has booked a profit of around $150m, plus another $30m for the brokers who have facilitated the capital raising.

That’s not to say that Star didn’t need to raise capital – it did. But it is also the classic “market” play to smash the share price of a troubled company knowing that the Board of the company will bow to the inevitable pressure and raise capital at a deep discount.

The good news is that retail shareholders haven’t been left out. They now get their chance to participate in an entitlement offer. But paper profits can be fickle – and Star certainly has its problems – so should you participate? Here’s my view.

The raising

All up, Star is raising $800m in new capital. After $30m of transaction costs, $770m will be used to repay debt and increase liquidity, giving Star headroom to navigate a range of operating and regulatory uncertainties.

Star’s pro-forma net debt will fall from $1,111m to $341m, or a multiple of 0.8 times EBIITDA.

$595m has already been raised from institutions through an entitlement offer and placement. $205m will be raised from retail shareholders through an underwritten entitlement offer.

The entitlement offer is on a 3 for 5 basis, that is, for every 50 shares currently owned, shareholders will be able to buy 30 new shares. The new shares will be issued at $1.20 per share, the same price the institutions paid. The offer is expected to open on 2 March and close on Monday 13 March. The entitlement is non-renounceable, meaning that shareholders either accept (partial acceptance allowed) or let the entitlement lapse.

A troubled company

Star’s share price graph (below) says it all. From a high of over $5.00 in 2019, it is now around $1.50, below the Covid lows when the casinos were closed.

Star Entertainment – 5 years to Feb 2023

Source: nab trade

Its problems have made headlines across all the major mastheads. These include:

- Its casino licence in Sydney has been suspended, and casino licences in Queensland have been suspended on a deferred basis. This follows the Bell and Gattison reviews respectively into its suitability to hold a licence after allegations of money laundering, fraud and criminal infiltration. In Sydney, The Star is currently managed by an appointee of the NSW Independent Casino Commission;

- Pecuniary penalties of $100m in NSW and Queensland have been imposed;

- Ongoing regulatory investigations, reviews and compliance;

- Civil penalty proceedings have commenced against the Star and former directors/staff by AUSTRAC;

- Four separate class actions have been filed by disgruntled shareholders;

- A proposed increase to casino taxes in NSW from FY24 is estimated to cost Star $100m pa;

- Mandatory carded play and cash limits in NSW from August 2024;

- Increasing competition from Crown Sydney;

- Delays and cost blowouts to the Star’s flagship project in Brisbane, the new Queens Wharf Brisbane; and

- A stretched balance sheet and breach of debt covenants (which appear to have been mitigated now by the capital raising).

As part of the investor presentation for the capital raising, there are 14 pages of tiny fine print covering the specific risks to Star’s business. Add in another 12 pages of general, market and macro-economic risks, the 26 pages must be close to an Australian record!.

But it is not all bad news for Star. The Gold Coast and current Brisbane Casino are trading well, with the last half year showing revenues up 30% and 9% on pre-covid levels. Sydney was still down 14% on pre Covid levels.

Overall, Star reported a net loss of $1.3bn for the half year. But that included a write-down on the Sydney casino of approx. $1bn. On a normalised basis, Star achieved EBITDA of $200m, EBIT before significant items of $99m and NPAT before significant items of $44m for the half year.

Looking ahead, Star has guided to underlying EBITDA in the second half of $330m to $360m. The guidance includes estimated remediation costs of $35m to $45m.

Strategically, Star says its priorities are:

- Comprehensive and urgent focus on remediation actions to align with the requirements of regulators, return to suitability and regain trust;

- Exploring portfolio optimisation strategies to optimise the capital structure and unlock shareholder value;

- Refocus on its competitive positioning and operational efficiencies to improve Sydney earnings. With the efficiencies, targeting $40m of cost on an annualised basis;

- Deliver Queens Wharf Brisbane (phased opening from December 23), and

- Continue to drive growth at the Gold Coast integrated resort (second tower to open in 2024).

What do the brokers say?

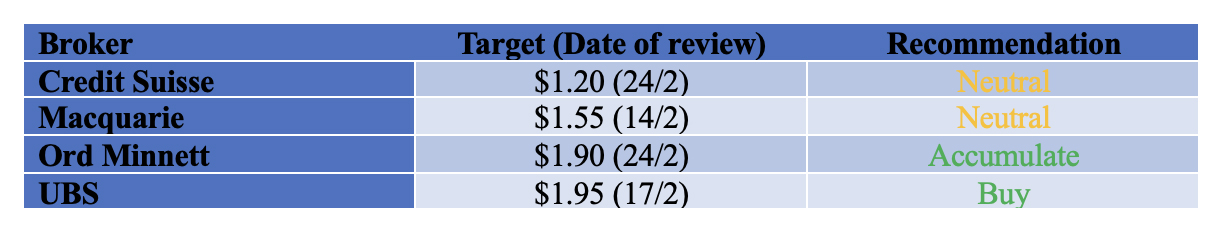

The major brokers are generally supportive of the stock, as shown in the table below from FN Arena.

Credit Suisse and Ord Minnett have both updated their target price following the capital raising. Credit Suisse is “neutral” with a target of $1.20, while Ord Minnett says “accumulate” and has a target price of $1.95.

Bottom line

I am with the market and think that to invest in this is a bit of a “no brainer”. Shareholders don’t need to decide for another week or so – and a lot can happen in a week – but my sense is that the $1.20 issue price will be the “low” for Star.

I can’t see the NSW Government forcing Star to surrender its Sydney licence – the Star in Sydney is too important to the NSW economy and there are too many jobs at risk. So if CEO Robbie Cooke and his team stay focussed on implementing the remediation actions to support return to suitability and regaining community trust, they will be allowed to get on with the business. The same goes in Queensland.

I am not expecting Star to shoot the lights out in the short term, but over the medium term, this will prove to be good buying. Income focussed investors should note that Star has suspended the payment of any dividends until its meets certain leverage targets – it might be some years before the payment of a dividend comes back on the agenda.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.