There are three ways to play the current stock market. Firstly, you can punt on a product that helps you short the market, but how much lower can the overall market go?

The second way is to buy ETFs for the Oz and US markets and play the waiting game, which means you could easily lose 5% before the market takes off sometime in the December quarter, rolling into 2023.

Or, thirdly, you could do nothing and wait for October 13, when the next CPI for the US is released. If the number is a better-than-expected result, then stocks would start to climb the wall of worry but there won’t be a real take-off until Wall Street thinks the Fed’s interest rate rise program and its inflation-killing obsession has or is about to be finished.

A good number on October 13 would put a floor under the sell-off of stocks but there would have to be a succession of falling inflation figures before a really sustained rise of stock prices and related indexes happen.

A good inflation number in October would mean you might miss the first few percentage gains for stocks, if you haven’t established a position beforehand, say in an ETF for the S&P/ASX 200. However, it could easily be the start of something great for investing in shares, especially if the inflation data keeps trending down. So you could jump on board after the October number and ride the market up.

But what’s the likelihood that the next US inflation figure will be a good one? It’s hard to second-guess what any statistic will do, but on Saturday I showed you what AMP’s Shane Oliver observed. Let me recap.

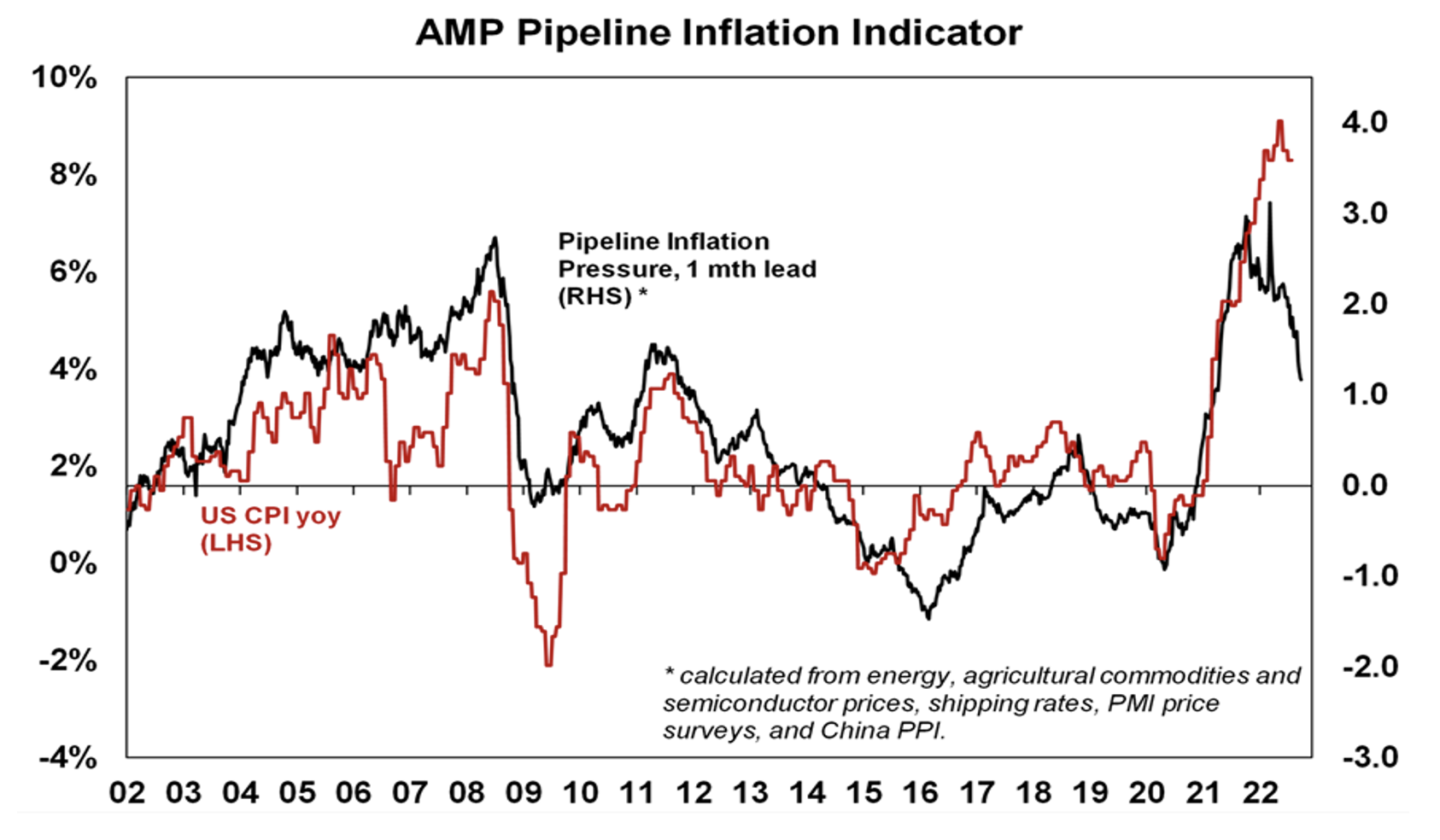

This is what Shane explained: “While inflation is still too high for the Fed and other central banks, there remain snippets of good news and reason for optimism on a 12-month horizon. Our Pipeline Inflation Indicator continues to slow suggesting that inflation will fall faster than the Fed is now expecting, inflation expectations outside of Europe have fallen and Canada has joined the US in showing signs of peak inflation.”

And he added this: “The bottom line is that while short-term inflation remains high, these considerations are consistent with the US having reached peak inflation and point to sharply lower inflation ahead which should enable central banks to slow down the pace of hiking by year-end hopefully in time to avoid a severe recession (except perhaps in Europe).

“If this applies in the US, then Australia should follow as its lagging the US by about six months with respect to inflation. For this reason, while shares are likely to fall further in the short term, we remain optimistic on shares on a 12-month horizon.”

This chart of Oliver’s shows how his Pipeline Indicators are telling us that inflation is falling, but the CPI isn’t showing it yet.

Official statistics often are slow to pick up what’s going on in the real economy. If you want stocks to go up — and most of us do — then we need to see some decent progress on the Fed’s inflation-fighting front.

So are there other optimists out there anticipating a change of sentiment sooner or later?

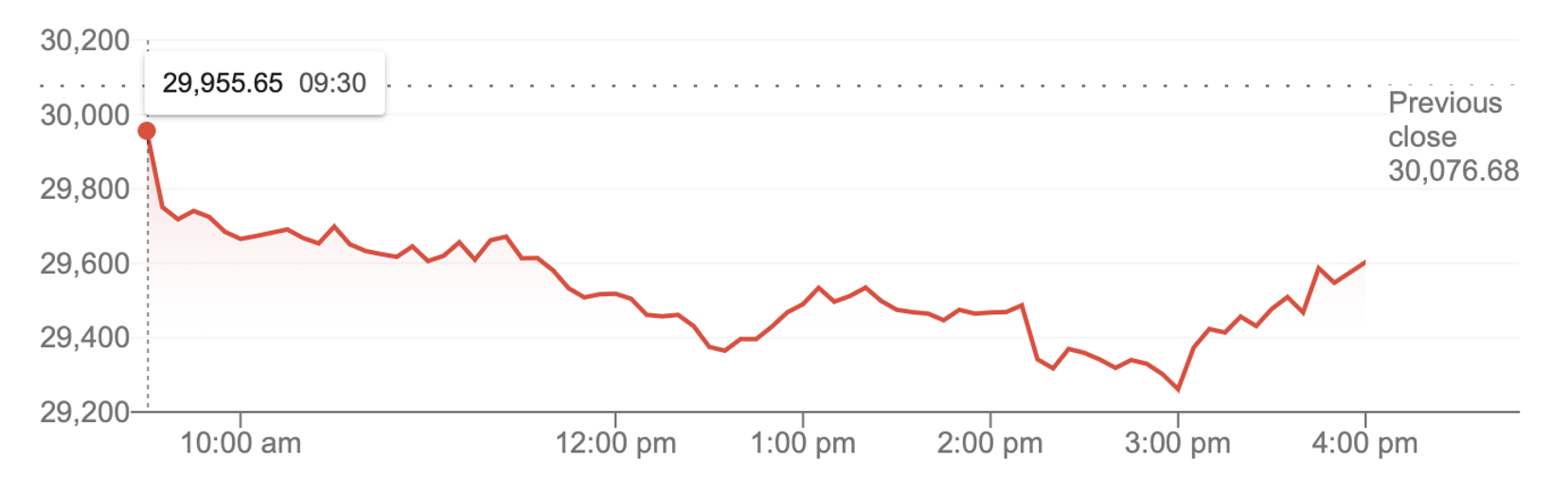

Yep, and we saw that on Saturday morning our time and Friday afternoon US-time, when the Dow staged a late comeback, as this chart shows.

Dow Jones Composite

That kick-up of stock prices between 3pm and 4pm could only be driven by dip-buyers, who had sifted through the damage of the sell-off to pick out the companies that had been crazily sold off. And remember in the age of the ETF, when someone wants to exit the market, good and bad companies in these index-based ETFs, such as the S&P500 and S&P/ASX 200, get sold off even if the companies’ individual outlooks are OK or even great.

This is the time to look at companies that have been unfairly smashed. One that springs to mind is Xero (XRO).

The consensus price target is $97. Xero is now at $79.15. Morgan Stanley thinks the current price is 93.39% lower than what it will be down the track.

Xero Limited (XRO)

Over the next couple of weeks, before October 13, I’m going to be looking for quality companies that have been caught up in this temporary drama for stock markets.

And if you want another one, try CSL (CSL)

With the average rise tipped to be 16.8%, I hope Citi is more on the money with a forecast of $340 (or a 22.24% rise) ahead.

CSL Limited (CSL)

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.