Before I assess what we learnt this week and how we should be reacting with our investments, I’d like to remind you what Warren Buffett once observed. “The most important quality for an investor is temperament, not intellect.” I’ll return to this later.

As to what has happened and what might happen, we face another big week for the market. Uppermost in your mind right now must be how you might invest, with the US banking crisis now migrating to Europe, thanks to Credit Suisse’s second-rate performance. It has resulted in a 3.9% loss for European stocks over the week, which means it was the worst result since September 2022.

Given how Wall Street finished on Friday, I must argue that there doesn’t seem to be enough bright spots for me to suggest that now is the time to be “greedy when others are fearful”, as Warren Buffett might advise.

Personally, I want to be a buyer so I can benefit some time later in the year or maybe even in 2024, so I’m on the lookout for good companies that are victims of the current high anxiety on financial markets.

What has to be the biggest worry is that despite announcements that Credit Suisse and First Republic Bank (another significant bank in California, where the Silicon Valley Bank is based) would receive financial help designed to prevent a crisis in the banking sector, the market sold these stocks off on Friday.

First Republic’s share price dropped 33% on Friday and has given up 72% for the week, which doesn’t say much about the market’s trust in the big rescuers of that bank, spearheaded by J.P. Morgan’s CEO Jamie Dimon. This rescue group banked US$30 billion of deposits in the troubled bank to prove how trustworthy the business was but Wall Street wasn’t buying it, as the 33% sell off for the bank’s share price on Friday shows.

Credit Suisse fared better, only losing 8% on Friday and 26% over the week, which says more about the Swiss National Bank that has vouched for the soundness of Credit Suisse, despite the bank’s embarrassing business track record for quite some time.

This from Frédérique Carrier, head of investment strategy for RBC Wealth Management, sums up a lot of the thinking on dodgy-looking banks right now: “Whether depositors are sufficiently reassured to stem outflows over the next few days is a key question, in our view. While markets are relieved that the Swiss central bank stepped in, sentiment is bound to remain very fragile, particularly as investors will likely worry about the eventual economic impact of aggressive monetary policy tightening by the European Central Bank.” (Reuters/CNBC)

So, we have the nagging doubts over the soundness of some (or even many) banks, which to date haven’t called for help, confronting historically aggressive central banks determined to kill inflation. And we’re not sure about how many risks these central bankers are prepared to take to beat inflation.

That’s not great for investing confidently now. There are hopes that central banks might hold fire, while question marks hover over the global banking system. But the European Central Bank’s Christine Lagarde made it clear with her 50-basis point rise this week that she’s not for turning from her quest to tame the inflation dragon.

That didn’t help optimists/bulls who are wondering if this hopefully temporary banking problem is a buying opportunity. Hopes were raised when the founder of Scion Asset Management, Michael Burry, said he expected the unfolding banking crisis to be over soon without severe damage.

Burry was the short seller who starred in the book and film called The Big Short, when he bet against US banks and their high debt exposure to very risky lending products, which made him very rich when the GFC smashed financial markets, as well as bank share prices.

But big call merchants aren’t infallible, and right now the market is erring on the side of caution, so this week’s revelations will prove important. So, what am I watching?

On Thursday we hear what the Fed will do with interest rates. The market expects a 0.25% rise but would love a pause, though if the Fed does pause, the market could say: “What do they know that we don’t know?” Right now, the flow of US economic data isn’t saying inflation is on the slide fast enough to justify a pause but there is one legitimate case for pausing.

While interest rate rises scare those with debts or those who might want to borrow, a banking crisis potentially scares everyone. This has increased the chances of a recession in the US and that will stop inflation in its track, as unemployment surges.

This explains why BHP fell 4.89% last week, as many thought the banking issues would delay the global recovery. It led to many factoring in an earlier arrival of interest rate cuts. That’s why tech stocks such as Microsoft rose 12.88% last week. And it’s why Xero put on 4% over the week and probably why it’s up 16% over the month. One day rate cuts will come and tech stock prices will head up.

The longer-term investors are positioning their portfolios for the future. It’s why a US contributor/financial adviser on CNBC nominated BHP as one of her best buys right now. She was planning for the future and liked its diversified portfolio of resource businesses. She also thought that lower rates and an eventual global economic rebound, even if it’s coming out of a recession, would help our big miner. She’s in agreement with Macquarie, which thinks that there’s a 20% upside lying out there for the company. In contrast, UBS tips a 10% slide for the miner and Ord Minnett sees an 8% slide ahead.

But wait there’s more with the tech stock purchasing this week, once again showing us what will happen when interest rates are on the way down. Remember, the banking crisis led to thinking that this could mean an end to rate rises and an earlier start to rate cuts.

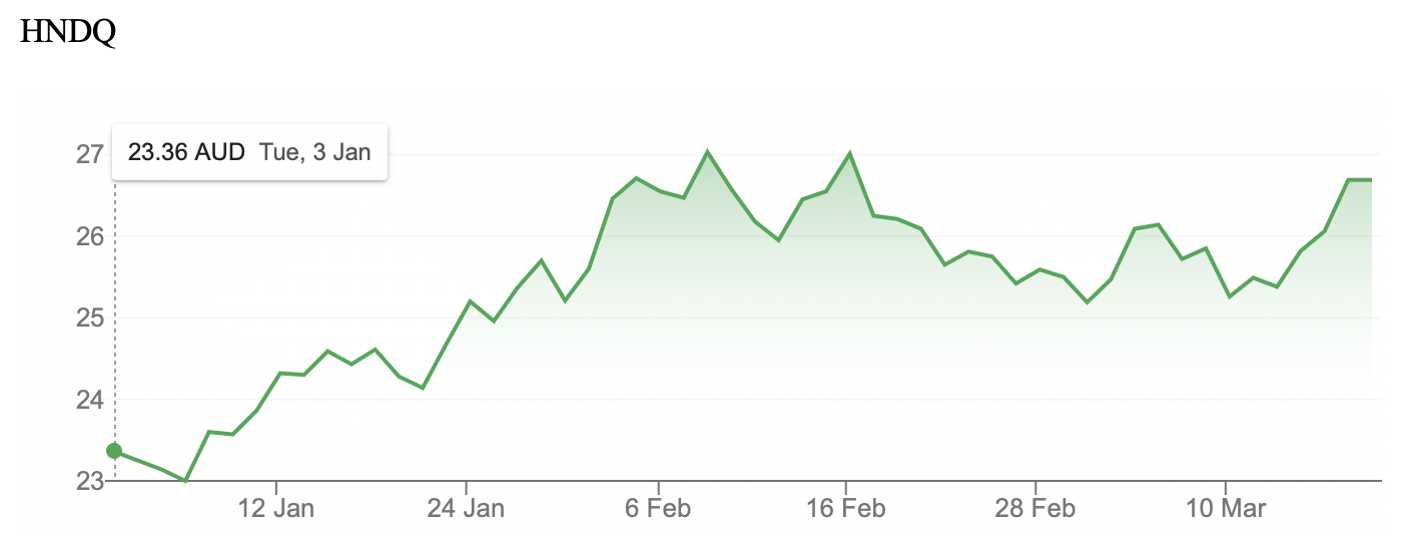

HNDQ is an ETF that I recommended late last year. It’s a hedged investment on the top 100 stocks in the Nasdaq Composite and has had a nice run up year-to-date, rising 14.26%.

Of course, if rates keep rising and a banking crisis leads to a deeper-than-expected recession, something like HNDQ could fall again before an eventual rebound when rates fall and growth picks up.

That said, no one knows how this will play out, or what the Fed and other central banks are thinking right now. That’s why the Fed meeting on Wednesday US-time will be critical to what markets do in the week ahead. And what comes out about the banks will be a big market mover as well.

Back to Buffett. When he said: “The most important quality for an investor is temperament, not intellect,” he was saying that a disciplined investor is a wealthy investor because they have learned that market fluctuations are normal and that patience pays off.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances