Experts who care about heady matters such as Australia’s AAA credit rating say we could be downgraded because of Treasurer Josh Frydenberg’s very generous Budget last Tuesday night. Those organisations such as Standard & Poor’s could be toying with the idea of taking us down a notch to AA+. However the only AAA issue I care about is when my three holdings (Appen, Altium and A2 Milk) will start justifying my confidence in these stocks.

All three companies have broader headwinds that are hitting their share prices.

Appen and Altium are tech stocks that have been challenged by the business unusual conditions brought on over 2020 with the Coronavirus. As normal business life is back and happening, it was expected that these companies’ share prices would improve.

They’ve also copped the negativity from the crazies on Wall Street who have been over-worrying about inflation and rising interest rates, despite what the Fed has been telling them, which has made them sell off tech companies. And because our momentum fund managers play ‘follow the leader’ with the New York Stock Exchange and the tech-heavy Nasdaq exchange, when they sell, we sell.

This is what CNBC saw on Friday in the US: “S&P 500 jumps 1.5% Friday as Big Tech rebounds…”. And we have played ‘follow the leader’ today.

On the other hand, A2 Milk has some internal company matters that haven’t helped. And it misses the daigou shoppers who buy baby formula here to peddle back home. China and its population never cease to amaze me! A2 Milk also could be affected by the simmering nastiness between Canberra and Beijing, even though A2M is actually a Kiwi company!

Let me be honest, these companies combined might be less than 2% of my portfolio and are meant to give my solid blue-chip holdings (that pay plenty of income) some alpha returns over time.

And that’s the important issue — time. I want to hazard a guess as to when we should see a rebound in these quality companies’ share prices.

Let’s see what the short-term analysis is saying from the experts surveyed by FNArena.

Company Analysts’ view

1. Appen +102%

2. Altium +40.3%

3. A2 Milk +14.2%

Let’s kick off with Appen

Let’s start with this tech stock and see how far this company has dived.

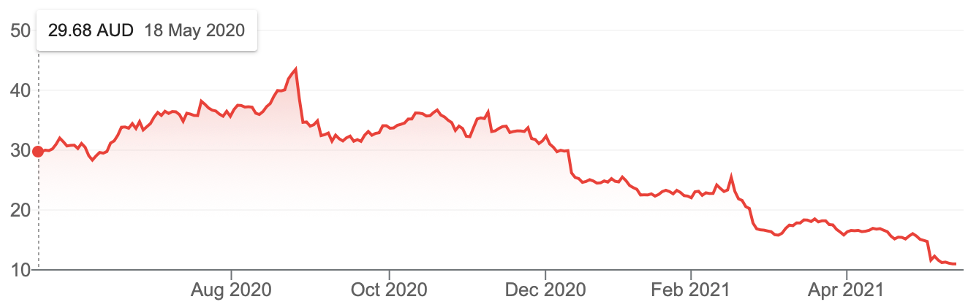

Appen (APX)

It’s now an $11 stock, but in August last year it was $43! Out of the five analysts surveyed (who let’s face it would’ve looked pretty closely at the company’s key indicators), none were sellers.

The lowest target price was $16 and the highest was $30.90. A further three out of the five have a target price ranging from $19.50 to $24.75. Meanwhile, two have “buy” signals on it, while the other three are “neutral”, with one moving from “underperform to neutral”.

On these views alone, APX looks like an easy hold. And if you’re ‘Appen-less’, it might be worth a punt.

What about Altium?

Let’s now put Altium under the microscope. Here the analysts are much more ‘hot to trot’ to support this maker of printed circuit boards and other software products.

Altium (ALU)

This five-year chart shows what this company has done until along came the Coronavirus. The experience has not been good for the business. This is a standout business that looks like it will be a rebounder when business gets back to normal. That’s when the former uninterrupted supply of silicon chips might return and ALU could be a beneficiary.

This is what the analysts think about the company with a share price at $24.16:

- All four out of five have a “buy”, an “outperform” or “overweight” rating on the company.

- The remaining expert is “neutral” but even that analyst has a target price of $30. That implies a 24% gain!

- The range of target prices is $30 to $37. If the latter number is right, it would mean a 53% gain.

What about A2 Milk?

For non-holders of APX and ALU, these two stocks look a lot easier to buy sooner rather than later but I can’t say the same about a quality company such as A2 Milk.

Seriously, this was once the darling of the funds management fraternity, even with the frostiness of the China leadership over the past few years, thanks to the poking of ‘panda’ by former US President Donald Trump and then the piling in from the likes of ScoMo.

But A2M’s biggest challenge has come from international border closures and the smashing of travel plans, especially for Chinese tourists who stampeded into Australia.

If the PM and President Xi could ‘kiss and make up’ and vaccinations were so good that we could see the comeback of Chinese tourists and students, then I think A2M’s share price would be on the comeback trail.

But when will that happen?

The longer this outcome fails to show up, the slower will be A2M’s price rebound. There’s talk that local substitutes are eating A2M’s lunch, but the story I keep getting from Chinese experts is that if given a choice, the ‘suspicious’ Chinese consumer would prefer overseas-made baby formula because they trust the health standards outside their own borders. Do I have to mention snakes, bats and a ‘little’ thing called the Coronavirus?

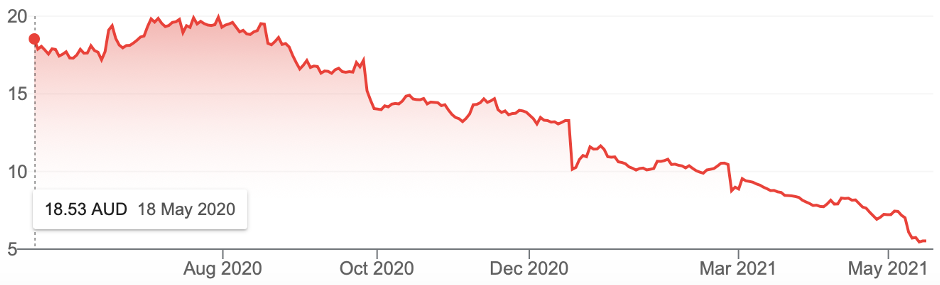

A2 Milk (A2M)

This once $20 company (less than a year ago) is so significant that there are seven analysts surveyed. This is the summary for a stock now priced at $5.53:

- Two out of the seven say “add” or “buy”.

- Four out of the seven say “sell”, “lighten” or “underperform.”

- The highest target price is $7.70. Even that analyst is the one advising: “Downgrade to lighten from hold.”

When will Chinese tourists return?

If I was asked how long before we see the old tsunami of Chinese tourists, I’d say one year at best, but I bet it’s at least two years or more! Unless A2M’s CEO David Bortolussi can pull a rabbit out of his hat any time soon, the best reason for a spike in the share price might be a takeover offer from a huge company like Nestle, who could see A2M as desperately and temporarily undervalued by the market.

Of course, the market is driven by shorter-term horizons but in the fullness of time I bet A2M is worth a lot more than it is now. The question is: “How patient are you and are you better off buying something else now and hopefully get on board with A2M when it’s ready to trend higher?

This is an A-stock that probably has a B-grade future in the short term.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.