Australian banks have had an interesting time on the ASX this year.

For the first few months, they were relative outperformers. Then in April/May, the market got bearish on banks as the mantra “bank earnings have peaked” took on currency. As we went through the horror months of August, September and October and followed Wall Street down, bank shares outperformed in a relative sense. Institutions, loaded with cash, didn’t want to touch small or mid-caps, let alone “growth” companies, and the money went back into banks. And then came bank reporting season that kicked off with Westpac on Friday 3 November. This disappointed, leading to further selling .

To Friday, the ASX 200 (including dividends) is showing a positive return in 2023 of 3.43%. The financial index (which is mainly the banks but also includes the insurers that have tended to outperform) is returning 2.09%. So in 2023, the banks have marginally underperformed.

Where do banks head from here?

Let’s start by looking at the key take aways rom Bank reporting season, the individual bank results and what the brokers have to stay.

Key take aways from bank reporting season

Each of ANZ, NAB and Westpac reported FY23 financial results. CBA, which balances on 30 June, reported its 1Q (first quarter) earnings. Summarising these reports, the following themes emerged:

- Overall, profit results “missed”. Not big misses, but below analysts’ expectations;

- Sequentially, second half (2H) earnings were weaker than first half (1H) earnings. This was due to lower net interest margins and higher costs;

- The net interest margin continued to fall. This was more pronounced for banks competing in the home loan market, and for retail divisions compared to business bank divisions;

- Expenses rose. Despite having “productivity programs” and commitments to keep expenses flat, pressure on wages caused most banks to report sequential expense growth of around 3%;

- Volume growth was low, non-interest income was flat to down;

- Bad debt expenses reduced (lower than the first half). Up on the corresponding period in FY22, but by historical standards, still relatively low;

- Capital ratios are strong, allowing banks to announce/continue buyback programmes; and

- Dividend payout ratios remain high – dividends met or very marginally exceeded analysts’ forecasts. This is due to their capital strength, solid provisioning and absence of bad debts.

Westpac, NAB, ANZ and CBA.

Westpac was the first to report. The positives included the announcement of a $1.5bn on-market share buyback and volume growth in home loans.

On the negative side, 2H underlying profit was down 7% on the 1H (from $3,823m to $3,545m), expense growth in the 2H was up 5% on 1H, core NIM was down 6bp and the exit NIM of 1.81% was 3bp lower than the average of the 2H. Westpac also announced increased investment in technology to grow and support the busine. While this should be a positive long term, the expected annual cost of $2bn plus delivery track record means short term risk.

NAB was next, reporting a tough 2H across all divisions with a 10% decline in profit ($3,661m for 2H cw $4,070m for 1H). NIM fell by 7bp in the half year, with expenses increasing by 3.2%. NAB is focussing on business and private banking, electing not to compete in the mortgage wars by paying “cashbacks”. It reconfirmed its on-market buyback announced in August ($1.2bn still to be completed).

ANZ was expected to be the “star” of reporting season, but underwhelmed in part due to the impact on profits from participating in the mortgage wars. It did report mortgage growth of $11bn in the half year, but profit fell by 6.2% from $3,821m to $3,584m. In Australian Retail, cash profit declined by 17.3% compared to the first half.

A “surprise” from ANZ was that the final dividend of 81c was only partially franked (65%). Although this had been telegraphed some time back, ANZ elected to pay a special, unfranked dividend of 13c per share to make up for the franking change.

CBA’s quarterly profit of $2.5bn was in line with expectations and flat to the previous quarters. As a trading update, only limited information was provided.

What do the brokers say?

The table below shows by bank the recommendations and target prices from the six major brokers.

Overall, the major brokers are neutral to marginally negative on the sector. ANZ has two “buy” recommendations and Westpac one, but otherwise, all recommendations are “neutral” or “sell”.

The brokers are negative on the CBA (as they have been for many years), feeling it is way over-valued compared to its industry peers. They see most potential upside in ANZ, but at 9.7% (target price $26.27, last ASX price $23.95), it is not that material.

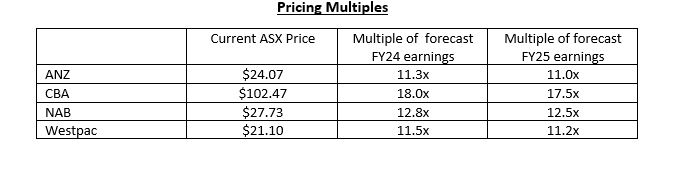

Looking at forecast earnings and current ASX prices, the banks are trading on the following multiples:

Bottom line

In a low credit growth environment with competitive pressures on the net interest margin, it is almost impossible for the banks to grow profits. There are opportunities to cut costs, but these have proven to be hard to realise. On a positive note, there is no real pressure on bad debts, but the risk remains that these rise over time.

In this environment, low single digit profit growth is the best that can be expected. More realistically, flat to marginally negative profit growth.

Dividends will stay reasonably attractive and secure, so income investors will continue to seek out the banks. However, there is no point obtaining income if the capital price falls.

I am not expecting bank share prices to fall, but I am also not expecting them to go for a strong run. In a “bull” market, I think they will underperform. Conversely, in a down market similar to September/October, I think the better names (e.g. CBA) will attract buyer support.

I am easing back on my bank investments (largely by not committing new monies). I think a more market weight tending to marginally underweight position is the way to go.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.