It was always predictable that a tough-talking Fed boss was always going to inspire some investors to take profit on shares that have rebounded strongly since early October, but be aware that many sellers today will be buyers in the not-too-distant future. They could be driven to sell today because of so-called recession speculation but if that economy-guessing proves to be wrong, that’s when buying will happen big time.

By the way, don’t rule out a usual Santa Claus rally in the week or so ahead — Americans love Christmas!

Overnight the market negativity (which was created by Powell with his understandable jawboning to stop a big rally before inflation really falls) continued. However, the most important comment he made was not about future rate rises but that the Fed’s interest rate actions will be data-driven. Remember, this week’s sell-off has been because US retail sales came in lower than expected, which then ramped up fears about a recession sooner and deeper than expected.

But let me warn you, after three decades of teaching and writing in major newspapers and websites on the economy, this recession forecasting is guesswork.

Economists and market heavyweights, including the bond market, have predicted eight of the past two recessions!

If you need proof about the ditsy nature of market ‘experts’, look at this week. The following comes from CommSec’s Ryan Felsman, who was on US market watch for the online broker this week:

- “US share markets climbed on Tuesday, led by rate sensitive megacap stocks, after a smaller-than-expected rise in US consumer prices raised hopes that the US Federal Reserve could soften its aggressive stance on interest rate hikes. Shares of Meta Platforms (4.7%) and Google-parent Alphabet (2.5%) both rose.”

- “US share markets fell sharply on Thursday after the US Federal Reserve’s guidance for protracted policy tightening reduced hopes of the rate-hike cycle ending any time soon and increased worries about a potential recession… Megacap technology shares Apple (-4.7%), Alphabet (-4.4%), Amazon (-3.4%) and Microsoft (-3.2%) all weighed on major indexes.”

In the space of two days, Megacaps were loved and despised all on second-guessing what the Fed will do and what data will do.

I don’t know what will happen with data and the Fed but I will make more money buying the stocks that will spike, even late in 2023 or early 2024, by buying them when the market irrationally sells off.

If you need more proof of how fickle and unreliable market-guessing can be, Meta (that’s Facebook’s new public face) saw its share price spike overnight, after JPMorgan upgraded teg stock from neutral to overweight.

This from Bokeh Capital founder Kim Forrest sums up the view of Wall Street players now: “At the beginning of the week, we had the hope, given the very soft CPI number, that we could expect the Fed, and maybe the other central banks of the world, to be less hawkish…but because they didn’t, and they had some stern words for investors and consumers alike that they were really focused on getting inflation down quickly, that has taken away a lot of our hope for a soft landing.”

Like Mr Powell, I’ll be closely watching data but I’ll also be taking the words of Warren Buffett seriously to be “greedy when others are fearful” because I invest long term. Sell-offs coming out of recession talk don’t spook me as I think if a US recession happens, the rise in unemployment could be one of the smallest ones ever seen!

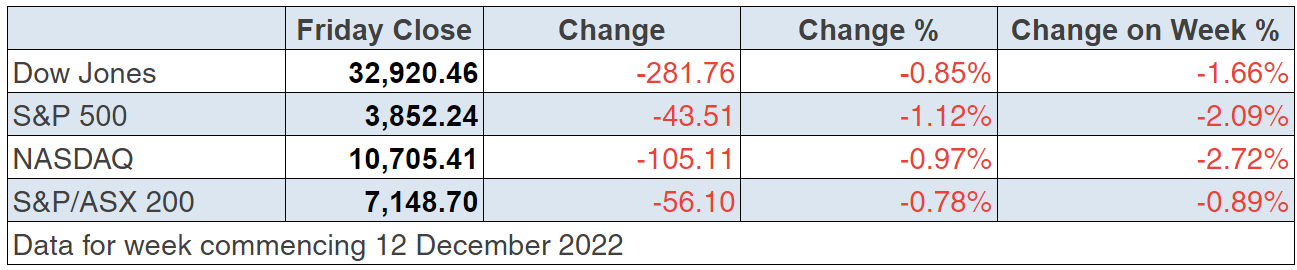

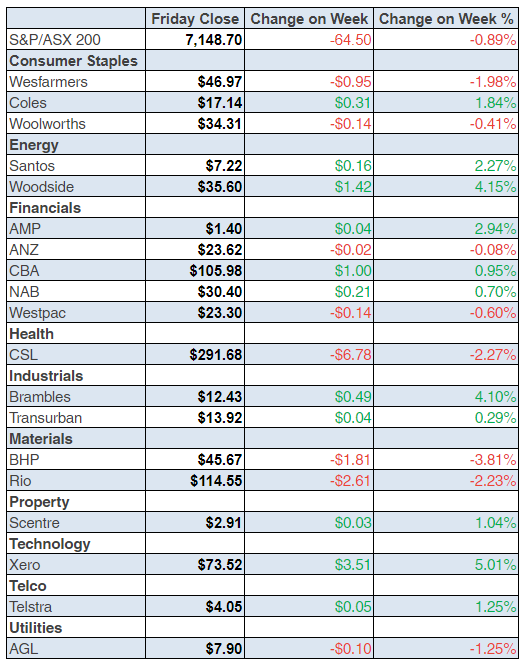

To the local story and the S&P/ASX 200 index lost 0.9% for the week but to keep it in context, our market is up 10.3% since October 3, while the Dow is up 15.5% September 30. That’s why recession talk in the US had to lead to some profit-taking.

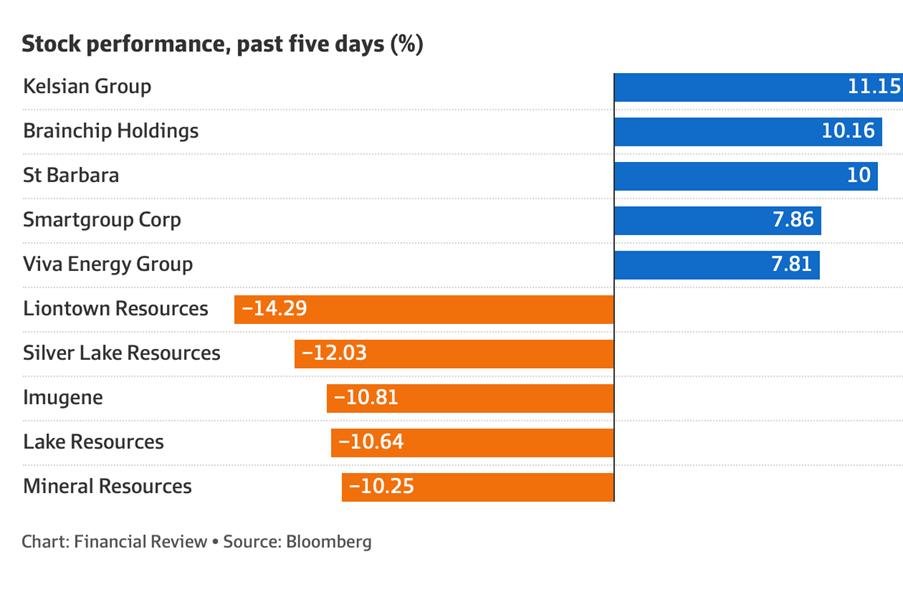

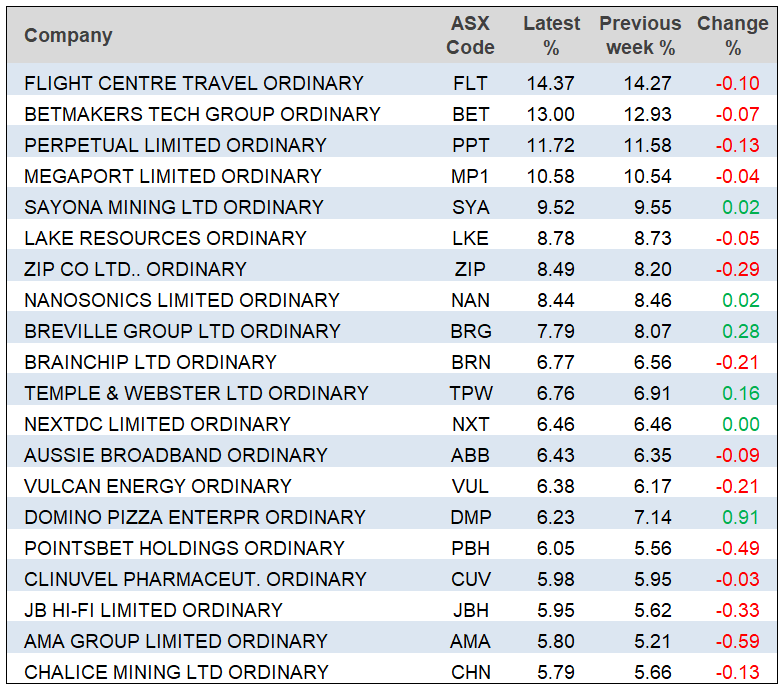

Here are the big winners and losers for the week:

Modern day resource companies are on the outer after Goldman Sachs slagged many lithium players except Allkem, which was only down 4.33% for the week to $12.36, while Pilbara Minerals was off 7.66% and Lake Resources lost over 10%.

Iron ore miners were less despised on a more positive China economic comeback story, with BHP down only 2.79% for the week to $45.67. Rio lost 2% to $114.55 and Fortescue lost 4.69% to $20.13 but is up over 8% for the month.

Banks had an OK week, despite a weaker performance on Friday. The CBA made 0.93% over the week after losing 0.77% on Friday, thanks to recession fear talk in the US. NAB was up 0.63% for the week to $30.40, but Westpac lost 0.68% for the week to $23.30, while ANZ was up 0.51% for the five days trading to $23.62.

What I liked

- The Westpac-Melbourne Institute consumer confidence index [1]rose by 3% in December to 80.3 points (long-run average: 101.2 points). A rise from a low level helps keep me believing that we can dodge a recession.

- The NAB business confidence index fell from -0.2 points in October to an 11-month low of -4.4 points in November (long-run average: 5.3 points). Business conditions eased from 22 points to 20.3 points (long-run average: 6.3 points). These were OK readings for the fight against inflation, without creating a recession.

- The CommBank (CBA) Household Spending Intentions (HSI) Index [2]rose by 1.9% in November, with the annual rate of increase dropping to 3.2% from 7.5% in October. This is a good development for inflation reduction.

- The workforce participation rate rose from 66.6% in October to an equal record high of 66.8% in November. Hours worked fell by 0.4% in November.

- The US Federal Reserve moderated the pace of rate hikes from 75 basis points to 50 basis points, raising the target range for the federal funds rate to a 15-year high of 4.25%-4.5%.

- In US economic data, the consumer price index (CPI) rose by 0.1% in November (survey: 0.3%). Annual growth eased from 7.7% to 7.1% in November (survey: 7.3%), its lowest level since December 2021. The core CPI (ex-food and energy) lifted 0.2% in November (survey: 0.3%). Annual growth of the core CPI fell from 6.3% to 6% in November (survey: 6.1%).

- In US economic data, consumer inflation expectations for the year ahead fell from 5.9% in October to 5.2% in November, the lowest level since August 2021 (survey: 5.8%).

What I didn’t like

- Employment rose by 64,000 people in November (consensus: 19,000), with full-time jobs up by 34,200 and part-time jobs up by 29,800. This number is good for the economy but bad for inflation-killing.

- US retail sales slid 0.6% in November (survey: -0.2%) and were seen as possibly telling us that a US recession is likely.

- Megacap technology shares Apple (-4.7%), Alphabet (-4.4%), Amazon (-3.4%) and Microsoft (-3.2%) all weighed on major indexes. At the close of trade, the Dow Jones index fell by 764 points (or 2.3%), its worst day since September. The S&P 500 index lost 2.5%, with the Nasdaq index down by 360 points (or 3.2%).

- TheEuropean Central Bank (ECB)hiked its benchmark policy rates by 50 basis points. The Deposit Facility Rate lifted to 2%. And the Bank of England (BoE) lifted the Bank Rate by 50 basis points to 3.5%, its highest level since 2008. The EU and the Poms have to be careful with such a weak economy.

- The US central bank also projected at least an additional 75 basis points of rate hikes by the end of 2023, which suggests that the Fed is going too hard.

On Monday

Our last Switzer Report for this year happens on Monday. For my contribution, I’ll look at what stock markets do in a US recession and how I think 2023 will play out. I’ll also tell you what I’m going to do to make money in what’s bound to be a tricky economic and market year.

The week in review:

- In this week’s Switzer Report, I talk about how this is the biggest week of the investing year: with critically important economic revelations set to drive stocks down hard or create a surge that could morph into the mother of all Santa Claus rallies. Here’s my take. [3]

- Paul Rickard discusses some shares that he thinks would be perfect gifts for your kids or even grandkids: with Christmas approaching, the idea of investing for your kids or grandchildren maybe something you should be considering. [4]

- Tony Featherstone in his first article tells us about 3 unpopular contrarian ETFs that could be good investments for 2023: The good news is that parts of the ETF market look far more interesting after heavy price falls, at least for prospective investors. Here are three contrarian ETF ideas for 2023. [5]

In his second article Tony shows us two IT service stocks which are well placed for 2023: here are two other ways to play the tech services trend in 2023 [6] as companies invest more to digitise operations.

- James Dunn in his two articles discusses his 3 small cap picks and 3 specs for 2023: I’ve been trawling through the ASX’s small caps. There’s a lot of interesting stories there – and here are my 3 small-cap picks for 2023. [7]

I think investors like the occasional ‘punt’ on the share market – so I’ve scoured the ASX for 3 potential high-reward stocks for 2023 [8] (and longer-term than that).

- In our “HOT” stock column today, MD of Fairmont Equities Michael Gable tells us why he likes BlueScope Steel (BSL). [9]

- In Buy, Hold, Sell – Brokers Say, there were 2 upgrades and 10 downgrades [10] in the first edition and 1 upgrades and 12 downgrades [11] in the second edition.

- And finally, In Paul’s (Rickard) Questions of the Week, [11] Why have IVV and IHVV shares been split? I own shares is WAM Capital – why does the share price keep falling? What are the price targets for the major lithium stocks? When do the big banks pay their dividends?

Our videos of the week:

- Chart tips for 2023, Bogdan on best stocks in his fund for 2023 + Firetrail tips for 2023 [12] | Switzer Investing (Monday)

- Boom! Doom! Zoom! [13] | 15th December 2022

Top Stocks – how they fared:

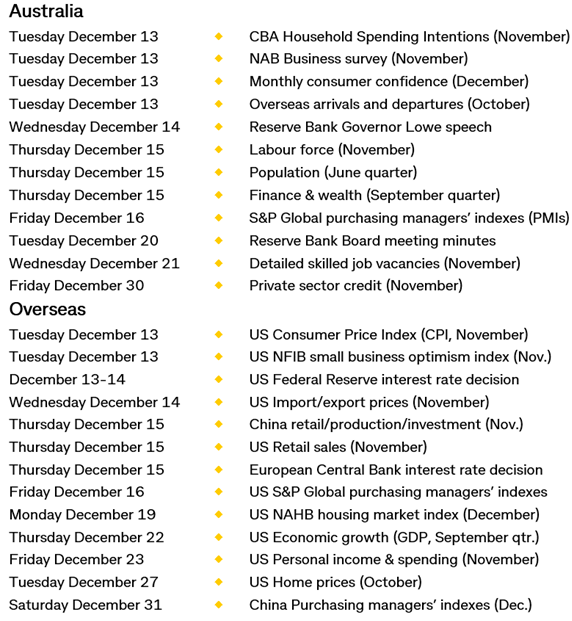

The Week Ahead:

Food for thought: “Buy when everyone else is selling and hold when everyone else is buying. This is not merely a catchy slogan. It is the very essence of successful investments.” – J. Paul Getty

Stocks shorted:

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before.

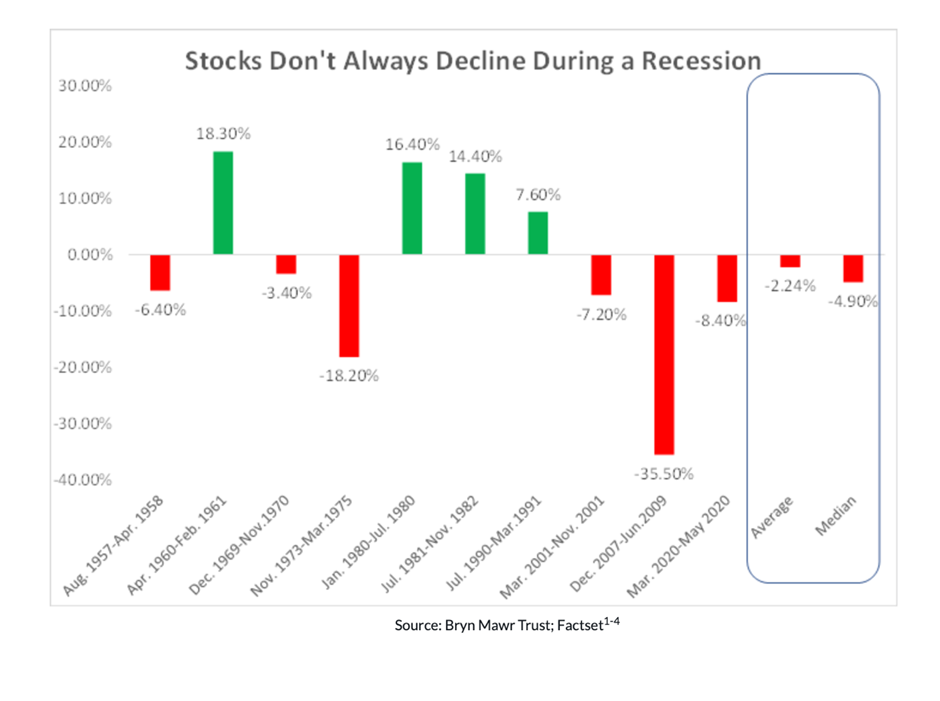

Chart of the week

1. Stocks usually decline most beforea recession hits.

The average decline for the S&P 500 during the past 10 recessions is only 2.2% while the median decline is only4.9%.

2. Stocks are sometimes upduring recessions.

The S&P 500 was positive in four of the past 10 recessions, including the early 1980s when the Fed was aggressively fighting inflation.

3. Stocks often begin to recover before a recession ends

The average return from the cycle’s peak (often before the recession starts) to the end of the recession is -15.3%, even if the average peak-to-trough decline is much larger (about 36% in the average Bear Market).

4. The average return one year after a 25% or more decline is far above average.

Since 1960, there have been eight declines in the S&P 500 of 25% or more (the current decline would make it 9). One year later, the average return is nearly23%.

And this chart shows that stocks can rise during a recession.

The sell-off we’ve seen this year was partly driven by the view that aggressive rate rises by the Fed could create a recession, and if a recession is deeper than the Fed wants, it would cut rates and stock markets would love that. Mind you, I suspect any recession we see will be mild and that could make those who’ve sold off stocks fearing a bad recession, would then become buyers, which would help stock prices in 2023.

The bottom line is — don’t let recession headlines over-worry you. – Peter Switzer, Switzer Daily

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances