The Yanks printed out a better-than-expected jobs report, with 379,000 new positions showing up in February, against the consensus guess of economists of 210,000. Meanwhile, unemployment fell from 6.3% to 6.2% but this wasn’t seen as good news by some, as this better-than-expected economic result gives that damn bond market reason to push 10-year bond yields higher.

This upward trend has explained the recent sell off of stocks, and tech ones in particular. But there’s something missing in this thinking, which creates a buying opportunity. I’ll get to that down below.

Before the close, the Dow and the S&P 500 were in the green but the Nasdaq was again in the red, as bond yields continued to sneak higher. What we’re seeing is a short-term link between rising bond yields and the dumping of tech stocks. But it’s not just that. There’s also a rotation out of tech and growth stocks into value stocks and those companies that will benefit from the reopening trade.

Locally, export-earners like CSL have currency headwinds at a time when Wall Street is going anti-healthcare, for reasons best explained by US-specific factors. And our market often plays follow the leader. That said, CSL does earn most of its money in the US but the sellers seem to be ignoring that CSL will be a beneficiary of the reopening trade and progress toward normalcy, as the vaccination programme continues.

This current anti-healthcare stance actually is at odds with what was expected at the start of the year, but more on that in my Monday story for this Report.

Of course, the big market story is the tech sell off because of rising yields in the bond market. Many of you might be wondering what the link is. Well, the success of the vaccine programme is lifting the expectation of more growth and, therefore, inflation, so the bond market is doubting the Fed’s (and other central banks) ability to keep interest rates down for as long as promised.

And this is what a more technical person might tell you: “Higher rates decrease the present value of future cash flows, making long-duration assets less attractive. Tesla tumbled more than 6% and Peloton shares fell more than 2%.”

There is an equation to work out the present value of future streams of money to a business or cashflow. What’s used is an interest rate to represent the rate of return. As interest rates rise, the present value of future money received falls. But what if the expected future cash flows are actually bigger than was initially thought? What if the US grows at 7% in 2021 rather than 5%? Well, the market could stop not only looking at rising interest rates but also what this growth does to revenues and profits of US companies.

That’s what will eventually help stock markets get over this rise in bond yields. And central banks like the Fed won’t sit by idly and let the bond market KO the stock market, confidence and the economic recovery.

This week, US Federal Reserve chair Jerome Powell reiterated his pledge to keep rates low until the economic recovery was established. “I want to be clear about this,” Powell said. Even when conditions do improve “I expect that we will be patient.”

He’s promising that the Fed won’t be trigger happy with rates as the reopening of the US economy brings some inflation. “We expect that as the economy reopens and hopefully picks up, we will see inflation move up through base effects,” Powell said during a Wall Street Journal conference. “That could create some upward pressure on prices.” (CNBC)

I’ve been in this game long enough to be mindful of that old market maxim that goes “don’t fight the Fed.”

By the way, while writing this, US stock market indexes swung strongly positive, including the Nasdaq! The power of an economic comeback eventually will trump fears about the bond market until short-term interest rates start to rise significantly.

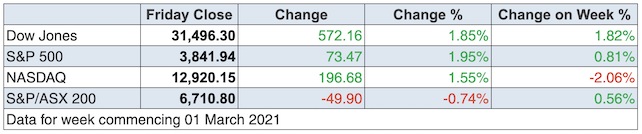

Not surprisingly, the bond market rattled the stock market this week, but the overall market sneaked in with a small gain. The S&P/ASX 200 Index was down 0.7% on Friday but was up 0.6% for the week.

It’s been a ping-pong game for stocks, with the bond market yields going down early in the week, which sent stocks up. But then yields went up and stocks went down. The potential for rising interest rates is being seen as a reason to sell off tech stocks, but there’s also a bit of profit-taking going on by big fund managers as they rotate into reopening trade stocks and those companies are seen as value trades.

Financials were up 4.78% because banks have dual tailwinds (higher rates and a booming economy) that are bound to help their bottom lines. And then there’s a belief that dividends are on the way up.

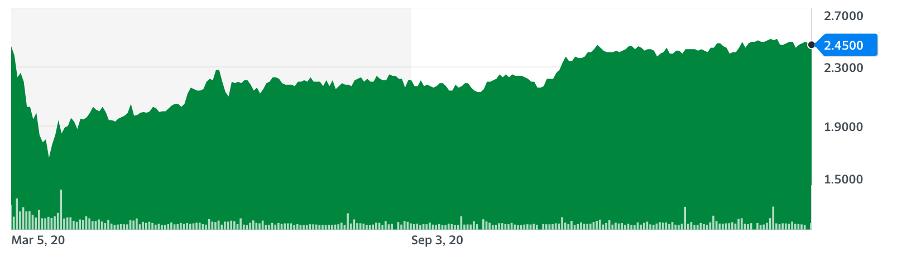

Having the Switzer Dividend Growth Fund (SWTZ), this is music to my ears and eyes, especially when I look at the chart below.

SWTZ

The fund is up 45% since the low in late March. The better the outlook for dividend payers, the better it is for a fund like SWTZ.

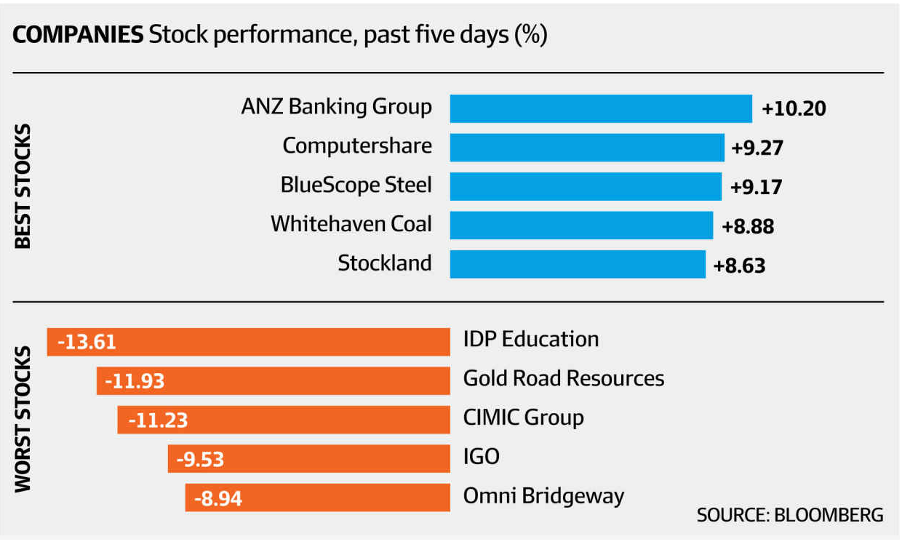

The AFR’s Sarah Taylor summed up the great week for banks this way: “The financials sector rose 4.8 per cent as ANZ shares topped the list of weekly ASX200 gainers, with its shares rising 9.9 per cent to $28.75. National Australia Bank performed strongly, moving higher by 6.9 per cent to $26.34.”

Interestingly, energy was up 2.93% for the week but materials were off 2.76%. Also tech/IT lost 2.3%, while healthcare was down 4.46%, with CSL now looking like a screaming buy at $248.58 for the long-term investor.

For those interested in the winners and losers, here’s the Bloomberg take on that story.

What I liked

- The Australian economy (as measured by gross domestic product or GDP) grew by 3.1% in the December quarter (consensus: 2.5%), after rising 3.4% in the September quarter and contracting 7% in the June quarter. It was the biggest six-month lift in GDP since quarterly records began in 1959.

- In 2020, the economy contracted 2.5% (the biggest fall since 1947) after growing 1.9% in 2019. It was a fall but a lot less than was predicted early in 2020.

- Retail spending lifted by 0.5% in January (consensus: 0.6%) to be up 10.6% on the year.

- The trade surplus rose by $3 billion to a record $10.1 billion in January (consensus: $7.5 billion surplus). Australia has posted 37 successive monthly trade surpluses.

- There was some other good news too with the share of housing and small business loans in payment deferrals falling further to just 1.8% and 1% respectively in January.

- The ISM services index in the US fell from 58.7 to 55.3 in February (survey: 58.7). The ‘final’ Markit services index rose from 58.3 to 59.8 in February (survey: 58.9) Any number over 50 means expansion.

- Planned job cuts in the US, as measured by Challenger, slumped from 79,552 to a 14-month low of 34,531 in February (survey: 72,000).

What I didn’t like

- Company operating profits fell by 6.6% in the December quarter but were still up 15.1% on the year. Profits hit a record $439.9 billion in calendar 2020, so this dislike isn’t terrible but I want to see business investment kick up soon, and profits are important for that to happen.

- ADP private sector payrolls rose by 117,000 in February (survey: 177,000).

- The US Federal Reserve Beige Book reported that economic activity expanded modestly from January to mid-February. Most districts reported that employment rose, albeit modestly. Given the infection rates in the US, I guess this reading isn’t all that bad but it’s not an impressive result.

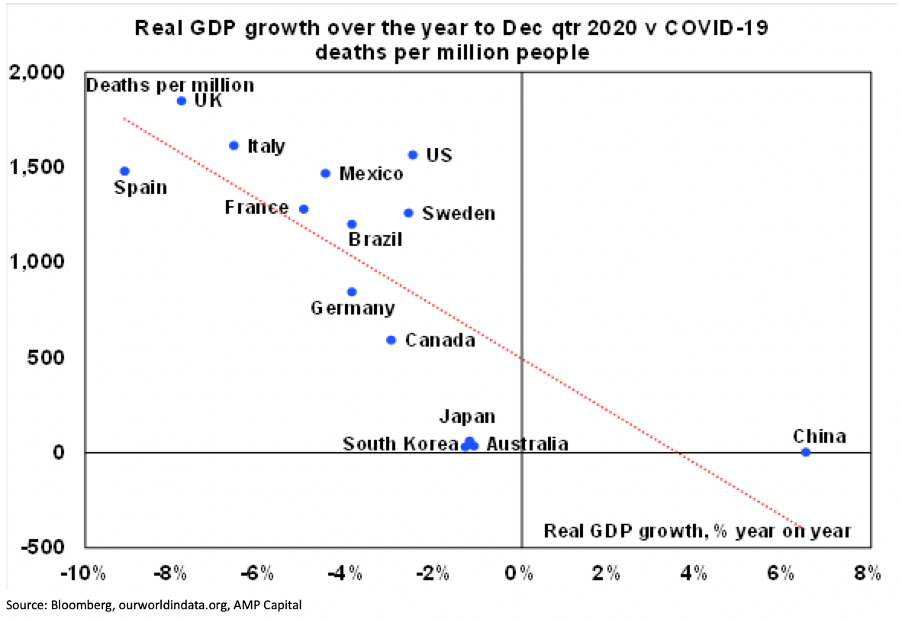

How important has beating the Coronavirus been for economic growth? This chart shows how our growth is world class and coincides with our handling of the virus, which again has been globally best of breed! Is this chart terrific? It shows we’re the highest on growth (apart from China) and one of the lowest on infections.

Don’t miss these big yarns

If you’ve been too busy this week to read some of the big stories we’ve run, I urge you to take a look at these:

- My 7 stocks with vaccination plus upside.

- Paul Rickard on CBA or Macquarie’s new capital notes.

- Tony Featherstone on three loser stocks that could start winning soon.

- And James Dunn gets objective on Afterpay and Zip!

The week in review:

- In my article earlier this week, I wrote that not only is there positive momentum for reopening trade stocks such as travel and casinos, there’s also a group of companies that will benefit from the uptick in vaccinations here and abroad. These are my 7 stocks bound to bounce with reopening & vaccinations [1]: CSL (CSL), Avita Medical (AVH), Sonic Healthcare (SHL), Appen (APX), Star Entertainment Group (SGR), Event Hospitality (EVT) and Elmo Software (ELO).

- Paul Rickard put capital notes from Macquarie & CommBank [2] under his microscope to determine whether they are worth investing in.

- Here are 3 beaten-up stocks where the market over-reacted to weaker-than-expected earnings or overlooked good news [3]. Tony Featherstone believes these 3 stocks offer value: Orica (ORI), Origin Energy (ORG) and Ampol (ALD).

- The burning question on many investors’ lips after Afterpay (APT) and Zip Co (Z1P) reported interim results last week is – are they buys, holds or sells? Here is James Dunn’s take [4].

- We had two “HOT” stocks this week: Adam Dawes from Shaw & Partners [5] chose Amaero International (3DA) and Julia Lee from Burman Invest [6] chose Credit Corp (CCP).

- In Buy, Hold, Sell – What the Brokers Say this week, there were 37 upgrades and 26 downgrades in the first edition [7], and 5 upgrades and 5 downgrades in the second edition [8].

- And in Questions of the Week [9], Paul Rickard answered your questions about the entitlement offer from Bank of Queensland (BOQ) and its acquisition of ME Bank, whether A2 Milk (A2M) is a buy, the hope of AMP (AMP) reaching $5.00 again and ETFs for the banks and financials.

Our videos of the week:

- Webinar: The stocks that look like buys or dumpers after reporting season [10]

- Stocks that will rise on vaccination – (ASX: A2M, EVT, AVH, SGR, CSL, APX, ELO) [11] | Switzer TV: Investing

- Time to buy CBD apartments and Mark Bouris on borrowing smart [12] | Switzer TV: Property

Top Stocks – how they fared:

The Week Ahead:

Australia

Tuesday March 9 – Weekly consumer sentiment (March 7)

Tuesday March 9 – CBA credit & debit card lending (March 5)

Tuesday March 9 – NAB Business survey (February)

Wednesday March 10 – Monthly consumer confidence (March)

Wednesday March 10 – Speech by Reserve Bank Governor

Wednesday March 10 – Labour account (December)

Thursday March 11 – Credit & debit card lending (January)

Overseas

Sunday March 7 – China International trade (Jan-Feb.)

Monday March 8 – US Wholesale inventories (January)

Tuesday March 9 – US NFIB Business optimism (February)

Wednesday March 10 – China Inflation data (February)

Wednesday March 10 – US Consumer prices (February)

Wednesday March 10 – US Monthly budget statement (February)

Thursday March 11 – US JOLTS job openings (January)

Thursday March 11 – China Lending & money supply (February)

Friday March 12 – US Producer prices (February)

Friday March 12 – US Consumer sentiment (March)

Friday March 12 – China Vehicle sales (February)

Food for thought:

“Buy when everyone else is selling and hold until everyone else is buying. That’s not just a catchy slogan. It’s the very essence of successful investing.” – J. Paul Getty

Stocks shorted:

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before.

Chart of the week:

In an article this week titled ‘Bitcoin – it’s not a currency, it’s not a capital asset… so what is it?’, AMP Capital’s Shane Oliver noted that the energy needed to mine the cryptocurrency is 0.6% of the world’s electricity consumption, equalling Argentina, Norway and Pakistan:

Top 5 most clicked:

- My 7 stocks bound to bounce with reopening & vaccinations [1] – Peter Switzer

- 3 beaten-up stocks set to bounce back [3] – Tony Featherstone

- Capital notes from Macquarie & CommBank – should you take part? [2] – Paul Rickard

- Afterpay & Zip: are they buys or sells? [4] – James Dunn

- My “HOT” stock: 3DA a strong buy [5] – Maureen Jordan

Recent Switzer Reports:

- Monday 1 March: My 7 stocks bound to bounce with reopening & vaccinations [13]

- Thursday 4 March: 3 beaten up stocks set to bounce back [14]

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.