One of the reasons I remain unflinchingly bullish on Australian equities (particularly those with high sustainable/growing fully franked dividend yields) is because Australia is one of the few countries left with conventional monetary policy levers to pull.

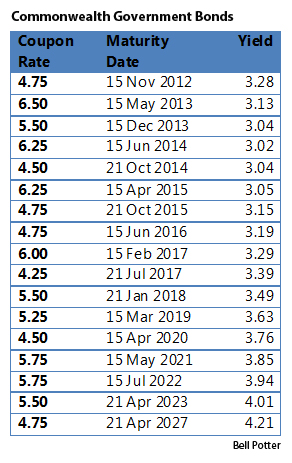

The Australian government bond markets and the Australian dollar have now seen right through the RBA’s jawboning and realise the RBA has no choice but to put policy in reverse. Yes, this started with November’s 25 basis point rate cut, but in my career I can never remember the RBA being so far behind the curve, metaphorically and literally. The table below shows the Australian government bond yield curve out 15 years. Note how the entire yield curve is significantly below the RBA’s current cash rate of 4.50%.

[1]Sure, an element of these very low government bond yields is a ‘flight to safety’ and the giant fixed interest bubble, but to see an Australian Government three-year bond at 3% when the RBA cash rate is at 4.5% is telling you how big this rate cut cycle potentially can be. This won’t end at a ‘neutral’ monetary policy setting, which is about where we’re at now – particularly given the $10 billion hole in Treasurer Wayne Swan’s budget that needs to be filled by widespread Federal spending cuts.

[1]Sure, an element of these very low government bond yields is a ‘flight to safety’ and the giant fixed interest bubble, but to see an Australian Government three-year bond at 3% when the RBA cash rate is at 4.5% is telling you how big this rate cut cycle potentially can be. This won’t end at a ‘neutral’ monetary policy setting, which is about where we’re at now – particularly given the $10 billion hole in Treasurer Wayne Swan’s budget that needs to be filled by widespread Federal spending cuts.

We also need to remember the average Australian residential variable mortgage rate holder is paying around 7.5% per annum, the highest mortgage interest rates in the first world by a huge margin. With the ‘Big Four’ banks still (wrongly) obsessed with margin maintenance and wholesale funding costs remaining persistently high, the RBA will have to cut rates harder than it suspects to actually have a noticeable economic effect.

This is another reason I believe the Australian Dollar has peaked for the cycle and will settle in the new lower trading range of 95 US cents to 100 US cents that we have been forecasting. Significantly lower cash rates and a lower Australian dollar trading range will be positive for the Australian economy and Australian companies. It’s that simple.

I just hope all those Australian retirees and approaching retirees piling out of equities at the bottom know they are piling into fixed interest ahead of a substantial rate cut cycle.

Yes, you might well sleep better at night with the ‘certainty’ of fixed interest, but in my view you are only truly locking in the ‘certainty’ of significantly lower unfranked total returns than the equity market will give you over the next few years. National Australia Bank shares returned more in capital growth on Monday alone than an Australian Government 10-year bond annual yield.

Eventually, in perhaps a year’s time, there will be a ‘fear of no income’ (FONI) switch back to high fully franked equity yield. You will look back in amazement that you could buy Big Four Australian banks or Telstra at 9% per annum fully franked dividend yields. But not only will the Big Four Banks and Telstra pay you 9% per annum fully franked yields simply to own them, but on our analysis we forecast 20% capital gains on top of that annual yield.

This is why from an investment strategy perspective I remain very positive on Australian banks, Telstra, Australian discretionary retailers, Australian unhedged resource stocks with US dollar revenues and Australian dollar costs, resource service companies, all things West Australian and am getting interested in east coast building materials stocks. Interestingly though, when you analyse the biggest short positions in the Australian equity market now, it’s in these sectors where they reside. Therein lies the contrarian opportunity.

Rio Tinto Limited (RIO) – Buy

We retain our ‘buy’ rating on Rio Tinto, with a target price of $98.45 per share derived from an average of 12.5-times peak year earnings, 13-times long-term earnings, and 1.06-times Calender year 2012 net present value. Growth for the next decade is underpinned by Pilbara iron ore expansions from 220Mtpa currently to 333Mtpa by 2015, and copper projects beyond 2015 (Oyu Tolgoi, Resolution, Bingham Canyon, Escondida). Coupled with the awakening ‘sleeper’, its aluminium business, and its strong balance sheet and cash flow, Rio is undervalued.

- Target price: $98.45

- Wednesday’s close: $62.95

Alacer Gold (AQG) – Buy

Alacer is consolidating its position as a leader of the mid-tier gold sector by moving towards about 800kozpa Au in 2015. At forecast, considerable value has been added by the ongoing ramp up of the Çöpler oxide mine. The share price is near the base of a steep trading range, partly due to recent negativity over an unexpected change in accounting method that accelerated D&A for the WA assets (affecting forecasts). We believe there’s potential for a near-term gain. Share price catalysts could be the Çöpler resource upgrade and sulphide feasibility study, a $40 million exploration program and a definitive feasibility study on the HBJ open pit expansion in WA. We maintain our ‘buy’ recommendation.

- Target price: $12.70

- Wednesday’s close: $10.74

Chalice Gold Mines (CHN) – Spec Buy

We maintain our ‘speculative buy’ for Chalice Gold Mines, which recently signed a mining agreement with Eritrea and announced high-grade gold intercepts at the Zara Project. These developments have further de-risked Zara and opened the way for funding and development of the Koka Mine. The mining agreement shows that Chalice’s patience in developing the Koka Gold Mine is paying off. The next critical steps will be the mining licence, and CHN/ENAMCO project finance for more than US$120 million capital expenditure.

Disclosure: Bell Potter Securities acted in the placement of CHN shares in May.

- Target price: $0.46

- Wednesday’s close: $0.25

Important information: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. For this reason, any individual should, before acting, consider the appropriateness of the information, having regard to the individual’s objectives, financial situation and needs and, if necessary, seek appropriate professional advice.

Also in the Switzer Super Report

- Peter Switzer: This rally could have legs [2]

- JP Goldman: The best Aussie ETFs for international exposure [3]

- Tony Negline: Is your lifetime pension financially sound? [4]

- Andrew Bloore: How to move large sums of money into super [5]