The Yanks aren’t ignoring the rise of the Delta variant in the US but Wall Street is, though you can’t help but ask if the penny will drop in coming months. On the other hand, our stock market hit record highs this week, which could only have been built on our expectation that we will get to the vaccinations levels that America has already achieved.

Two big stories for US stocks overnight were the fall in the University of Michigan’s consumer sentiment reading to 70.2, the lowest reading since December 2011. And inflation, which is tipped to be only high temporarily because of the rebound out of Coronavirus lockdowns and new fears about the Delta strain, has created consumer negativity.

And yet it has been a positive week for Wall Street.

S&P 500 5 days

This isn’t the kind of chart that says negativity is creeping into the US stock market. It’s more likely saying that earnings have been great, as Disney showed on Thursday, which explained its share price spike this week.

Walt Disney

On the subject of strong US company earnings, Refinitiv says 90% of S&P 500 companies have reported and 88% beat experts’ earnings expectations! If you look at earnings on a year-on-year basis, the collective earnings is looking like it will be up a whopping 92.9%!

That’s been a powerful force pushing stocks up, but if you’re looking for a warning sign that optimism could be challenged, then Airbnb’s alert that the Delta variant is bound to reduce travel spending is one.

Offsetting this kind of curve ball for economic positivity, the FDA has approved a third booster shot for those with weakened immune systems, which would include cancer and HIV sufferers. In addition, employment and other bans will force those who are unvaccinated to jab up, which will be an economic positive. The current thinking is that the virus will move from being a pandemic to an endemic virus, which means it becomes a disease outbreak that’s consistently present but limited to a particular region.

Clearly, those US states where there is a big number of anti-vaxxers could become home to the many future forms of the Coronavirus!

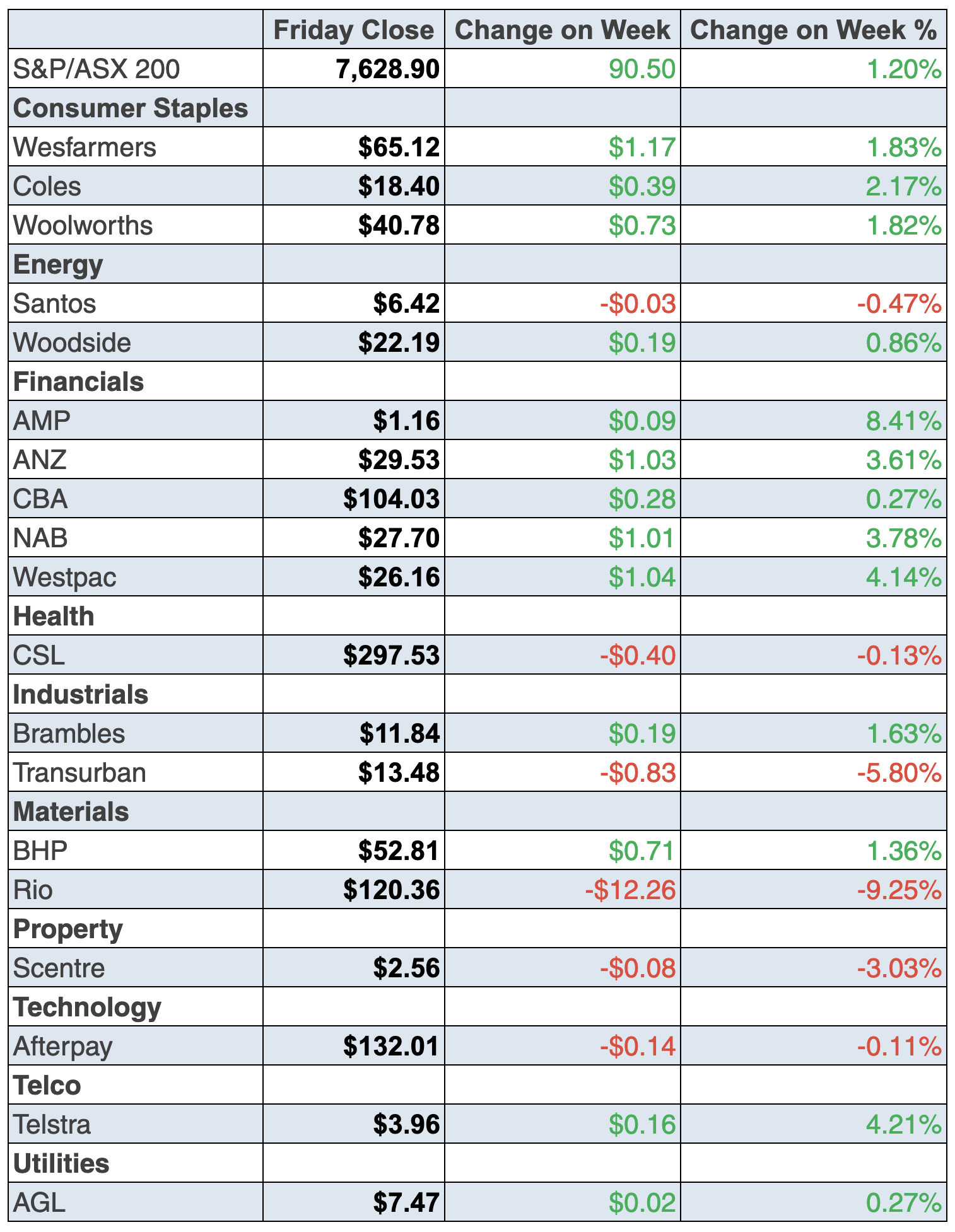

To the local story and it’s been a record high week, which makes a market optimist like yours truly very happy! The S&P/ASX 200 Index put on 90.5 points for the week (or 1.2%) as the earnings story and buybacks all excited stock players.

That said, the winners and losers were a motley crew of companies, as the Bloomberg/AFR table below shows.

Those who have persisted with QBE will be hailing this week’s 12.12% spike after an overdue good year but this company has a lot to do to reclaim its once great status. And it was once great with a capital G!

QBE

Interestingly, AMP doubters would’ve been surprised at the 8.4% gain after a better underlying profit number.

The banks were positive, though CBA lost ground after hitting an all-time high of $108.86. But profit-takers couldn’t help themselves and the stock price ended at $104.30, still up 0.3% for the week.

NAB put on 3.8% to $27.70, Westpac added 4.1% to $26.16 and ANZ was up 3.6% to $29.53.

Those wondering about Rio’s 9.2% slump should know it went ex-dividend, with a whopper dividend of $5.61 per share, which is scheduled to be paid on September 23.

I’m always suspicious of food businesses but maybe the Graincorp 14% gain on a better earnings story could be something worth noting.

It wasn’t a great week for gold stocks, but for the patient, a buying opportunity is emerging. Northern Star was down 6.5% to $9.29 and Newcrest lost 3.5% to $25.19.

Tech stocks also lost out because of higher 10-year bond yields in the US on a more positive economic outlook. Buying opportunities are building with these companies as well. I noted on Thursday in the US that mega-tech stocks became popular after the overall tech sector lost out earlier in the week, as US bond yields rose.

What I liked

- Used vehicle prices rose by 27.4% in the year to July, down from 34.2% in the year to June.

- The pan-European STOXX 600 index rose by 0.1%, hitting record highs for a ninth consecutive session on Thursday.

- US consumer prices (CPI) lifted 0.5% in July to be up 5.4% on a year ago (survey: 5.3%). It’s a high reading but is coming down as was predicted.

What I didn’t like

- The Westpac-Melbourne Institute Index of Consumer Sentiment fell by 4.4% in August to an 11-month low of 104.1. All five major components of the index fell. Blame the lockdowns!

- The NAB business confidence index fell by 18.5 points to a 12-month low of -7.9 points in July. It was the second biggest monthly decline in sentiment since October 2008 (after the record 61.8-point plunge in March 2020). And the conditions index dropped 13.5 points to a 9-month low of 11.4 points in July, with the 13.5 point fall the third biggest decline since records began in March 1997. Blame the lockdowns again.

- In seasonally adjusted terms, private new detached home sales plunged by 20.5% in July to 4,646 units. Sales fell most in Victoria (-32.2%) but lifted in Western Australia (+8.5%).

- Preliminary skilled job vacancies fell by 3% (-7,177 jobs ads) to 232,632 available positions in July. CommSec says: “While it was the second monthly decline after reaching a 12-year high in May (241,764 ads), recruitment activity is still up 38.3% (or around 64,400 ads) when compared to pre-Covid-19 levels. But the 10.3% (or -8,081 ads) plunge in NSW job vacancies was the third biggest monthly decline since July 2009.”

- This from Reuters on the slump in US consumer sentiment: “The University of Michigan said its preliminary consumer sentiment index fell to 70.2 in the first half of this month from a final reading of 81.2 in July. That was the lowest level since 2011, and there have been only two larger declines in the index over the past 50 years. Those were at the depths of the 2007-2009 recession and during the first wave of shutdowns in April 2020 at the beginning of the pandemic.”

This is something that’s temporary

For the first time since the depths of the Coronavirus crash of the market there are less “What I liked” than “What I didn’t like”, which needs to be monitored. Watching rising vaccination rates has become the critically important variable here and in the US. How the Delta strain hits economic activity will be another crucial indicator to keep tabs on.

Right now, the stock market is saying the threats are beatable but they must be checked — as US market experts often tell us “sentiment on Wall Street can turn on a dime!”

The week in review:

- Here’s my list of 11 stocks with double-digit gains ahead [1], if the experts are on the money in their assessments.

- Paul Rickard looked at who should consider accepting an off-market buyback and who shouldn’t [2], and what actions you can take to prepare for the Commonwealth Bank (CBA) off-market share buyback

- James Dunn discussed the potential stars of company reporting season [3].

- Tony Featherstone shared three “dogs” he thinks will have their day [4]: Alumina (AWC), Challenger (CGF) and Suncorp (SUN).

- For our “HOT” stocks this week, Raymond Chan from Morgans [5] highlighted ResMed (RMD) and Michael Gable from Fairmont Equities [6] highlighted Ardent Leisure (ALG).

- Here’s why Appen (APX) is a key stock to watch this reporting season [7].

- There were 9 upgrades and 6 downgrades [8] in the first Buy, Hold, Sell – What the Brokers Say this week, and 4 upgrades and 10 downgrades [9] in the second.

- And in Questions of the Week [10], Paul Rickard answered your questions about Santos (STO), carry-forward concessional contributions, Ramsay Health Care (RHC) and calculating the returns for an SMSF.

Our videos of the week:

- Boom! Doom! Zoom! | August 12, 2021 [11]

- Stocks covered: APX, WPL, ORG, AGL, BGA, SUN + ELMO’s CEO on his co’s result! [12] | Switzer Investing

- Is Airtasker a hot stock? The good oil on this week’s listing of Cobram Estate + CBA & TLS booming [13] | Switzer Investing

Top Stocks – how they fared:

The Week Ahead:

Australia

Tuesday August 17 – CBA Household Spending Intentions (July)

Tuesday August 17 – Weekly consumer sentiment index (August 15)

Tuesday August 17 – Reserve Bank Board meeting minutes

Tuesday August 17 – Overseas arrivals & departures (June)

Wednesday August 18 – Wage Price Index (June quarter)

Wednesday August 18 – Skilled job vacancies (July)

Thursday August 19 – Labour force (July)

Thursday August 19 – Average Weekly Earnings (May)

Friday August 20 – Reserve Bank official speech

Overseas

Monday August 16 – China retail sales/production/investment (July)

Monday August 16 – US Empire State manufacturing index (August)

Tuesday August 17 – US Retail sales (July)

Tuesday August 17 – US Industrial production (July)

Tuesday August 17 – US NAHB housing market index (August)

Wednesday August 18 – Reserve Bank of New Zealand meeting

Wednesday August 18 – US Housing starts & building permits (July)

Wednesday August 18 – US FOMC meeting minutes (July)

Thursday August 19 – US Philadelphia Fed factory index (August)

Friday August 20 – US Conference Board leading index (July)

Friday August 20 – China 1- and 5-year loan prime rates

Food for thought:

“To be an investor you must be a believer in a better tomorrow.” – Benjamin Graham

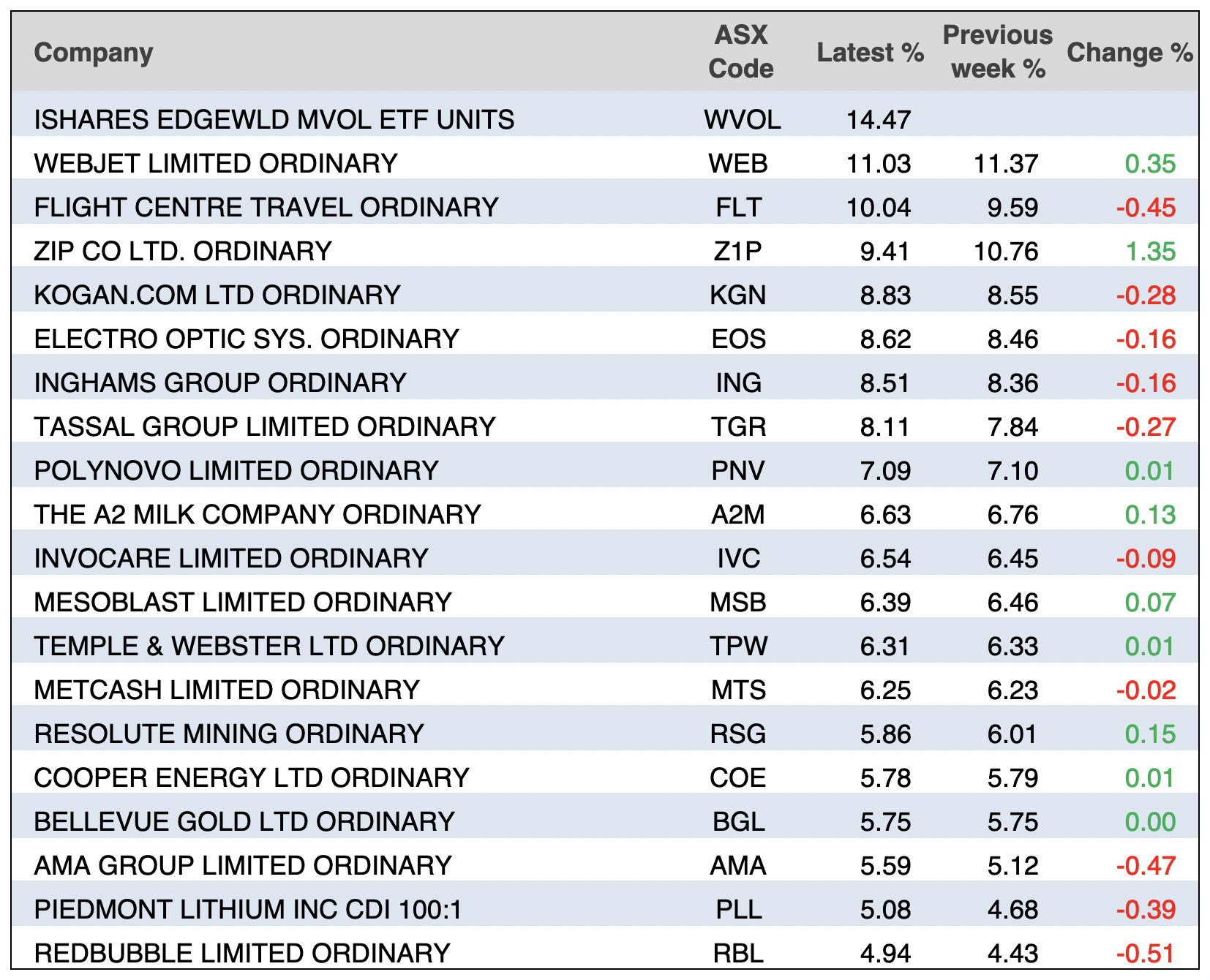

Stocks shorted:

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before.

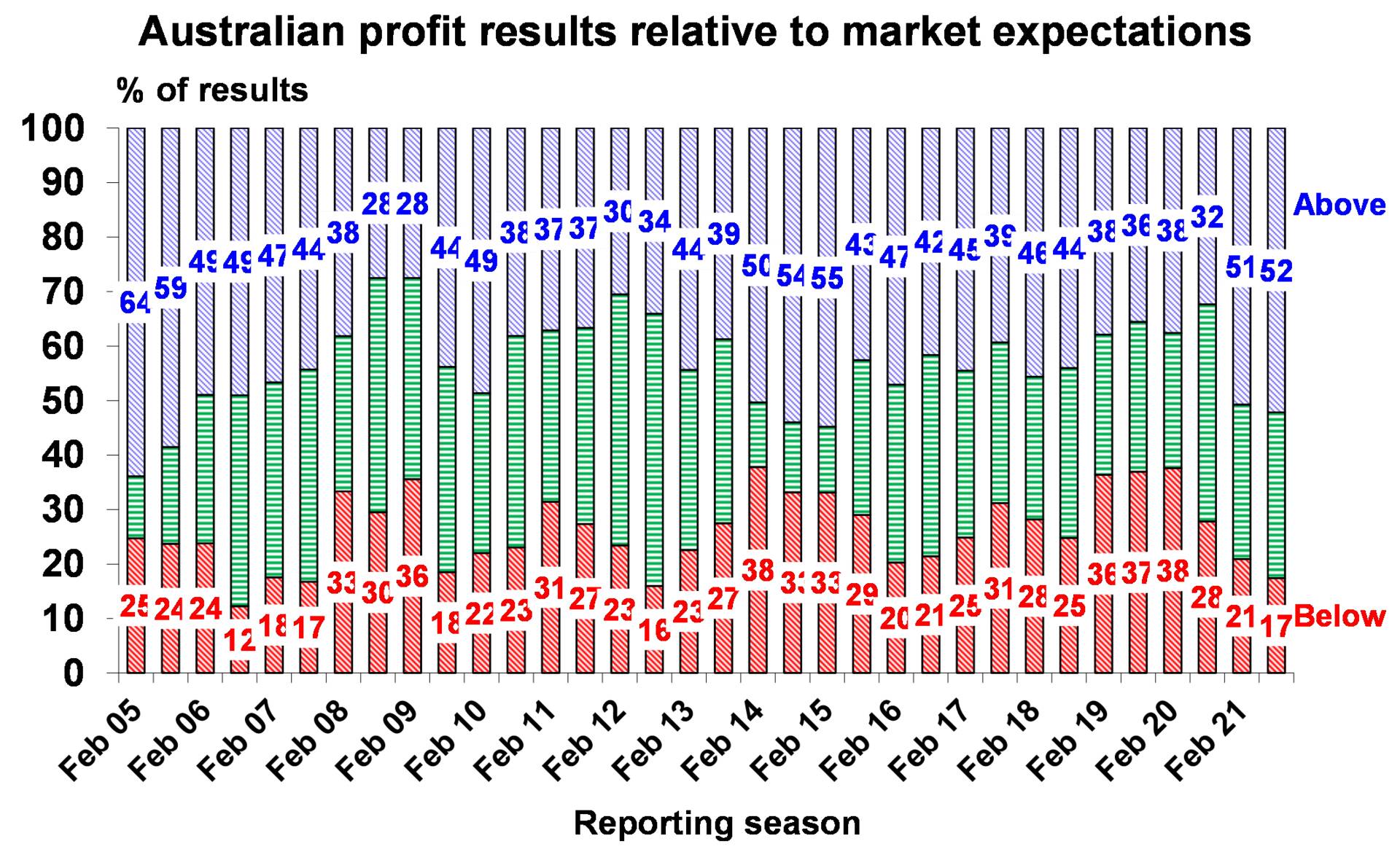

Chart of the week:

Shane Oliver from AMP Capital shared the following chart on reporting season and highlighted that, even though only about 35 major companies have reported so far, 52% of results have been beaten market expectations:

Top 5 most clicked:

- 11 smaller caps with double digit gains ahead [1] – Peter Switzer

- 3 dogs I think will have their day [4] – Tony Featherstone

- Should you plan to accept CBA’s off-market share buyback? [2] – Paul Rickard

- Who’ll be the stars of company reporting season? [3] – James Dunn

- Buy, Hold, Sell – What the Brokers Say [8] – Rudi Filapek-Vandyck

Recent Switzer Reports:

- Monday 9 August: 11 smaller caps with double digit gains ahead [14]

- Thursday 12 August: 3 dogs I think will have their day [15]

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.