The Switzer Model Portfolios performed strongly in the March quarter, gaining up to 9% and comfortably outperforming the benchmark S&P/ASX 200 Index. There are two model portfolios: an income oriented portfolio and a growth portfolio. The objective of the income portfolio is to deliver tax advantaged income whilst broadly tracking the S&P/ASX 200. With the growth portfolio, the objective is to outperform the S&P/ASX 200 over the medium term, whilst closely tracking the index.

The portfolios were rebalanced and re-set at the start of 2021. Details concerning the construction methodology and underlying assumptions can be referenced here: (see: https://switzersuperreport.com.au/our-portfolios-for-2021/ [1] )

It is important to note that these are “long-only” portfolios and as such, are assumed to be to be fully invested at all times. They are not “actively managed”, although adjustments are made from time to time. They are also periodically re-balanced and re-set.

In this article, we will look at how they performed during the March quarter. To do so, we will start by reviewing how the overall market fared in this period.

Financials and ‘top 20’ stocks lead, technology gets walloped

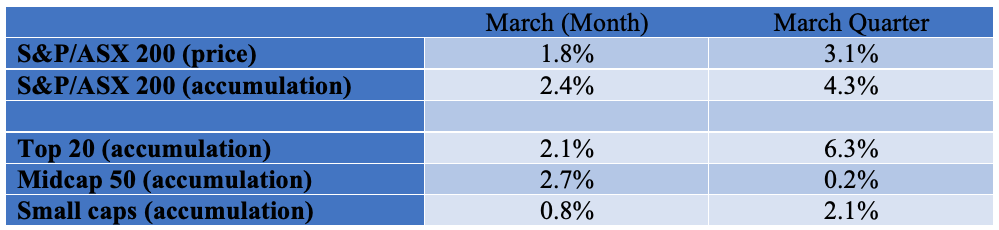

The broad market as measured by the S&P/ASX 200 added 3.1% in the quarter, climbing from 6,587 to 6,790. With dividends included, the total return (accumulation index) was 4.3%.

The top 20 stocks, which includes the 4 major banks, Macquarie and major miners in BHP, Rio and Fortescue, outperformed the rest of the market by adding 6.3%. Midcaps and small caps underperformed in a relative sense.

Market Component Performance

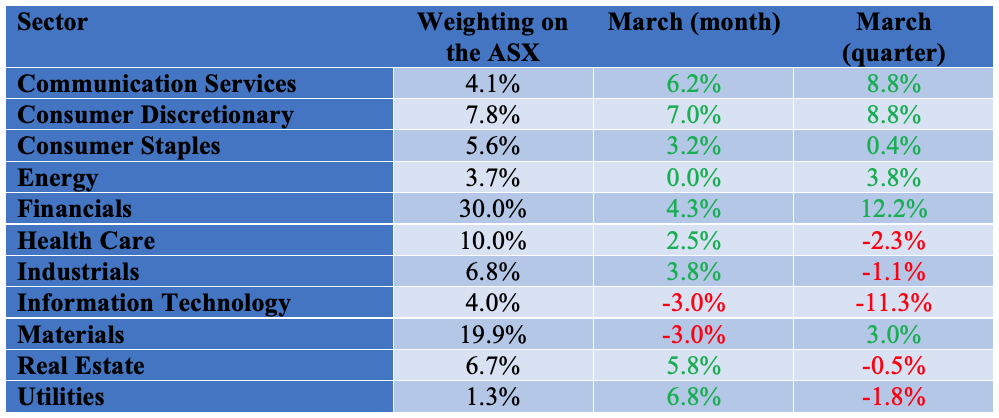

With the industry sectors, the largest sector on the ASX, financials, which makes up 30% by weighting, was the best performing sector with a return of 12.2%. This was led by the performances of the four major banks and Macquarie.

The best performing sector in 2020, information technology, was the worst performing sector in the March quarter with a loss of 11.3%. Health care, which has a weighting of 10% in the S&P/ASX 200, also performed poorly, losing 2.3%.

Overall, consumer facing stocks and sectors fared well.

The following table shows the performance of the 11 industry sectors for the month of March, for the March quarter, and their respective weighting on the ASX.

Industry Sector Weighting and Performance

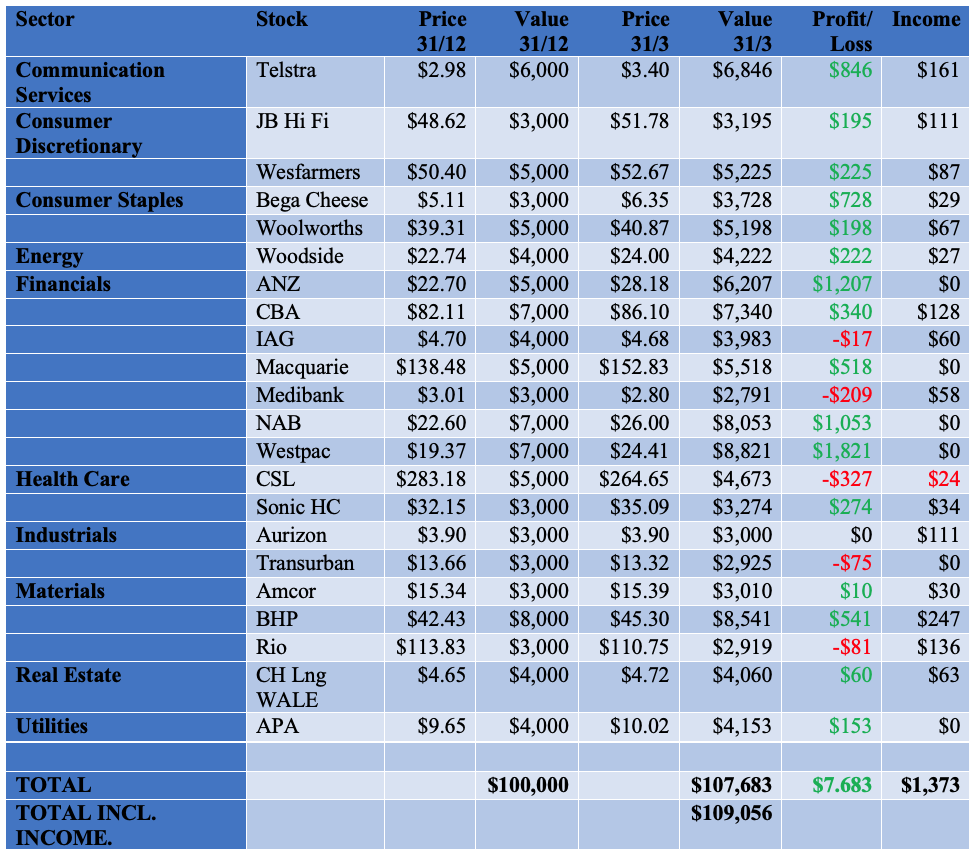

Income Portfolio

The objective of the income portfolio is to deliver tax advantaged income whilst broadly tracking the S&P/ASX 200. It forecast to deliver an income return of 4.04% (based on its opening value at the start of the year), franked to 77%.

The portfolio is moderately overweight financials, consumer staples and consumer discretionary stocks, and underweight information technology. It is broadly index-weight the other sectors.

For the March quarter, it returned 9.06%, outperforming the benchmark S&P/ASX 200 Accumulation Index by 4.80%. The portfolio return comprises capital growth of 7.68%, and an income return of 1.37% (franked at 83%).

Strong performances by the major banks, Macquarie, Telstra and BHP led to the portfolio gains. Bega Cheese has also been a surprise outperformer. On the negative side, CSL, Medibank and IAG were the main detractors.

No major changes are proposed at this point in time.

The income biased portfolio per $100,000 invested (using prices as at the close of business on 31 March 2021) is as follows:

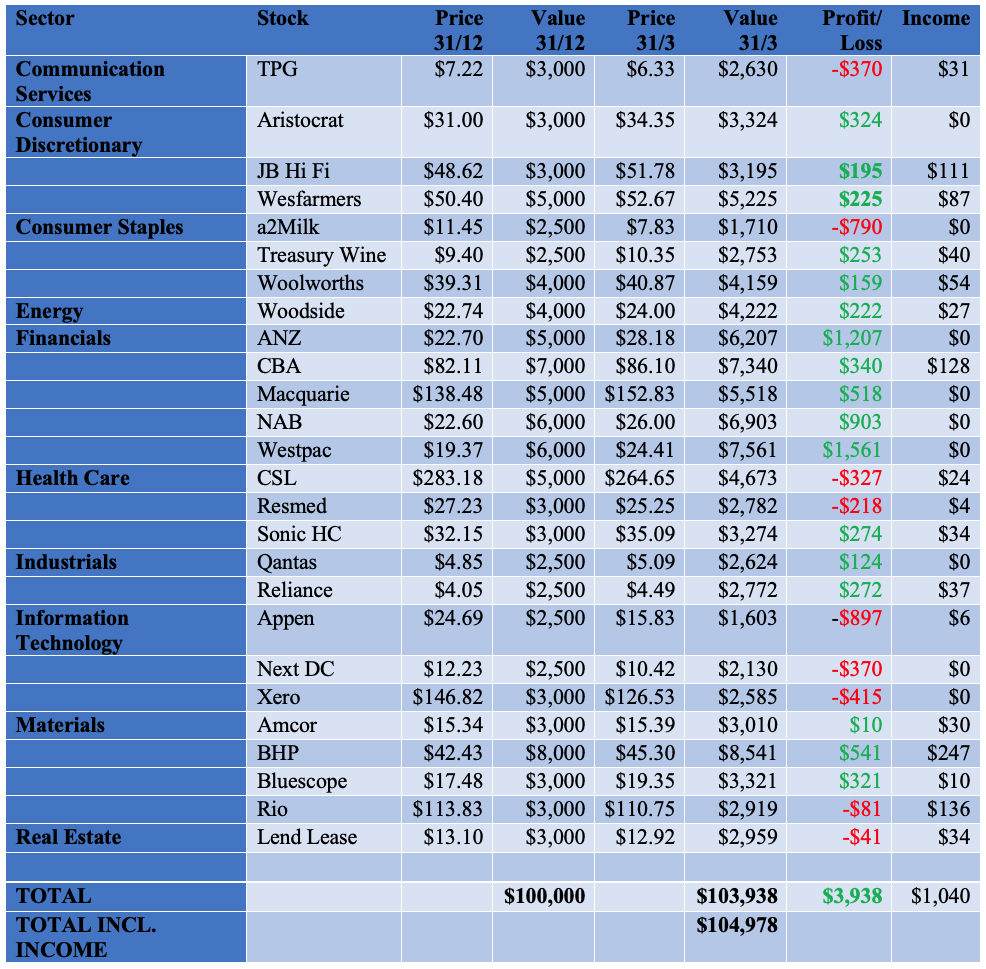

Growth Portfolio

The objective of the growth portfolio is to outperform the S&P/ASX 200 market over the medium term, whilst closely tracking the index.

The portfolio is moderately overweight consumer discretionary, consumer staples, information technology and materials, and underweight real estate, utilities and industrials. It is index-weight financials and health care.

For the March quarter, it returned 4.98%, outperforming the benchmark S&P/ASX 200 Accumulation Index by 0.72%.

Strong performances by the major banks, Macquarie, BHP, Reliance, Bluescope and Aristocrat led to the portfolio gains. On the negative side, A2 Milk, TPG, CSL, and the IT troika (Appen, Next DC and Xero) were the main detractors.

No major changes are proposed at this point in time, although we are watching A2 Milk closely and considering whether to reduce the exposure to the materials sector.

Our growth-oriented portfolio per $100,000 invested (using prices as at the close of business on 31 March 2021) is as follows:

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.