Concerns that the impact of the coronavirus would severely curtail economic activity sent the share market tumbling in the last week of February. After posting record highs mid-month, the market ended with a net loss of 7.7% for the month.

Our model portfolios, which are long-only portfolios, followed the market lower to give up all their gains for January and finish in the red.

In this our second review for the year, we look at how our income and growth portfolios performed in February. We have also made some small changes.

The purpose of these portfolios is to demonstrate an approach to portfolio construction. As the rule sets applied are of critical importance, we provide a quick recap on these. Also, it is important to note that these portfolios are designed as “long only”. They don’t allocate to “cash” and don’t represent a view about the outright direction of the market.

Portfolio recap

In January, we made some adjustments to our Australian share ‘Income Portfolio’ and ‘Growth Portfolio’ (see https://switzersuperreport.com.au/our-portfolios-for-2020/ [1])

The construction rules for the portfolios are:

- We use a ‘top down approach’ looking at the prospects for each of the industry sectors;

- For the income portfolio, we introduce biases that favour lower PE, higher yielding sectors;

- So that we are not overly exposed to a market move, in the major sectors (financials and materials), our sector biases will not be more than 33% away from index. For example, the weighting of the ‘materials’ sector on the S&P/ASX 200 is currently 18.1%, and under this rule, our possible portfolio weighting is in the range from 12.1% to 24.2% (i.e. plus or minus one third or 6.1%);

- We require 15 to 25 stocks (less than 10 is insufficient diversification, over 25 is too hard to monitor), and have set a minimum stock investment size of $3,000;

- Our stock universe is confined to the ASX 100. This has important implications for the growth portfolio, because the stocks with the best medium-term growth prospects will often come from outside this group (the so called ‘small’ caps);

- We avoid stocks from industries where there is a high level of exogenous risk, such as airlines;

- For the income portfolio, we prioritise stocks that pay fully franked dividends and have a consistent record of paying dividends; and

- Within a sector, the stocks are broadly weighted to their respective index weights, although there are some biases.

Overlaying these processes are our predominant investment themes for 2020, which we expect to be:

- A positive lead from the US markets. While the gains of 2019 are unlikely to be repeated, the US election in November means that President Trump will favour market supportive policies;

- Trade tensions between the USA and China to ease (or at least be put on hold);

- Modest economic growth in the USA, with Europe remaining relatively moribund and growth in China moderating;

- In Australia, economic growth to ease to around 2%, with no real pick up in domestic inflation;

- Interest rates in Australia to remain ultra-low, while in the USA, the Fed will delay any hike until 2021;

- The oil price to be well supported above US$50 per barrel as OPEC “manages” production to meet demand;

- Iron ore and metal prices to soften;

- The aussie dollar to remain range bound around 70c, but with some risk of breaking down;

- Ultra-low interest rates to continue to support the recovery in the Australian housing market; and

- Following on from 2018 and 2019, quality stocks with both top and bottom line growth will get even more expensive.

Performance

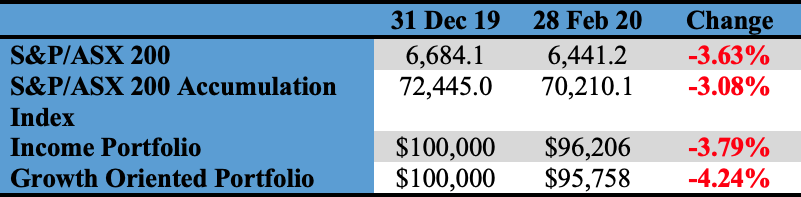

The income portfolio to 28 February has lost 3.79%, and the growth oriented portfolio 4.24% (see tables at the end). Compared to the benchmark S&P/ASX 200 Accumulation Index (which adds back income from dividends), the income portfolio has underperformed by 0.71% and the growth oriented portfolio by 1.16%.

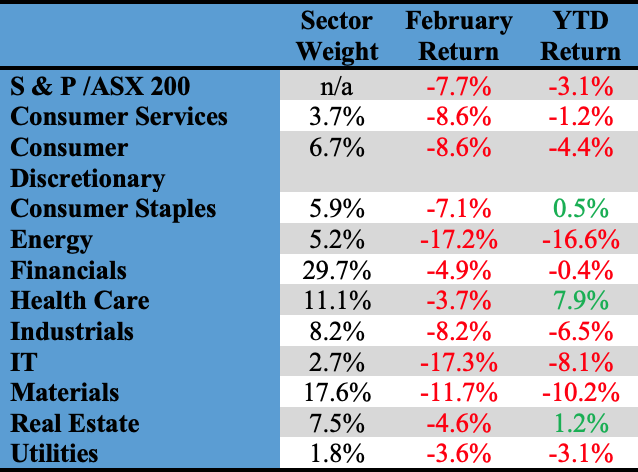

All sectors in the red, but healthcare still positive for the year

All ASX sectors were in the red in February, with losses varying between 3.6% for the defensive utilities sector (the lowest), to 17.3% for the information technology sector (the highest).

Company reporting season, the time when most companies report their half-year or full-year earnings, was overshadowed by the coronavirus sell-off.

Year to date, three sectors are positive. Healthcare with a return of 7.9%, and the defensive consumer staples and real estate sectors. Resource-based sectors (materials and energy are the hardest hit), with the energy sector giving up 16.6%.

Performances of the 11 industry sectors, together with their respective market weights, are set out in the table below.

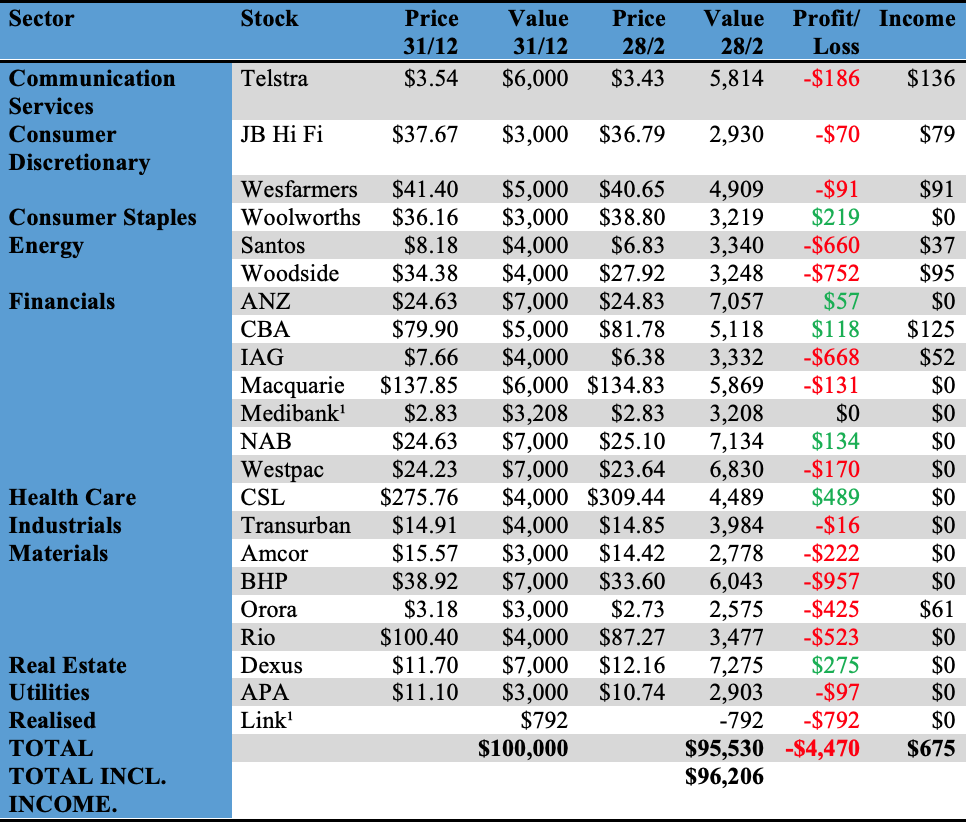

Income portfolio

The objective of the income portfolio is to deliver tax advantaged income whilst broadly tracking the S&P/ASX 200.

On a sector basis, the biases for the income portfolio in 2020 are fairly minor. It is moderately overweight financials and underweight health care (where there are no medium or high yielding stocks in the ASX 100).

In the expectation that interest rates in Australia are staying at record low levels, it has a defensive orientation and a bias to yield style stocks. In a bull market, we expect that the income portfolio will underperform relative to the broader market, due to the underweight position in the more growth oriented sectors and the stock selection being more defensive, and conversely in a bear market, it should moderately outperform.

The income portfolio is forecast to generate a yield on its opening value of 4.65%, franked at 78%. The franking percentage has been reduced by the inclusion of stocks such as Dexus, Transurban and APA.

In February, the income portfolio gave up 8.66% for a relative underperformance of 0.97%. This is measured on a total return basis, which includes dividends. Material underperformers included Link (on the back of a weak earnings report), and energy companies Santos and Woodside. BHP and Rio also suffered as commodity prices (in particular, iron ore) pulled back. Interestingly, the financials sector held up reasonably well, despite suggestions that the RBA would cut the cash rate.

We are calling this movement a ‘correction’ (rather than the start of a bear market) and don’t propose to make wholesale changes to the portfolio. However, we do propose to exit the position in Link. Despite now being cheap, we can’t see it recovering quickly when the market turns around. It is being replaced with Medibank.

The income-biased portfolio per $100,000 invested (using prices as at the close of business on 28 February 2020) is as follows:

¹ Link sold on 28 Feb at $4.70 to realise loss of $792. Net proceeds of $3,208 invested in Medibank at $2.83 (cum-dividend).

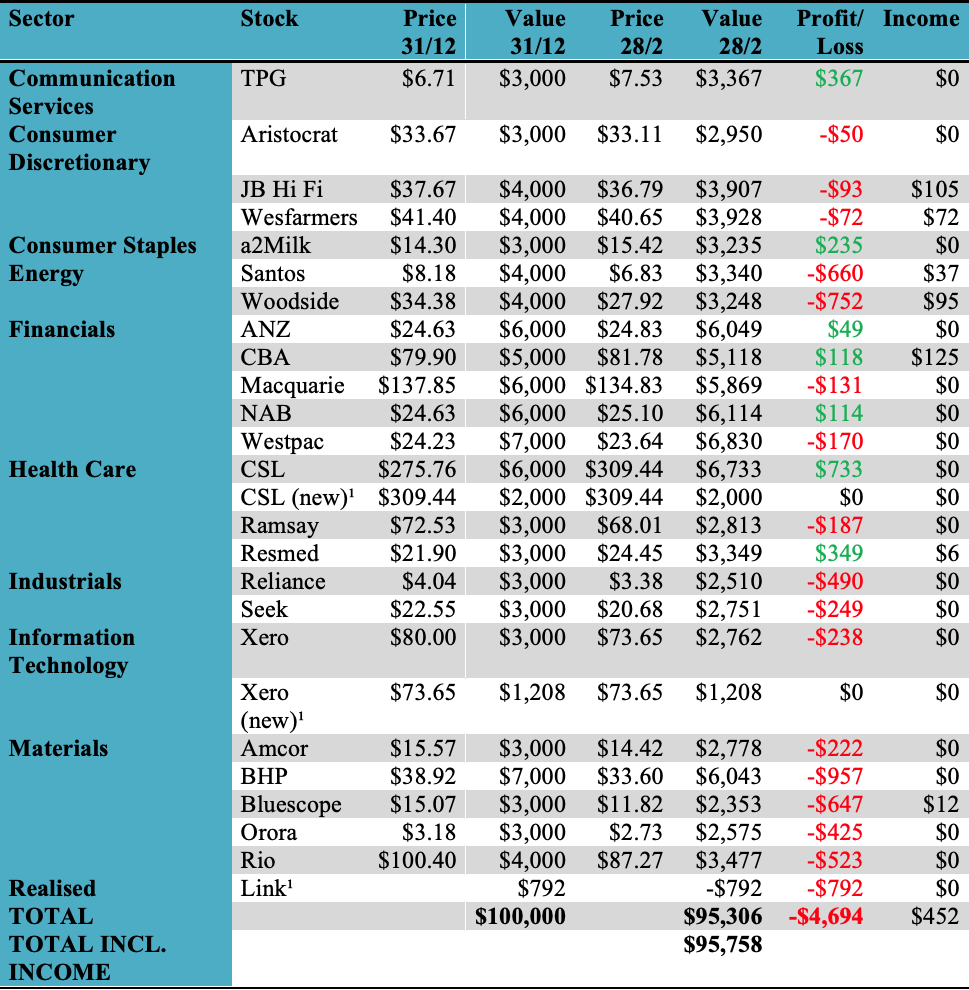

Growth portfolio

The objective of the growth portfolio is to outperform the S&P/ASX 200 market over the medium term, whilst closely tracking the index.

The growth portfolio in 2020 is moderately overweight health care, energy, consumer discretionary and information technology. It is underweight consumer staples, real estate and utilities. Overall, the sector biases are not strong.

On a stock selection basis, it also has a bias to companies that earn revenue outside Australia, and should benefit from a weaker Australian dollar.

In February, the growth portfolio gave up 9.34% for a relative underperformance of 1.65%. This is measured on a total return basis, which includes dividends. Material underperformers included Link Reliance and Ramsay (on the back of weak earnings reports), and energy companies Santos and Woodside. BHP and Rio also suffered as commodity prices (in particular, iron ore) pulled back.

We are calling this movement a ‘correction’ (rather than the start of a bear market) and don’t propose to make wholesale changes to the portfolio. However, we do propose to exit the position in Link. Despite now being cheap, we can’t see it recovering quickly when the market turns around. It is being replaced with further investments in CSL ($2,000) and Xero ($1,208).

Our growth oriented portfolio per $100,000 invested (using prices as at the close of business on 28 February 2020) is as follows:

¹ Link sold on 28 Feb at $4.70 to realise loss of $792. Net proceeds of $3,208 invested in $2,000 CSL at $309.45 and $1,208 Xero at $73.55.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.