I had to do a double-take when I filled my car up last week. It cost almost $100 to fill my near-empty tank, thanks to a fuel price approaching $2 a litre.

Good one, Russia. As all car owners know, Russia’s sickening invasion of Ukraine has put a rocket under the oil price. Brent Crude oil futures hit a 13-year high this month.

Some economists expect the average price of a litre of petrol in Australia to quickly climb past $2.10 and head higher if the Russia/Ukraine war persists and global oil supply contracts. In January 2021, the average price per litre was $1.20.

Consider motorists who have a long work commute each day and go through a 50-litre tank each week. Their monthly fuel bill could be $180 higher than a year ago.

That’s a huge tax on consumers and the economy. Something must give if petrol prices continue to rise or stay at current levels for too long. No doubt, some people will cut back on discretionary spending or take on more debt to cover higher living costs.

Others will reduce their car usage. As a home-based business owner, I barely use my car, so higher fuel costs don’t matter much to me. It’s a different story for my family’s “good car”, which seemingly gets driven hours each day, ferrying children.

For the first time in a long time, I’ve wondered if our car could be used less, given spiralling fuel prices. Or if we could make greater use of public transport (yes, it won’t happen, but it is a consideration as living costs rise).

I bet many families think the same way. The leisurely Sunday drive seems less appealing when there’s so much petrol-pump pain and the prospect of more to come.

My guess is other habits will change if petrol prices head higher. When replacing a car, buying an Electric Vehicle (EV) will be more enticing if fuel costs stay high. Smaller cars or motorbikes might seem more attractive if high petrol prices persist.

Of course, it’s dangerous to draw too long a bow with something as hard to predict as the oil price. What is clear is a lack of new investment in oil exploration and by supermajors will constrain non-OPEC oil supply in coming decades – possibly much more than the market expects, supporting a higher oil price for longer.

Renewables are great, but if the transition away from fossil fuels is too rapid – as seems to be the case as shareholder activists pressure oil supermajors to curtail investment in new or expanded energy reserves – the oil and fuel prices could be elevated.

This brings me to Australian Real Estate Investment Trusts (A-REITs) that own petrol stations and convenience stores. I have written favourably on Waypoint REIT for this publication before and have covered Dexus Convenience Retail REIT.

Petrol stations are an interesting niche sector of the A-REIT market. The best ones have long leases to prominent petrol suppliers or supermarkets. Their location on highways and busy thoroughfares in capital cities is hard to replicate. The property is valuable.

Population growth is good for petrol-station A-REITs. Urban densification means extra people and cars, at least for now. Some petrol stations could be worth more if they were turned into apartment complexes, assuming their land can be remediated cheaply.

Dexus Convenience Retail REIT’s latest earnings presentation said 55% of Australians visit a service station at least once a week, from 49% in 2017.

Dexus said convenience retail at petrol stations (junk food, bread, milk and coffee) will eventually overtake fuel as the main driver of petrol-station sales and profits.

There are two main headwinds for petrol-station A-RIETs. The short-term risk is less demand for petrol-station space if fuel costs remain elevated and people change their driving habits or spend less on convenience goods when getting fuel.

I’m less concerned about this risk and more worried about EV adoption and what that means for petrol-station demand. For the record, I’m a fan of EVs and probably should buy one when our next family car is traded in. But EVs will disrupt traditional petrol stations.

For now, EVs are tiny in the scheme of Australia’s car market and have a low impact on petrol-station operators. We’re probably at least 10 years behind Norway and other European countries in EV adoption. With some rare government foresight, EV adoption rates could quicken here, particularly if fuel costs stay high.

That would be bad for petrol station A-REITs. However, recent price weakness has made them more attractive. If you believe in the adage of buying when news is bad, Waypoint REIT and Dexus Convenience Retail REIT look interesting.

Remember, both A-REITs own, rather than operate, the petrol stations (that’s up to BP, Shell, Caltex, Coles, Woolworths, Ampol and other petrol-station brands). The issue is whether demand for petrol-station assets will soften in coming years, leading to lower rental income and slower gains in Net Tangible Assets per security.

1. Waypoint REIT (WPR)

Waypoint (formerly Viva Energy REIT) is the largest of the petrol-station A-REITs on the ASX with $3.09bn of assets across 433 properties in the first half of FY21.

Waypoint has delivered consistent growth in Net Tangible Assets (NTA) and Distributable Earnings Per Share (EPS). Since 2016, Waypoint’s NTA has climbed from $2.02 a unit to $2.95 in December 2021. Distributable EPS has grown from 12.68 cents a unit to 15.8 cents during that period. Both metrics have grown each year.

Waypoint’s properties have a Weighted Average Lease Expiry (WALE) of 10 years, meaning the petrol stations have many long-term tenants. Gearing of 30.1% at end-December 2021 is at the low end of Waypoint’s targeted 30-40% range.

Waypoint has reviewed its portfolio strategy. It anticipates selling about 10% of its property portfolio over 3-5 years. Most will be regional sites or smaller metropolitan assets. Waypoint sensibly seems more interested in capital-city petrol stations.

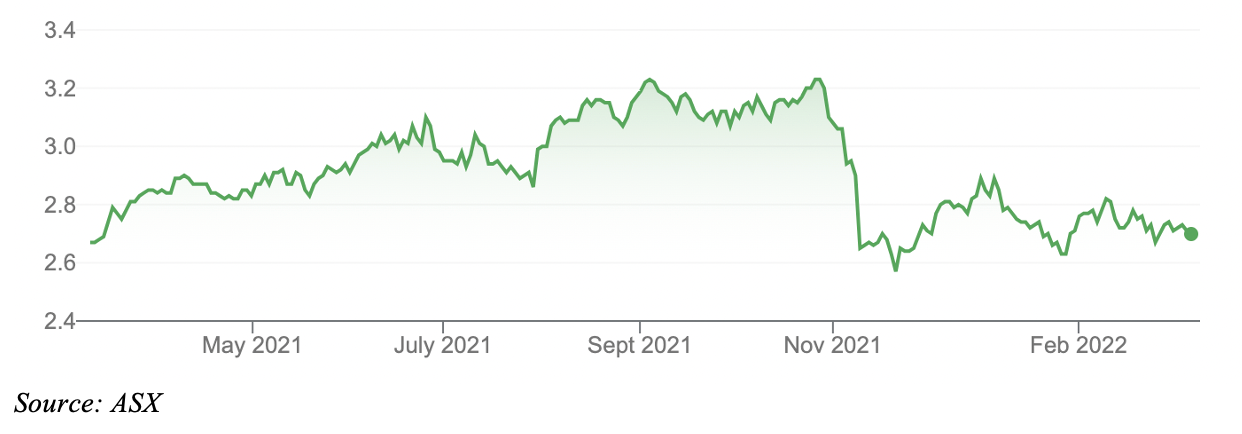

Waypoint has fallen from a 52-week high of $3.06 to $2.71, amid broader market weakness and oil-price fears. The current price compares to a consensus target of $2.93 among broking analysts, suggesting Waypoint is modestly undervalued.

That consensus target looks reasonable. Waypoint is no screaming buy but has appeal for long-term income investors at the current price.

Waypoint’s latest Net Tangible Assets per security of $2.95 means it trades at a slight discount to NTA.

Waypoint REIT (WPR)

2. Dexus Convenience Retail REIT (DXC)

In May 2021, Dexus acquired APN Property Group, which meant it became the manager of the APN Convenience Retail REIT (now the Dexus Convenience Retail REIT).

With a portfolio of 112 properties worth $803 million at end-December 2021, DXC is smaller than Waypoint. DXC’s property portfolio is growing quickly through acquisitions, which were partly funded by capital raisings last year.

DXC’s Weighted Average Lease Expiry is 11.3 years, providing high earnings visibility. About 90% of its income is from 10 major tenants.

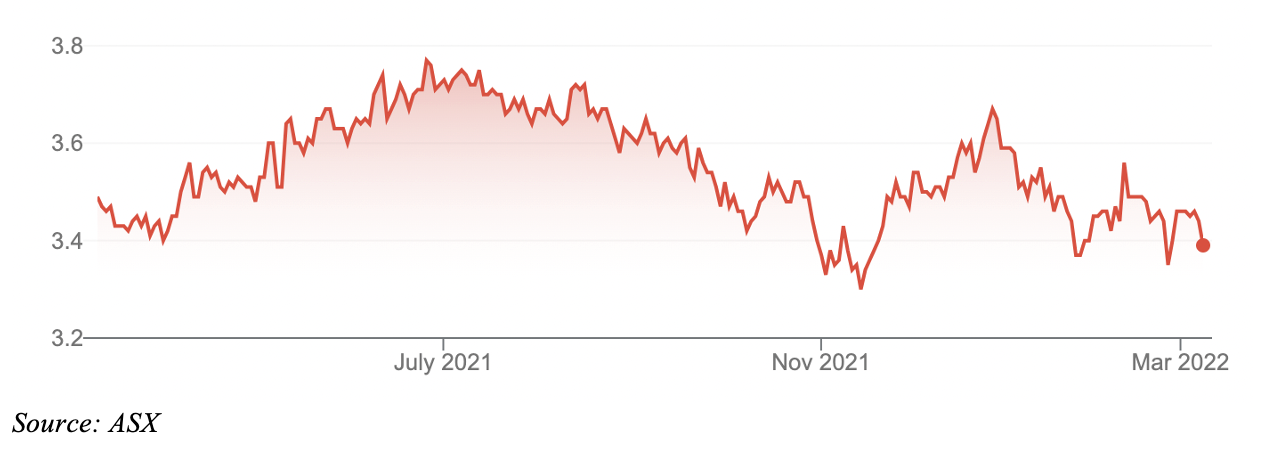

Like Waypoint, DXC has fallen in the past few months. From a 52-week high of $3.80, DXC now trades at $3.39. Its current price compares to a consensus price target of $4.11 among analysts, suggesting DXC offers reasonable value.

DXC trades at a discount to Net Tangible Asset (NTA) per security of $3.83 (at end-December 2021).

As a micro-cap A-REIT, DXC poses higher risk than Waypoint. But DXC should be able to leverage tenant relationships of its parent Dexus, which is a leading A-REIT.

If broking analysts are correct, Dexus has more upside in its valuation from the current price than Waypoint, but investors must factor in the higher risk.

Dexus Convenience Retail REIT (DXC)

Tony Featherstone is a former managing editor of BRW, Shares and Personal Investor magazines. The information in this article should not be considered personal advice. It has been prepared without considering your objectives, financial situation or needs. Before acting on information in this article consider its appropriateness and accuracy, regarding your objectives, financial situation and needs. Do further research of your own and/or seek personal financial advice from a licensed adviser before making any financial or investment decisions based on this article. All prices and analysis at 9 March 2022.