The purpose of our model portfolios (income and growth) is to demonstrate an approach to portfolio construction that SMSFs or personal investors could apply.

We have made some minor changes to our portfolios for 2021 to take into account the dominant investment themes that we expect to apply. We have also rebalanced the portfolios.

Recap on portfolio objectives and performance

The objective of the income portfolio is to deliver tax advantaged income whilst broadly tracking the S&P/ASX 200.

Typically, it has delivered an income return of around 4.5% to 5% pa, with the balance of the return comprising capital gain or loss. In 2020, the income return was impacted by Covid-19, dropping to 3.5% as many companies curtailed the payment of dividends.

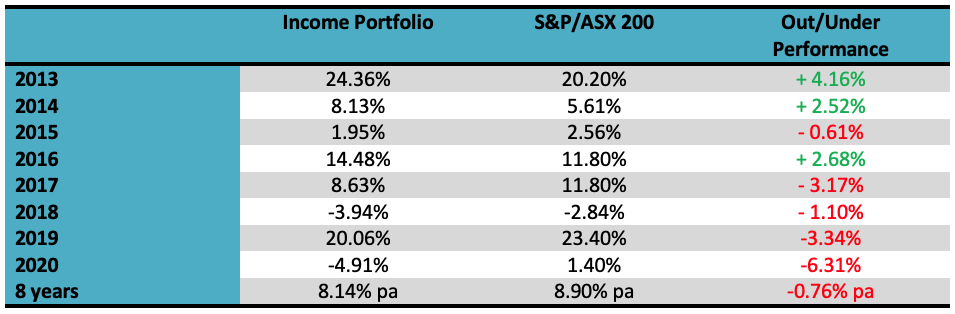

The table below shows the total performance of the income portfolio and that of the benchmark S&P/ASX 200. Over the eight years since 2013, it has delivered an annualized average return of 8.14% pa compared to the index return of 8.90%. These figures don’t include the benefits of franking credits or from participating in capital actions such as off-market share buybacks or share purchase plans.

The objective of the growth portfolio is to outperform the S&P/ASX 200 market over the medium term, whilst closely tracking the index.

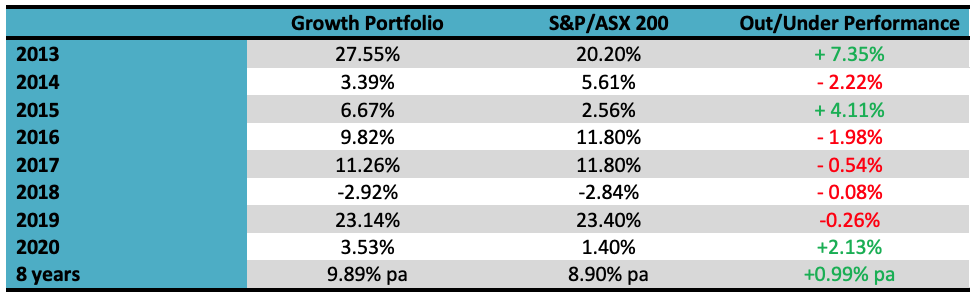

The table below shows the performance of the growth portfolio and that of the benchmark S&P/ASX 200. Over the eight years since 2013, it has delivered an annualized average return of 9.89% pa, outperforming the index by 0.99% pa.

Portfolio construction rules

The construction rules for the portfolios are:

- we use a ‘top down approach’ looking at the prospects for each of the industry sectors;

- for the income portfolio, we introduce biases that favour lower PE, higher yielding sectors;

- so that we are not overly exposed to a market move, in the major sectors (financials and materials), our sector biases will not be more than 33% away from index. For example, the weighting of the ‘materials’ sector on the S&P/ASX 200 is currently 20.3%, and under this rule, our possible portfolio weighting is in the range from 13.5% to 27.1% (i.e. plus or minus one third or 6.8%);

- we require 20 to 30 stocks (less than 10 is insufficient diversification, over 30 it is too hard to monitor), and have set a minimum stock investment size of $2,500;

- our stock universe is confined to the ASX 150. This has important implications for the growth portfolio, because the stocks with the best medium term growth prospects will often come from outside this group (the so called ‘small’ caps);

- for the income portfolio, we prioritise stocks that pay fully franked dividends and have a consistent record of paying dividends; and

- within a sector, the stocks are broadly weighted to their respective index weights, although there are some biases.

Investment themes and sector outlook for 2021

Our investment themes and ASX sector views are detailed in the ‘Investment Outlook 2021 eBook’ and the article ‘How to play the Australian Stock market in 2021” (see https://switzersuperreport.com.au/investment-outlook-2021-ebook/ [1] )

In summary, we expect the following major investment themes:

- Record spending by governments and ultra-low interest rates will propel economic growth and stocks higher – the bull market will clock up a 13th year;

- The US dollar is set to weaken further, meaning that the Aussie dollar will go higher in 2021, potentially up into the eighties. This will impact the earnings and be a dampener on the share price of Aussie companies operating globally;

- A weaker US dollar, plus a general pick up in global economic activity, will be supportive for hard commodities;

- Although the Reserve Bank will keep the cash rate at 0.10%, we will follow the lead of the US with a steepening yield curve and higher bond yields; and

- Commercial property will feel the ongoing impact from Covid-19, with permanent changes to the way we go about working and shopping.

From these themes and other data, we determined our sector views expressed as a bias relative to the sector’s market weighting.

* ASX 200 index weights as of 31 December 2020

* ASX 200 index weights as of 31 December 2020Overall, our sector views are not particularly strong and so the biases will be relatively small.

Income portfolio

The objective of the income portfolio is to deliver tax advantaged income whilst broadly tracking the S&P/ASX 200.

On a sector basis, the biases for the income portfolio in 2021 are fairly minor. It is overweight financials (in order to find income) and consumer facing sectors, and underweight health care and information technology (where there are very few medium yielding stocks).

In the expectation that interest rates in Australia are staying at record low levels, it has a defensive orientation and a bias to yield style stocks. In a bull market, we expect that the income portfolio will underperform relative to the broader market due to the underweight position in growth oriented sectors and the stock selections being more defensive, and conversely in a bear market, it should moderately outperform.

Changes to the portfolio from 2020 are the inclusion of Bega Cheese, Sonic Health Care, Aurizon and Charter Hall Long WALE REIT, and the removal of Orora and Dexus.

Using consensus analyst forecasts from FN Arena, the income portfolio has the following characteristics:

Forecast Price Earnings (PE) for 2021: 37.3 times

Forecast PE for 2021 (excluding Transurban and IAG): 21.2 times

Forecast Dividend Yield for 2021: 4.04% pa

Franking: 77.0% (estimated)

The forecast dividend yield of 4.04% is based on stock prices as of 31 December 2020. It is higher than the yield achieved in 2020, but down on 2019 due to a trend of lower payout ratios, higher stock prices and the absence of special dividends. The franking percentage has been reduced by the inclusion of stocks such as Transurban, APA, Charter Hall Long WALE REIT, Amcor, CSL and to a lesser extent, Macquarie, Sonic and ANZ.

For an SMSF in the accumulation phase, the forecast 4.04% dividend yield translates to an income return of 4.7% (after tax), and for a fund in pension phase, to 5.4%.

Our income portfolio per $100,000 invested (using prices at the close of business on 31 December 2020) is:

Growth portfolio

The objective of the growth portfolio is to outperform the S&P/ASX 200 market over the medium term, whilst closely tracking the index.

The growth portfolio in 2021 is moderately overweight consumer facing sectors and information technology. It is underweight industrials, real estate and utilities. Overall, the sector biases are not strong.

Changes from 2020 are the inclusion of Treasury Wine Estates, Sonic Health Care, Qantas, Appen, Next DC and Lend Lease. Exclusions are Ramsay Health, Seek and Orora. Stocks which are exposed to an appreciating Aussie dollar have generally been down-weighted.

Using consensus broker forecasts from FN Arena, the portfolio has the following characteristics:

Forecast Price Earnings (PE) multiple for 2021: 60.9 times

Forecast PE for 2021 (excluding Xero, Qantas and NextDC): 23.0 times

Forecast Dividend Yield for 2021: 2.85%

Franking: 80.9% (estimated)

Our growth portfolio per $100,000 invested (using prices as at the close of business on 31 December 2020) is as follows:

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.