The objective of the high income stock portfolio is to deliver tax advantaged income, whilst broadly tracking the S&P/ASX 200. Following above market performances in 2013 and 2014 and marginal underperformance in 2015 (24.36% in calendar year 2013 for outperformance of 4.16%, 8.13% in 2014 for outperformance of 2.52%, and 1.95% in 2015 for underperformance of 0.61%), we have made some changes to the income portfolio. These changes reflect our view on the dominant investment themes for 2016, which we expect to be:

- Continued low interest rates (yield sectors will continue to perform);

- The US Fed will be very cautious about further US interest rate rises;

- Australian dollar at around 0.70 US cents, but with risk of breaking down;

- Commodity prices remaining weak;

- A positive lead from the US markets; and

- Growth running below trend in Australia.

The changes to our portfolio include:

- We have exited our positions in Primary Health Care, South32 (which came as a result of the BHP demerger) and Woolworths. While Primary now looks super cheap, its performance has been horrible and as leverage is high, it remains vulnerable. With Woolworths, it is largely a matter of preferring Wesfarmers, while noting that Woolworth’s fundamental issues remain unresolved;

- We have added IAG, Medibank and Sydney Airport. Although an insurance stock, IAG has recently announced that it has $7bn gross reinsurance cover and many also argue that the abandonment of a proposal to move into the Chinese market is a good thing. Medibank has been a solid but unspectacular stock since listing, while Sydney Airport is a leveraged infrastructure stock. A disadvantage of the latter is that the dividend is unfranked;

- We have moderately increased our weighting to the financial sector (now that the bank capital raisings are out of the way), and marginally reduced our exposure to the resources sectors. Otherwise, sector biases are small;

- Our stock selections are in the main relatively defensive, with a bias to stocks that are trading on lower multiples.

The portfolio is forecast to generate a yield of 5.26%, franked to 84.2%. Importantly, we expect that this portfolio should moderately underperform relative to the benchmark price index in a strong bull market, and moderately outperform in a bear market.

Construction rules

Before detailing the portfolio, let’s recap on the construction rules that have been applied to develop the portfolio. These are:

- we used a ‘top down approach’ looking at the industry sectors, and introduced biases that favour lower PE, higher yielding sectors;

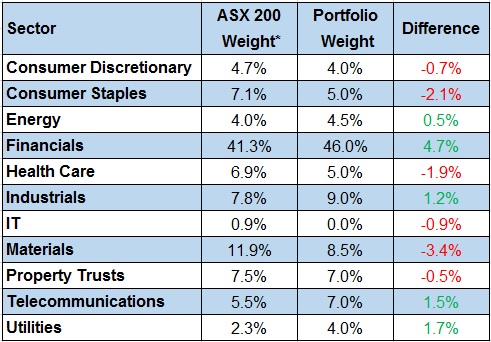

- so that we are not overly exposed to a market move, we have determined that in the major sectors (financials and materials), our sector biases will not be more than 33% away from index. For example, the ‘materials’ sector weighting on the S&P/ASX 200 is currently 11.9%, and under this rule, our possible weighting is in the range from 7.9% to 15.9% (i.e. plus or minus one third or 4.0%);

- we require 15 to 20 stocks (less than 10 is insufficient diversification, over 25 it is too hard to monitor), and have set a minimum stock investment of $3,000;

- we confined our stock universe to the ASX 100;

- we have avoided stocks from industries where there is a high level of exogenous risk, such as airlines;

- we prioritise stocks that pay fully franked dividends and have a strong track record; and

- within a sector, the stocks are broadly weighted to their respective index weight, although there are some biases.

On a sector basis, we are underweight materials stocks and marginally overweight financial stocks, otherwise our sector biases are relatively small. Our portfolio compares to the S&P/ASX 200 sectors as follows:

[1]* ASX 200 index weights as at 31 December 2015

[1]* ASX 200 index weights as at 31 December 2015

Portfolio

Our income-biased portfolio per $100,000 invested (using prices at the close of business on 31 December 2015) is:

Forecast returns

Using consensus analyst forecasts from FN Arena (and making a couple of adjustments for the commodity-based stocks), the portfolio has the following characteristics:

Forecast PE for 2016: 18.1 (15.9 if Sydney Airport is excluded)

Forecast Dividend Yield for 2016: 5.26% pa

Franking: 84.2%

For an SMSF in the accumulation phase, the 5.26% dividend yield will translate to an income return of 6.21% pa (after tax), and for a fund in pension phase, the income return will increase to 7.16% pa. In a bull market, we expect that the income-biased portfolio should underperform relative to the standard S&P/ASX200 price index, due to the underweight position in the more growth-oriented sectors and the stock selection being more defensive, and conversely in a bear market, it should moderately outperform.

We will monitor the portfolio and report back each month in the Switzer Super Report on its performance. On Monday, we will take a look at our growth-oriented portfolio.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.