“HOT” stock number 1

Managing Director of Fairmont Equities, Michael Gable, says why he thinks Woodside Petroleum (WPL) is a buy.

Michael believes that cyclical stocks should have further to run this year, and energy stocks fall into that category. Oil demand should continue to increase as global airlines start to get moving again and OPEC keeps production levels in check.

“WPL is set to benefit from this and has been a go-to stock for Australian investors looking for a blue-chip energy stock. And it also pays a dividend,” Michael said.

“The charting profile of WPL is also telling us that now is the time to buy. WPL rallied strongly at the end of 2020, but after peaking in January, it drifted back to give up about half of those gains. However, last week we finally saw the shares break this downtrend by gapping and closing on its high of the day.

“Since then it has continued to perform well, with good volume coming back into the stock. “There is some short-term resistance here near $24, but it looks as though WPL shares should continue their recovery from here,” Michael said.

“HOT” stock also number 1!

Raymond Chan, Head of Asian Desk – Retail at Morgans, sees a bullish breakout for WPL.

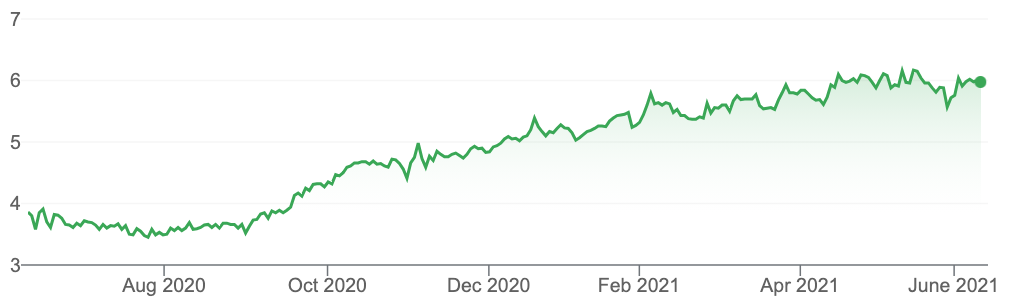

“Our technical analyst wrote that WPL has been trading in a slow but consistent up trend since March 2020, which is still technically intact,” Raymond said.

“The recent secondary correction has retraced close to a Fibonacci cluster (measured from the March 2020 and October 2020 lows) and its previous support of $21.70, where buying interest is likely to start building up.

“The medium-term down trend line and minor resistance of $23.48 have been broken upwards on Thursday, suggesting that the correction is likely to be over. The RSI indicator broke above its resistance suggesting that higher prices are likely to unfold in the months ahead.

“The initial medium-term upside price target is $27.00, however higher price levels are achievable over the long-term,” Raymond said.

“HOT” stock number 3

Meanwhile Julia Lee, Chief Investment Officer, Burman Invest, gives her reasons for liking building products company CSR.

“CSR is at the cusp of a wave of demand. The housing cycle is favourable, Government stimulus through Homebuilder also supportive,” she said.

“CSR typically benefits in the second half of a build, with products such as gyprock and insulation. “With a strong control of costs at the beginning of the cycle, this should bode well for operating leverage.

“Risks come from rising costs with many builders having forward sold future builds. There is also a risk that the housing market softens and with it demand for CSR’s products,” she added.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.