I recently upgraded some business insurance to meet the requirements of a government tender. Before choosing the insurance provider, I organised a handful of quotes online.

That was a mistake. For two weeks, I was hounded by insurance companies trying to sell me a policy. Several brokers emailed and called trying to win my business.

The experience provided three insights. First, that competition in business insurance is intense. One firm called me the same day I got an online quote.

Second, that lots of business owners like me are probably thinking about new or upgraded cover as they emerge from Covid lockdowns and the economy improves.

And third, that business insurance has attractive characteristics (for brokers). For many business owners, insurance is the last thing they cut. Also, insurance premiums feel like they only ever head in one direction. It always seems to be about more rather than less cover.

Business forecaster IBISWorld predicts stronger revenue growth in insurance broking as the Australian economy recovers from the Covid pandemic and policy demand increases. Annualised industry revenue will be 2.7% over 2021-2026, from 0.9% over 2016-2021.

As business activity roars back to life next year, my sense is more small and medium-sized enterprises will want to add or upgrade their insurance. That’s good for industry leaders Steadfast Group (SDF) and AUB Group (AUB), both of which are ASX-listed mid-cap stocks.

Insurance is a remarkably resilient product. Morningstar notes that over the last 10 years general insurance premiums have increased at a compound annual growth rate of 5%. The weakest period recorded was just 0.7% growth.

Morningstar wrote: “The severest economic downturn can impact insurance premium as businesses close and their insurance needs reduce, but it’s typically one of the last expenses to be trimmed. The consequences of having inadequate insurance can be significant, and even put individuals into financial ruin.” For business owners, insurance is an unavoidable cost.

Opportunities in AUB, Steadfast

I have written favourably on AUB and Steadfast for the Switzer Report several times over the past five years. AUB has a five-year annualised total return (including dividends) of 22%. Steadfast, a larger company than AUB, has returned 20% annually over that period. Both have been among the better-performing small- and mid-cap stocks over that period.

Clearly, it’s been a more rewarding bet to own distributors of insurance policies (AUB, Steadfast) than manufacturers (such as QBE Insurance (QBE) or Insurance Australia Group (IAG)). Steadfast’s 20% annualised return over five years compares to 7% for QBE, 2% for IAG and 4% for Suncorp Group (SUN).

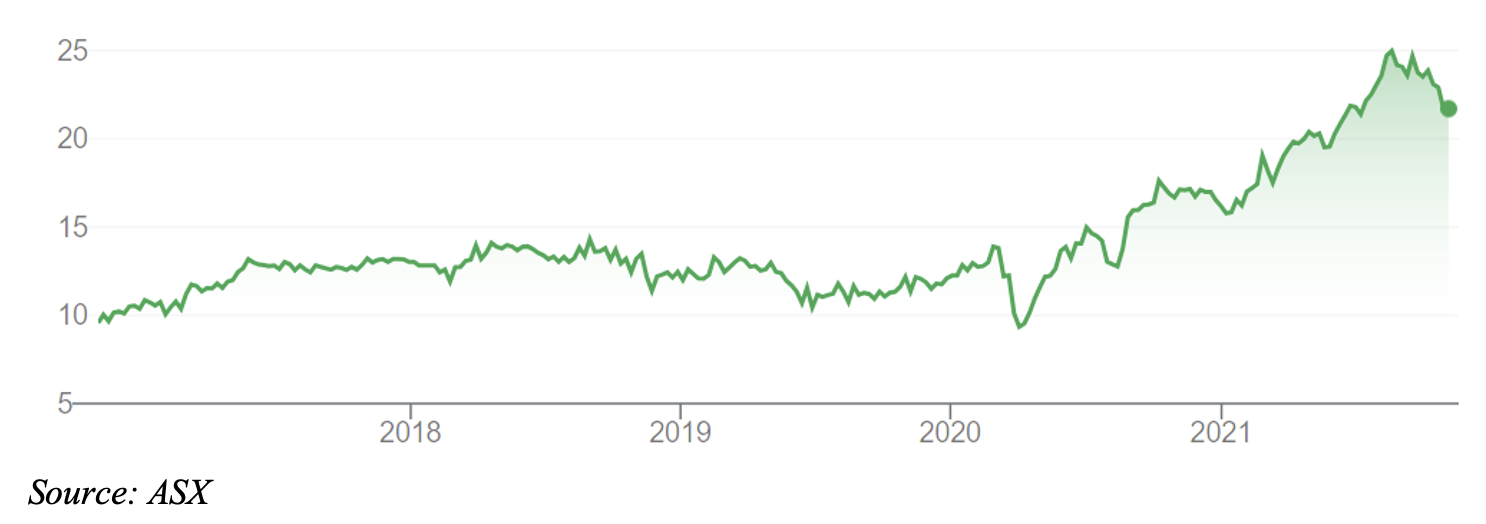

For this Report in October 2019, I nominated AUB as one of five stocks to consider (‘Five overlooked small- and mid-cap stocks worth considering’) AUB has rallied from $11.02 at the time of that report to $22.43– and still has solid medium-term growth prospects.

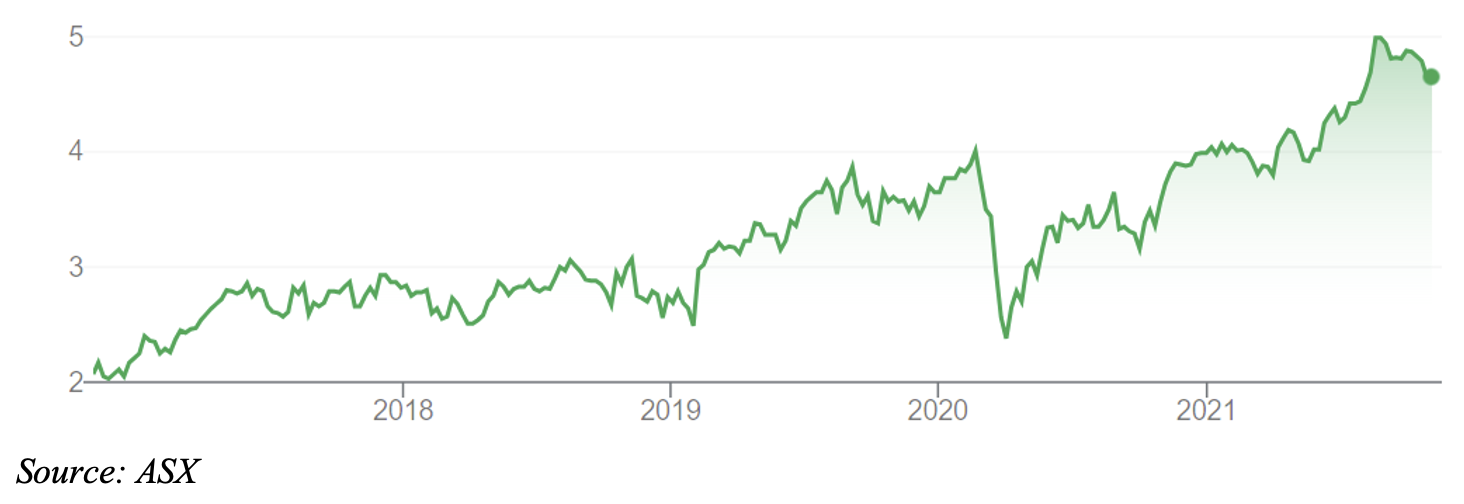

In June 2020, I included Steadfast as one of several stocks that would gain from a recovery after Covid. (‘Three B2B stocks that will benefit from Australia’s recovery’ [1]). Steadfast has rallied from $3.40 at the time of that story to $4.72, having hit a 52-week high of $5.12.

Market commentary on AUB and Steadfast typically focuses on the link between a recovering economy and higher premium demand. But overlooked in this analysis is the growing complexity and regulation of business – and how more businesses than ever need more cover.

In my case, I needed to show an astonishingly large amount of private-indemnity insurance (for a small business) to meet the requirements of a tender. Sadly, that is the world we live in: more rules, regulations and business risks – and thus greater need for insurance cover. It’s hard to see that changing after Covid; if anything, the pandemic adds new ongoing business risks.

Longer-term, the outlook for insurance broking appeals. An ageing population should underpin higher insurance demand (older people are more likely to be insured). As AUB and Steadfast increase their market share even further (through acquisitions), that strengthens their economies of scale and market dominance, creating formidable barriers to entry for new rivals.

Technology is another growth driver. To my thinking, there hasn’t been as much innovation in insurance broking as in other sectors (insuretech is not nearly as big an issue as fintech in financial services, for example). But that’s also an opportunity for the big players to use technology to improve product distribution, cross-promotion and create extra value from data.

There’s a lot to like about the short- and long-term prospects of AUB and Steadfast. Share-price gains will be slower from here, and a pullback or correction would not surprise, given the extent of their recent rally. But both are clear winners from a stronger economy in 2022 and beyond.

Of the two, Steadfast offers better value at current prices.

1. Steadfast Group (SDF)

Steadfast has the largest general insurance network in Australia and New Zealand.

The business has grown quickly over the years by acquiring equity stakes in small insurance brokers and consolidating a fragmented industry. In August 2013, Steadfast listed on ASX with a market capitalisation of $587 million. The business is worth $4.56bn at the current price.

Steadfast had a cracking FY21. It reported a 20.2% increase in underlying net profit after tax (NPAT) to $130.7 million. Earnings per share grew 18.8% on the previous period. A total dividend of 11.4 cents per share for FY21 was almost 19% higher than a year ago.

A highlight in FY21 was Steadfast growing its gross written premium (GWP) by 18.3% to $9.8 billion, while maintaining good cost controls. That’s the benefit of having 457 brokerages in its insurance network. About $793 million of the GWP was transacted on the Steadfast Client Trading Platform, which means the company is quickly growing its insuretech offerings.

Steadfast’s current price of $4.72 compares to a target price of $5.28 based on consensus broking forecasts. That suggests the stock is moderately undervalued. I expect Steadfast’s share price to go a little higher than the consensus forecast, with most gains in the second half of FY22.

Steadfast Group Limited (SDF)

2. AUB Group (AUB)

Like Steadfast, AUB had a strong FY21. Underlying net profit after tax rose 25.7% to $67.1 million – ahead of earlier market guidance. A total dividend of 55 cents per share was up 10%.

AUB is delivering excellent results from its transformation strategy. The company exited the health and rehabilitation insurance markets, allowing it to focus more on Australian broking and standalone BizCover operations. AUB’s transformation of its NZ operation has a long way to run.

AUB Group expects to deliver FY22 underlying NPAT of $70-$73 million. At the upper end of AUB’s market guidance, NPAT growth is 20.7% over FY21. AUB’s high confidence in its outlook is a good sign.

A key assumption behind AUB’s expected NPAT growth is a 5-6% increase in insurance premium rates for Australia. That matches my view of stronger demand for business insurance next year, and higher premiums. Continued small bolt-on acquisitions are expected and AUB believes Covid impacts on its business will be muted and in line with those in FY21.

AUB’s current price of $22.73 compares to a target price of $25.66 based on consensus broking forecasts compiled by FNArena. That implies AUB is undervalued. Most brokers that cover AUB have ‘buy’ or ‘accumulate’ recommendations on the stock.

I like AUB but would watch and wait for further price weakness in the next few months. The stock is down from a 52-week high of $25.58 in recent months and is fast approaching value territory. Like Steadfast, AUB is a well-run company with a promising medium-term outlook.

AUB Group (AUB)

Tony Featherstone is a former managing editor of BRW, Shares and Personal Investor magazines. The information in this article should not be considered personal advice. It has been prepared without considering your objectives, financial situation or needs. Before acting on information in this article consider its appropriateness and accuracy, regarding your objectives, financial situation and needs. Do further research of your own and/or seek personal financial advice from a licensed adviser before making any financial or investment decisions based on this article. All prices and analysis at 2 November 2021.