Wall Street was again negative overnight, with Fed officials not letting stock market influencers believe that the central bank will ease up with its interest rate torture of the US economy any time soon. CNBC’s Sarah Min summed up the big driver of Friday market action this way: “Fed Vice Chair Lael Brainard on Friday underscored the need to bring down inflation, saying the central bank is ‘committed to avoiding pulling back prematurely’ on restrictive monetary policy.”

Our only hope is that the fired-up US central bank and its tough talk get hosed down by better-than-expected data and what happened to US share markets on Thursday proves it, as Federal Reserve officials gave no indication the US central bank would moderate or change its plans to aggressively raise interest rates to bring down high inflation. This is keeping the downward price pressure on tech and other growth stocks, so only data pointing to lower inflation will take the pressure down.

And it’s why October 13, with the latest release of the Consumer Price Index for the Yanks, is really important. If it’s better than expected, stocks will rise and vice versa. A good reading will be interpreted as a sign that the Fed will soon back off from 0.75% rate rises and that the rate-rising cycle would be closer to the end.

If this happens, then what happened on Thursday, when US tech stocks copped it on this tough Fed talk, should be reversed. On that day, shares of rate-sensitive technology heavyweights like Tesla lost 6.8%, Apple gave up 4.9% and Nvidia slumped 4.1%.

What was the tough talk?

This from CommSec’s Ryan Felsman sums it up neatly: “US treasuries resumed their sell-off on Thursday, taking yields higher, after St. Louis Fed President James Bullard said rates will probably need to be ‘higher for longer’ than markets previously anticipated. Cleveland Fed President Loretta Mester said: ‘We’re still not even in restrictive territory on the funds rate.’”

US 10-year yields rose by about 8 points to near 3.79% on the observations, while US 2-year yields lifted by about 10 points to near 4.2%.

Thursday was a good day for stocks in the US and here and it showed how important central banks are for stocks right now, with share markets rallying strongly, following their recent sell-off, helped by easing bond yields, after the Bank of England’s decision to stage a market intervention to buy £5 billion worth of government bonds for 13 days in a row. This boosted UK stocks and helped other markets too, but the positivity only lasted a day! By the way, the market negativity does have two diametrically opposing forces driving it, as was shown on Monday in the US, when Ryan Felsman wrote: “US share markets fell on Monday as investors worried that the US Federal Reserve’s aggressive campaign against inflation could throw the US economy into a sharp downturn. The US dollar soared to a record high and US government bond yields hit fresh 12-year to 15-year highs.”

Some selling is linked to interest rate rising fears that KO growth stocks, but other selling is more driven by this rate-rising program, which could cause a serious recession.

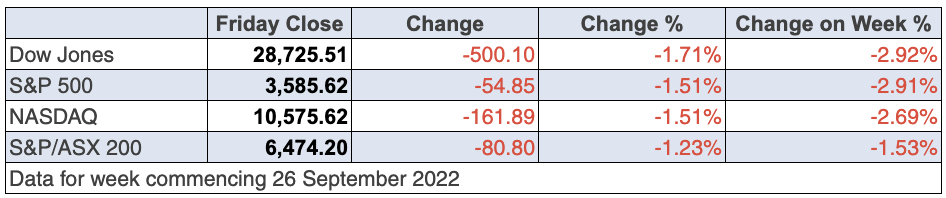

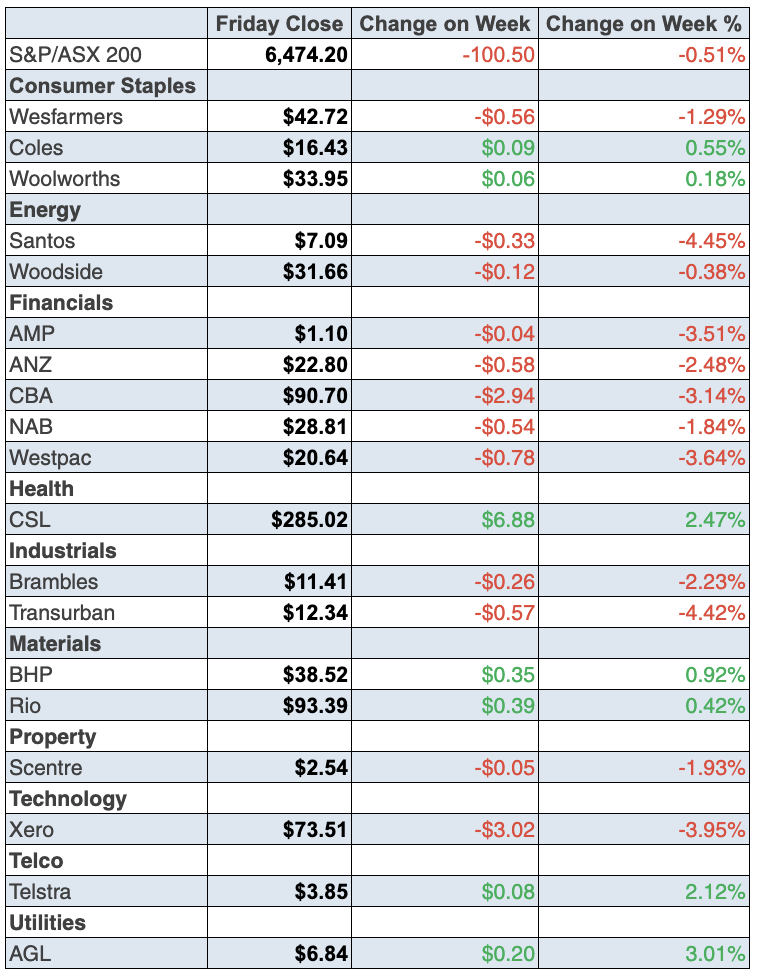

To the local stocks story, and the S&P/ASX 200 Index was down but only off 1.5% for the week to finish at 6474.2. That was just above the June low of 6407.

The double uncertainty of inflation and recession is helping gold, which is now at US$1,672 an ounce. Before you get too excited, this is a small uplift after a bad six months, as this chart below shows.

Newcrest (NCM) was up 3.3% over the week but my favourite in this space, Northern Star, was up 8.9% over the five trading days. Fear will do that.

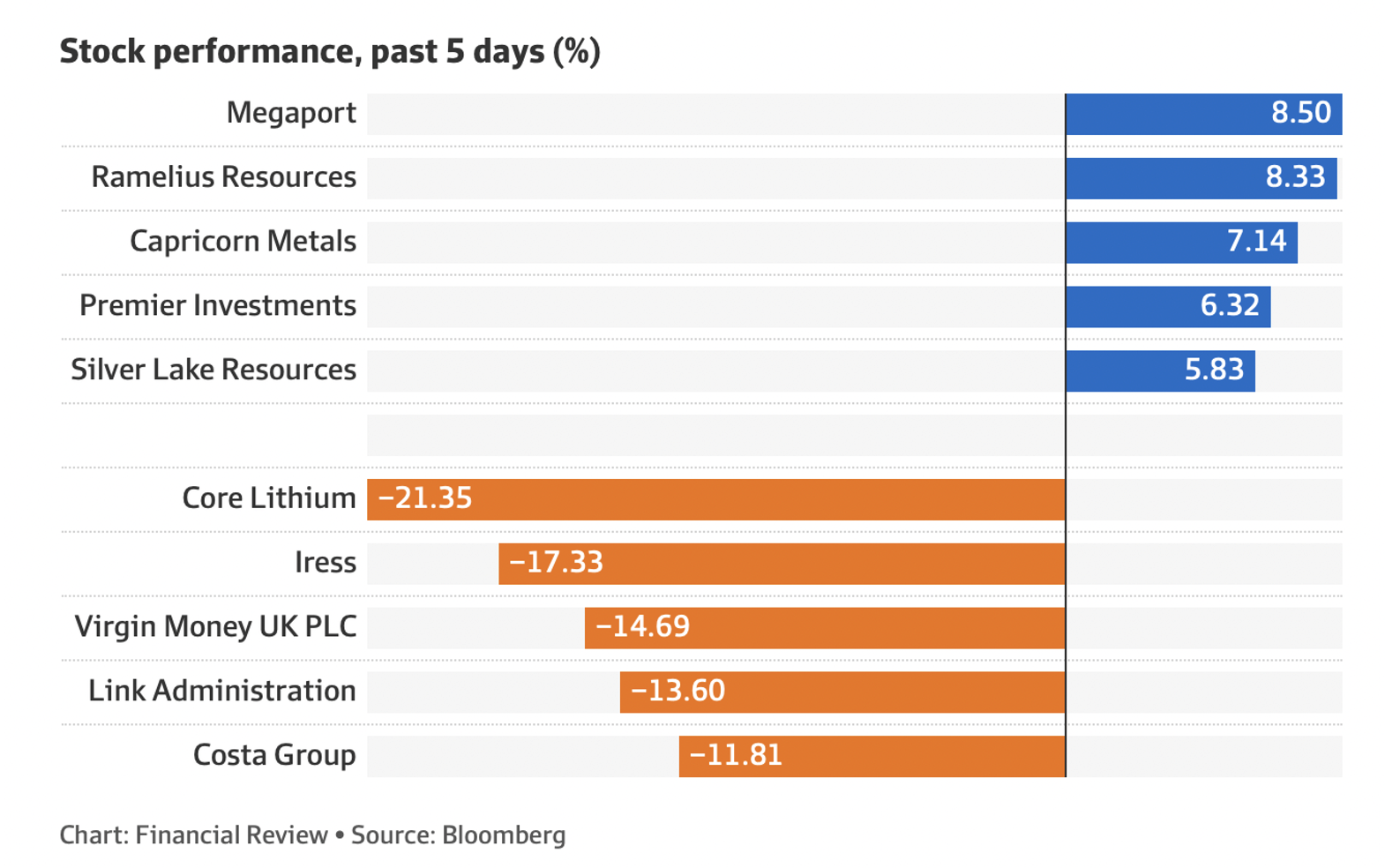

Here are the big winners and losers over the week:

Megaport, one of my “like stocks”, had a good week on no apparent news, but certainly, bargain hunters waiting for a break in the rate-rising cycle could be reacting to the stock, which is down 59.28% year-to-date. It actually gained 13% for the week. Meanwhile, Virgin Money UK, which had been a ripper stock out of the pandemic low, is now down 39% year-to-date and you can put that down to the UK economy in real trouble.

What I liked

- The new monthly Consumer Price Index eased from an annual growth rate of 7% in July 2022 to 6.8% in August 2022, due to a decrease in petrol prices.

- Household deposits increased by $10.3 billion (or 0.8%) in August to a record $1,305 billion, up by 11.4% on a year ago. Households have accumulated $315.8 billion worth of savings since the pandemic began in February 2020 and saving rather than spending is good for slowing inflation.

- The ABS says job vacancies fell by 2.1% in the three months to August 2022, or by 10,000 job postings, to 470,900 available positions — below the record high of 480,900 in May 2022. This is good for inflation-fighting efforts.

- The Federal Government announced a $32 billion underlying cash deficit (1.4% of GDP) for financial year (2021/22), down $47.9 billion from the deficit previously forecast in the 2022/23 March Budget. The final 2021/22 Budget outcome also showed a $27.7 billion lift in tax receipts, with government payments down by $20.1 billion. You can thank a strong economy for that but we need to see it get weaker to help beat inflation.

- The US economy contracted at a 0.6% annualised rate in the June quarter, which was bang on expectations.

What I didn’t like

- Retail trade rose by 0.6% in August to record highs of $34.9 billion. Spending was up 19.2% on the year. Turnover at department stores ($1.9 billion) and at cafes, restaurants and takeaway food services ($5.1 billion) both hit record highs. This isn’t good inflation-fighting news!

- The Aussie dollar is about 64.35 US cents, thanks to Fed tough talk on rates and global recession fears.

- Over the year to August 2022, new dwelling construction costs rose by 20.7%.

- Private sector credit (effectively outstanding loans) rose by 0.8% in August to be up 9.3% on a year ago – the strongest annual growth rate in almost 14 years (since October 2008). Business credit rose by 1.2% in August to be 14.1% higher over the year – the strongest pace in 14 years (since August 2008). We need credit growth to slow to show the rate rises are working to beat inflation.

- German inflation soared by 10.9% over the year to September (survey: 10.2%). It was the highest level in more than 25 years, strengthening the case for another 75-basis point rate hike from the European Central Bank.

- Geopolitical tensions intensified as Europe investigated severe damage to two Nord Stream gas pipelines from Russia.

- US Initial Jobless claims fell by 16,000 to a 5-month low of 193,000 last week (survey: 215,000). It’s good for US recession fears but not for slowing down rate rises.

- New home sales in the US jumped 28.8% in August (survey: -2.2%). The Conference Board consumer confidence index rose from 103.6 to 108 in September (survey: 104.6). The Richmond Fed manufacturing index rose from -8 to 0 in September (survey: -10). All good for suggesting a US recession isn’t happening but it helps explain tough talk from the Fed determined to beat inflation.

I’m watching China

China’s economic comeback will not only be good for Australia’s economy, but it will also help lower inflation, as its zero-Covid policy has restricted supplies and driven up costs of production worldwide and inflation.

In China this week, the purchasing managers’ indexes (PMIs) showed the official manufacturing PMI rose from 49.4 to 50.1 in September (survey: 49.7) and readings below 50 denote a contraction in business activity and vice versa.

The non-manufacturing PMI eased from 52.6 to 50.6 in September (survey: 52.4), but the private sector Caixin manufacturing PMI fell from 49.5 to 48.1 in September (survey: 49.5).

Geopolitically, China can be annoying but it’s critically important to believe 2023 will be a rebound year, after a sell-off year in 2022, so I’m watching this economy closely!

The week in review:

- There are three ways to play the current stock market. Whatever you choose is your call but this is certainly the time to look at companies that have been unfairly smashed. This week in the Switzer Report, I mention two such companies. [1]

- Love them or loathe them, Paul (Rickard) says short sellers are here to stay. They don’t always get it right. But they are investment professionals, so you’d expect them to get it right more often than not. Knowing how they’re positioned can be an important data input into investment decisions. Paul goes through 20 of the most shorted stocks. [2]

- Tony’s view is that successful long-term investing requires buying undervalued assets and having a patient, disciplined long-term strategy. Here are two ideas he likes. [3] Tony later goes through three ways for contrarians to buy into medium-term recovery in precious metals. [4] He says we could be within a few months of a turn in the gold price. It’s impossible to know, but history shows that the big gains in gold often happen quickly, meaning it’s better to buy too early than too late.

- Low interest rates over the last decade have brought equity dividends back to front of mind for investors, despite the return from dividends not being as reliable as an interest coupon from a fixed-income security. James Dunn goes through 7 resource stocks that pay dividends. [5]

- In our “HOT” stock column this week, Michael Gable, Managing Director of Fairmont Equities, tells us why Coronado Global Resources (CRN) is in his good books. [6] Later, Raymond Chan, Head of Asian Desk at Morgan’s takes a look at Treasury Wines (TWE). [7]

- In Buy, Hold, Sell — Brokers Say, there were 3 upgrades and 2 downgrades [8]in the first edition, and 3 upgrades and 1 downgrade [9] in the second edition.

- And finally, in Questions of the Week, [10] Paul answers your questions on whether there’s an easy way to be short the US dollar; What are five companies to hold for income and the long term?; What do the brokers say about Qantas?; What is the 2-year/10-year government bond spread and why does this signal that a recession is coming?

Our videos of the week:

- A promising male contraception pill with zero effects on hormones?! | The Check Up [11]

- Are we heading for a recession? + Expert analysis on these 7 stocks! | Switzer Investing (Monday) [12]

- Michael Wayne on these stocks & more; TYR, APX, DDR + What’s going on in the housing market? | Switzer Investing (Thursday) [13]

- Boom! Doom! Zoom! | 29 September 2022 [14]

Top Stocks – how they fared:

The Week Ahead:

Food for thought: “With a good perspective on history, we can have a better understanding of the past and present, and thus a clear vision of the future.” — Carlos Slim Helu

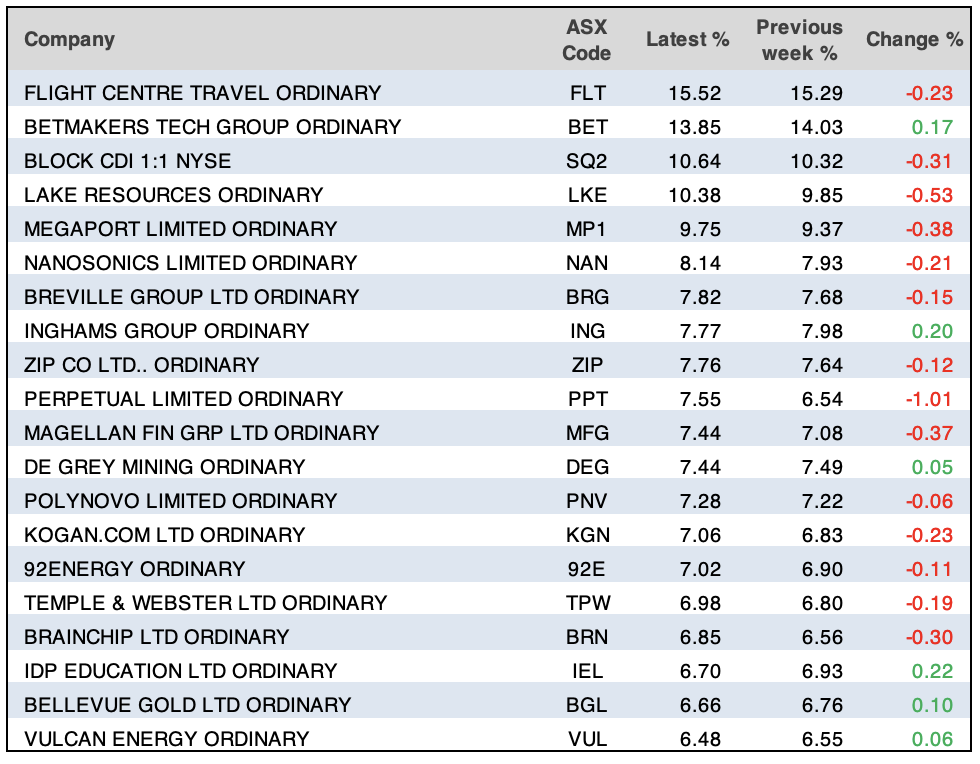

Stocks shorted:

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before.

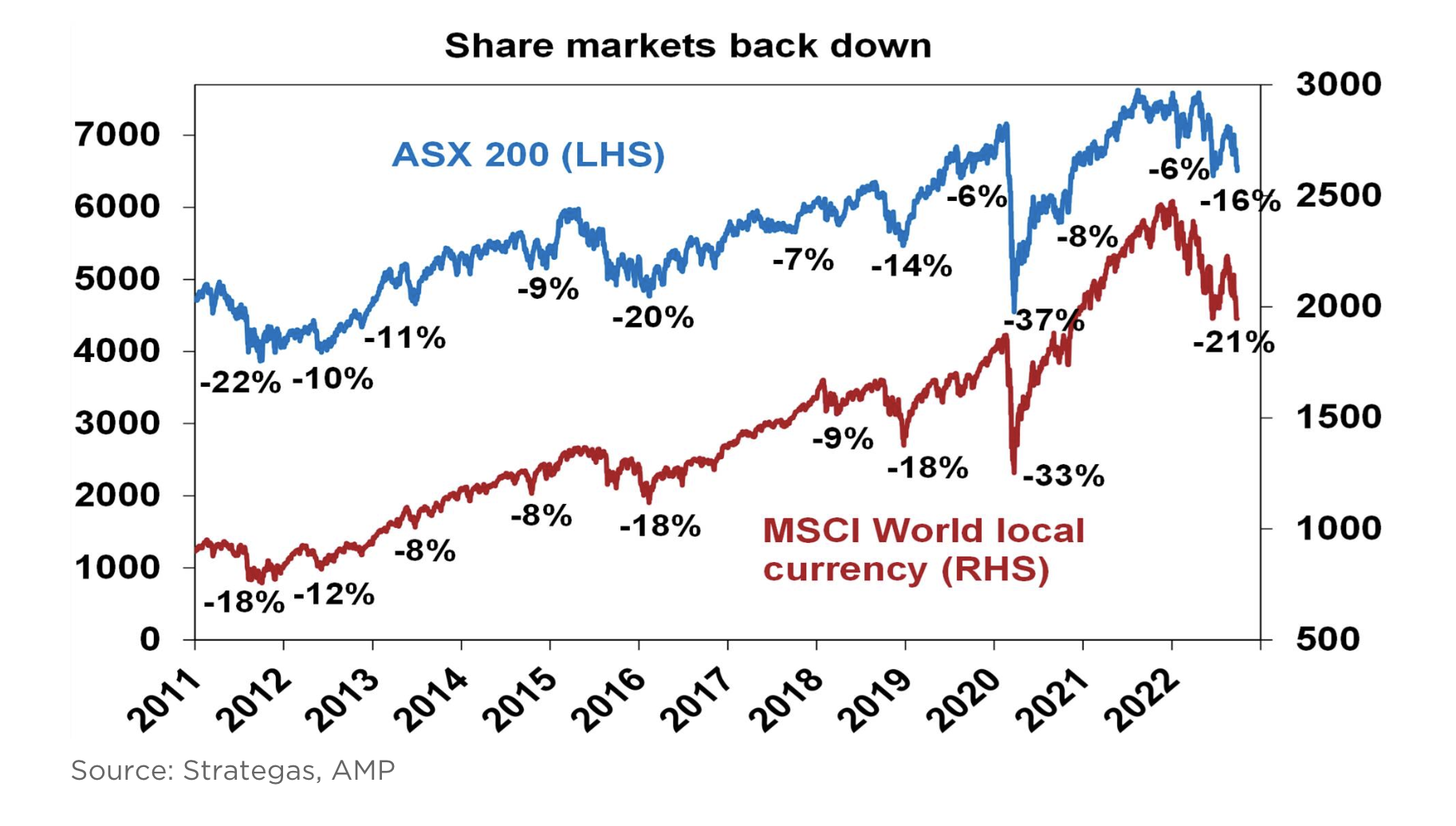

Chart of the week:

For our chart of the week, Shane Oliver of AMP Capital assesses the sheer drop in share markets for 2022 and the primary factors in driving equities down.

The plunge in shares back to their June lows mostly reflects the same concerns that drove the falls into June:

- Inflation remains high or is still rising depending on the country. For example, US headline inflation is still 8.3%yoy and core inflation at 6.3%yoy in August is still under pressure from rising services inflation. Headline inflation is 8.9% in the UK, 9.1% in Europe, 9.9% in the UK and an estimated 7.2% in Australia.

- Global central banks have become more hawkish noting that permanently high inflation will lead to lower living standards and the longer inflation stays high the greater the risk that inflation expectations move higher, making it harder to get down. As a result, they are committed to getting it back to target and have been flagging more rate hikes (e.g., with the dot plot of Fed interest rate forecasts about 1% higher than 3 months ago) and an implied tolerance for a recession in order to get it under control.

- Increasingly hawkish central banks are bad for shares in the short term for two reasons. First, higher interest rates make shares less attractive from a valuation perspective. Second, a recession would weigh on company profits. Recession is now almost certain in Europe and about a 50% probability in the US. In Australia, the probability of recession is now about 40% (if as we expect the cash rate peaks around 3%, but if it rises to 4.3% as predicted by the money market then recession is probable here). Historically deep bear markets in the US and Australian shares have tended to be associated with a US recession.

Top 5 most clicked:

- Should you invest now to be ready for the stock market rebound? [15] – Peter Switzer

- 2 contrarian ideas for patient, long-term investing [16] – Tony Featherstone

- 7 dividend-paying resource stocks [17] – James Dunn

- Can we learn anything from the short sellers? [18] – Paul Rickard

- Buy, Hold, Sell – What the Brokers Say [19] – Rudi Filapek-Vandyck

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.