I am a great believer in a diversified portfolio – so I would never recommend a ‘one’ stock portfolio. But a question from a subscriber and some follow-up emails when I addressed it [1] last Thursday in Questions of the Week got me thinking that this subject was worth further investigation.

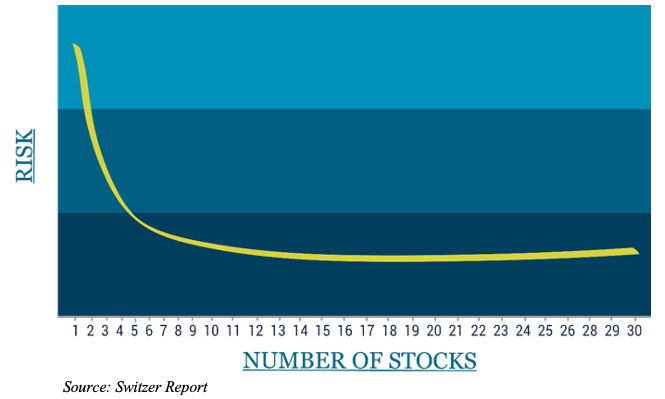

Diversification, that is adding different stocks to a portfolio to minimize the impact of specific risks such as a CEO doing something crazy, a flawed acquisition, action by a competitor or industry and sector issues, can be readily achieved. As the following graph demonstrates, risk reduces rapidly when more stocks are added.

While you can never eliminate the impact of individual company risk, a portfolio of 15-20 stocks chosen from different industry sectors materially reduces the overall risk. Once you get to a portfolio of 30 stocks, the benefit of adding additional stocks becomes small.

So back to the idea of one core stock, and which one?

Let’s keep the universe of stocks to reviewing the top 20 stocks on the ASX, which are shown in the table below together with their relative market weights as a share of the top 20.

Starting with the financials – CBA, NAB, Westpac, ANZ and Macquarie. CBA is clearly the leading bank out of the ‘Big 4’, and while it is expensive [2], for the long term, it has to be a core stock. Interestingly, it lost 2.1% last week, while NAB added 1.2%.

The other really strong candidate is investment bank Macquarie. Although listed on the ASX, about half its profits come from offshore.

In the resources, we have BHP, Rio Tinto, Fortescue, Woodside and Newcrest. Woodside, on track record, can’t seriously be a contender and I can’t imagine a gold miner being my one core stock (I am just not that sort of doomsday merchant). Of the three iron ore majors, BHP with its additional exposure to copper, nickel and potentially potash takes the prize.

CSL is the only healthcare company to make the top 20 but what a fantastic company. The global leader in blood plasma products and number two in influenza vaccines, it has delivered an outstanding return for investors who were lucky enough to take part in the privatisation of the then Commonwealth Serum Laboratories. They paid an effective 77c for their shares – today worth almost $300.

Two consumers staples companies, Woolworths and Coles, are in the top 20. Woolworths is the market leader across all of the major supermarket industry metrics, and if I were to back just one, I would pick the leader rather than the “number two”.

Wesfarmers is classified as consumer discretionary. The last of Australia’s major conglomerates, the bulk of revenues and profits come from its retailing businesses – the Bunnings powerhouse, Kmart, OfficeWorks and Catch. It has made a play into lithium with the acquisition of Kidman Resources and owns chemical, industrial safety, and fertiliser businesses.

Of the others, I have eliminated Aristocrat Leisure on ESG (environmental, social and governance) grounds and Afterpay as it is being purchased by Square Inc. Telstra is a ‘work in progress’ on sustainably growing earnings, while toll road operator Transurban and logistics company Brambles don’t quite meet the grade. That leaves property group Goodman Group, a company I am a big fan of. While it experienced a real purple patch following the pandemic with the market rewarding its focus on industrial property, its 10-year chart is basically “one way up”.

My shortlist is then Commonwealth Bank, Macquarie, BHP, CSL, Wesfarmers, Woolworths and Goodman Group.

And the winner?

CSL gets the gong. On long term track record, global market position and supportive industry tailwinds. These include an industry supported by Government, combined with an ageing population and increasing demand for services as technology improves.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.